Revenge of the floating-rate CRE loans: Ironically, use of floating-rate office loans ballooned as interest rates rose.

By Wolf Richter for WOLF STREET.

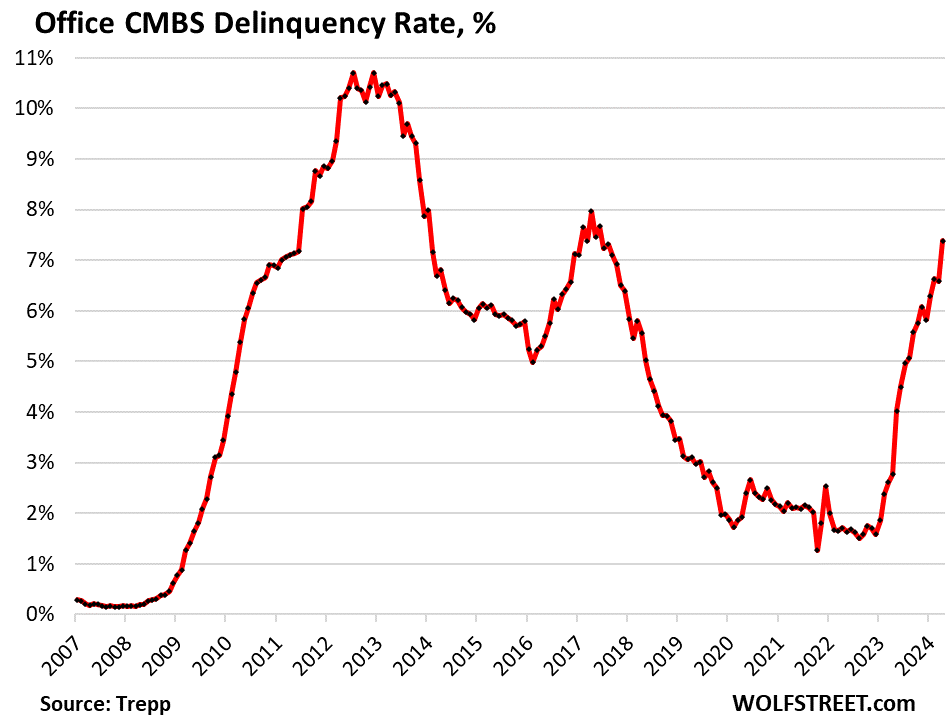

The delinquency rate of office mortgages that have been securitized into Commercial Mortgage-Backed Securities (CMBS) – investors on the hook here, not banks – spiked to 7.4%, powered by floating-rate mortgages, whose delinquencies spiked to 20%.

Data provided by Trepp, which tracks and analyzes CMBS. These are loans that have not paid interest for 30 days or more, after the 30-day grace period expired.

In 2012 and 2013, delinquency rates of office CMBS eventually exceeded 10%, as one of the many consequences of the Financial Crisis and the Great Recession, not interest rates, which the Fed had pushed toward zero back then.

This time around, landlords are dealing with two big issues even as the economy is growing rapidly: ballooning vacancies and much higher interest rates that are tearing up floating-rate loans.

Floating-rate CRE mortgages.

During the now bygone era of near-0% policy rates and massive QE by the Fed, the delinquencies of floating-rate office mortgages were below 0.5%, (red in the chart below), and well below the 2% delinquency rates of fixed-rate mortgages (blue in the chart below).

But during the current era of historically more normal interest rates, delinquency rates of floating-rate office mortgages rose to 20%, while delinquency rates of fixed-rate mortgages rose to 4.7% (data via Trepp):

CRE mortgage rates have more than doubled, and floating-rate mortgages adjust to them. There loans are often interest only, and when the rate doubles, the payment doubles. This was behind many of the office-loan failures we’ve discussed here for the past two years.

Many of these loans have relatively short terms, such as two years, or five years, and then there is the added risk of the landlord not being able to refinance the loan at maturity because the new rates are so high that the property is not economically feasible at the amount needed to pay off the maturing loan.

In many cases, landlords just walked away. For example, Blackstone walked away from an office tower in Manhattan it had purchased for $605 million in 2014, and later refinanced with an interest-only floating-rate mortgage. The special servicer, representing the CMBS holders, has now sold the loan for $200 million. The losses were spread across equity and debt investors, not banks. The new owner, sitting on this much lower cost base, might develop the tower into a residential property.

Office availability rates have reached 30% and more in some cities, and are above 20% in most cities, due to a structural problem as Corporate America has discovered it doesn’t need, never needed, and won’t ever need all this office space that it has leased. High vacancy rates mean the cash flow from rents is diminished, and that makes it harder to make the payments of any type of mortgage – fixed or floating rate.

There is not a good way out, buildings are being drastically repriced, quite a few of them are sold for close to land value to be redeveloped into residential. And it’s a huge mess. Lower mortgage rates, should they re-appear, won’t alter the structural problem.

The growing share of floating-rate office loans.

During the era of interest-rate repression, nearly all (98%) of office mortgages were fixed-rate, according to Trepp. Makes sense as interest-rates were very low.

But when interest rates began to rise, landlords needing to finance or refinance a building switched to floating-rate loans because rates were a little lower than fixed rates at the time. Apparently, they were hoping all along the way that rates wouldn’t rise any further, and would soon drop again, as the Fed would be forced to pivot or whatever, which has turned out to be a colossally wrong wager.

Currently, about 37% of CMBS office loans are floating rate (red), and 63% are fixed rate:

Overall CMBS delinquency rates.

The overall delinquency rate for mortgages in CMBS mortgage pools jumped to 5.1%. The office sector is now the worst performing sector of CMBS, even worse than retail and lodging. Still in good shape in terms of delinquencies are multifamily, despite some issues, and industrial (warehouse space, fulfillment centers, etc.):

- Office: 7.4%

- Lodging: 6.0%

- Retail: 5.9%

- Multifamily: 1.3%

- Industrial (warehouse space, etc.): 0.4%

The divergence in overall delinquency rates between fixed-rate and floating-rate loans is quite something, with much lower delinquency rates for floating-rate loans (red) during the era of interest-rate repression, in the 1.5% range, than with fixed rate loans during that time, at over twice that rate.

Then the free-money era ended, and delinquencies among floating-rate loans began to surge, while fixed-rate loan delinquency rates plateaued:

Repayment defaults are an issue that fixed-rate loans face – when, for example, a 3%-loan matures and has to be refinanced with a 7% loan, while rent revenues don’t cover the payments for the 7% loan. So lenders will not lend on the property, and the borrower cannot pay off the existing loan when it matures and ends up defaulting on it. But many floating rate loans get washed out before repayment even comes up.

Loans that missed their payoff dates but continued to make interest payments are not included in the delinquency rates here. Missing a payoff date can mean that the borrower is negotiating with the lender, or that a loan extension is in the works, etc., or that the landlord cannot refinance the property. According to Trepp, if loans that missed their maturity dates, but are still making interest payments, are included in the overall delinquency rate, it would be 5.8%, instead of the current 5.1%.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()