The lowest fixed rate mortgages have dipped below 4 per cent for the first time in months, as the battle over rates steps up a gear.

Santander is currently offering a two-year fix at 3.99 per cent with a £1,999 product fee.

HSBC is offering a 3.98 per cent five-year fix to its Premier banking customers and Barclays is offering a 3.99 five-year deal to those buying the most energy effecient homes.

The Bank’s ratesetters brought base rate down 0.25 per cent to 4.5 per cent at the start of February and several major banks have cut rates since then.

This was a welcome relief, as fixed rate mortgages had been rising early in 2025, with major lenders reversing some of the cuts they made in the latter stages of 2024 after gilt yields spiked.

The likes of NatWest, Halifax, HSBC, Santander and Barclays had increased rates across fixed rate products. Now this trend appears to be reversing.

> Best mortgage rates calculator: Check the deals you could apply for

Mortgage rates: what is happening

The Bank of England opted to cut interest rates in February from 4.75 per cent to 4.5 per cent.

Base rate has been dropped by 0.75 percentage points since August when it was first cut from 5.25 per cent.

Between the start of July and October, the lowest five-year fixed rate mortgage fell from 4.28 per cent to 3.68 per cent. Meanwhile, the lowest two-year fix fell from 4.68 per cent to 3.84 per cent.

The lowest rates are now higher at 3.99 per cent respectively. Nonetheless, mortgage rates remain well below their recent peak.

In 2023, a combination of base rate hikes and worries over inflation figures saw average two-year fixed mortgage rates reach a high of 6.86 per cent in the summer, according to Moneyfacts, while five-year fixed rates hit 6.35 per cent.

That said, mortgage rates still remain far higher than borrowers had enjoyed prior to the surge in 2022.

Roughly three years ago, the averages were hovering around 2.5 per cent for a five-year fix and 2.25 per cent for a two-year.

In fact, as recently as October 2021, some of the lowest mortgage rates were under 1 per cent.

Will mortgage rates go down or up?

Forecasts are tricky game at the best of times and interest rate expectations change regularly.

Mortgage borrowers on fixed rate deals should worry less about where the base rate is today, and more about where markets think it will go in the future.

This is because banks tend to pre-empt base rate movements. Lenders change their fixed mortgage rates on the back of predictions about how high or low the base rate will ultimately go and how long it will stick there.

In 2023, forecasts for where the base rate would eventually peak fell from a high of 6.5 per cent to 5.25 per cent, mortgage rates shifted with this.

At the start of 2024, markets were pricing in six or seven base rate cuts, with investors betting on rates falling to 3.75 per cent or 3.5 per cent by Christmas.

And we now know how that ended up. Base rate ended the year at 4.75 per cent.

Now, in 2025, markets are now suggesting that base rate will be cut two more times this year and fall to 4 per cent – but based on last year’s performance, these should all be taken with a pinch of salt.

Borrowers due to remortgage should stay on top of rate forecasts but also look to lock in some certainty as soon as they can.

New fixes can be arranged through brokers around six months in advance, with the fees added to the loan and no upfront cost. There is no obligation to take the mortgage if rates fall – instead you could swap for a better deal – but you will have it in your back pocket if you need it.

Mortgage pricing: a rough guide

Mortgage market expectations are reflected in something known as Sonia swap rates.

These are agreements in which two counterparties, for example banks, agree to exchange a stream of future fixed interest payments for a stream of future variable payments.

Mortgage lenders enter into these agreements to shield themselves against the interest rate risk involved with lending fixed rate mortgages over a period of time.

For example, if a bank lends a mortgage fixed for five years, it wants to have some certainty on what it will cost to fund that over the time period, rather than being dependent on shifting interest rates and potentially being caught out by big unexpected moves.

Put simply, swap rates show what financial institutions think the future holds concerning interest rates.

Swaps have been moving about quite a bit since the middle of December 2024.

As of 6 December, five-year swaps were at 3.8 per cent and two-year swaps were at 4 per cent. They then rose. As of 14 January, five-year swaps were at to 4.28 per cent and two-year swaps are at 4.41 per cent.

But they fallen since mid January. As of 13 February, five-year swaps were at 3.89 per cent and two-year swaps were at 3.99 per cent.

The inflation and mortgage rates spike

Mortgage rates first began to increase towards the end of 2021, when inflation started to rise, resulting in the Bank of England increasing base rate to try and combat it.

