Here at TPG, we often focus on using credit cards to earn rewards to help fund our travel bucket list. Collect points and miles from spending, redeem them for incredible trips, repeat.

However, our staffers also take advantage of many perks and offers that help them save serious money on their everyday purchases. In some circumstances, the same cards you use for lounge access and free checked bags could also come with discounts on hotel stays or cellphone protection.

These under-the-radar perks may not be as familiar to you, but they should definitely be on your radar.

I’m going to walk you through the ways some of TPG’s top rewards credit cards can save you money through credits, discounts and offers. Check your wallet to see if your cards have any of these easy-to-maximize credits.

Cellphone protection

If you’re ready to move on from AppleCare to keep your iPhone safe from major damage and theft, you may have more options than you think.

Cellphone protection has become a common perk on many popular credit cards. If you have an iPhone, many of these built-in benefits overlap with pricey AppleCare. Plus, some of the cards that come with cellphone protection are available for no annual fee.

Here’s a list of five popular cards that offer cellphone protection:

| Card | Cellphone coverage details | Annual fee |

|---|---|---|

| Capital One Venture X Rewards Credit Card |

Receive up to $800 if your phone is stolen or damaged when you pay your cellphone bill with your card. Subject to a $25 deductible. |

$395 |

| Chase Freedom Flex® (see rates and fees) | Receive up to $800 per claim and $1,000 per 12-month period against covered theft or damage for cellphones listed on your monthly cellphone bill when you pay with your card. Maximum two claims per 12-month period with a $50 deductible per claim. | $0 |

| Wells Fargo Active Cash® Card (see rates and fees) |

Receive up to $600 of cellphone protection against damage or theft. Your claims are subject to a $25 deductible. |

$0 |

| The Platinum Card® from American Express | Receive up to $800 per claim to repair or replace a damaged or stolen cellphone with a limit of two approved claims per 12-month period when your cellphone is listed on a previous month’s bill that was paid for with the card. A $50 deductible applies to each approved claim.** | $695 (see rates and fees) |

| Ink Business Preferred® Credit Card (see rates and fees) | Receive up to $1,000 per claim against covered damage or theft for cellphones listed on your monthly cellphone bill when you pay with your card. Maximum three claims in a 12-month period with a $100 deductible per claim. | $95 |

Just remember you have to charge your monthly cellphone bill to one of these cards to receive this benefit.

**Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by New Hampshire Insurance Company, an AIG Company.

Daily Newsletter

Reward your inbox with the TPG Daily newsletter

Join over 700,000 readers for breaking news, in-depth guides and exclusive deals from TPG’s experts

Related: Link a credit card with cellphone protection to your mobile bill

Cover the cost of streaming services

The number of popular streaming services has exploded in the last few years. Because of this, more of our monthly budgets continue to go toward these purchases. Many cards offer credits to help offset these costs.

Digital entertainment credits

The Platinum Card from American Express offers up to $20 in monthly statement credits (up to $240 annually; enrollment required) on Disney+, ESPN+, Hulu, the Disney Bundle (which includes all three previously mentioned services or a combination thereof), Peacock, The New York Times and The Wall Street Journal.

