Elon Musk became heavily involved in politics on the side of Donald Trump during the recent presidential campaign. The two men’s cooperation appeared exemplary even after the new president was sworn in, as evidenced by the multibillionaire’s involvement in the so-called Department of Government Efficiency. However, all indications are that this tandem may split—especially if reports of the formation of a new political party led by Elon Musk are confirmed. Tesla (NASDAQ:)’s stock price reacted to the news with a 7% drop, confirming that investors are wary of the Tesla chief’s political ambitions. The U.S. auto giant’s overvaluation is also rooted in fundamental issues and current sales results, which lag especially behind its main Chinese competitor, BYD (SZ:). Whether we will see a continuation of the downward movement will likely be determined by the quarterly results, which are set to be announced on July 23.

Will Elon Musk Get Involved in Politics for Good?

“America Party” — that would be the name of the new party under Elon Musk’s leadership. According to the Tesla chief, the idea was prompted by Donald Trump’s broad tax bill, which the billionaire believes is harmful and adds significantly to the national debt. If these plans come to fruition, it would likely create a conflict of interest at the intersection of business and politics, as recent market reactions have already indicated. Even without this, Tesla’s leadership has cause for concern—especially after the latest quarterly vehicle delivery figures, which stood at 384,122 units, representing a 13.5% decline compared to the same period a year earlier (year-end consensus was for 500,000 units). While this figure is nominally higher than Q1, it still lags far behind its main Chinese rival BYD, which delivered 607,000 units in the same period—surpassing Tesla for the third consecutive quarter.

So where can we look for positives? The focus should be on Tesla’s long-term projects, such as energy storage, autonomous driving, and the robotaxi, which could provide a future technological edge. However, these initiatives are unlikely to support the stock price in the short term.

Fundamentals Suggest Further Discounting of Tesla Shares

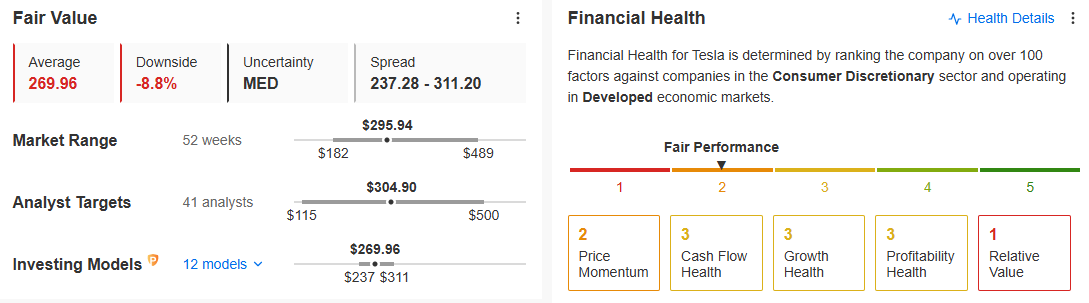

From a fundamental analysis perspective, Tesla remains at risk of further downside in the weeks ahead. Particularly noteworthy is the fair value estimate, which sits at -8.8%, and a financial health score of just 2 points.

Figure 1: InvestingPro’s fair value and financial health index.

Source: InvestingPro

Equally telling is the number of downward earnings revisions ahead of the upcoming report—22 in total—with zero upward revisions, painting a clear picture of prevailing sentiment around the company.

Figure 2: Tesla quarterly earnings forecasts.

Source: InvestingPro

Demand Struggles To Stay Above $300 per Share

Tesla’s stock price has entered a period of local consolidation and is currently trading around $300 per share, with the lower boundary just below that level.

Figure 3: Technical analysis of Tesla

If the supply side manages to trigger a breakout—which appears to be the base case—the next target would be $220 per share. In this scenario, the key resistance level sits around $360 per share, which acts as the primary defense zone.

***

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Whether you’re a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

- ProPicks AI: AI-selected stock winners with proven track record.

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.