The Comex report last month showed a lot of strength in gold which directly preceded a massive up move for the price of gold. The data is looking similar in silver this month!

The CME Comex is the Exchange where futures are traded for gold, silver, and other commodities. The CME also allows futures buyers to turn their contracts into physical metal through delivery. You can find more details on the CME here (e.g., vault types, major/minor months, delivery explanation, historical data, etc.).

The data below looks at contract delivery where the ownership of physical metal changes hands within CME vaults. It also shows data that details the movement of metal in and out of CME vaults. It is very possible that if there is a run on the dollar and a flight into gold, this is the data that will show early warning signs.

Gold

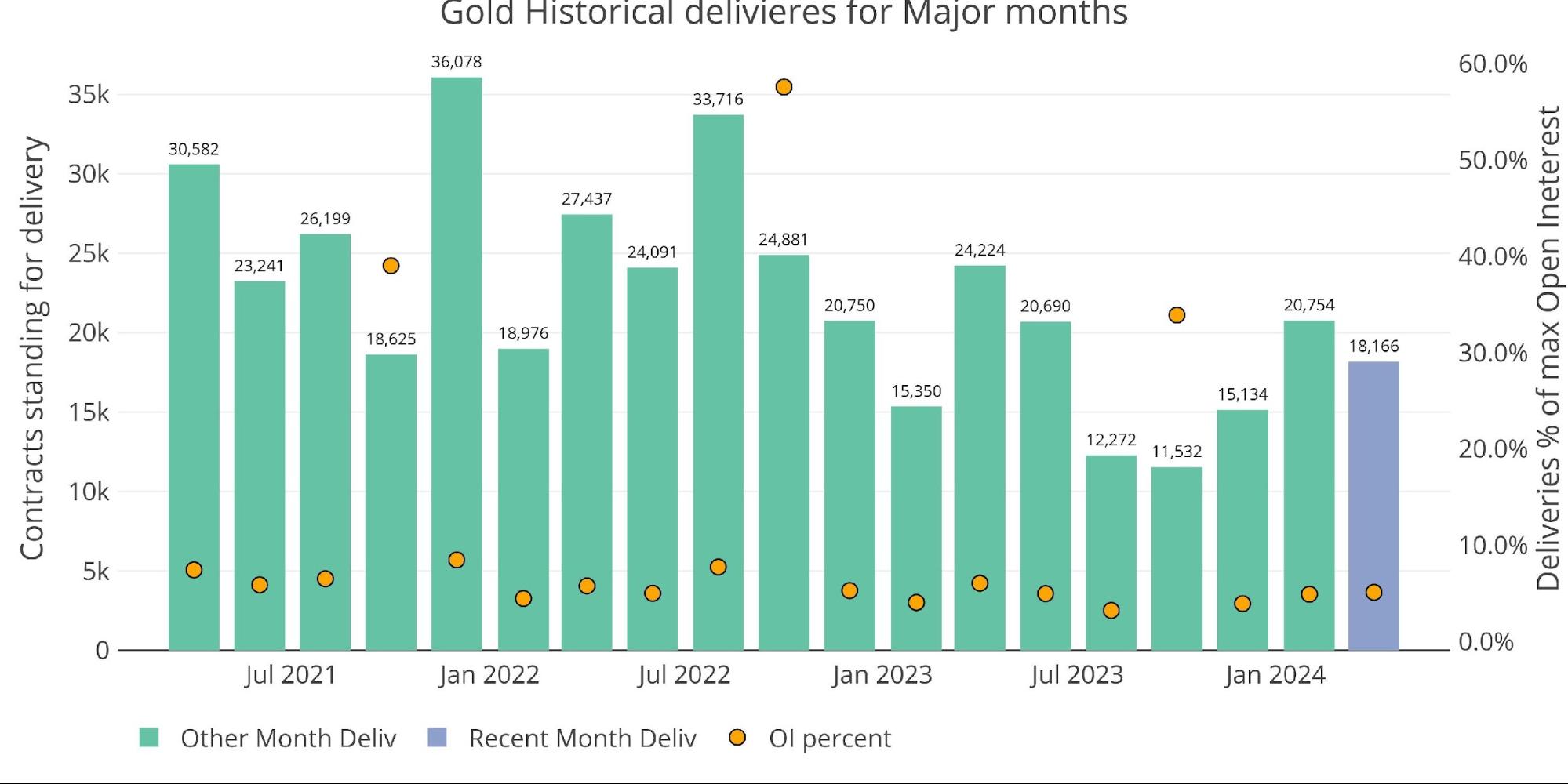

April is a major delivery month in gold. The delivery amount this month of 18k contracts was second highest since June of last year.