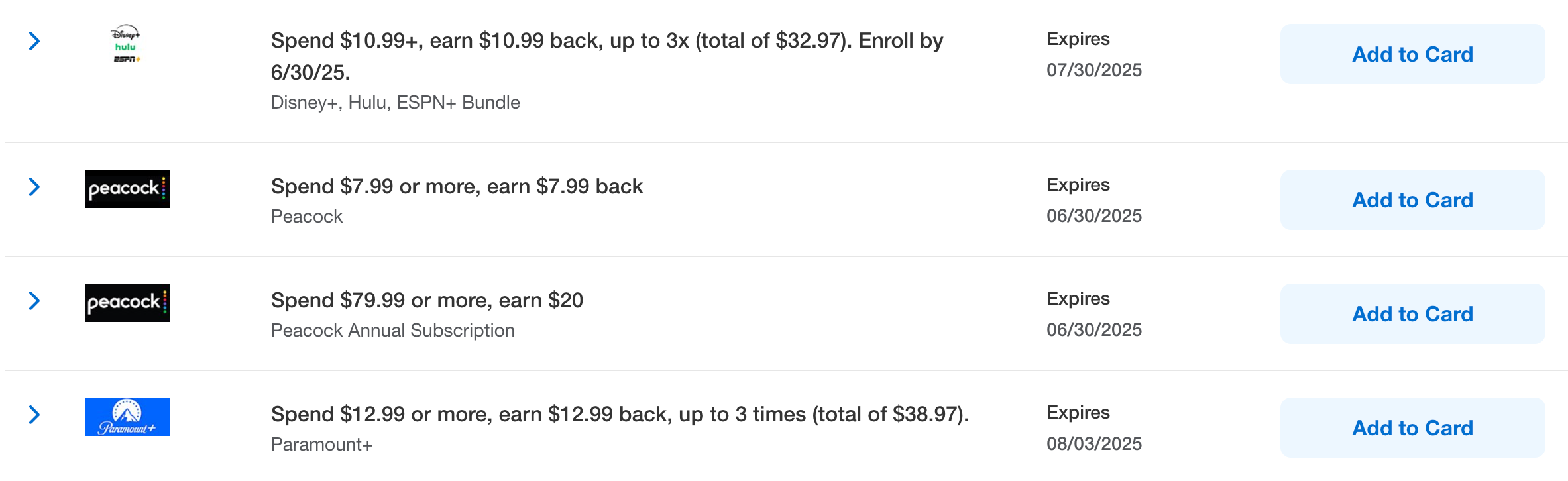

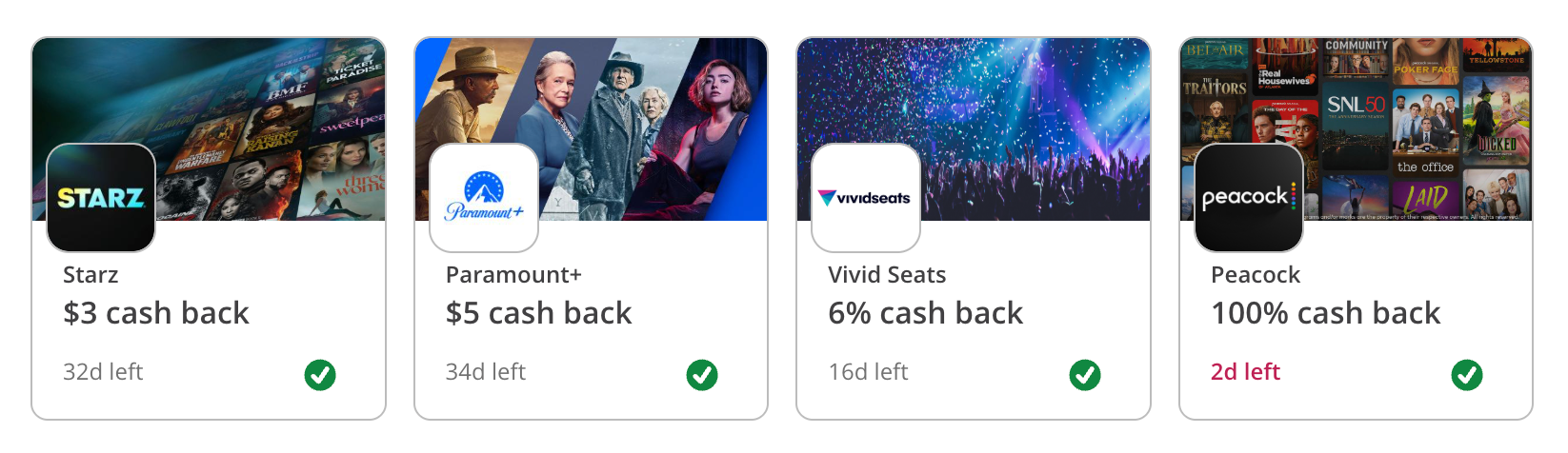

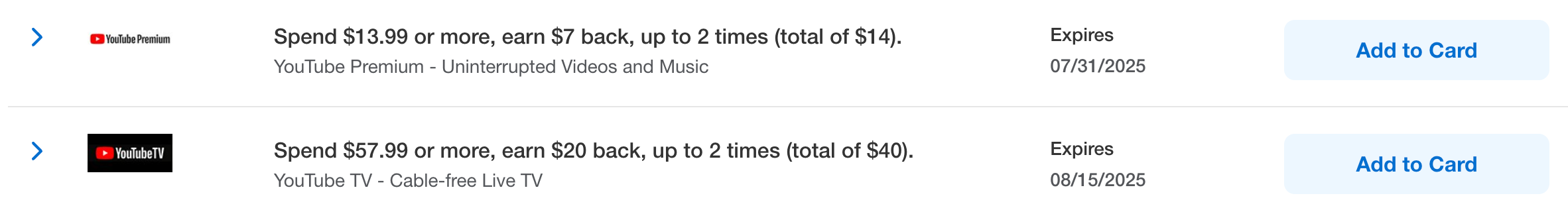

Amex Offers and Chase Offers

If you hold an eligible American Express or Chase card, don’t overlook your Amex Offers or Chase Offers. These deals are targeted, and you must enroll to redeem them. If you check them frequently, you can find some excellent statement credits on streaming.

For instance, I currently have offers on my American Express® Gold Card to save on a monthly or annual Peacock subscription and receive three free months of Paramount+ and the Disney Bundle. I have the same Peacock and Paramount+ offers on my Hilton Honors American Express Surpass® Card.

With Chase Offers, my Chase Sapphire Preferred® Card (see rates and fees) is currently offering a free month of Peacock or cash-back offers for Amazon Music, Disney+, ESPN+, Fubo TV, Kindle Unlimited, Paramount+ and Starz.

Since the Sapphire Preferred already earns 3 points per dollar on select streaming services, this card is a no-brainer for anyone who frequently pays for entertainment.

These offers are targeted and eventually expire, but the same offers will sometimes pop up on multiple cards. TPG senior editorial director Nick Ewen said he has saved $20 monthly on YouTube TV for the last nine months by activating an Amex or Chase Offer on one of his credit cards. So, it’s always worth checking.

Disney Bundle credits

With the Blue Cash Everyday® Card from American Express and Blue Cash Preferred® Card from American Express, you’ll receive $7 back monthly ($84 annually) after spending at least $9.99 on an auto-renewing Disney Bundle purchase with your card (enrollment required).

Related: 4 credit cards that save you money on streaming subscriptions

Protect your purchases

If you’ve ever had the misfortune of having an item break as soon as you start to use it or a package stolen off your doorstep, your credit card may be able to save the day with its purchase protection.

