At its H125 results, Topps Tiles’ (LON:) (TPT’s) management excluded CTD Tiles’ results from its adjusted results, as it did not take full control of the business until after the period end due to the prolonged investigation by the Competition and Markets Authority (CMA).

Management also indicated it would apply the same treatment to CTD’s results for the full year. We have adjusted our estimates to be consistent with management’s treatment of CTD’s results, removing the previous estimated operating profit from our adjusted numbers. We should stress there are no underlying changes to our estimates for TPT’s other operating divisions.

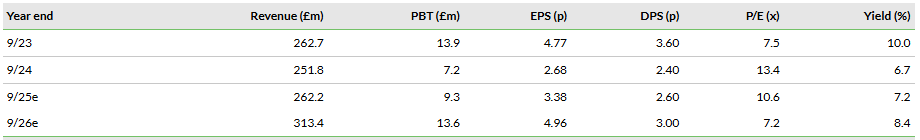

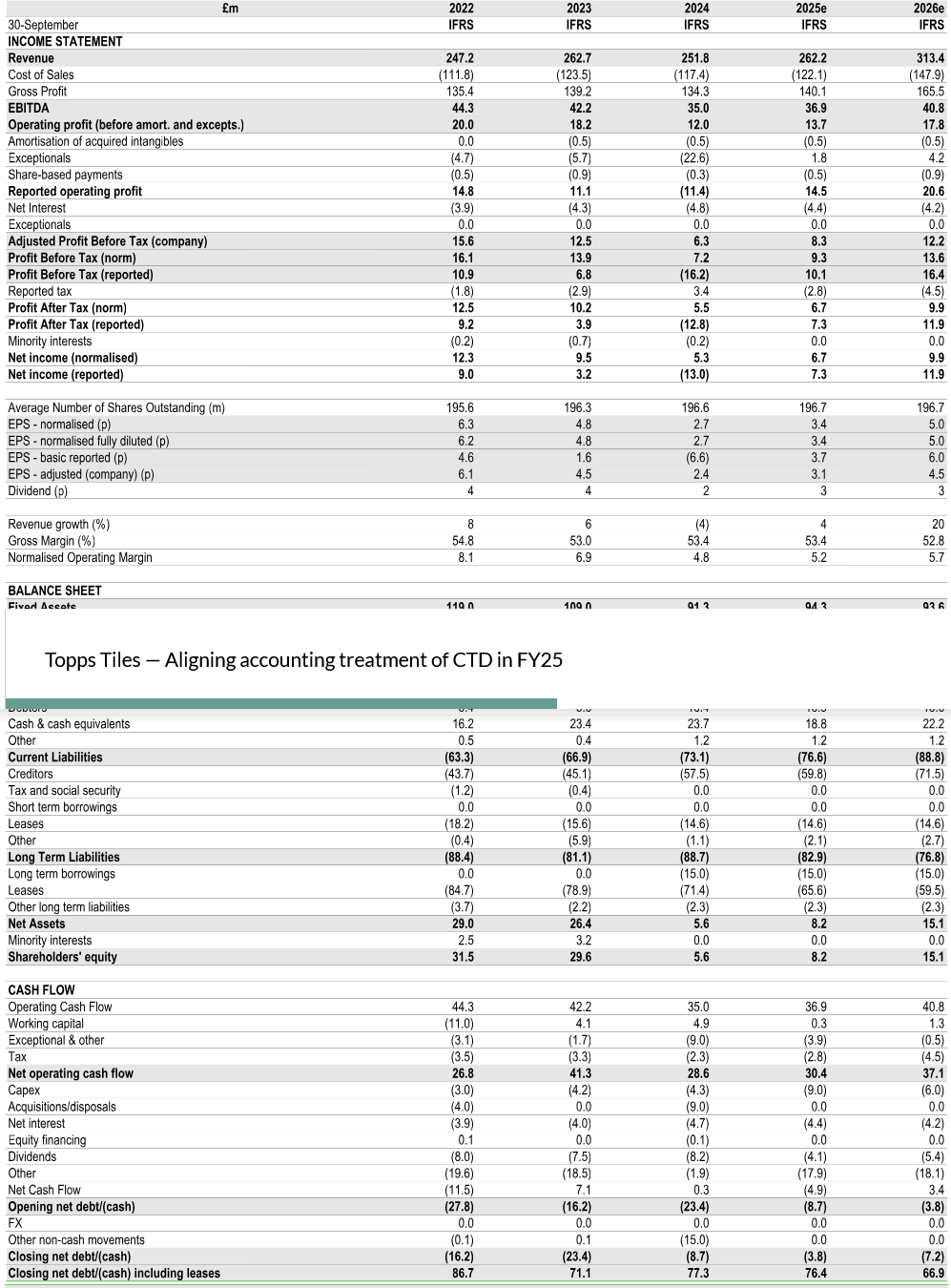

Note: PBT and EPS are normalised, excluding amortisation of acquired intangibles, exceptional items and share-based payments.

TPT Regained Control of CTD after H125

On 24 April 2025, after the end of H125, the CMA announced it had accepted TPT’s proposal to dispose of the four CTD stores where local competition concerns had been identified, from a total of 30 stores at the time of the acquisition. At this stage, TPT was able to take full control of the assets and review the business’s performance, hence it was appropriate to report both adjusted results, excluding CTD to give a better understanding of the group’s underlying performance, and statutory results.

Management concluded they are confident of CTD’s medium-term potential of £30–40m of revenue with a PBT margin of 8–10%, which is consistent with the rest of the group. For FY25, despite the weakness in all parts of the business, management indicated that CTD’s annualised sales remain at £30m. They also highlighted that CTD’s trading losses (during the period when TPT did not have full control) were greater than expected at £1m. However, management’s actions should move the company to at least breakeven in Q4.

Moving CTD Below the Line in FY25

When the acquisition was originally announced in June 2025, we added £30m revenue, £15m gross profit (30% margin) and £1.5m operating profit (5% margin) in our TPT forecasts. We subsequently reduced the latter to £0.75m at the Q125 trading update when it became clear the CMA’s review would last longer than originally anticipated and, therefore, management would not be able to make the required operational changes.

We now remove these figures from our adjusted estimates to be consistent with management’s treatment for CTD, and include £300k of operating losses for CTD in H225, as well as the operating and exceptional results included in the H125 results in reported results.

Valuation: Low Multiples, Attractive Dividend Yield

TPT’s prospective EV/sales multiple of 0.2x looks very low in an historical context, given its prospective growth outlook and levels of profitability. This is complemented by a high dividend yield.

Exhibit 1: Financial Summary

Source: Topps Tiles, Edison Investment Research