Figure: 1 Recent like-month delivery volume

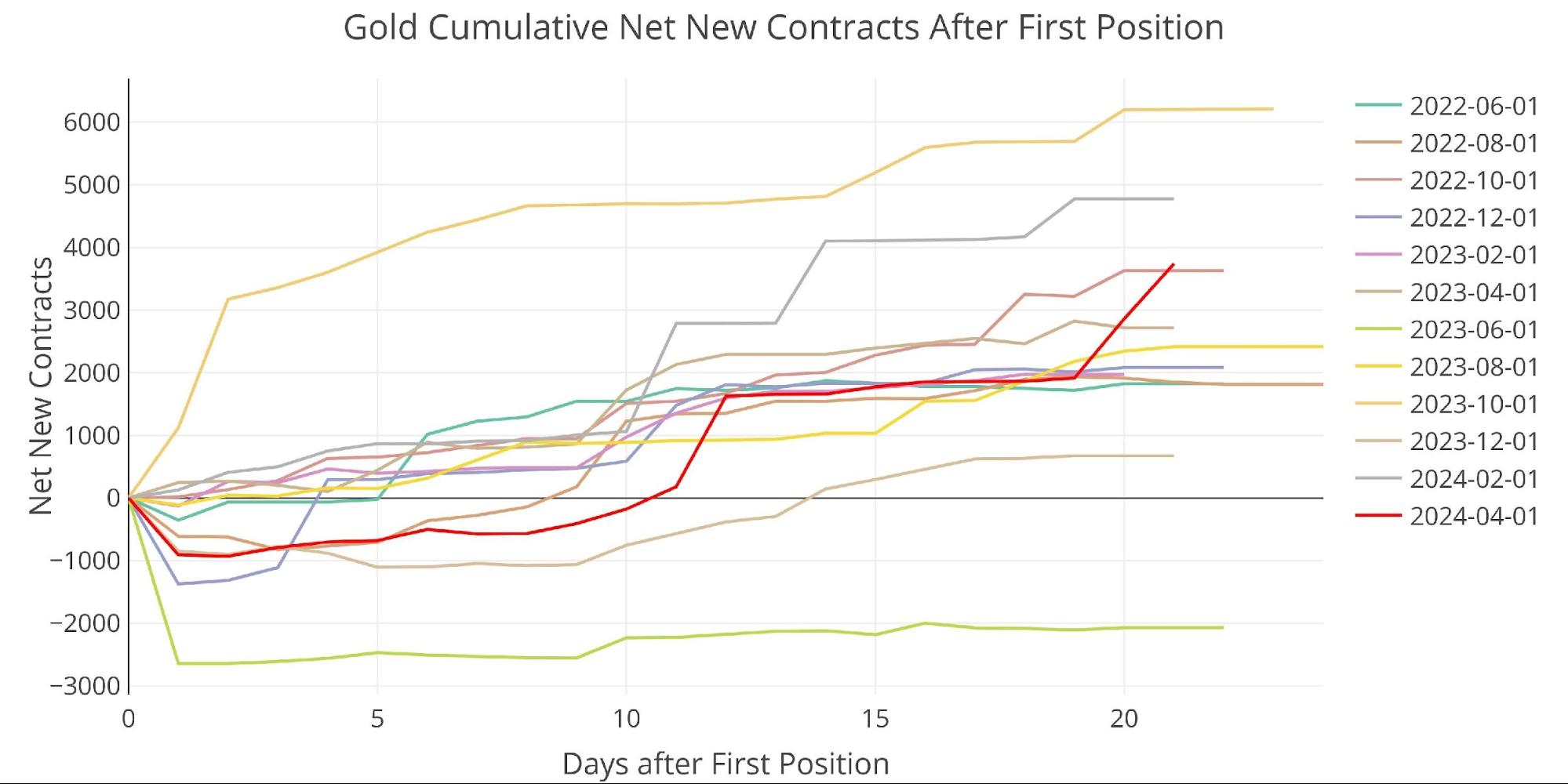

Net new contracts saw a late surge of almost 2k contracts into the end of the cycle. This is quite uncharacteristic as shown below where surges typically happen much earlier in the delivery cycle. Net new contracts represent contracts that are opened for immediate delivery on contracts that are already in their delivery phase.

