It meant that gold prices continued to remain firm, globally and in India, resulting in better returns for investors in the metal, a hedge against inflation and for those who invested in gold ETFs and gold funds. It has reflected in loans against gold being one of the fastest growing products offered by financial institutions in India.

Total global gold demand gained 5 percent year-on-year to 1,313 tonnes—a record for Q3FY24, according to the World Gold Council report released in October 2024. This strength was reflected in the gold price (see chart), which reached a series of new record highs during the quarter. The value of demand for global gold jumped 35 percent year-on-year to exceed $100 billion for the first time ever, the report said.

Kaynat Chainwala, associate vice president—commodity, currency at Kotak Securities, expects the momentum of buying of gold by central banks to continue in 2025, “but the pace of buying will moderate”. Globally, central banks have bought gold of approximately 695 tonnes till October 2024. [This compares to 1,030 tonnes in 2023 and 1,081 tonnes of gold in 2022].

Chainwala says there are several uncertainties which could impact global gold prices in the coming months.

US President-elect Donald Trump has a task on what to do with the debt ceiling—the maximum amount of money that the US Treasury can borrow to pay for the bills incurred. The US national debt stands close to $36.1 trillion. Lawmakers had suspended the ceiling till January 1, 2025. Any breach of the debt ceiling will severely hit its credit rating and impact economic activity, besides the dollar.

“Any uncertainty will impact gold prices. Why we expect a modest run for gold and risk to the outlook is due to the recalibration of interest rate cuts by the Federal Reserve,” she adds. A majority of bankers now project just two quarter point rate cuts till the end of 2025. “Rate cuts, potential tariffs on US imports, tax cuts and immigrant policies are all inflationary, so the Fed cannot continue to keep cutting rates too much. Hence gold prices may not rise too much,” she explains.

Global gold prices rose on expectations of more rate cuts, but then they fell. So, the future commentary and action from the US Federal Reserve will directly impact gold prices.