Purchase protection is now a common perk of credit cards and sends out reimbursements for stolen or damaged goods.

Be sure to check the benefit on whichever card you used for the purchase to see what’s available to you in one of these disappointing events. Like with cellphone protection, you may be surprised by the coverage offered by your favorite no-annual-fee card.

Four of our top choices are:

***Eligibility and benefit levels vary by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for details. Policies are underwritten by AMEX Assurance Company.

TPG contributing editor Matt Moffitt recently decided to use his Citi Rewards+® Card to purchase a new set of AirPods because of the card’s two-year extended warranty and 90 days of purchase protection. With these perks, he essentially tripled the warranty.

The information for the Citi Rewards+ has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Hotel statement credits

Many popular cards offer solid cash-back opportunities or statement credits when booking with particular hotel chains and brands. There’s a chance you hold some of these eligible cards and don’t even know you could be saving some cash.

Sapphire Preferred hotel credit

The Chase Sapphire Preferred card’s $50 annual hotel statement credit on bookings made through Chase Travel℠ wipes out more than half of the card’s $95 annual fee. So, if you’re into maximizing credit card rewards, you’re going to want to use this one.

This credit is easy to use. Simply book a hotel stay through Chase’s travel portal and pay with your eligible card. The statement credit will appear on your monthly credit card billing statement within 1-2 billing cycles, but we’ve typically seen it post within a few days, as it did here for TPG senior credit cards editor Giselle Gomez.