Figure: 2 Cumulative Net New Contracts

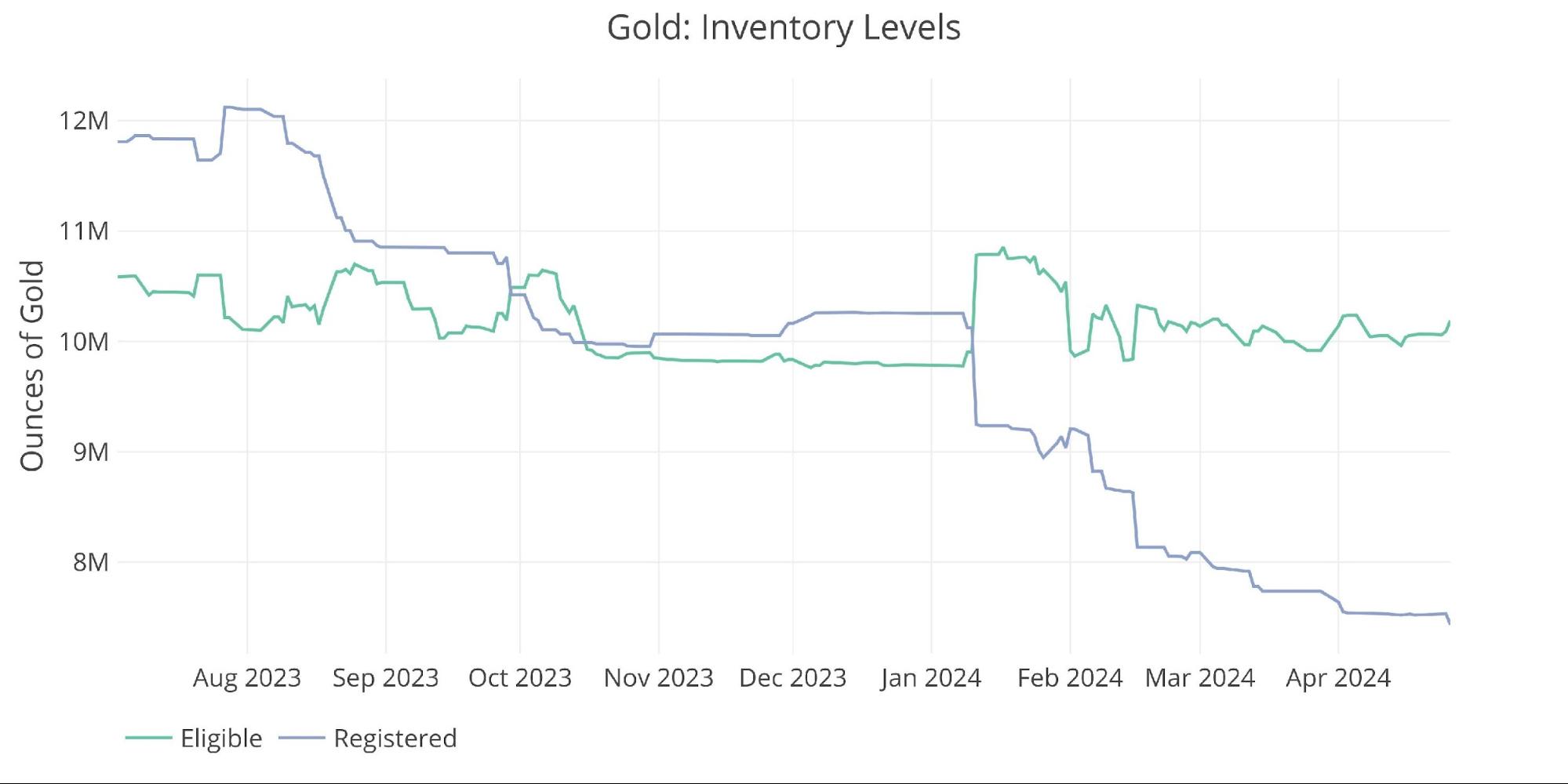

Inventory levels have been very stable throughout most of April.

