Via Metal Miner

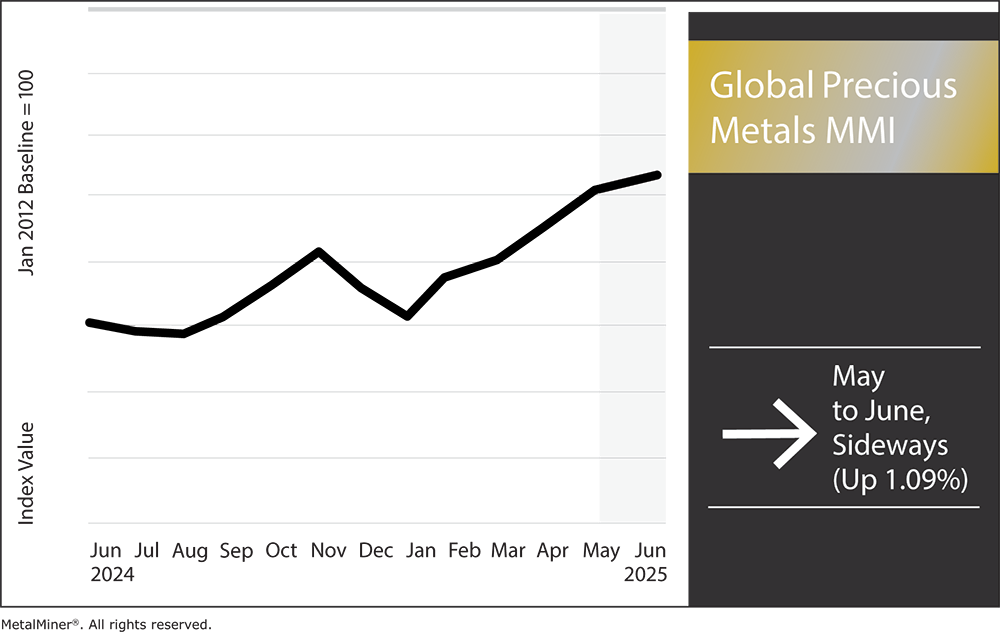

The Global Precious Metals MMI (Monthly Metals Index) saw a strong rally from mid-May to mid-June. Precious metals prices like gold, silver, platinum and palladium all climbed on a potent mix of safe-haven investment flows and robust industrial demand. Geopolitical tensions, notably the recent flare-up in the Middle East between Israel and Iran, have only fueled more risk aversion. This continues to drive safe-haven demand into gold and silver.

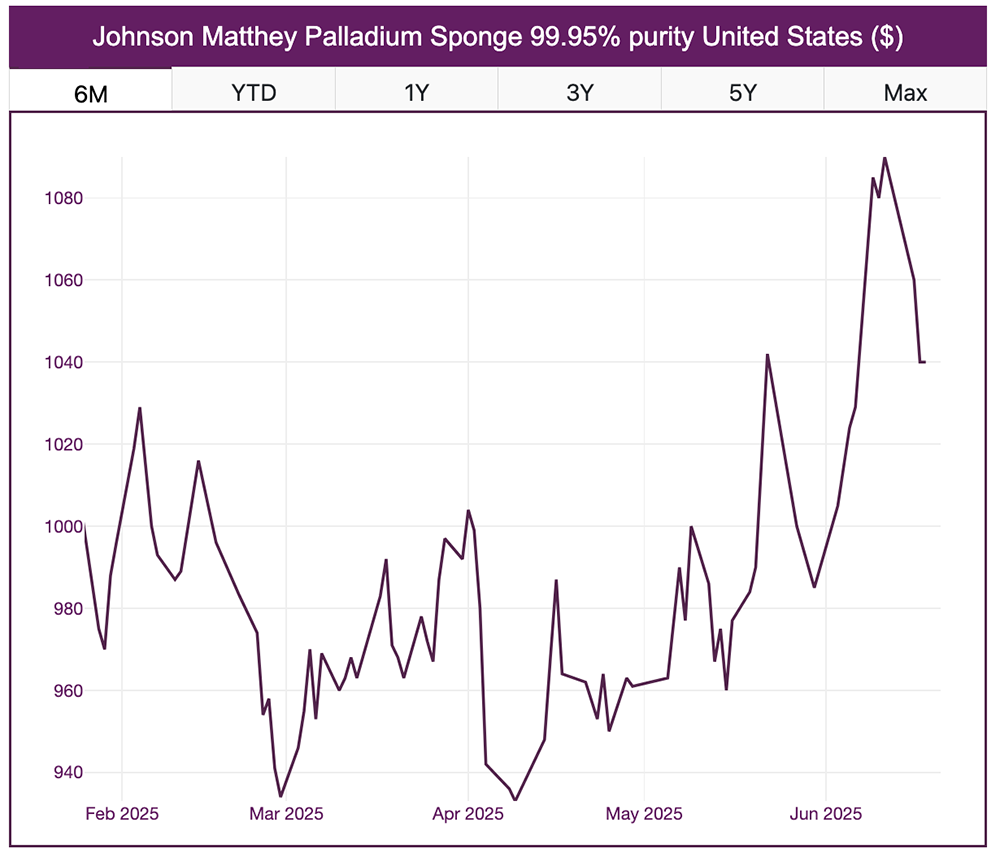

Palladium Lagging in Struggles with EV Transition

Palladium has improved from its spring lows but continues to lag other precious metals prices due to a fundamentally narrower demand profile. While that marks a modest rebound, palladium remains far below its peaks from a few years ago. The primary issue is softening demand. Over 85–90% of palladium’s use is in catalytic converters for gasoline cars, a segment that remains under pressure as EV sales accelerate.

