House prices are more affordable on average than they were 20 years ago, according to the latest figures from Nationwide Building Society.

This is based on the ratio comparing average incomes and average property prices.

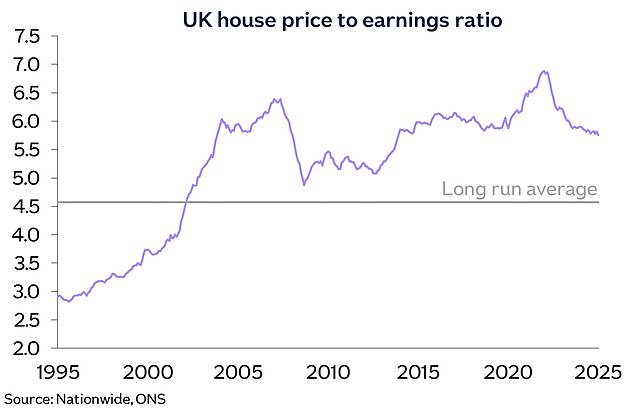

Between April and June this year, Nationwide says the average UK house price was 5.8 times the average annual salary of someone in full time work.

This is marginally down on the same three month period in 2005 when the average house price was 5.9 times the average annual full time salary.

Over the last 20 years, house prices have increased 73 per cent compared to earnings growth of 76 per cent over the same period.

However, the current house price to earnings ratio is still above the long-run average of 4.8.

Little change: The house price-to-earnings ratio is similar to where it was 20 years ago

These areas AREN’T more affordable

Whether property has become more or less affordable will also greatly depend on where in the country someone lives.

For example, in London, the house price to earnings ratio has risen from 7.1 to 9.2 over the past 20 years, which means property is less affordable in the capital.

The surrounding outer metropolitan regions of London also saw a rise from 6.9 to 8.

Meanwhile, the North has seen the most improvement, with a fall in average house price to earnings ratio from 5.4 in 2005 to 4 in 2025. This reflects the fact that house price growth has been the lowest there over this period.

High house prices relative to earnings make it more challenging for prospective buyers to save for a deposit, particularly in London and the South East.

| Region | April-June 2005 | April-June2025 |

| North | 5.4 | 4 |

| Scotland | 4.7 | 4.1 |

| Yorks & H | 5.8 | 5 |

| N Ireland | 5 | 5 |

| N West | 5.7 | 5.1 |

| Wales | 5.8 | 5.1 |

| E Mids | 5.7 | 5.5 |

| W Mids | 6.2 | 5.7 |

| E Anglia | 6.2 | 6 |

| S West | 7.1 | 7 |

| Outer SE | 6.8 | 7.1 |

| Outer Met | 6.9 | 8 |

| London | 7.1 | 9.2 |

| UK | 5.9 | 5.8 |

| Source: Nationwide, ONS |

Richard Donnell, executive director at Zoopla said: ‘Future improvements to the house price to earnings ratio will vary depend on the region of UK and the headroom for house price growth.

‘Home values have been unaffordable in Southern England for some time and remain so, which is why house prices are struggling to rise as a result of higher mortgage rates.’

The other key factor in relation to affordability is interest rates and their impact on mortgage payments.

Richard Donnell, executive director at Zoopla

Compared with 2005, mortgage payments have slightly decreased relative to take-home pay for a first-time buyer, according to Nationwide.

Based on someone buying their first property with a 20 per cent deposit, average mortgage payments currently account for 34 per cent of take home pay, compared with 38 per cent in 2005.

However, it’s worth pointing out that affordability has deteriorated from a mortgage cost perspective over the past five years given the sharp rise in interest rates in 2022 and 2023.

In July 2020 someone buying with a 20 per cent deposit could bag a five-year rate as low as 1.7 per cent.

Now, most buyers are securing mortgage rates around 4 to 5 per cent. The lowest five-year fix for someone buying with a 20 per cent deposit is 4.15 per cent.

Someone buying a property in 2020 with a £200,000 mortgage at 1.7 per cent with a 25 year repayment term would have been paying £818 a month.

However, someone buying today with a £200,000 mortgage today and a 25 year term on a 4.015 per cent rate can now expect to pay £1,072 a month.

Nationwide says the typical mortgage payments were 27 per cent of take home pay between April and June 2020, far less than the 34 per cent proportion today.

Looking ahead, Nationwide says it expects a gradual easing in affordability constraints through a combination of falling interest rates and earnings outpacing house price growth.

However, while the house price to earnings ratio suggests property isn’t any less affordable on average than it was 20 years ago, it doesn’t necessarily mean that getting on the ladder is as easy as it was 20 years ago.

Jeremy Leaf, north London estate agent and a former Rics residential chairman argues that rising rental prices has made it harder for people to save a deposit towards buying their first home.

‘What the house price-to-earnings ratio doesn’t show is the impact of the rise in rents over that period – particularly in London and other cities,’ said Leaf.

‘That increase has made it more difficult for aspiring first-time buyers to save for deposits and resulted in the postponement of many moves.

‘The sharp drop in transaction numbers following the ending of the stamp duty holiday last March showed the importance of financing those initial costs to first-time buyers in particular.

‘In our offices, we have noticed how the demand for higher-priced properties in more favoured locations has struggled recently compared with less expensive areas.’

He adds: ‘Looking forward, that trend is likely to continue unless the government can improve for instance take-up in its ‘Freedom to Buy’ scheme by setting more generous terms than under the previous Mortgage Guarantee Scheme which would give a lift to the whole market.’