BlackRock American Income Trust’s (LON:) board has proposed a significant and innovative package of changes to adopt a systematic investment approach, which is a first in the investment trust sector. Given the prevalence of growth funds available, BRAI will continue to differentiate itself by retaining a focus on value and income and the US 1000 Value reference index will remain the same.

Management of the portfolio will be moved from BlackRock’s US income and value team to its Systematic Active Equity (SAE) team. This will involve a meaningfully different investment approach, which combines the power of big data, AI and human expertise, aiming to deliver low-cost, risk-controlled consistent returns. These proposals are subject to the passing of the regular triennial continuation vote at the AGM, and a subsequent vote to change the investment strategy at a general meeting; both of which will be held on 16 April 2025. The board unanimously recommends that shareholders vote in favour of these resolutions.

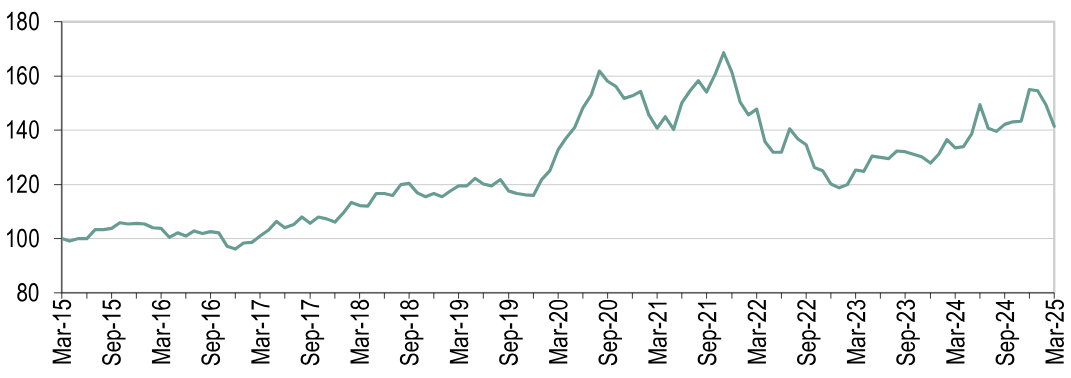

S&P 500 Growth Index/S&P 500 Value Index (Total Return) Over Last Decade

Source: LSEG Data & Analytics, Edison Investment Research

Why Consider BRAI?

Following a thorough strategic review, the trust’s board is proposing a change in the investment strategy, which would maintain the value focus but offer a differentiated approach to investing in US equities, with an enhanced dividend policy and at a lower cost. The proposed strategy will be managed by BlackRock’s SAE team, which has a track record of similar strategies outperforming the same reference index. Along with the change in investment approach, an enhanced dividend policy would see a shift away from a regular 2.0p quarterly payment to four distributions based on 1.5% of quarter-end NAV, equating to a variable annual payment of 6.0% of NAV. There would be a reduction in annual management fees from a flat 0.70% of net assets to a tiered structure of 0.35% up to £350m and 0.30% thereafter, with a fee holiday for the first six months.

The board’s proposals also include opportunities for shareholders to exit the trust at close to NAV, either up to 20% in April 2025 or 100% if three-year performance or minimum fund size targets are not met. More details about the tender offers are shown below. BlackRock (NYSE:) would make a contribution to the costs of the implementation of the board’s proposals. In an environment where investment company boards are under increasing pressure to act in the best interests of their shareholders, BRAI’s proposed meaningful change in investment strategy and other enhancements to the trust are an innovative move, which we believe is likely to appeal to existing and prospective shareholders.

BRAI: All Change

BRAI’s board has proposed a significant package of changes to relaunch the trust after a period of poor relative performance of the existing strategy versus its reference index:

- Adoption of an SAE approach – this combines the power of big data, AI and human expertise, aiming to unlock new ways of generating consistent portfolio returns and exploit market inefficiencies.

