Your browser does not support the

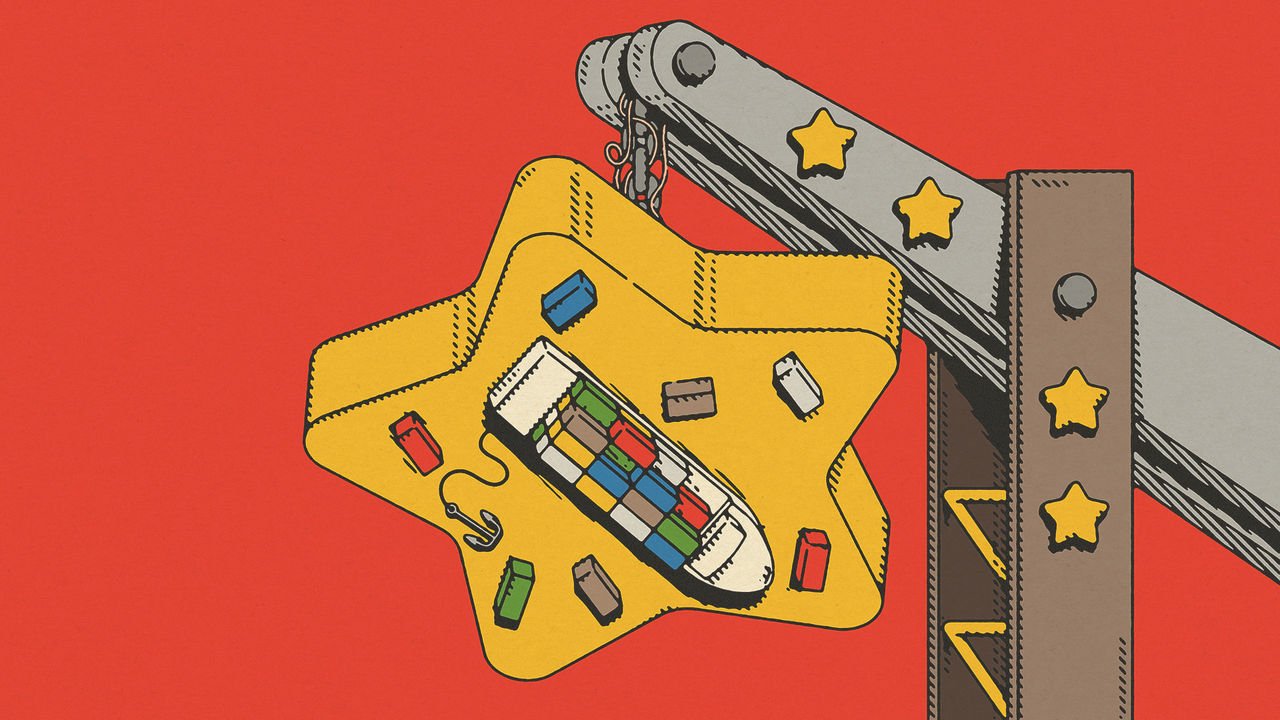

THE HUMBLE magnet may not seem to belong alongside steel, microchips and oil as a chess piece in the great diplomatic game. But on April 4th, as part of its retaliation against America’s tariffs, China announced export restrictions on a particularly useful kind of magnet—the powerful permanent sort that can be made with “rare-earth” metals.

Assuming the restrictions stay in force, they are likely to have a big impact. Strong and compact, rare-earth magnets have found their way into everything from electric cars and wind turbines to MRI machines and missile-guidance systems. And as with the rare-earth industry in general, Chinese firms dominate the market. America’s Department of Energy estimated in 2022 that China produced 92% of the 100,000-odd tonnes of rare-earth magnets made each year.

That China is exploiting its dominance of rare earths and the things made from them is hardly new: in 2010 it halted exports of rare-earth metals to Japan for months over a fishing dispute. It imposed further restrictions in February, before Donald Trump, America’s president, kicked off the latest round of the trade war. But restrictions on magnets themselves came as a surprise, says Jack Howley, an analyst at IDTechEx, a market-analysis firm. “Many firms were focused on the tariffs,” says one industry observer. “But these export restrictions could end up hurting them more.” And the defence implications, says Dr Howley, are likely to “really scare” governments around the world.

