Last Updated:

Market experts are also predicting that silver price could increase in the future in align with gold due to heavy demand in industrial usage and supply constraints.

Silver Price Outlook 2025

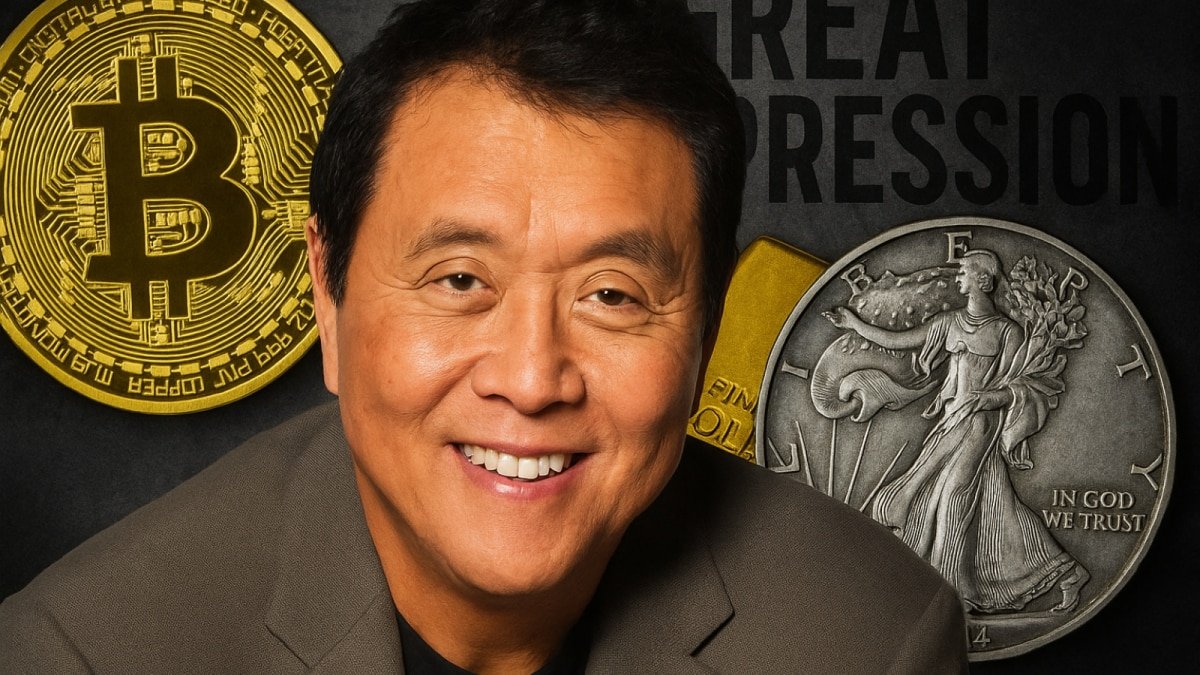

Silver Price Outlook 2025: Renowned financial author Robert Kiyosaki, best known for Rich Dad Poor Dad, has issued a bold prediction for silver, forecasting a significant price surge in July 2025. In a recent post on X, Kiyosaki described silver as the “best asymmetric buy” today, emphasizing its high reward-to-risk potential. “Your profits are made when you buy… not when you sell,” he wrote, urging investors to act quickly as silver remains affordable. “Everyone can afford silver today… but not tomorrow,” he added, predicting a price explosion next month.

Despite a recent dip in silver prices to $35.98 per ounce on June 28, 2025, following eased geopolitical tensions, the metal is up 24% year-to-date. Kiyosaki’s earlier posts, including one on June 23, 2025, called silver the “best investment” in June, while he waits for gold and Bitcoin to crash before adding to those positions. His long-term optimism includes predictions of silver hitting $3,000 per ounce by 2035.

REMINDER: Rich Lesson:“Your profits are made when you buy…. Not when you sell.”

Silver is the best “asymmetric buy” today. That means more possible upside gain with little down side risk.

Silver price will explode in July,

Everyone can afford silver today… but not…

— Robert Kiyosaki (@theRealKiyosaki) June 27, 2025

Market experts are also predicting that silver price could increase in the future in align with gold due to heavy demand in industrial usage and supply constraints.

Satish Donadapati, VP and fund manager of Kotak AMC argued that silver is still seen as cheaper compared to gold, even after its recent price increase.

“The gold-silver ratio is still higher than usual, meaning silver hasn’t caught up to gold’s rise yet. Given silver’s important role both as an industrial metal and a precious metal, we believe there is still potential for silver prices to increase further relative to gold, he added.

He further believed that the outlook for silver over the next 6-12 months is positive, with expectations of increase in silver prices driven by strong industrial demand, supply constraints, weakening US dollar and macroeconomic factors.

Silver has strong long-term potential, but investors should be cautious of risks like high price volatility, a stronger U.S. dollar, or rising interest rates, he added.

Disclaimer: The views and investment tips by experts in this News18.com report are their own and not those of the website or its management. Users are advised to check with certified experts before taking any investment decisions.

Varun Yadav is a Sub Editor at News18 Business Digital. He writes articles on markets, personal finance, technology, and more. He completed his post-graduation diploma in English Journalism from the Indian Inst…Read More

Varun Yadav is a Sub Editor at News18 Business Digital. He writes articles on markets, personal finance, technology, and more. He completed his post-graduation diploma in English Journalism from the Indian Inst… Read More

- First Published: