Summary:

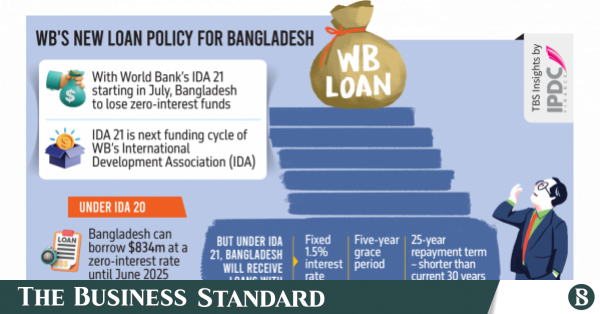

- Bangladesh moves from zero-interest loans to fixed 1.5% interest under IDA 21.

- Loan repayment shortened from 30 years to 25 years.

- Higher debt servicing costs may strain Bangladesh’s economy.

- Floating-rate loans available but capped at 5% interest.

- IDA 21 replenishment increased to $100 billion, up 8% from IDA 20.

Bangladesh is entering a new phase in its relationship with the World Bank (WB), moving away from zero-interest funds. Starting July, under IDA 21, the WB’s next three-year concessional lending cycle.

Shift to fixed interest and shorter repayment terms

According to Economic Relations Division (ERD) officials, Bangladesh can borrow $834 million at zero interest under the current cycle, ending in June. The International Development Association (IDA), the WB’s concessional loan wing, will now offer Bangladesh, classified as a “blend” country, loans with a fixed 1.5% interest rate, a five-year grace period, and a 25-year repayment term. This shorter repayment period, compared to the current 30 years, could increase installment amounts.

The interest rate for IDA 20 (July 2022 to June 2025) is 1.25%, with a 0.75% service charge. Over $5 billion in loans have been signed under this cycle. Additionally, 15% of the WB’s core IDA lending will be offered at market-based floating rates under IDA 21, potentially linked to the International Bank for Reconstruction and Development (IBRD) Group A lending terms, minus 250 basis points.

Increased financial burden and economic implications

The end of zero-interest loans signifies a shift from ultra-concessional financing. Bangladesh, already facing depleted foreign currency reserves and fiscal constraints, will encounter higher debt servicing costs.

Bangladesh, already grappling with depleted foreign currency reserves and a tight fiscal space, will now face higher debt servicing costs on future borrowing. For a country that has leaned on low-cost external financing to bankroll its infrastructure drive and plug budget deficits, the end of zero-interest loans is a sharp reminder of the economic transition it is undergoing.

“This was inevitable as Bangladesh moves towards middle-income status. But it also means we have to be more prudent in how we manage external borrowing,” a senior ERD official said.

Experts warn that without disciplined fiscal management and efficient project implementation, the higher cost of funds could lead to a growing debt burden.

Mustafa K Mujeri, Executive Director at the Institute for Inclusive Finance and Development (InM), emphasized the need for strategic loan utilisation and prevention of fund waste and corruption.

“In this situation, we must use loans strategically and wisely. Investment-friendly projects that drive economic activities should be prioritised.”

Mustafa K Mujeri, Executive Director, Institute for Inclusive Finance and Development

New loan rates and options under IDA 21

Under IDA 21, “blend countries” will have access to 25-year loans with a five-year grace period, at a fixed 1.5% Special Drawing Rights (SDRs) interest rate, without service charges. Floating-rate credits will also be available, with interest rates equivalent to the IBRD Group A lending rate minus 250 basis points.

Countries can opt for fixed rates, but this will come with a 15% allocation discount compared to floating rates. To mitigate market fluctuations, the interest rate will be capped at 5%.

ERD officials noted that Bangladesh has been borrowing from the WB’s Scale-Up Window at market-based rates since 2016. Other lenders like the Asian Development Bank (ADB) and the Asian Infrastructure Investment Bank (AIIB) also provide loans at market-based rates.

Zahid Hussain, former lead economist at the World Bank’s Dhaka Office, highlighted that the new 1.5% SDR interest rate is a decrease from the current 1.25% with a 0.75% service charge. He also noted the 15% allocation discount for fixed rates, suggesting a potentially smaller window size.

IDA 21 allocation and upcoming announcements

The WB document indicates an $100 billion IDA 21 replenishment, an 8% increase from IDA 20’s $93 billion. Country-specific allocations for IDA 21 will be announced at the WB-IMF spring meetings in April.

For IDA 20, Bangladesh’s indicative allocation was SDR 2,452.7 million. IDA resource allocation is determined annually based on performance and needs through the Performance-Based Allocation (PBA) system.