Also read: The future of gold prices

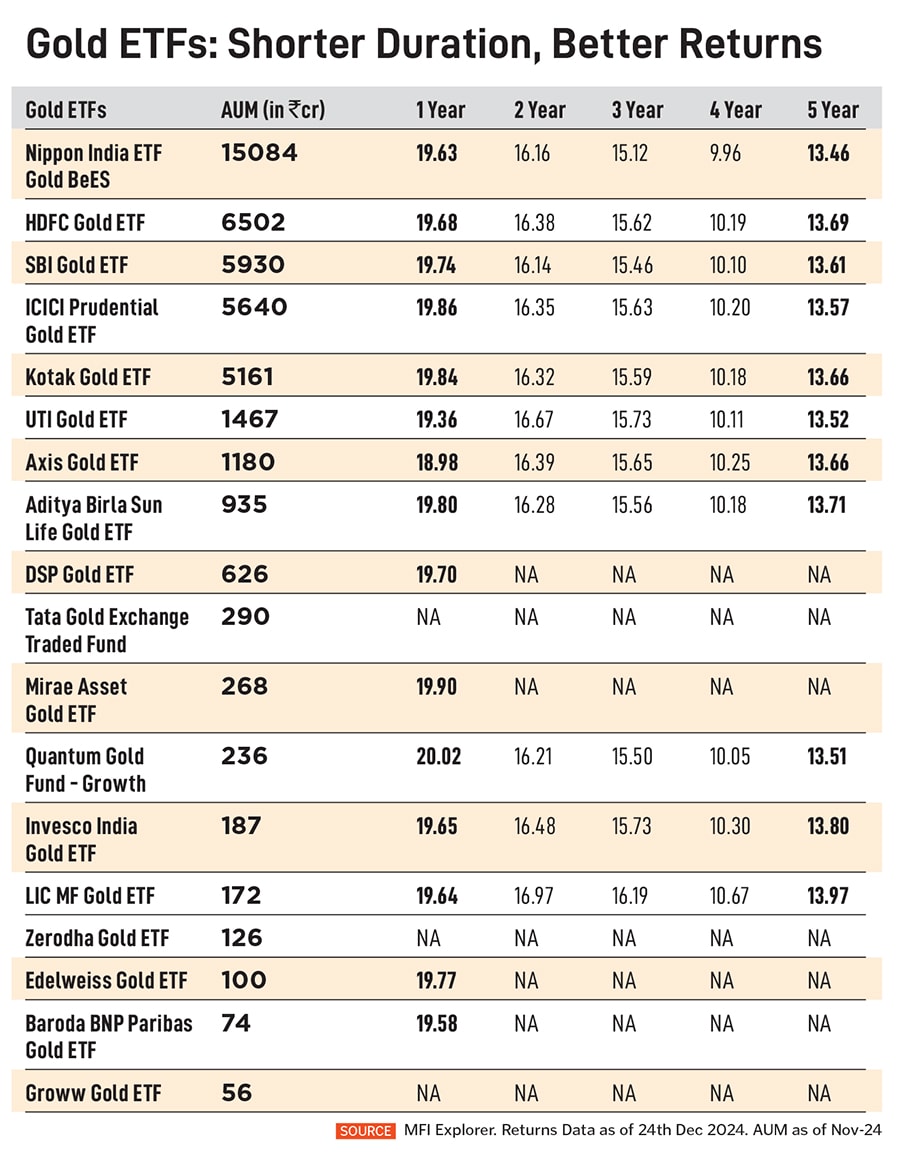

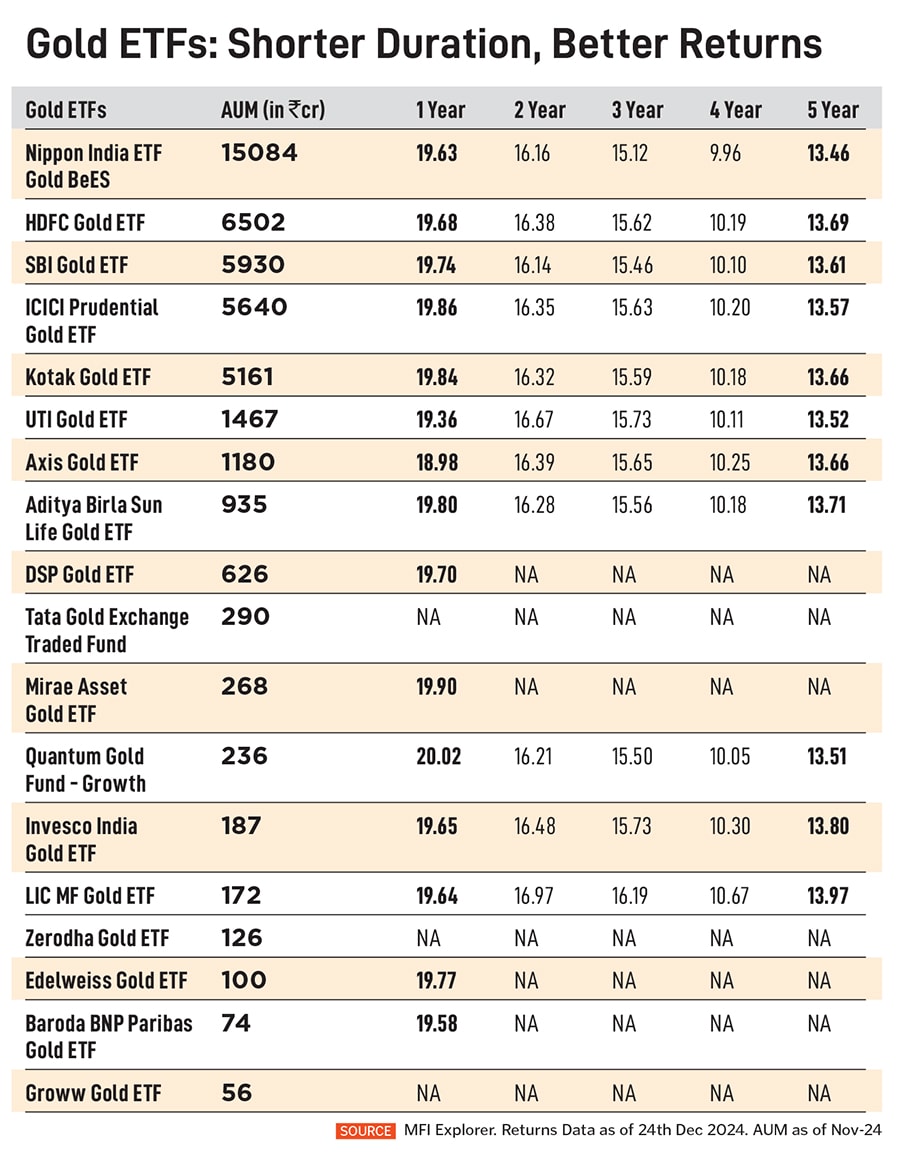

Gold ETFs Surge

There was a smart rise in gold demand through gold ETF schemes and Gold Fund of Funds in 2024. According to the Association of Mutual Funds in India data, investment in gold ETFs quadrupled to ₹1,256 crore in November from levels a year ago.

The government-backed initiative to promote investments in gold—the sovereign gold bond (SGB) scheme—last came in February 2024. These schemes have provided tax advantage (gains made on maturity of scheme are exempt from capital gains tax) and also attracted a fixed interest income of 2.5 percent (on the initial investment amount), though this portion is taxed marginally.

The government has returned a lot of money to investors since its inception in 2015-16. “But the demand for SGBs is now shifting towards gold ETFs. High net worth individuals and retail investors have both been investing into gold ETFs,” says Satish Dondapati, fund manager (ETF) at Kotak Mutual Fund.

The industry assets under management (AUM) for gold ETFs now stand at ₹44,034 crore, where Kotak ETF AUM is at ₹5,161 crore. The industry’s AUM has grown approximately 64 percent in the last 18 months.

In the case of gold ETFs, investors park money with the AMC to manage it; the AMC buys gold and keeps it as a custodian and the units can be traded on an exchange, as per market price of gold. In the case of Gold Fund of Funds, it is a passive fund where the money comes in and the fund manager invests it into underlying gold ETFs. Gold ETF has a lower expense while Gold Fund of Funds has two expenses—a gold fund expense and an underlying ETF expense. For gold ETFs, a demat account is compulsory, while Gold Fund of Funds can do without demat.

Dondapati, like Chainwala, agrees that factors such as gold being a safe haven and a store of value will continue to be a positive for gold prices. But investments towards gold as an asset class will be dependent on the global and US economic activity. “The higher interest rate environment, better returns from equities and real estate could mean that gold will attract lesser investment,” Dondapati says.

