One of Wall Street’s most successful investors has warned that the stock market slide in the wake of Donald Trump‘s tariffs is merely a pothole in the road toward a sheer cliff edge.

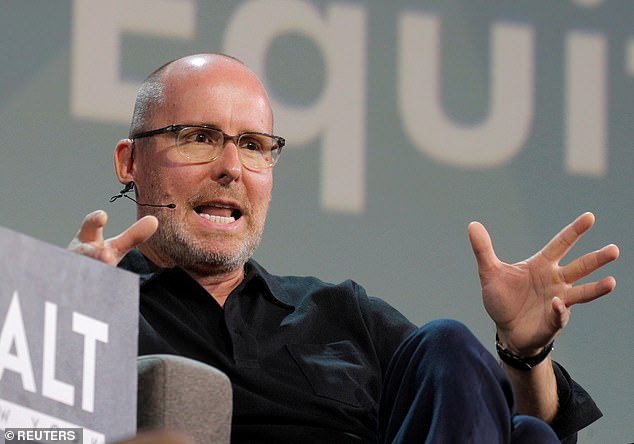

Mark Spitznagel, chief investment officer and founder of Universa Investments, told MarketWatch he expected an ‘80% crash’ was lurking around the corner.

‘I expect an 80% crash when this is over. I just don’t think this is it. This is a trap,’ he said, adding that when the real crash happens, investors will know it.

Universa is a $16 billion hedge fund specialising in risk mitigation against ‘black swan’ events – unpredictable and high-impact drivers of market volatility.

It uses credit default swaps, stock options and other derivatives to profit from severe market dislocations.

Spitznagel’s fund was one of the big winners during the extreme volatility that rocked markets in the early days of the pandemic in 2020, returning a whopping 4,144% in Q1 of the Covid-affected year.

‘This is another selloff to shake people out. This isn’t Armageddon. That time will come as the bubble bursts,’ he said in comments to MarketWatch.

President Donald Trump last week announced a slew of tariffs on US trading partners, ostensibly to correct a decades-long trade deficit after complaining America had been taken advantage of.

Global markets went into freefall, with America’s S&P 500 dipping almost 20% since its February high, as the risk of a US recession and higher inflation ratcheted up.

Mark Spitznagel, Founder and Chief Investment Officer of Universa Investments

President Donald Trump last week announced a slew of tariffs on US trading partners, ostensibly to correct a decades-long trade deficit after complaining America had been taken advantage of

Traders work the floor of the New York Stock Exchange

Though Spitznagel said the worst was yet to come, top market officials said the imposition of Trump’s tariff programme had already caused chaos.

‘Fear exists all over,’ Stephane Boujnah, the head of the pan-European stock exchange operator Euronext, told France Inter radio this morning.

‘The (United States) is unrecognisable and we are living in a transition period. There is a certain form of mourning because the United States we had known for the most part as a dominant nation resembled the values and institutions of Europe and now resembles more an emerging market.’

Markets began to calm this morning after sharp drop-offs throughout last week and Monday, but hedge funds tracked by Morgan Stanley globally posted growing losses.

Trump launched his historic trade war on Wednesday, and China retaliated with 34% reciprocal tariffs on US imports on Friday, stoking fears of a global recession and sparking the worst two trading days for stocks since the pandemic in 2020.

The swift retaliation from China sparked a fresh warning from Trump that he would impose additional levies if Beijing refused to stop pushing back against his barrage of tariffs – a move that would drive the overall levies on Chinese goods to 104%.

‘I have great respect for China but they can not do this,’ Trump said in the White House.

‘We are going to have one shot at this… I’ll tell you what, it is an honour to do it.’

But Beijing has continued undeterred, blasting what it called ‘blackmailing’ by the US and vowing ‘countermeasures’ if Washington imposes tariffs on top of the 34% extra that were due to come in force on Wednesday.

‘If the US insists on going its own way, China will fight it to the end,’ a spokesperson for Beijing’s commerce ministry said this morning.

The growing war of words is stoking fears that global markets are in line for yet more pain should Washington or Beijing unleash another wave of tariffs.

US President Donald Trump looks on during a meeting with Israeli Prime Minister Benjamin Netanyahu in the Oval Office of the White House in Washington, DC, on April 7, 2025

A stock trader monitors the Jakarta Composite Index (JCI) in South Tangerang, Banten, on April 8, 2025

Trump launched his historic trade war on Wednesday, and China retaliated with 34% reciprocal tariffs on US imports on Friday, stoking fears of a global recession and sparking the worst two trading days for stocks since the pandemic in 2020

Trump last week dismissed the steep stock market losses in the wake of his tariffs announcement, suggesting it was the product of the global economy healing itself.

‘The operation’s over, and now we let it settle in,’ he told reporters on Air Force One.

He continued by comparing the economy to a sick patient that had just concluded emergency surgery.

‘It’s to be expected, this is a patient that was very sick, we inherited a terrible economy as you know, with a lot of problems including the loss of manufacturing and plants closed up all over the country,’ he said.

He pointed out that the United States had lost 90,000 manufacturing plants since the 1990s when the NAFTA trade deal was put into effect.

‘It was a sick patient, it went through an operation on liberation day and it’s going to be a booming country, a very booming country it’s going to be amazing actually,’ he said.

Trump urged more companies to build their manufacturing plants in the United States.

‘I think it’s going to work out,’ he said. ‘Remember there are no tariffs if you build your plant or you build and make your product in the US.’