- The strategy would retain a value bias – the US 1000 Value index would continue as the reference index to differentiate BRAI from the majority of US equity funds available, which have a growth bias. The trust would be the first in the UK to offer an SAE strategy. An allowed up to 20% investment in companies outside the US would continue, but in practical terms BRAI would be a pure US equity fund. The ability to invest in options and write covered calls would be removed as this feature has not been utilised for a long time.

- Enhanced dividend and gearing – a quarterly distribution would be made, equivalent to 1.5% of quarter-end NAV (6% per year). Hence, BRAI would provide exposure to the US, which makes up around 70% of global equity indices and offer a much more attractive yield than the US market. The trust would continue to be able to employ gearing.

- A fee reduction – annual management fees would reduce from 0.70% of net assets to 0.35% up to £350m with 0.30% above this level. BlackRock has agreed to a six-month fee holiday in respect of 1 May 2025 to 31 October 2025, and would make a contribution towards the proposals so that they are cost-neutral to shareholders in respect of their continuing investment in the company.

- Opportunities for exit – the board is proposing a tender offer. As part of the strategy change, shareholders could tender up to 20% of issued share capital at a 2% discount to NAV, adjusted for portfolio realisation costs (to take place in April 2025). A periodic conditional tender offer has also been introduced, whereby shareholders could also tender up to 100% of issued share capital (excluding treasury shares) at NAV minus 2%, adjusted for related portfolio realisation costs, if BRAI’s annual NAV net total return does not outperform the reference index’s total return by more than 50bp per annum over each three-year period from 1 May 2025. The board would also implement a tender offer if cum-income NAV at the end of each three-year period is less than £125m.

It is important to note that all these proposals are conditional on the continuation vote being passed at the 16 April 2025 AGM. Subject to the continuation vote passing, shareholders will also need to vote on the proposals to change the investment strategy.

SAE Investment Approach

The board believes that employing an SAE approach, which involves human insight in conjunction with the use of big data, machine learning and AI for portfolio construction and to exploit market efficiencies, can generate risk-controlled, consistent returns at a lower cost. It is expected that the portfolio would contain 150–250 names, compared to the current c 60. The investment objective would change to providing long-term capital growth, while paying an attractive level of income; hence, the portfolio managers will seek to maximise capital growth, while using the investment trust structure to meet the income objective. Also, there would no longer be ESG baseline screens and outperformance targets, which would remove restrictions on the investment universe.

Over time, wider adoption of systematic investment has been driven by: an increase in available data; more computing power; and whole portfolio diversification, by providing a cost-effective, risk-managed differentiated product. SAE is a leader in a business where scale is key given the very high IT and personnel costs. Its team is highly experienced, and has operated through multiple market cycles. The platform goals are 1) consistent returns – delivering a ‘no-drama’ performance from a wide range of investments so that a single unsuccessful investment does not affect the whole portfolio performance (maximum active stock bet is 1.0–1.5%, and 2) differentiated alpha combining proprietary technology and human insight.

The SAE database has increased its number of investment signals and now has around 1,000 different data sources (compared with around 250 in 2013). Different data sets are combined, the resulting models are back-tested (a five-year daily global portfolio simulation takes just 1.8 seconds) and the outcomes are checked. SAE’s scale also brings trading advantages as 30% of transactions are matched internally, which are low cost and have no market impact. The team scours traditional and alternative data sets in their quest to exploit market inefficiencies, focusing on areas that a traditional investor would explore; for example, company fundamentals, market sentiment, macro themes and ESG.

More than 1,000 US stocks are evaluated and ranked daily with all signals ascribed an alpha score between +3 and -3, which are combined to give an overall rating for a stock. A portfolio can then be built based on the highest expected return for a given tracking error (taking trading costs into account), which is diversified and risk-controlled with small factor bets; country and industry bets are constrained at 2–4%.

BlackRock’s SAE Team

If shareholders vote in favour of the change in strategy, management of the portfolio will move from BlackRock’s US income and value team to its SAE team, which has more than 90 investment professionals and c £25bn in dedicated US large-cap strategies. The team has been running strategies since 1985 and throughout its history it has sought to innovate and evolve the insights used within the investment process, while maintaining the core philosophy of blending human insight, data and cutting-edge technology.