“Combining everything, over the next two years, gold will give a moderate but steady return,” Dondapati says. He declined to forecast returns on gold in the coming quarters, saying it is difficult to assess, considering the uncertainties surrounding the US economy, the dollar and interest rate trends.

Portfolio Allocation

Both Dondapati and Chainwala say allocations towards investing in gold in 2025, whether as a pure yellow metal (bars, coins) or through ETFs or other investment avenues, should depend on their risk appetite and the time horizon they chose.

Dondapati says that, realistically, gold should still continue to form 5 to 10 percent of the average investor portfolio at current levels, though it could rise to 10 percent for an investor with a moderate risk appetite and 15 percent for a conservative investor. “If the time horizon is one to three years, then the allocation should be higher. But for a completely new investor, the time horizon becomes more important,” Dondapati adds.

Chainwala says demand for gold might not be what was seen in 2024 and demand for the yellow metal will moderate—possibly by even more than 10 percent—in 2025 (barring during the festive and marriage season), due to the global factors. “The pace will definitely slow down, but one can expect a steady return from gold,” she says.

(This story appears in the 24 January, 2025 issue

of Forbes India. To visit our Archives, click here.)

Total global gold demand gained 5 percent year-on-year to 1,313 tonnes—a record for Q3FY24, according to the World Gold Council report released in October 2024.

Total global gold demand gained 5 percent year-on-year to 1,313 tonnes—a record for Q3FY24, according to the World Gold Council report released in October 2024.

“Global geopolitics and the safe haven characteristics will continue to see demand for gold going up, even from current levels. But prices may not be as accelerated as we have seen in the last 18 months,” she tells Forbes India. She forecasts gold prices to gain 8 to 10 percent from current levels.

“Global geopolitics and the safe haven characteristics will continue to see demand for gold going up, even from current levels. But prices may not be as accelerated as we have seen in the last 18 months,” she tells Forbes India. She forecasts gold prices to gain 8 to 10 percent from current levels.