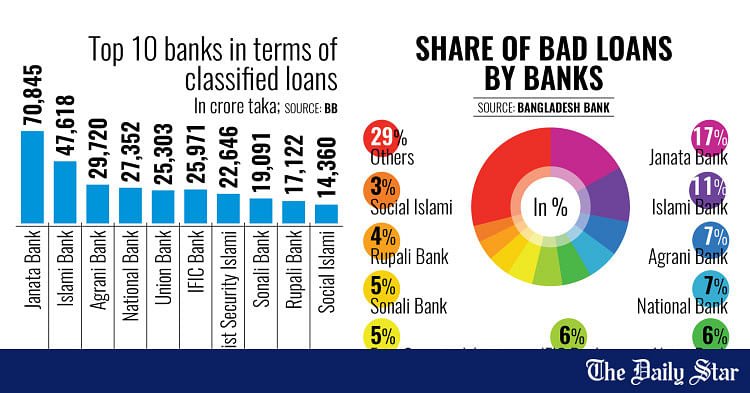

Just ten banks, both state-owned and private, account for 71 percent of all non-performing loans (NPLs) in the country’s banking sector.

The heavy concentration of bad loans within these banks exposes their fragile financial health and adds to the strain on the sector as a whole.

By the end of March this year, bad loans in the banking sector soared to a record Tk 420,335 crore. Of this, Tk 300,028 crore was tied to ten banks, according to the latest data from Bangladesh Bank (BB).

Among them are four state-run banks: Agrani Bank, Janata Bank, Sonali Bank, and Rupali Bank.

The other six are private lenders: Islami Bank Bangladesh, First Security Islami Bank, IFIC Bank, National Bank, Social Islami Bank, and Union Bank.

Janata Bank has the highest volume of bad loans, due largely to widespread irregularities and major scams.

As of March, Janata had disbursed loans totalling Tk 94,734.94 crore, of which Tk 70,845.68 crore had turned sour.

Once a respected lender, Janata’s reputation collapsed following a series of scandals involving Anontex, Crescent, Beximco, Thermax, and the S Alam Group during the previous Awami League regime.

Its bad loans rose 48 percent in just nine months, climbing from Tk 48,000 crore in June last year.

Islami Bank Bangladesh has also seen a sharp rise in bad loans. The bank, the largest Shariah-based lender in the country, became entangled with the controversial S Alam Group, which controlled its board until mid-August last year.

By March this year, its NPLs had reached Tk 47,618 crore, which is 27.38 percent of total disbursed loans.

The S Alam Group and its affiliated firms took more than half of Islami Bank’s Tk 163,863.78 crore loan portfolio, show BB data.

At the end of June last year, just before the August 5 political changeover, the bank’s bad loans stood at only Tk 7,724 crore.

State-run Agrani Bank’s NPLs hit Tk 29,720 crore by March, accounting for 41.35 percent of its disbursed loans.

This marked a 39.37 percent jump from June last year. Agrani Bank officials said politically influential individuals borrowed large sums from state banks that have since turned bad.

National Bank’s NPLs stood at Tk 27,352 crore in March, or 64 percent of its outstanding loans. This was up from Tk 20,929 crore nine months earlier.

The central bank restructured the board of National Bank and ten other banks following the formation of the interim government in early August last year.

Once Bangladesh’s first private commercial bank with a promising future, National Bank became mired in losses due to loan irregularities, weak governance, and internal feuds.

During the previous Awami League government’s 16-year tenure, the Sikder Group held sway over the bank.

After the political changeover, businessman Abdul Awal Mintoo, vice-chairman of the Bangladesh Nationalist Party (BNP), took over as chairman.

Three other banks — First Security Islami Bank, Social Islami Bank, and Union Bank — were also under the influence of the S Alam Group and have seen their bad loans surge.

First Security Islami Bank’s NPLs reached Tk 22,646 crore, which is 36.63 percent of disbursed loans.

Social Islami Bank recorded Tk 14,360 crore in bad loans, or 38 percent, while Union Bank’s NPLs soared to Tk 25,303 crore — nearly 90 percent of its outstanding loans.

IFIC Bank’s bad loans shot up to Tk 25,971 crore in March this year, compared with Tk 3,756 crore in June last year.

Officials at the bank alleged that Salman F Rahman, former chairman of IFIC Bank and a close adviser to ousted prime minister Sheikh Hasina, used the bank for personal gain.

Another state lender, Sonali Bank, reported NPLs of Tk 19,091 crore, or 21.11 percent of its disbursed loans.

Rupali Bank’s bad loans stood at Tk 17,122 crore, or 36 percent, according to central bank data.

Md Omar Faruk Khan, acting managing director of Islami Bank Bangladesh, said that the current management is making every effort to recover the bank’s bad loans.

“But loan recovery has not reached a satisfactory level due to non-cooperation by large borrowers,” he told The Daily Star.

According to the acting MD, Islami Bank has filed 370 cases under the Negotiable Instruments Act and 24 cases with the money loan court over the past two months against several large borrowers, including the S Alam Group, to recover the loans.

“Meanwhile, the bank’s financial health has improved, thanks to a growing trend in deposits,” Khan commented.

Syed Abu Naser Bukhtear Ahmed, chairman of Agrani Bank, said that the rise in bad loans reflects massive irregularities during the previous regime.

“I wanted the actual scenario to come to light. That’s why the volume of bad loans has increased,” he said.

He also mentioned that the bank’s loan recovery efforts were not satisfactory.

Moinul Islam, economist and former professor at the University of Chittagong, said, “A special tribunal must be formed to bring loan defaulters under strict punishment.”

“Otherwise, others will also be encouraged to default on loans,” he told The Daily Star.

For all latest news, follow The Daily Star’s Google News channel.

For all latest news, follow The Daily Star’s Google News channel.