Two of the SAE team have been selected to manage BRAI: Travis Cooke and Muzo Kayacan. Cooke is a managing director and head of the US portfolio management group. He is responsible for managing the US long-only, partial long-short and long-short strategies within SAE. Kayacan is a director and portfolio manager and head of EMEA product strategy in the SAE division of BlackRock’s portfolio management group, which provides a link between investment teams and clients.

The US Market

The US market is by far the most dominant in global indices (for example, it makes up around two-thirds of the MSCI All Countries World Index) and this position had strengthened over the last two years. During 2023 and 2024, the bellwether US rose by at least 25% per year (in local currency terms) and it is notable that, in both years, the two best-performing sectors were communication services and IT. Stock market leadership was very narrow, led by the ‘Magnificent 7’ (Alphabet (NASDAQ:), Amazon (NASDAQ:), Apple (NASDAQ:), Meta Platforms, Microsoft (NASDAQ:), NVIDIA (NASDAQ:) and Tesla). This intense focus on these seven growth companies that are considered to be AI beneficiaries was a significant contributing factor in the superior performance of growth versus value stocks in recent years (see front page chart).

Things are now looking very different. Given the strong performance of the US market, history suggests that 2025 would mean more muted returns for shareholders. Stock market leadership had broadened out, which was a healthy development, as investors sought companies with solid fundamentals that were trading on more reasonable valuations. However, the investment backdrop recently changed very rapidly when President Trump moved from a policy of imposing selective to universal trade tariffs, which led to a major sell-off in global equities. The consensus view is that ultimately tariffs will lead to higher inflation and there are increased concerns about economic growth due to disruption to global supply chains and the hit to consumer and corporate sentiment, among other factors.

When equity markets stabilise, data from BlackRock show that since the early 1920s, value stocks have outperformed growth names during periods of rising inflation. Also, while value stocks usually trade at a discount to growth stocks, the differential has been wider than the historical average.

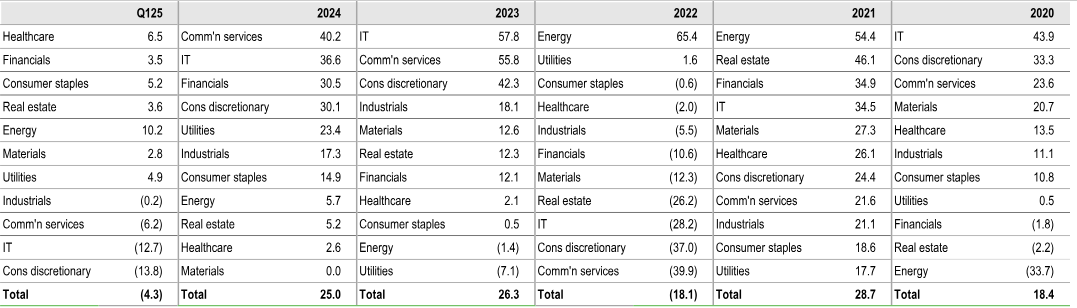

Exhibit 1: Performance of S&P 500 Sectors (%, at 31 March 2025)