Source: MetalMiner Insights

Even within combustion vehicles, some automakers are reducing palladium loadings or substituting platinum to cut costs. On the supply side, palladium had faced chronic deficits for much of the past decade. However, that seems to be changing. After 13 years of shortfalls, 2025 is forecast to be roughly balanced in palladium supply and demand.

Unless an unexpected supply disruption occurs (for instance, mining issues or sanctions affecting top producer Russia), palladium is likely to remain range-bound. Some downward pressure could even re-emerge if auto production weakens further. Procurement teams with palladium needs may want to adopt a more hand-to-mouth buying approach or look into substitution strategies, topics frequently covered in MetalMiner’s free knowledge resources.

Precious Metals Prices: Multi-Year Peak on Platinum Supply Squeeze and Diversified Demand

Platinum has been a standout performer in the precious complex, with prices climbing significantly month-over-month. Unlike gold and silver, platinum’s strength is heavily tied to supply and fabrication demand dynamics. On the supply side, the platinum market is swinging into a significant deficit this year. Leading analysts at Johnson Matthey project that platinum supply will fall short for a third consecutive year in 2025.

This constrained supply, coupled with only modest recycling flows, continues to tighten the market. Metals strategists generally expect platinum to hold and potentially extend its previous gains. “Platinum will retain recent gains and could rise a little further as gold and silver gain,” notes one analyst, emphasizing the metal’s diversified demand base as outlined by Reuters.

Silver: 13-Year High as Industrial Demand Meets Tight Supply

Silver prices have surged even more dramatically, outpacing gold in recent weeks. July COMEX silver futures mirrored this rise, with only minimal spread versus spot, indicating robust near-term demand. The Silver Institute forecasts the 2025 deficit at about 118 million ounces, which is only slightly narrower than last year. However, any reversal in gold or a resurgence of the dollar could cap silver’s gains short-term.

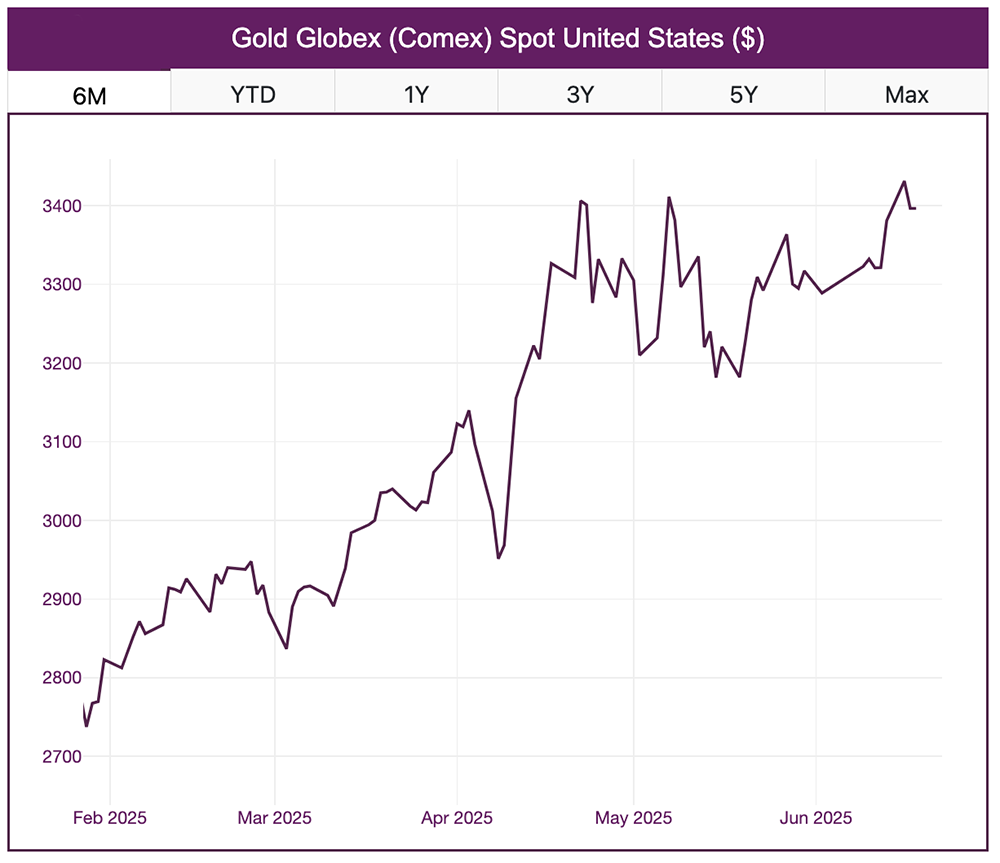

Gold’s Rally Shows Few Signs of Abating

U.S. gold futures for August delivery have largely tracked spot prices, recently settling in the same range: a slight contango reflecting carrying costs. Over the past month, gold gained roughly 5%, and it’s up an astounding ~45% from a year ago.

Source: MetalMiner Insights. To get specific price points without overpaying for unnecessary data, learn about MetalMiner Select.

Like other precious metals prices, a softer economic outlook and ongoing dollar weakness have added momentum to the gold index. On the demand side, central banks continue a buying spree, providing the metal with a firm floor. In Q1 2025, global central bank purchases hit a quarterly record of 244 tonnes, putting this year on track for ~1,000 tonnes again.

This “insatiable” official sector demand, along with resilient jewelry and investment buying, continues to offset stable mine output. Looking ahead two months, most analysts expect gold to remain elevated in the high-$3,200s to $3,400 range. Analyst sentiment is not only bullish, but major banks have been racing to raise their gold forecasts based on its 2025 performance thus far.

By The MetalMiner Team

More Top Reads From Oilprice.com