One of my favorite ways to leverage this perk is using it to book boutique hotels that don’t belong to any specific loyalty program. That way, I’m not missing out on extra points earning by going through Chase Travel instead of booking directly.

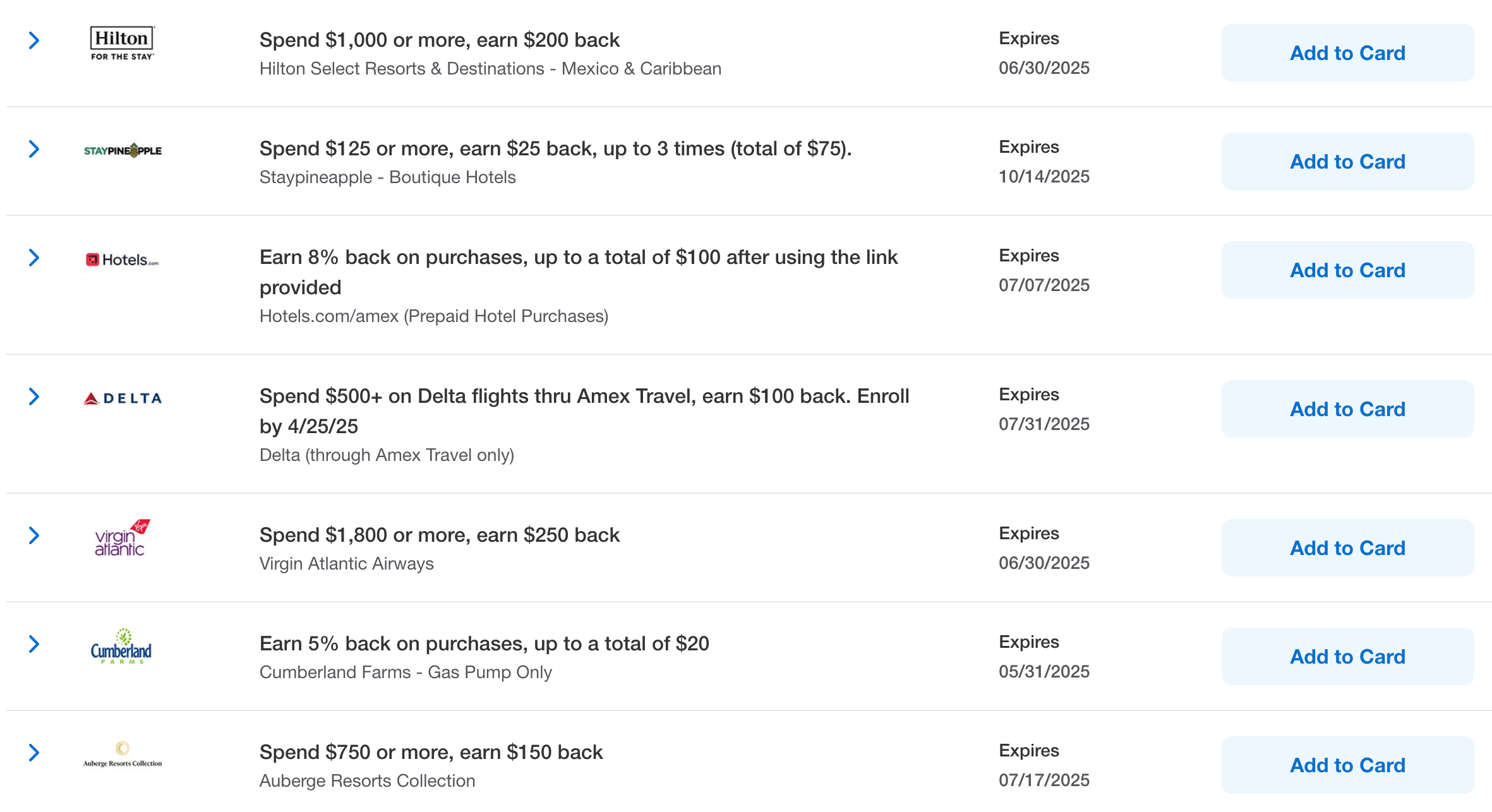

Amex Offers and Chase Offers

Like with streaming services, Amex Offers and Chase Offers can come in clutch once again if you’re targeted for cash-back deals at multiple properties. We’ve seen Amex Platinum offers with cash-back deals on Hilton stays, Delta flights booked through Amex Travel, flights booked with Virgin Atlantic and more.