Source: LSEG Data & Analytics, Edison Investment Research

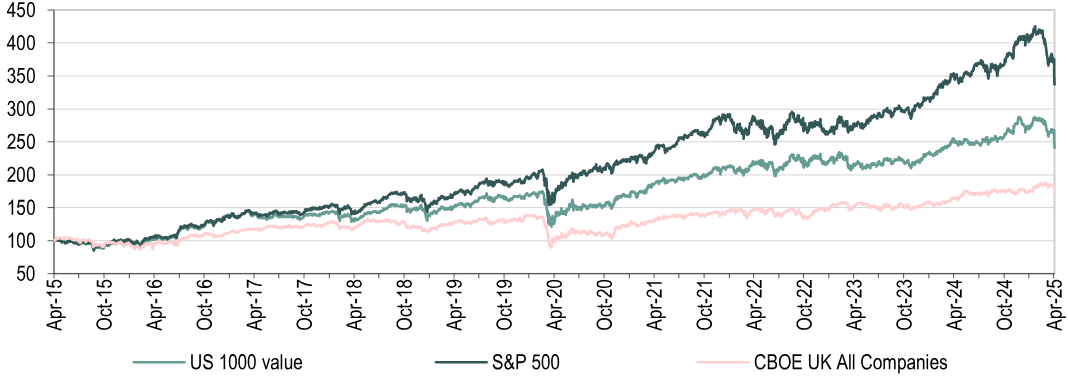

Exhibit 2: Performance of Indices Over the Last Decade (£)

Source: LSEG Data & Analytics, Edison Investment Research

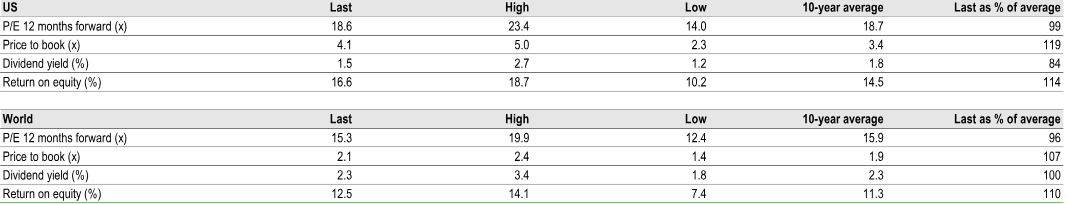

Strong performance from the US market in recent years has led to a premium valuation. At the end of 2024, the US was trading on a 21.8x forward P/E multiple, which was a 29.4% premium to the world market. However, global markets have been volatile in 2025 and US stocks are looking more reasonably priced. In absolute terms, the US is now trading on an 18.6x forward P/E multiple, while its premium to global stocks has declined to 21.6%. In general, US stocks are more profitable, generating a 4.1pp higher return on equity, but offer a less attractive dividend yield.

Exhibit 3: Valuation of Datastream Indices (at 4 April 2025)

Source: LSEG Data & Analytics, Edison Investment Research

Highlights from BRAI’s FY24 (ending 31 October)

- Performance – BRAI’s NAV and share price total returns of +16.0% and +13.8% respectively trailed the reference index’s +23.2% total return.

- Revenue and dividends – the trust’s revenue per share declined 7.6% y-o-y from 3.67p to 3.39p. Once more, there were four quarterly dividends of 2.0p per share, which required a contribution from distributable reserves.

- Share repurchases – during FY24, c 8.3m shares (10.4% of the share base) were bought back at an average 9.9% discount and a cost of c £16.1m. The share repurchases added 1.07% to the average daily NAV.

Following FY24, to reflect sustainability disclosure requirements, naming and marketing rules, non-material changes were made to BRAI’s investment policy and objective.

Performance: Behind the Reference Index in FY24

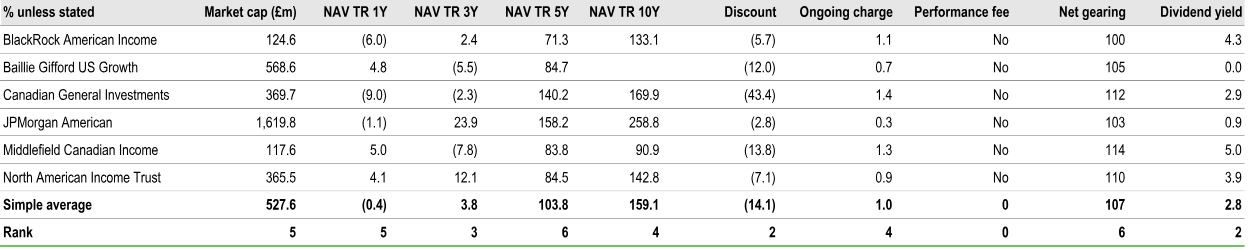

BRAI is one of the smaller funds in the AIC North America sector shown in Exhibit 4 (we have excluded Pershing Square (LON:) due to a lack of available data). The trust’s NAV total returns are below the selected peer group averages over the periods shown. At 4 April 2025, BRAI had the second-narrowest discount. The trust’s ongoing charge is modestly above average, it is currently ungeared, and it has the second-highest dividend yield, which is 150bp above the mean.

