XAU/USD

Gold is probably forming a descending channel but it is too early to know at this stage of course.

Last week we traded in a sideways consolidation exactly as predicted.

Two weeks ago I warned that we are unlikely to reach $3000 at this stage.

It is likely that we must wait several days ( and probably even weeks) for clarification of the new pattern or trend, as stated at the start of last week.

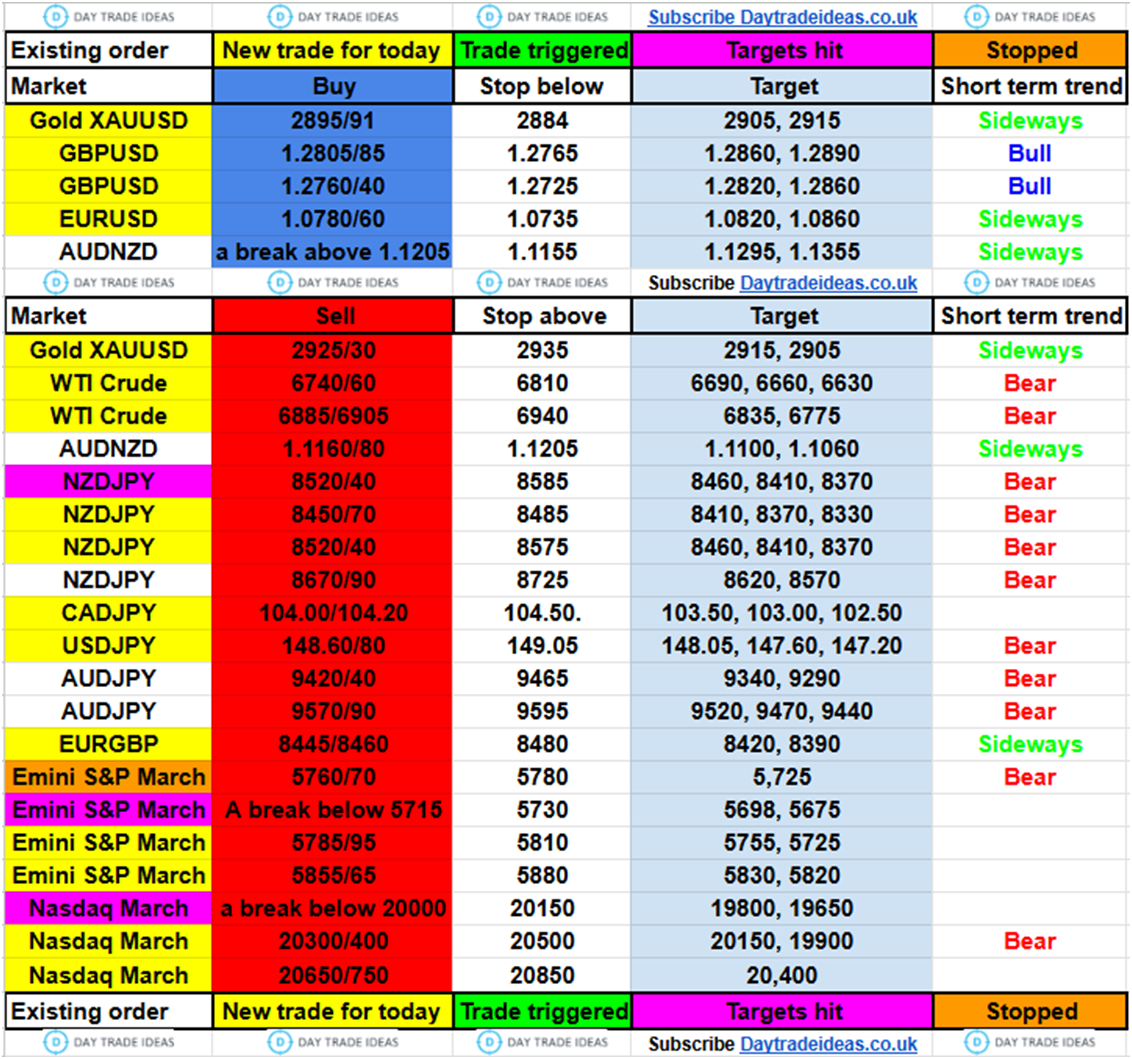

Currently the only strategy that can work is scalping short term support at 2895/91 – buy here with stop below 2884.

Targets: 2905 & 2915

And scalp resistance at 2925/30 – shorts need stops above 2935

Targets: 2905, 2915

Watch the 3 day range of 2893/91 2926/30.

A break below 2882/81 is a sell signal targeting 2870/2868 & even 2869/56 is not out of the question.

A break above 2932 may retest the all time high at 2951/56.

XAG/USD

Silver outlook remains unclear in the longer term sideways channel.

We could have support again at 3230/3220 & in fact longs here worked perfectly on Thursday & Friday. – but longs need stops below 3200 again today.

.

Targets: 3240, 3260 again for Monday & I hope this trade worked for you on Friday.

A break above 3275 can retest the February high at 3322/3340.

Just be aware that a break below 3200 can target 3175

WTI Crude April future

Last session low & high: 6612 – 6822.

WTI Crude on Friday we had a sell opportunity at 6740/60 but shorts needed stops above 6800.

Unfortunately we momentarily shot higher to 6822 before the expected decline.

However I would try this trade again on Monday, with stop above 6810.

Targets:

A break higher can target 6820/30 then strong resistance at 6885/6905 & shorts need stops above 6940.

Targets: 6835 & 6775

Support again at 6530/20. A break below 6500 is a sell signal targeting 6445/35 & 6395/75.