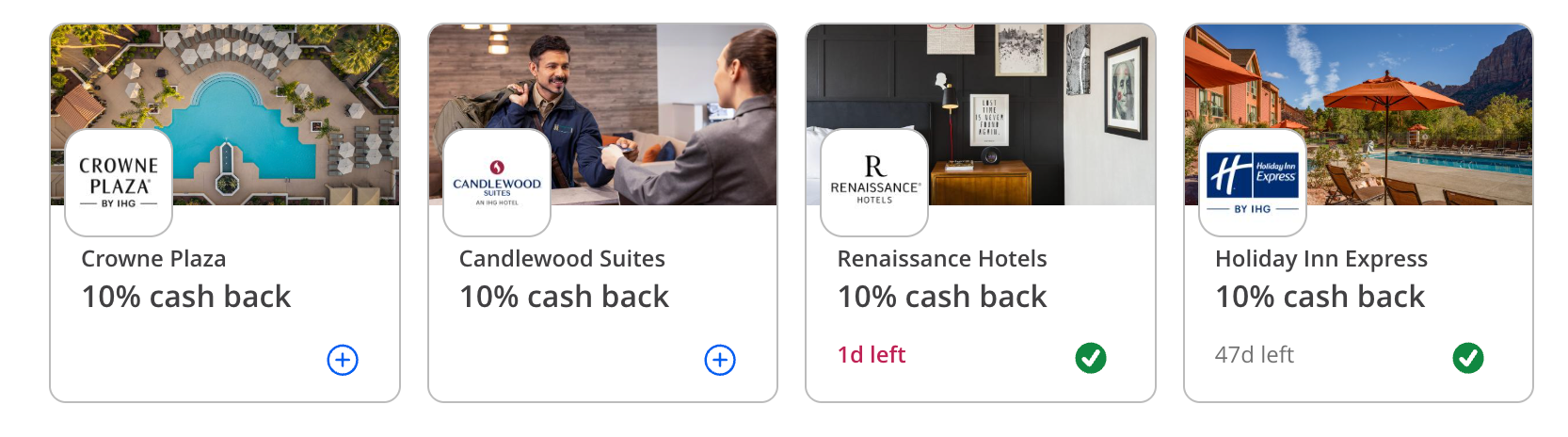

Meanwhile, my Sapphire Preferred is offering 10% cash back on bookings with Crowne Plaza, Candlewood Suites, Renaissance Hotels and Holiday Inn Express.

Amex and Chase Offers are consistently changing and targeted, however, so be sure to check your account to see what you may be able to use.

Related: Points and miles travel deals for this month

Ride-hailing credits

Like cellphone protection, ride-hailing credits on cards have grown more popular throughout the years. If you’re frequently calling an Uber or a Lyft, you may be missing out on some discounts if you aren’t maximizing these.

Ride-hailing credits on United Chase cards

Most of Chase’s suite of United Airlines cobranded cards offer monthly ride-hailing statement credits at multiple thresholds. Yearly opt-in is required.

The information for the United Club Business has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Uber cash on Amex cards

The Amex Platinum and Amex Gold cards offer Uber credits that reload into your account each month to use on rides or food orders in the U.S. Here’s how this benefit breaks down on each card:

- Platinum: $15 monthly, additional $20 in December; up to $200 annually

- Gold: $10 monthly; up to $120 annually

Just note the cash does not roll over month-to-month, so you have to remember to use it every month or risk losing it. You also have use an Amex card as the payment to use the monthly Uber cash benefit. It doesn’t have to be the Amex card with the embedded benefit (though either your Amex Platinum or Amex Gold must be added to your Uber account), but it does have to be an Amex card.