The aftermath of the Covid lockdowns, combined with Russia’s invasion of Ukraine in February 2022, triggered a huge inflation spike. Central banks were caught on the hop and rushed to try to rein this in with higher interest rates.

Mortgage rates accelerated after the Liz Truss-Kwasi Kwarteng mini-Budget in late September 2022, with its wave of unfunded tax cuts that unsettled bond markets.

After Truss resigned in October 2022, new Chancellor Jeremy Hunt reversed nearly all of the mini-Budget announcements. The markets calmed down and the cost of borrowing fell with mortgage rates dropping too.

But following a fresh round of stubbornly high inflation figures in late spring 2023, markets began betting the base rate would peak at 6.5 per cent.This triggered a summer inflation panic and led to mortgage lenders whacking their rates up again.

Once the inflation worries subsided, interest rate expectations eased substantially but inflation proved stickier than expected in 2024 and the Bank of England ended up holding base rate at 5.25 per cent.

With inflation finally returning to its 2 per cent target, the Bank finally felt comfortable cutting rates to 5 per cent at its August 2024 meeting.

Base rate was cut again to 4.75 per cent by a vote of 8 to 1 at the November Monetary Policy Committee meeting and then it held rates there in December.

The next rate decision will be announced on Thursday 20 March, but in the meantime all eyes are on inflation as well as the overall health of the UK economy.

The ONS revealed that inflation rose 2.5 per cent in the 12 months to December – slightly below what markets forecast.

While this is better than expected it means inflation is still increasing above the Bank of England target of 2 per cent.

Most economists and personal finance experts think the Bank of England will proceed cautiously from here.

What will happen to house prices?

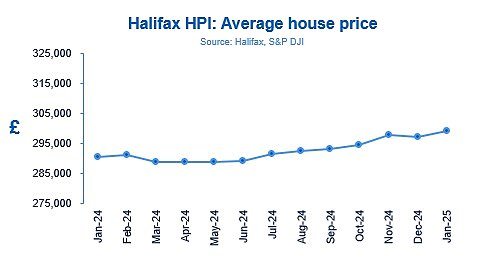

House prices have reached another record high, according to latest figures from Britain’s biggest mortgage lender Halifax.

It revealed the average house price rose by 0.7 per cent in January alone, with the typical home now selling for £299,138.

Someone buying the typical British home would now need to find almost £9,000 more than a year ago, Halifax’s figures show.

But despite the near £2,000 monthly jump in average house prices, property inflation is slowing, with house prices up 3 per cent annually in January, compared to 3.4 per cent the month before.

Homebuyers are continuing to struggle with much higher mortgage costs, although rates have shifted down from their peak and the Bank of England cut base rate again yesterday.

Creeping up: Average prices rose by 0.7 per cent in January, more than recovering the slight dip of 0.2 per cent in December

What next for interest rates?

At present, markets are pricing in two further interest rate cuts between now and the end of this year. This could see the base rate will fall to 4 per cent by the end of 2025.

However, as is to be be expected, forecasts vary.

Santander expects interest rates to fall to 3.75 per cent by the end of 2025 while Barclays is a bit more punchy thinking rates will fall as far 3.5 per cent.

Analysts at Morgan Stanley predict UK interest rates will fall to 3.5 per cent by the end of this year, while Goldman Sachs says interest rates will fall to 3.25 per cent during the first half of next year.

The two giant US banks believe the UK economy will struggle over 2025 forcing the Bank of England to take action and cut rates more aggressively.

Both banks say lower GDP growth will be exacerbated by a slowdown in household disposable incomes. Goldman Sachs sees further pressure coming from rising trade tensions.

As a result, both expect growth of only 0.9 per cent in 2025 – below the Bank of England’s 1.5 per cent and the OBR’s 2 per cent forecasts, as well as the market consensus of 1.3 per cent.

Meanwhile, economists at Capital Economics think the base rate will fall to 3.5 per cent by early next year.

They had previously forecast that interest rates would fall to 3 per cent by the end of next year, but have concluded that rates will now fall slower as a result of the Labour’s first budget.

Looking even further ahead than late 2025 and early 2026, economists vary on where they think interest rates will level off.

Santander, for example, thinks interest rates will remain between 3 per cent and 4 per cent for the foreseeable future.

However, economists at Oxford Economics are predicitng base rate will eventually fall to 2.5 per cent in 2027 where it will broadly remain throughout 2028 and 2029.

New forecast: Capital Economics (CE) has changed its interest rate forecast because it now thinks the Bank of England will cut rates more slowly as a result of the budget

> Why interest rates may NEVER fall back to their lows

Should you fix for two or five years?