Figure: 3 Inventory Data

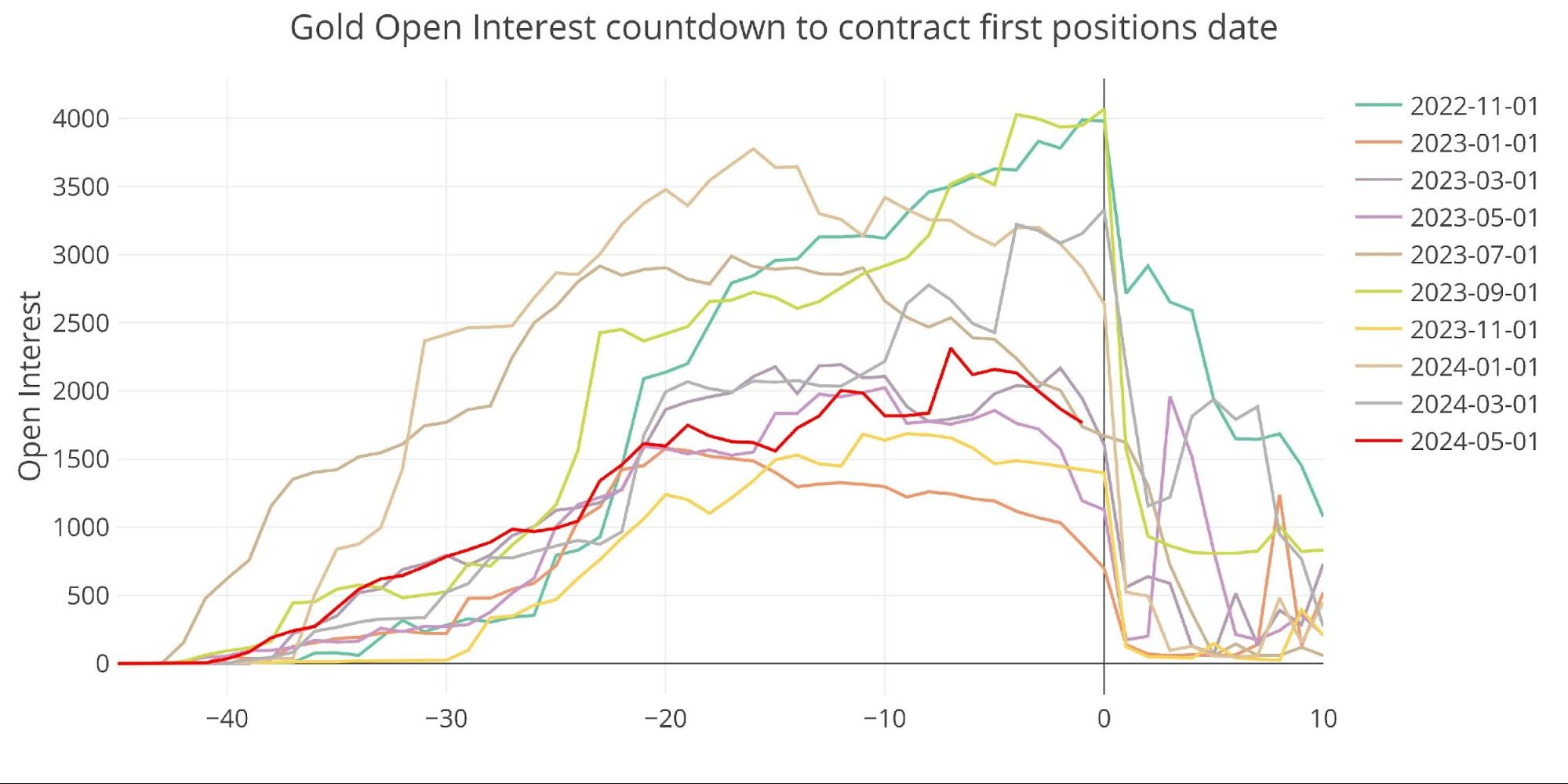

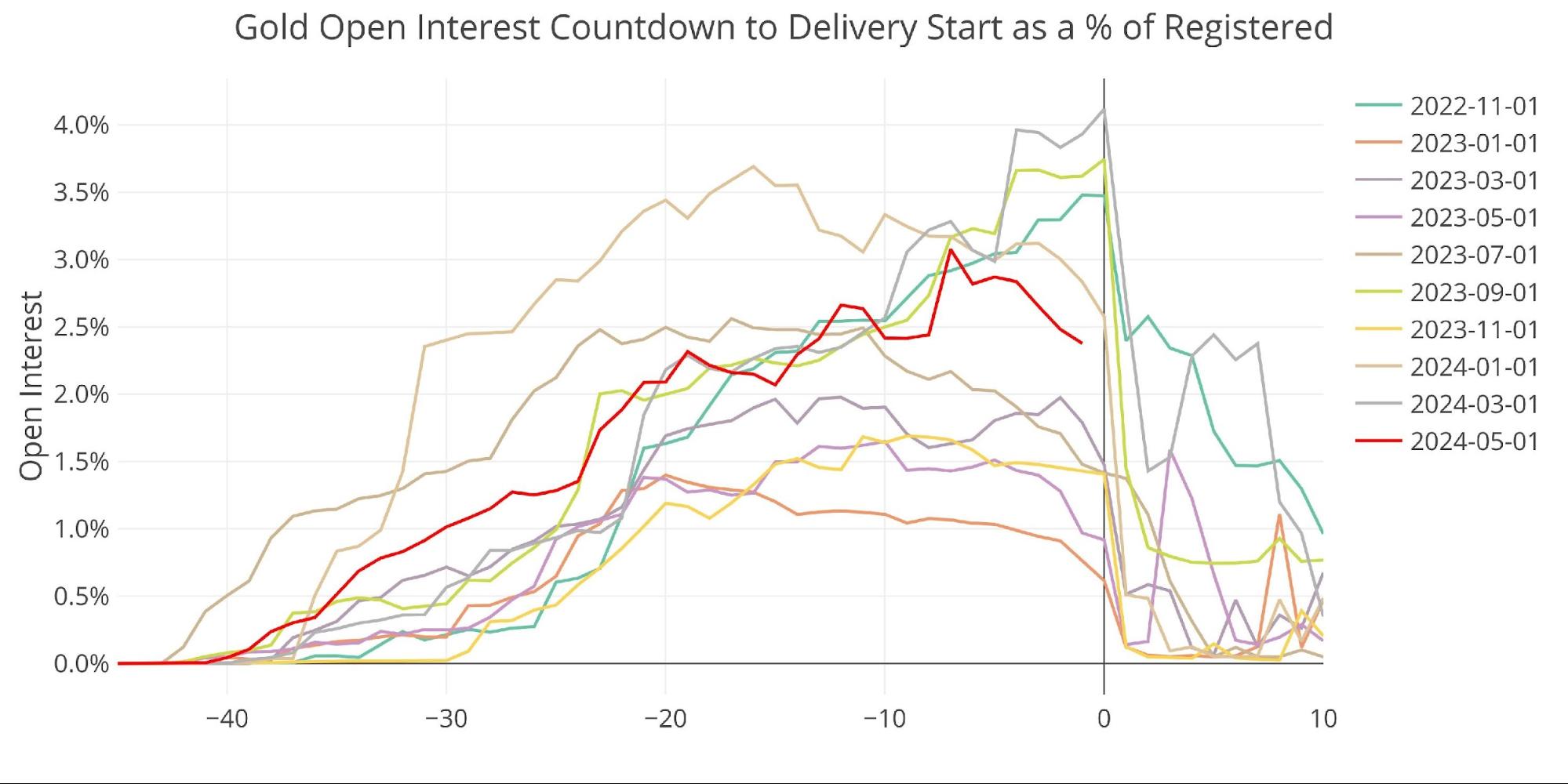

As the May contract approaches, gold open interest is at an average level going into the delivery phase.

Figure: 4 Open Interest Countdown

On a percentage basis compared to available gold for delivery, gold open interest is slightly above the pack but is still around average.