Exhibit 4: AIC North America Sector (excluding Pershing Square Holdings) at 4 April 2025

Source: Morningstar, Edison Investment Research. Note: TR = total return. Performance at 3 April 2025.

In FY24, BRAI generated an NAV total return of +16.0% and a share price total return of +13.8% versus the reference index’s +23.2% total return. The trust struggled to keep up in a market that was driven more by macroeconomic events than by company fundamentals. Performance was also negatively affected by stock selection, including in the consumer staples and healthcare sectors. The largest positive contributors to the trust’s performance were: Fidelity National Information Services (NASDAQ:) (financials, +0.8pp); Citigroup (NYSE:) (financials, +0.8pp); General Motors (NYSE:) (consumer discretionary, +0.7pp); and Western Digital (NASDAQ:) (IT, +0.7pp). On the other side of the ledger, the largest detractors were: Dollar Tree (NASDAQ:) (consumer staples, -1.8pp); Kosmos Energy (energy, -1.5pp); Fortrea Holdings (healthcare, -1.2pp); and Aptiv (consumer discretionary, -1.0pp).

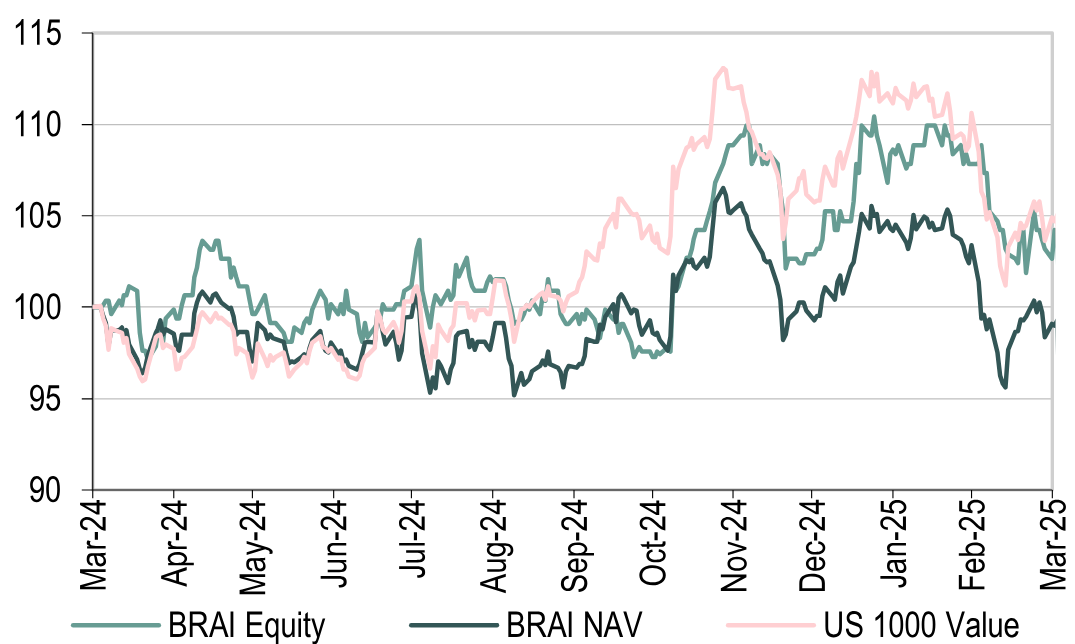

Exhibit 5: Rebased Price, NAV and Index Total Return Performance, One Year to 31 March 2025

