Highlights:

- Foreign loan defaulters now barred from local borrowing

- Central bank’s CIB to include foreign loan defaults

- Move aims to curb external credit risk, defaults

- Experts praise decision as “good step.”

- Currency depreciation makes foreign loan repayment harder

- Committee prioritizes restructuring due to dollar crisis

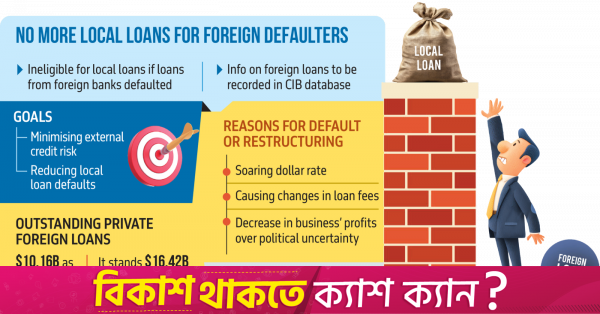

Private companies that default on foreign loans will now appear in the central bank’s credit information bureau (CIB) database and be barred from borrowing from local banks and financial institutions too.

This significant decision, aimed at curbing external credit risk and minimising defaults, was made by the Scrutiny Committee on Foreign Loan and Supplier’s Credit.

The committee has mandated the inclusion of foreign loan default information in the Bangladesh Bank’s Credit Information Bureau (CIB) database. This move addresses a critical loophole: previously, while defaults on domestic loans were recorded in the CIB, no such data existed for foreign obligations, allowing defaulting companies to secure new local credit.

The resolution was adopted at a meeting on 21st May, chaired by Bangladesh Bank Governor Ahsan H Mansur, who also heads the committee. An excerpt from the committee’s proceedings confirms the rationale: “To assess external credit risk and minimise default, the committee decided that CIB of the Bangladesh Bank will take necessary measures to include information of foreign loan and supplier’s credit of private sector in CIB database so that no resident entities default against foreign borrowing can avail facility from local sources.”

Expert praises “good step”

Fahmida Khatun, executive director at the Centre for Policy Dialogue (CPD) and a director at the Bangladesh Bank, lauded the initiative as “undoubtedly a good step.” She emphasised the necessity of this data for assessing external credit risks and deemed it “logical” to restrict domestic bank lending to companies defaulting on foreign loans. Fahmida also questioned why such foreign loan default information had not been maintained in the CIB database previously.

A Bangladesh Bank official present at the scrutiny committee meeting highlighted the current limitations on government intervention when a company defaults on a foreign loan. “Now, the decision to record default information in the CIB and restrict access to domestic credit aims to compel borrowers to honour their foreign debt commitments,” the official stated.

Rising dollar rate and restructuring challenges

The meeting also saw the sanctioning of new loan proposals totaling $20.20 million for Incepta Pharmaceuticals Limited ($20 million) and Theatre Medical Bangladesh Company Limited ($0.20 million).

Additionally, the committee approved proposals for changes to repayment schedules, fees, and charges for approximately $988 million in existing loans from nine companies. It also granted retrospective approval for $315.07 million in loans across 13 companies.

Bangladesh Bank officials indicate that borrowing companies are frequently extending their repayment deadlines due to difficulties in servicing their loans on time, often incurring additional one-off charges. The global transition from LIBOR (London Interbank Offered Rate) to SOFR (Secured Overnight Financing Rate) has also led to changes in fees for various loans, requiring committee approval.

The scrutiny committee meeting minutes revealed that out of 24 proposals approved, only two were for new loans, with the majority involving restructuring existing loans. Fahmida Khatun suggested that the committee likely prioritised restructuring proposals due to the foreign currency crisis in Bangladesh over the past 18 months, which has made timely instalment payments challenging for borrowing institutions.

Abdul Awal Mintoo, chairman of National Bank and former president of the FBCCI, explained the severe impact of the depreciating Taka on foreign loan repayment. “When these foreign loans were initially taken, the dollar rate was Tk83-84, but now it is Tk123-124. This means businesses now require significantly more taka to pay the same instalment,” he stated. He added that political and social instability, coupled with gas and electricity shortages, further hinder companies’ ability to boost production and profits, forcing them to defer loan repayments by incurring additional charges.

Short-term foreign loan landscape

According to Bangladesh Bank data, the outstanding balance of short-term private sector foreign loans stood at $10.16 billion at the end of February. As the dollar exchange rate began to climb in 2023, businesses increasingly prioritised repaying dollar loans to mitigate exchange rate risks. Consequently, the outstanding balance of these loans fell from $16.42 billion at the end of December 2022 to $11.79 billion by December 2023 – a reduction of approximately $4.63 billion within a year. However, the volume of foreign loans has shown an upward trend since February of the current year.

Companies undergoing loan restructuring and retrospective approvals

Notable companies receiving restructuring approvals include Banglalink Digital Communications Limited, which secured changes to its lender, repayment structure, and extended repayment period for a $300 million loan. Robi Axiata PLC received approval for an earlier repayment of its $95 million loan from the International Finance Corporation. Uttara Foods and Feeds (Bangladesh) Limited, HDFC Sinpower Ltd (for two loans), and Nutan Bidyut (Bangladesh) Ltd also saw approved changes to their repayment schedules, fees, or charges for substantial existing loans. Additionally, the committee approved amendments to fees and expenses for a $90 million loan involving the Islamic Corporation for the Development of the Private Sector, Infrastructure Development Company Limited, and Bangladesh Infrastructure Finance Fund.

Several companies received retrospective approval for their foreign loans, including EUBD Accessories Ltd ($0.55 million), SHIMA SEIKI MFG LTD ($1.87 million), and Barisal Electric Power Company Ltd ($69 million). BSRM Steels Ltd received an extension for the availability period of its $83 million loan. Approvals for various loan-related adjustments were also granted to RSGT Bangladesh Ltd, Pearl Garments Company Ltd, US-DK Green Energy (BD) Ltd, Bangladesh Edible Oil Ltd, and Baraka Shikalbaha Power Ltd.

Officials explained that the Bangladesh Investment Development Authority (BIDA) manages the scrutiny committee’s overall activities. Urgent proposals may receive conditional BIDA approval, allowing companies to proceed, with the scrutiny committee granting retrospective approval later. The latest scrutiny committee meeting on 21st May was the first in nearly four months, following its last meeting on 28th January.