Figure: 5 Open Interest Countdown Percent

Silver

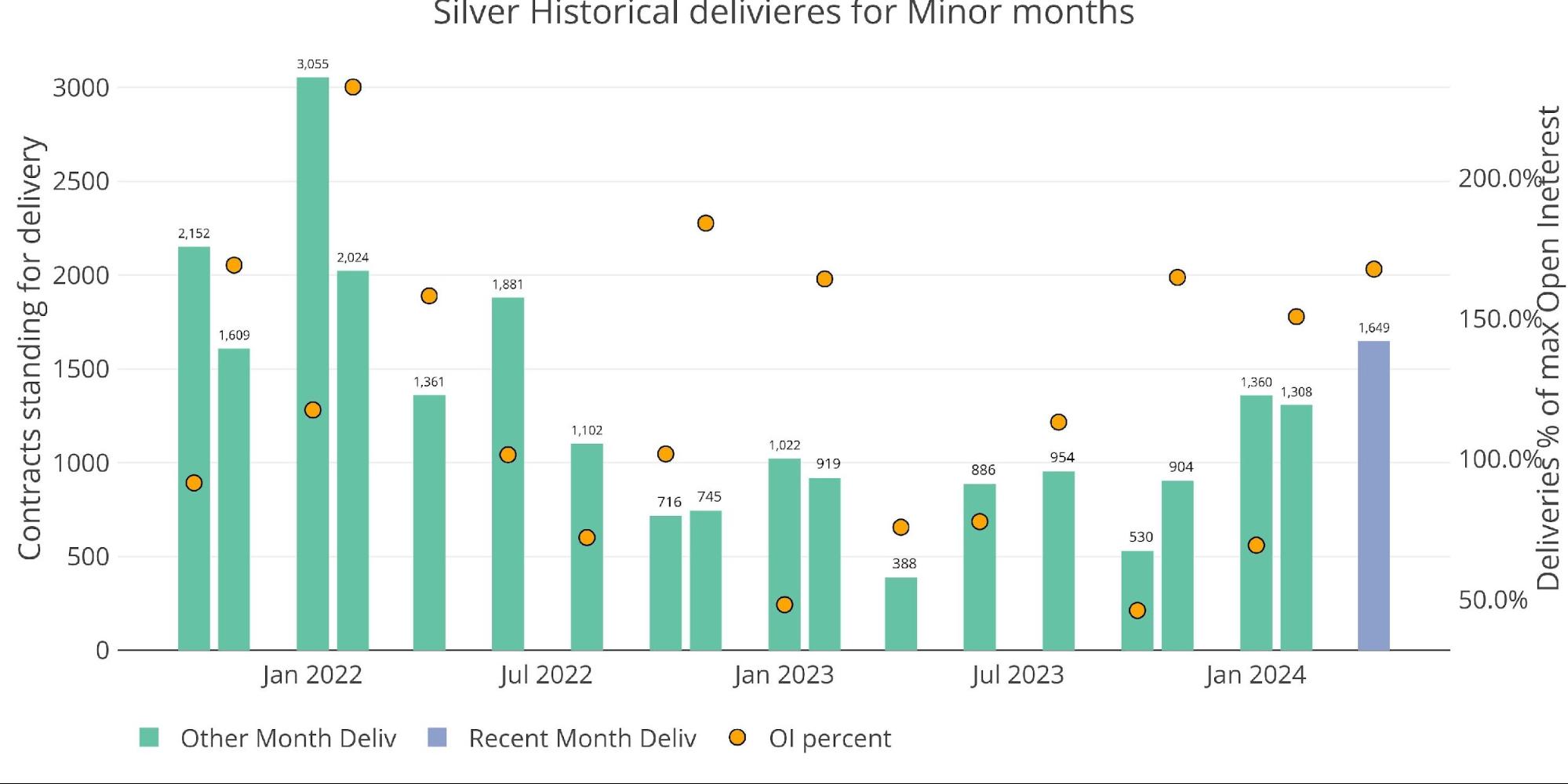

April delivery is a minor delivery month for silver. Delivery volume has been climbing in recent months but saw a major increase in the latest month. In fact, the 1,649 delivered contracts is the highest since June of 2022 which was during the peak of the Covid scare.

