Via Metal Miner

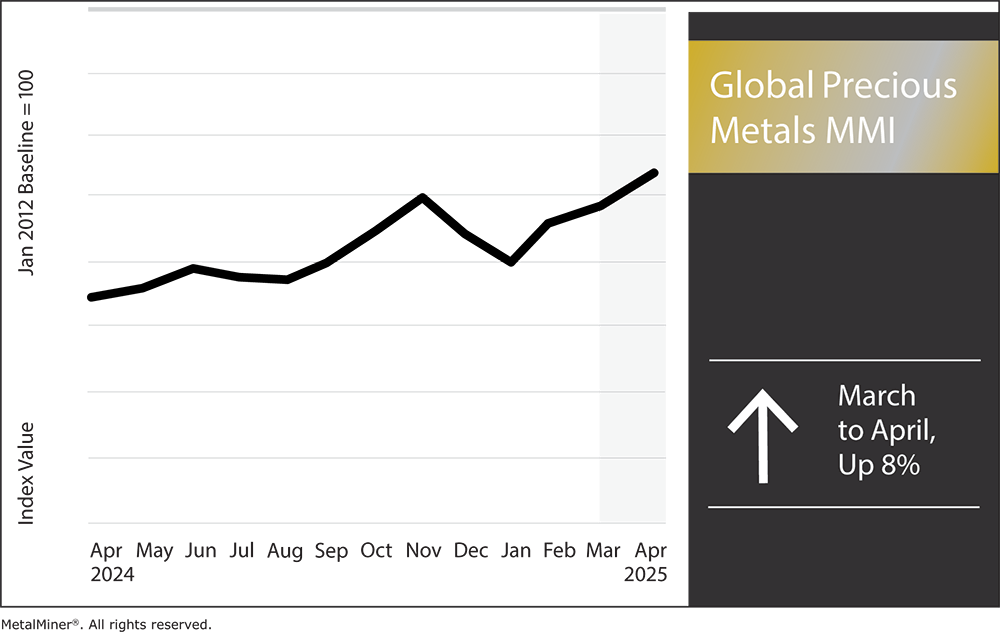

The Global Precious Metals MMI (Monthly Metals Index) saw a significant bullish action month-over-month, rising by a total of 8%. The U.S. precious metals market (and precious metals prices in general) saw dramatic swings over the past five weeks amid a backdrop of stubborn inflation, evolving interest rate expectations, new tariffs and geopolitical tensions. All of these factors have all come together to pull the index in different directions.

Meanwhile, manufacturing buyers continue to feel whiplash from rapid price movements. Simultaneously, inflationary pressures and looming interest rate shifts are pushing procurement teams to be more agile than ever. Many are turning to resources like MetalMiner’s weekly newsletter to get data-driven market intelligence to time purchases and hedge risks correctly.

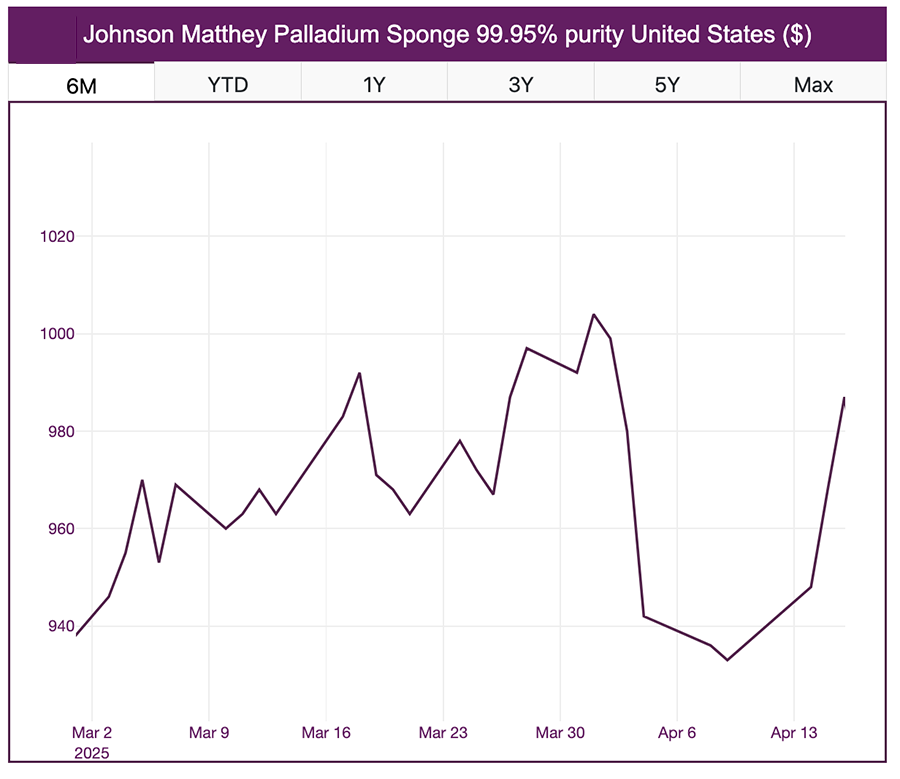

Palladium Prices in the Past Month

Unlike other precious metals prices, palladium has been in retreat, reflecting both immediate and structural challenges. During the March-April period, palladium traded around five-year lows, at times slipping below $950/oz. In late March 2025, palladium gave up its long-held premium over platinum. By April 15, palladium was still languishing at $973/oz despite a slight 1.7% daily uptick.