China’s restrictions, therefore, seem likely to boost efforts to find new sorts of magnets that do not rely on rare-earth elements. Interest in this subject has increased hugely in recent years, says Nicola Morley, a physicist at the University of Sheffield. Last year, she says, Masato Sagawa, a Japanese scientist who helped commercialise rare-earth magnets in the 1980s, did a lecture tour around Europe. “It was 40 years since he’d created the best magnet going, and he wanted to know why we hadn’t done better since then.”

Rare-earth magnets are prized because they pack a lot of magnetic punch into a small space. One commonly used figure of merit is a magnet’s “maximum energy product”, known in the literature as its (BH)max. An easy way to think of this, says Laura Lewis, an engineer at Northeastern University in Massachusetts, is as a measure of the effort needed to prise a magnet off a steel filing cabinet. A high-quality rare-earth magnet made of an alloy of iron, neodymium and boron might have a (BH)max of more than 400 kilojoules (kJ) per cubic metre; ten times more than cheap ferrite fridge magnets, or even more.

Rare-earth magnets will also retain their own magnetism even in the presence of strong external magnetic fields—important in motors and generators, which rely on the interaction between two or more magnetic fields to work. With the addition of other rare-earth elements such as dysprosium, they can be made to function at temperatures of more than 200°C.

This combination of properties makes rare-earth magnets hard to beat. One alternative, says Dr Lewis, is to switch rare-earth elements for others that are chemically at least somewhat similar. Platinum is one, she says, although it is rare and expensive. Magnets made from aluminium, nickel and cobalt, meanwhile, use relatively cheap materials and work well at high temperatures, but offer only a fraction of the strength of rare-earth magnets.

Better options are on the horizon. Dr Lewis is working on an exotic rare-earth substitute that is not found naturally on Earth, but which does occasionally fall from the sky. Tetrataenite is a mineral found in some meteorites, composed of atomically thin layers of iron and nickel stacked on top of each other. With a theoretical (BH)max of around 335kJ/m3, magnets made from the stuff would be nearly as strong as the best neodymium ones, while being even more heat-resistant. And its ingredients are common.

The difficulty lies in actually making it. Natural tetrataenite is formed as the nickel and iron inside meteorites cool slowly over millions of years. Scientists have been able to make tetrataenite in the lab since the 1960s, but the process—which involves bombarding iron and nickel with beams of neutrons—is too slow for mass production.

Dr Lewis and her colleagues are looking for a better way. Their method involves heating iron and nickel in a vacuum, in the presence of a magnetic field, while also subjecting the alloy to mechanical strain. The result, according to a paper published in 2024, is that small batches of lab-grown tetrataenite can be produced in about six weeks. That may sound like a long time to an industrialist, but is millions of times faster than natural methods can achieve.

Other researchers claim to have brought a different chemistry to the cusp of commercialisation. Niron Magnetics, a firm based in Minnesota, was founded on the back of work carried out on iron and nitrogen by Jian-Ping Wang, a physicist at the University of Minnesota. In theory, the (BH)max of iron nitrides could reach more than 1,000kJ/m3, far higher than even the best rare-earth magnets, though they are more susceptible to being scrambled by other magnetic fields. And nitrogen is common as muck: it can be sieved or distilled straight out of the air with relatively simple equipment. But until recently no one could produce iron nitride at scale.

Niron, though, thinks it has cracked that problem. It plans to break ground on a pilot plant later this year with a capacity of around 1,500 tonnes a year, and aspires to build a bigger, 10,000-tonne commercial factory in 2027. For now, the firm’s magnets still fall some way short of their theoretical performance. A document published by Niron in 2023 mentions a (BH)max of around 286kJ/m3, around half that of a good neodymium magnet. But improvements in manufacturing will raise that further. Niron has managed to attract around $140m in funding, says Jonathan Rowntree, its boss, with around a third coming from America’s government and two-thirds from private investors, including General Motors and Stellantis, a carmaker whose largest shareholder, Exor, part-owns The Economist’s parent company.

Even if everything goes swimmingly, none of the new magnets will arrive in time to fix the present shortage. Many industrial firms, says Dr Howley, will simply be hoping that diplomacy will prevail; on May 6th America and China said they would begin formal trade talks. Having been repeatedly burned, though, he thinks some governments may take a different tack. “They are probably going to have to make more of a concerted effort to support approaches that don’t rely on China,” he says. The best time to start looking seriously into alternatives was 20 years ago. But the second-best time is probably today. ■

Curious about the world? To enjoy our mind-expanding science coverage, sign up to Simply Science, our weekly subscriber-only newsletter.