Figure: 6 Recent like-month delivery volume

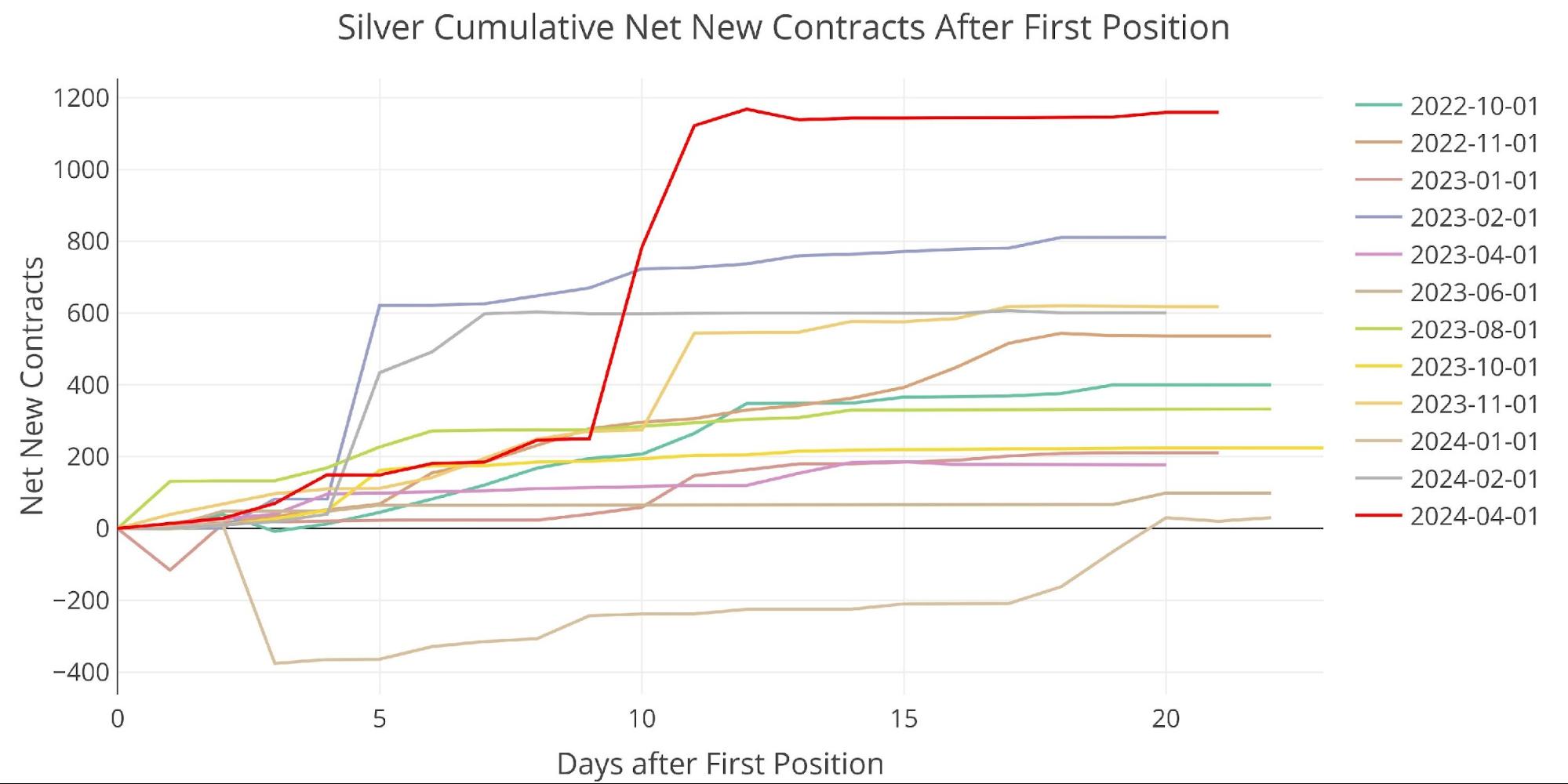

This was entirely driven by a surge in net new contracts which suggests people did not want to wait for the May delivery period (a major month) and instead wanted immediate delivery. New contract delivery (1,159) was 50% higher than the next closest month over the last two years (Feb 2023).