Source: LSEG Data & Analytics, Edison Investment Research

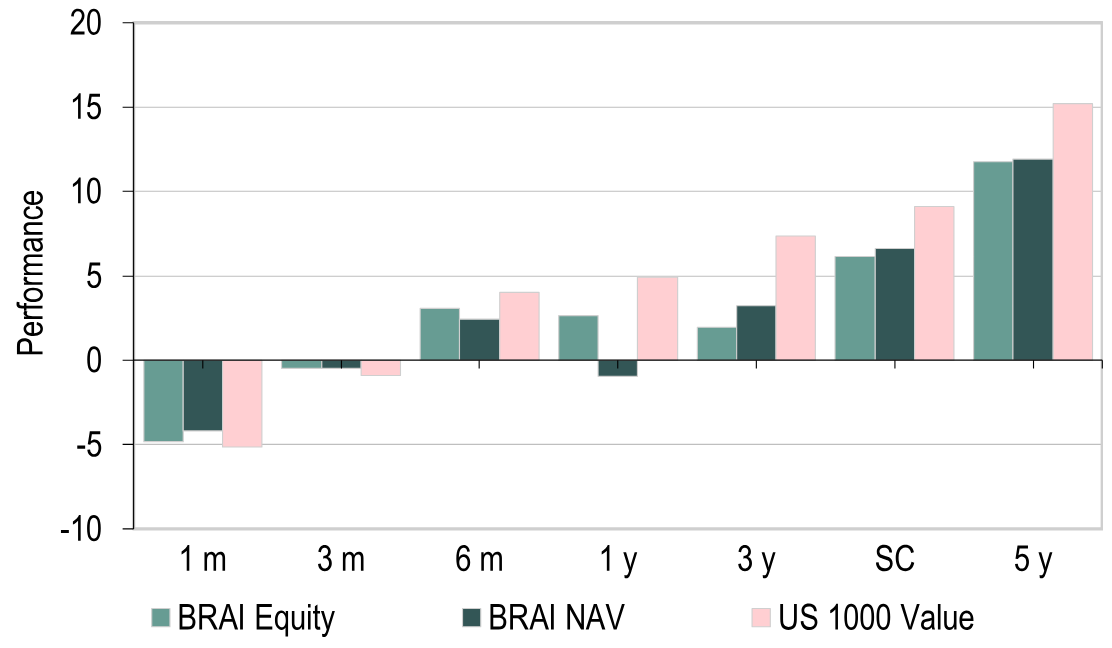

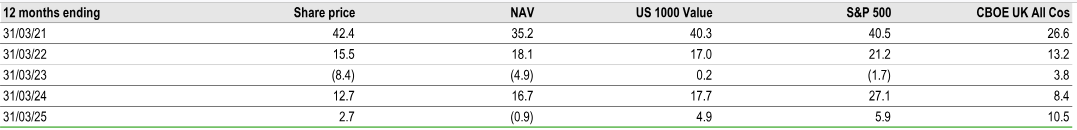

Exhibit 6: Price, NAV and Index Total Return Performance (%)

Source: LSEG Data & Analytics, Edison Investment Research. Note: Three-year, SC and five-year figures annualised. SC is since change in strategy on 30 July 2021.

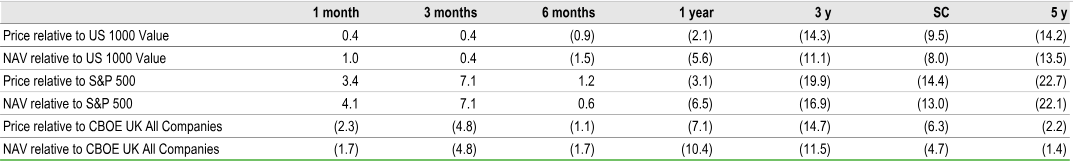

Exhibit 7: Share Price and NAV Total Return Performance, Relative to Indices (%)

Source: LSEG Data & Analytics, Edison Investment Research. Note: Data to end March 2025. Geometric calculation. SC is since change in strategy on 30 July 2021.