It appears many mortgage borrowers are opting for the shorter two-year fixed rate deals, according to recent analysis by Santander.

In the final three months of 2024, it said 65 per cent of customers opted for a two-year fixed, compared to 27 per cent choosing a five-year.

This represents a big shift, given that in recent years, Santander says its customers have tended to show a 60/40 split in favour of five-year fixes.

Choosing what length to fix for depends on what you think may happen to interest rates but should importantly take more account of what your personal circumstances are.

Key factors include whether you may move soon, how much you prefer the security of fixed payments for longer and how well you could cope with a rise in mortgage bills.

Fixed rates of any length offer borrowers certainty over what their payments will be from month-to-month.

Those opting for a shorter two-year fix are backing interest rates falling over the next couple of years, or at least staying steady, so that when it is time to remortgage their bills won’t rise.

With five-year fixes borrowers are locking in to rates that they know won’t change for longer, perhaps either because they believe rates may rise or because they prefer the security. Five-year fixes were hugely popular when rates were lower.

If rates continue to fall, a tracker mortgage without an early repayment charge could put borrowers in a position to take advantage.

However, for all the potential benefit, a tracker product will also leave people vulnerable to further base rate hikes, while also being more expensive than fixed rates at present.

Whatever the right type of mortgage for your circumstances, shopping around and speaking to a good mortgage broker is a wise move.

> Check the best mortgage rates based on your house price and loan size

What are the best mortgage rates?

We have taken a look at the best deals on the market based on a 25-year mortgage for a £290,000 property – the current UK average house price according to the ONS.

The mortgage deals below are best in terms of having the lowest rate. They may not be the cheapest deal overall when arrangement fees are also factored in.

Bigger deposit mortgages

Five-year fixed rate mortgages

Santander has a five-year fixed rate at 3.99 per cent with a £1,999 fee at 60 per cent loan to value.

Barclays has a five-year fixed rate at 4.09 per cent with £899 fees at 60 per cent loan to value.

Two-year fixed rate mortgages

Santander has a 3.99 per cent two-year fixed rate deal with a 1,999 fee at 60 per cent loan-to-value.

Barclays has a two-year fixed rate at 4.22 per cent with a £899 fee at 60 per cent loan to value.

Mid-range deposit mortgages

Five-year fixed rate mortgages

First Direct has a five-year fixed rate at 4.24 per cent with a £490 fee at 75 per cent loan to value.

Yorkshire Building Society has a five-year fixed rate at 4.26 per cent with a £995 fee at 75 per cent loan to value.

Two-year fixed rate mortgages

Yorkshire Building Society has a two-year fixed rate at 4.27 per cent with a £995 fee at 75 per cent loan-to-value.

Barclays has a two-year fixed rate at 4.34 per cent with a £899 fee at 75 per cent loan to value.

Low-deposit mortgages

Five-year fixed rate mortgages

Virgin Money has a five-year fixed rate at 4.68 per cent with £883 fees at 90 per cent loan to value.

HSBC has a five-year fixed rate at 4.69 per cent with £649 fees at 90 per cent loan to value.

Two-year fixed rate mortgages

Yorkshire Building Society has a two-year fixed rate at 4.93 per cent with a £1,495 fee at 90 per cent loan to value.

Santander has a two-year fixed rate at 4.96 per cent with £749 fees at 90 per cent loan to value.

>> Check our our mortgage tracker to compare the latest available deals

Tracker and discount rate mortgages

The big advantage to a tracker mortgage is flexibility. The downside is they are currently more expensive, so it will take a few more interest rate cuts before borrowers starting beating the fixed rate deals.

The can sometimes be the case with discount rate mortgages, which track a certain level below the lenders’ standard variable rate.

A fixed-rate mortgage will almost inevitably carry early repayment charges, meaning you will be limited as to how much you can overpay, or face potentially thousands of pounds in fees if you opt to leave before the initial deal period is up.

You should be able to take a fixed mortgage with you if you move, as most are portable, but there is no guarantee your new property will be eligible or you may even have a gap between ownership.

Many tracker deals have no early repayment charges, which means you can up sticks whenever you want – and that suits some people.

Make sure you stress test yourself against a sharper rise in base rate than is forecast.

Compare true mortgage costs

Work out mortgage costs and check what the real best deal taking into account rates and fees. You can either use one part to work out a single mortgage costs, or both to compare loans

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.