Figure: 7 Cumulative Net New Contracts

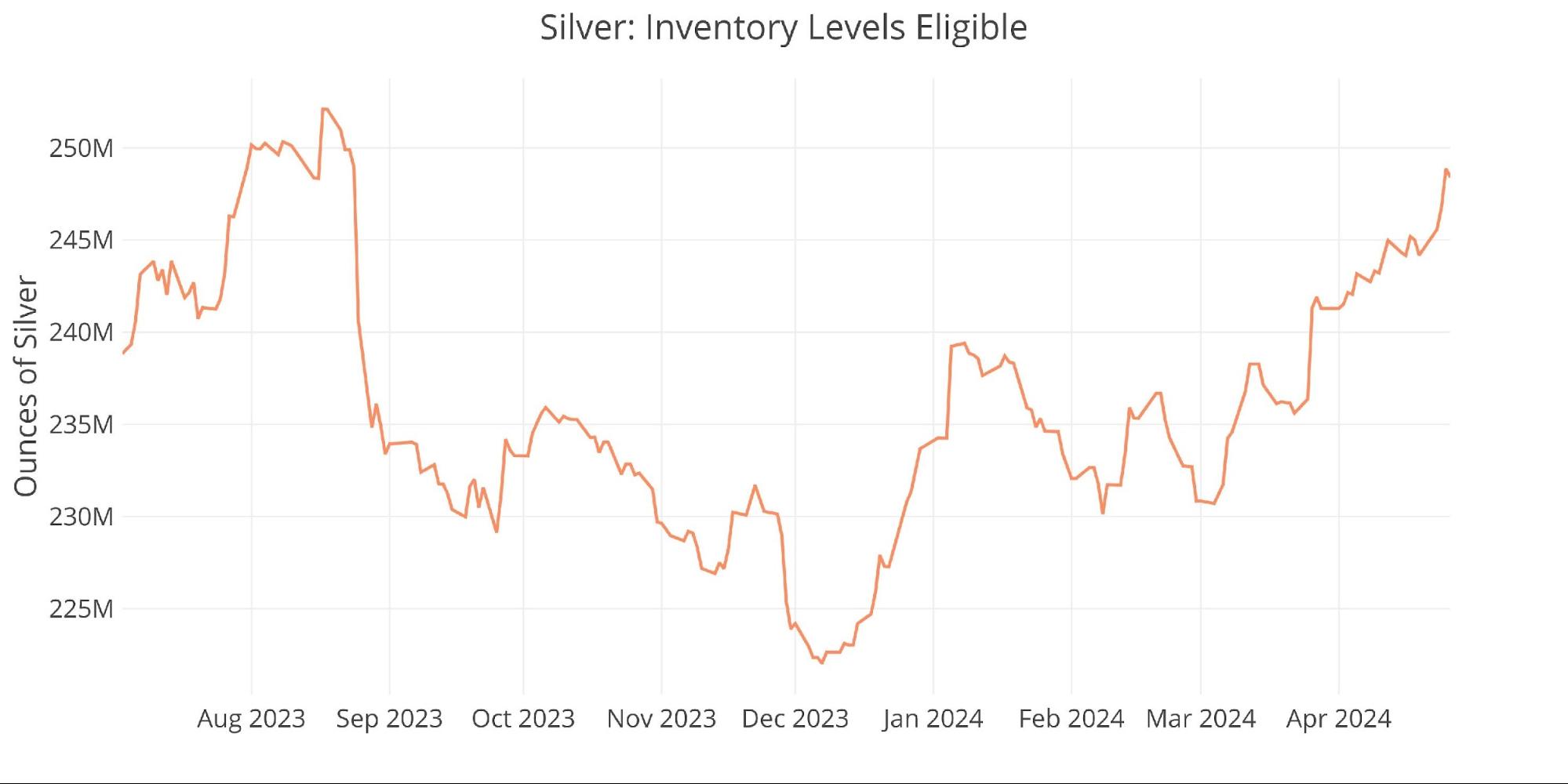

Registered and Eligible have been plotted separately to make the charts more readable. Eligible has seen a surge in the latest month.

Figure: 8 Inventory Data

Eligible has seen a sudden drop, but remains well above the August 2023 lows.

Figure: 9 Inventory Data

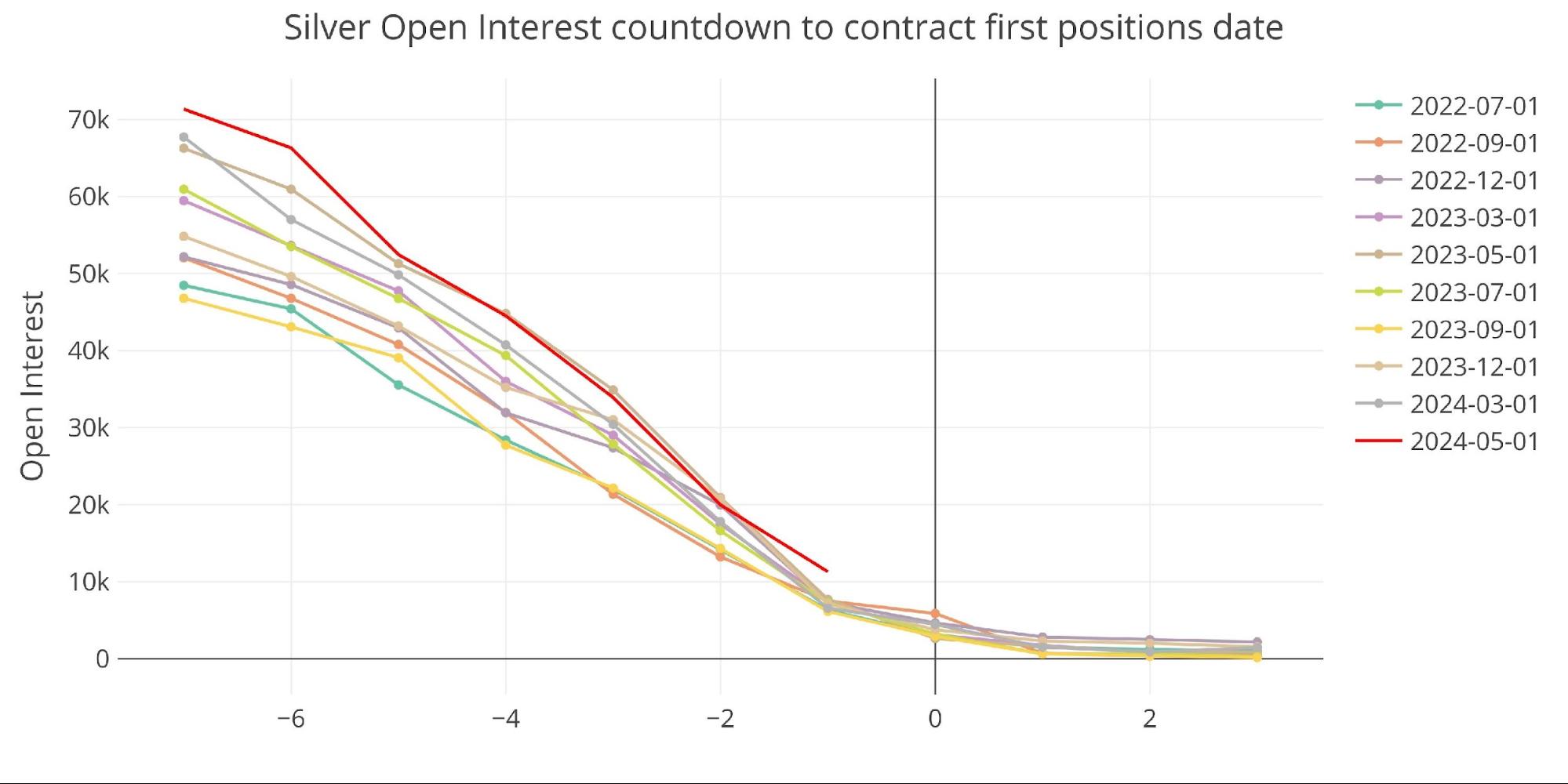

As we approach the delivery period for May, you can see that the silver contract stands well above all other months. This has been consistent throughout this month but has really popped above the rest with one day to go. We will likely see a big drawdown on the final day, but those contract holders are waiting until the very last minute to roll their contract.