For palladium, the primary culprit is sinking automotive demand, which results from two major trends. First and foremost is U.S. trade policy. President Trump’s tariffs on imported cars could dampen vehicle sales, directly reducing the need for palladium in exhaust systems.

Source: MetalMiner Insights

On the supply side, producers are reacting to low prices. Several major palladium miners are even curtailing operations to stem losses. In late February, Impala Platinum warned that it may wind down a Canadian palladium mine years earlier than planned if prices don’t recover soon. Most analysts foresee palladium remaining under pressure in the next 2–3 months. The consensus is that the bleak demand outlook will likely cap any price rallies.

Precious Metals Prices: Platinum Market in April 2025

Platinum has been caught in the same storm as palladium, albeit with a few unique twists. Over the past month, platinum prices have seesawed. By April 15, the metal was trading around $960/oz, bouncing from roughly flat to slightly down over a five-week span. Compared to gold and silver, platinum’s performance looks muted.

Much like palladium, the automotive sector heavily influences platinum markets. Therefore, the new U.S. auto tariffs are casting a rather large shadow. However, platinum’s story has upsides that palladium lacks. One is substitution and diversification. As palladium became exorbitantly expensive over the past few years, automakers began shifting some catalytic converter loadings from palladium to platinum?.

As a result, platinum’s outlook over the next couple of months is cautiously optimistic, and many experts see relative strength in platinum compared to palladium.

What Were Silver Price Trends in the Past Month?

Silver has delivered a mixed performance in 2025 thus far, oscillating between its dual identities as a safe-haven asset and an industrial metal. U.S. silver prices climbed alongside gold from March to mid-April, then wobbled as industrial clouds gathered. In mid-March, silver briefly spiked to its highest level in over a year. This spike stemmed from the same flight to safety that lifted gold—investors seeking refuge from equity market volatility.

Silver also benefited from the same macro drivers that sent gold soaring. Persistent inflation and the possibility of Federal Reserve rate cuts have weakened the U.S. dollar, making hard assets like silver more attractive. Meanwhile, geopolitical tensions, notably the U.S.-China tariff tussle, have also prompted investors to hedge with precious metals.

Looking ahead 2–3 months, analysts are somewhat divided on silver but generally expect continued volatility. If the U.S. does tip into recession, “demand for manufactured goods, including silver, decreases,” which would likely cap silver prices or even push them down temporarily.

Precious Metals Prices: Gold

When it comes to precious metals prices, gold has been the headline-grabber for Spring 2025, and for good reason. The yellow metal is traditionally the barometer of investor fear and inflation hedging, and true to character, it’s been on a tear. Over the past month, gold not only climbed but smashed through previous records. On March 19, as the Federal Reserve signaled potential rate cuts later in the year, spot gold rocketed to an all-time high of $3,051.99/oz.

Several macroeconomic and geopolitical forces have converged to fuel gold’s record run. First and foremost is the shift in U.S. monetary policy expectations. In late March, the Federal Reserve opted to hold interest rates steady and crucially signaled that it may cut rates later in 2025 if economic growth falters. Despite this, inflation remains a concern and somewhat elevated, meaning investors will likely continue turning to hedging items like gold.

Trade War Spurs on Gold Prices

Another major driver of precious metals prices like gold has been geopolitical and economic uncertainty, particularly regarding U.S. trade policy. The Trump administration’s aggressive tariff stance has not only injected volatility into markets, but also fear of a global economic slowdown. Gold thrives on uncertainty, and every new headline about tariff investigations or international retaliation has tended to push gold higher on safe-haven buying.

The short-term forecast for gold remains largely optimistic, although some risks remain. Analysts widely believe gold will hold steady at elevated levels, maintaining a slight upward trend. Since the Federal Reserve won’t reconvene until early May, gold has a window to respond to broader economic indicators and developments.

For business procurement, gold’s record territory might seem less directly relevant. After all, except for specific uses, manufacturers don’t typically purchase gold in bulk. This is where MetalMiner’s advisory tools can be invaluable. For instance, the MetalMiner Insights platform not only tracks gold but also correlates movements in commodities so you can anticipate impacts on your specific spend.

By the Metal Miner Team

More Top Reads From Oilprice.com