Lyft credits on multiple cards

Chase Sapphire Reserve® (see rates and fees) offers $10 in Lyft credits through September 2027. This credit expires if it is not used by the end of the month. Plus, you’ll receive 5 points per dollar on rides with Lyft.

Meanwhile, any World Mastercard or World Elite Mastercard, such as the Citi Strata Premier℠ Card (see rates and fees) or JetBlue Plus Card, earns $5 in Lyft credits each month if you take at least three Lyft rides in a calendar month (through Jan. 31, 2026). This bumps up to $10 in Lyft credits if you take three Lyfts in a calendar month and pay with the Citi® / AAdvantage® Executive World Elite Mastercard® (see rates and fees).

The information for the JetBlue Plus Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Related: The most valuable World Elite Mastercard benefits

Save on Amazon orders

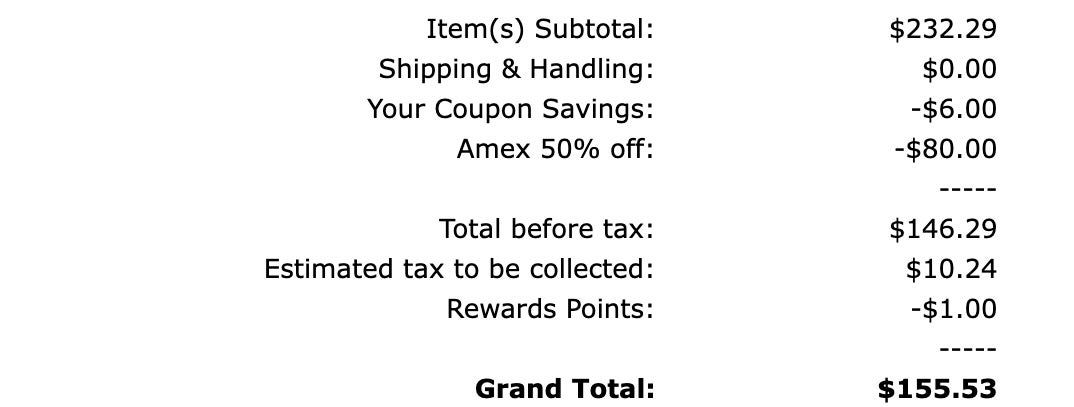

An Amazon discount for targeted American Express cardholders can net some serious savings when they pay with Membership Rewards points.

When this targeted offer is available, you only need to redeem 1 Membership Rewards point to get up to 50% off on eligible orders. You’ll need an Amex Platinum, Amex Gold or the American Express® Green Card to receive this offer.

The information for the American Express Green Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

TPG senior credit cards editor Giselle Gomez used her 50% off deal on up to $80 in purchases for the holiday season in 2024.

Not all Amex cardholders are targeted for this offer, so you’ll have to check your account when the promotion is running to see if you’re eligible and activate the offer.

You could also redeem your points for Amazon purchases. However, since this generally gives you a lower per-point value than when you use your points for travel, we generally don’t recommend this.

Related: Ways to save money on Amazon orders

Free or reduced Walmart+ subscription

A Walmart+ membership includes free shipping from Walmart without an order minimum, free same-day delivery from the store (when available), a free Paramount+ Essential subscription, discounts with select gas stations and more. This membership costs either $12.95 monthly or $98 per year.

Several American Express cards offer occasional deals to get a Walmart+ membership either free or at a discount.

Free Walmart+ offer on the Amex Platinum

The Amex Platinum offers a statement credit of up to $12.95 (the full price of a monthly membership) each month when you pay for Walmart+ with the card, coming out to $155 a year (subject to auto-renewal; enrollment required). Plus-Ups not eligible.

