Foxtons Group’s (LON:) Q125 trading update revealed revenue growth of 24%, driven predominantly by growth in the Sales division, which in turn benefited from a pull forward in transactions due to Stamp Duty changes. However, in the longer term, we believe the company’s strategic direction remains positive, and we expect an update on its strategy to be revealed at the 4 June capital markets day.

This may see an upgrade to the medium-term adjusted operating profit target of £28–33m, which is now coming into focus. We maintain our revenue and operating profit estimates and our 134p/share valuation, although risks appear to be skewed to the upside if market momentum continues.

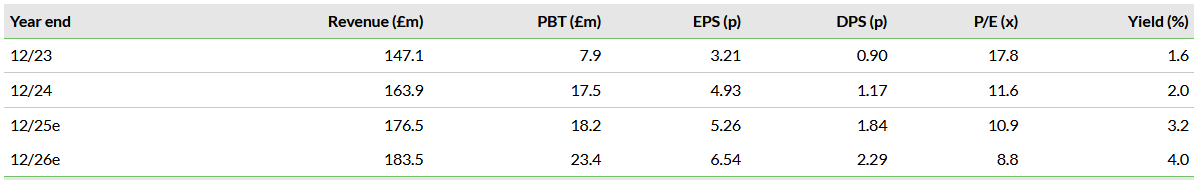

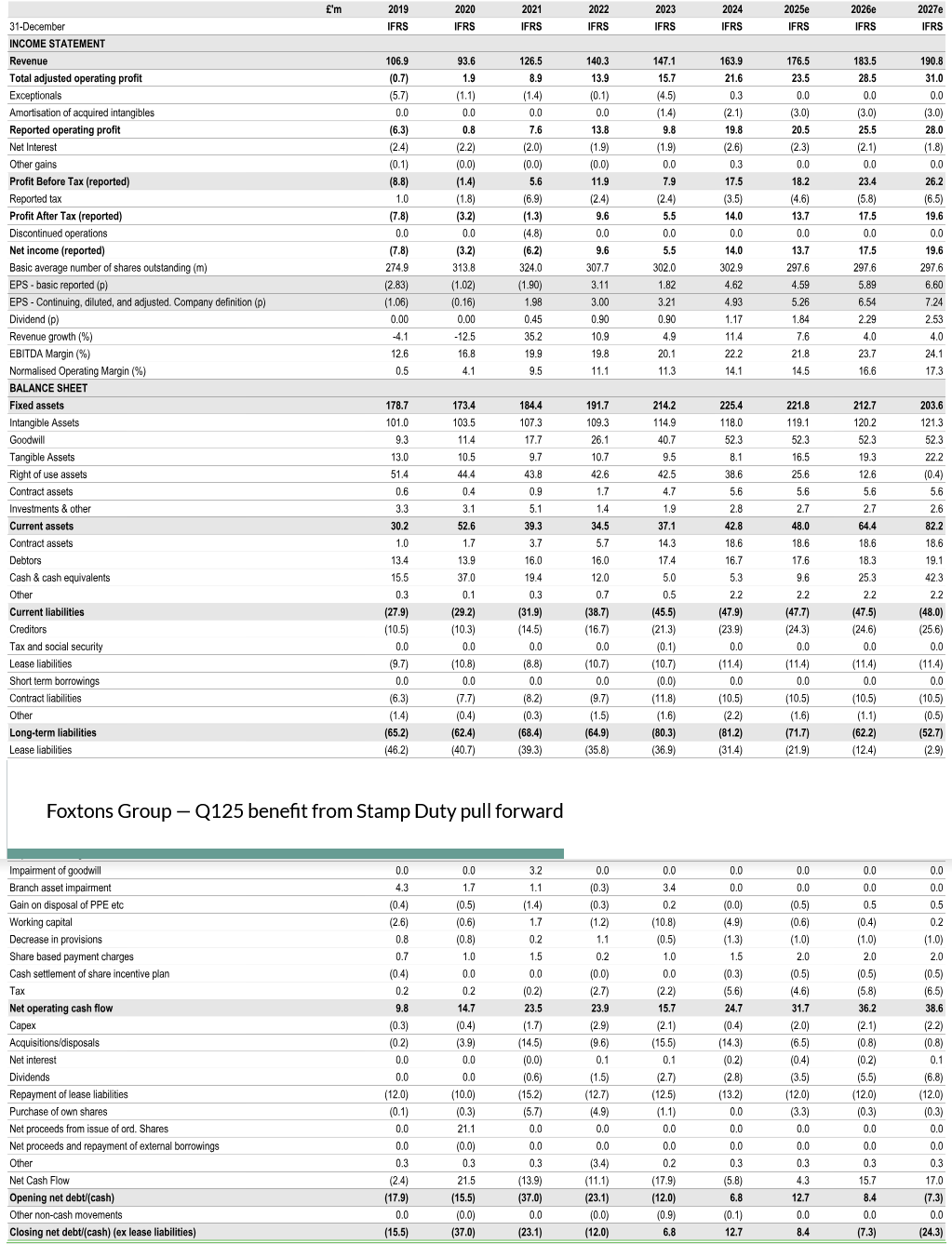

Note: PBT and EPS include amortisation of acquired intangibles and exceptional items (ie diluted company definition).

Healthy Q1 Trading Driven by Sales

Foxtons’ Q1 group revenue increased by 24% to £44.1m, with Sales being the primary driver, supported by more modest growth in Lettings and Financial Services. The largest division, Lettings, grew revenue by 5% (or £1.3m) to £25.2m, mainly due to including the October 2024 acquisitions.

It also benefited from higher property management revenues and increased long-term lets, offset by volatility in renewals and lower interest income on client deposits. The Sales division increased revenue by 73% (or £6.9m), largely driven by organic growth, with the Stamp Duty change pulling volumes forward from Q2, with some additional benefit from M&A.

The Financial Services division increased revenue by 7%, supported by the new purchase revenue and partially offset by lower refinance activity.

Capital Markets Day to Set Out Revised Growth Strategy

On 17 April, Foxtons announced that it intends to hold a capital markets day at the London Stock Exchange (LON:) on 4 June to present and discuss its latest strategy for growth. This is likely to build on the existing strategy and targets that have been largely met and, in the case of Sales’ market share, exceeded.

Furthermore, the medium-term profit target, which was increased from £25–30m to £28–33m to reflect the exclusion of amortisation, is likely to be reviewed and potentially revised upwards considering the success to date and the fact that we believe Foxtons is likely to hit the lower end of the target range as early as FY26.

Share Buyback and Largely Unchanged Forecasts

Following the Q125 results statement, we have retained existing revenue and adjusted operating profit figures, but raised EPS modestly due to the share buyback. Q1 trading was robust, especially in Sales, but Q2 will no doubt be initially affected as the Stamp Duty changes saw volumes pulled forward into Q1, and the under-offer pipeline was down c 10% at the start of Q2.

However, we have reflected the £3m share buyback, which implies that year-end net debt increases by a similar figure, from £5.4m to £8.4m, leaving sufficient upside for M&A.

Exhibit 1: Financial Summary

Source: Company accounts, Edison Investment Research