Figure: 10 Open Interest Countdown

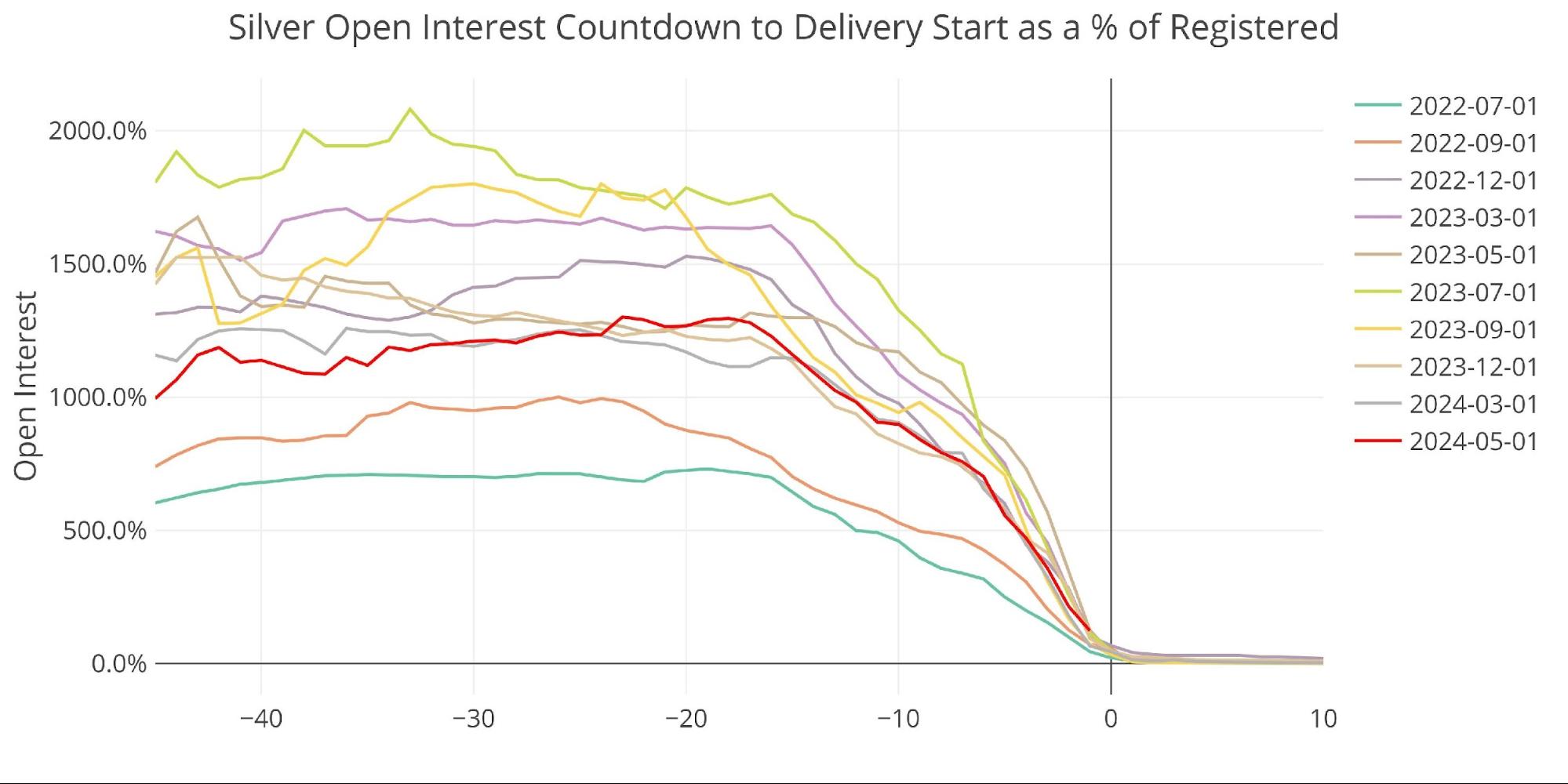

On a relative basis (when compared to Registered metal), this month is a bit more middle of the pack. As shown by the charts above, this is driven by an increase in Registered metal more than anything. We still stand at 125% of Registered with one day to go.

Figure: 11 Open Interest Countdown Percent

Conclusion

Last month, gold was looking very strong. In the days following the last report, gold started ripping higher and didn’t stop until the price reached a healthy corrective pullback. Silver saw a similar surge as it followed gold higher, but the Comex data suggests there is a lot of interest in physical silver right now. This could lead to a major surge in price coming soon. Let’s see how the data plays out over the short term.

Data Source: https://www.cmegroup.com/

Data Updated: Nightly around 11 PM Eastern

Last Updated: Apr 26, 2024

Gold and Silver interactive charts and graphs can be found on the Exploring Finance dashboard: https://exploringfinance.shinyapps.io/goldsilver/

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!