Exhibit 8: Five-Year Discrete Performance Data (%)

Source: LSEG Data & Analytics, Edison Investment Research. Note: All % on a total return basis in pounds sterling.

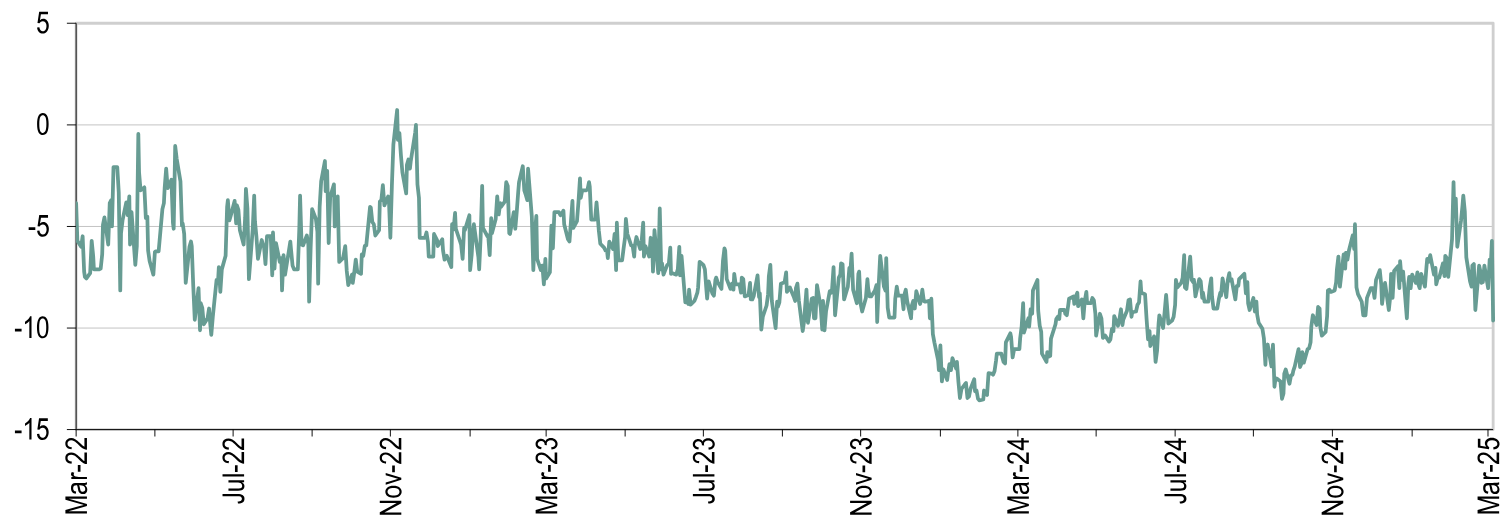

Valuation: Discount Starting to Narrow

BRAI’s 8.0% discount compares with the three-year range of a 0.7% premium to a 13.6% discount. Over the last one, three and five years, the average discounts are 8.7%, 7.4% and 6.4% respectively. The discount has been in a narrowing trend over the last few months and there is scope for the trust to regularly trade closer to NAV if there is sufficient interest in the proposed new strategy.

Renewed annually, the trust’s board has the authority to repurchase up to 14.99% and allot up to 10% of its share capital. Due to the prevailing discount to NAV in October 2023, when, in general, investment companies’ discounts had widened to levels last seen during the global financial crisis, BRAI’s board restarted share buybacks and, since then, shares have regularly been repurchased.

Exhibit 9: Discount Over the Last Three Years (%)

Source: LSEG Data & Analytics, Edison Investment Research

The Board

Alice Ryder has been a director for more than 10 years, partly to provide continuity, and has announced her intention to retire from BRAI’s board at the 2025 AGM. David Barron will become the chair. If the continuation vote is passed, another director will be appointed. For FY25, each of the directors’ remuneration will increase by £1,000.

Exhibit 10: BRAI’s Board at End FY24

Source: BRAI