Amex Offers for discounted Walmart+

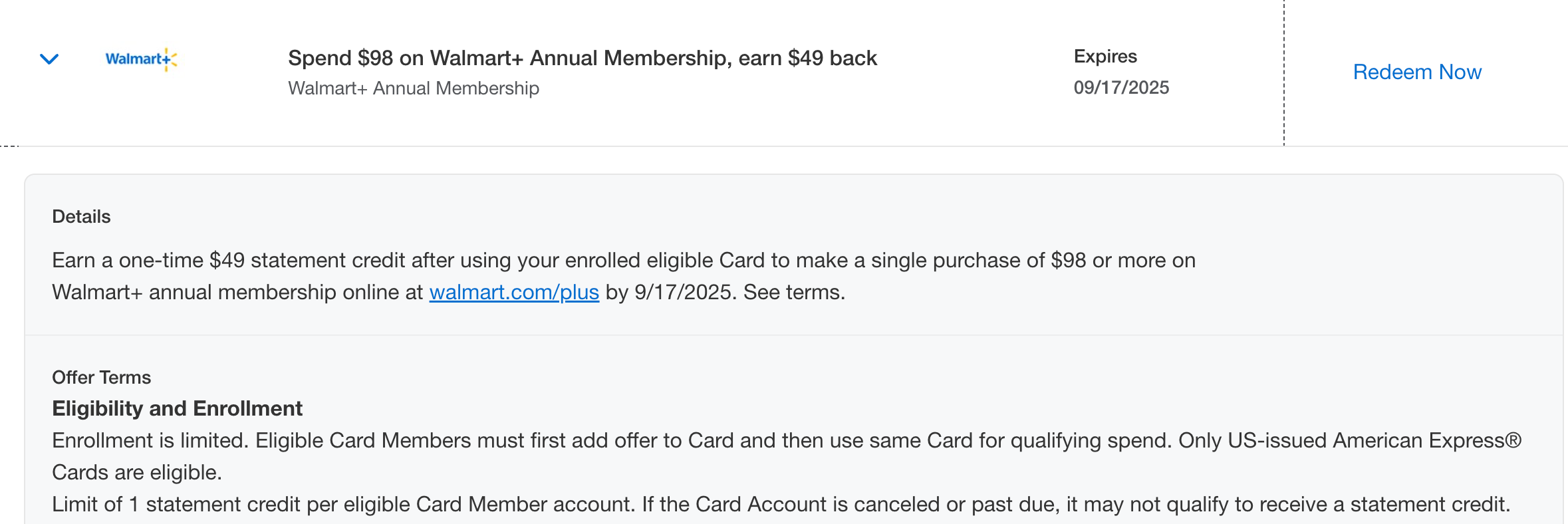

Anecdotally, I’ve previously seen an Amex Offer to receive $49 back on a $98 annual Walmart+ purchase on my Amex Gold.

Most recently, a similar deal popped up on my Hilton Surpass Amex.

Travel insurance savings

You never want to miss out on a trip you were excited to take or deal with a significant delay en route to your final destination, but sometimes these hiccups are inevitable.

Many credit cards come with varying degrees of protection for the following events:

Some of our favorite cards with travel protections include the Chase Sapphire Preferred, United Club Card, Ink Business Preferred and Chase Sapphire Reserve.

However, these perks are included on multiple popular travel credit cards. So, if you’re ever in a covered situation, check out your card’s guide to benefits to see if you’re eligible.

I saved almost $250 on a canceled hotel stay thanks to my Sapphire Preferred. It was a relatively easy process and helped me get that money back when I had to miss a trip.

Related: Should you get travel insurance if you have credit card protection?

Bottom line

As credit card enthusiasts here at TPG, we love finding ways to utilize our perks and save money. However, many of our favorite credit card benefits may go unnoticed by casual spenders.

You could be missing out on hundreds of dollars in statement credits and cash-back offers if you aren’t keeping up with some of the perks listed above. There’s a lot of value to be found, so don’t leave cash on the table.

Check up on your credit card benefits and targeted offers to see if there’s anything you’ve overlooked. It’s easily worth the extra time to use these lesser-known credits to save money on popular everyday purchases.

Related: Credit card perks and benefits you should be using this month

For rates and fees of the Amex Platinum, click here.

For rates and fees of the Amex Gold, click here.

For rates and fees of the Amex Blue Cash Everyday, click here.