Your airline miles and points earning could be at risk.

getty

Are your credit card miles and points at risk? They could be if the ongoing battle for credit card legislation, initiated by the Durbin-Marshall amendment (Senators Roger Marshall and Dick Durbin), passes in Congress. Bipartisan negotiations continue, but a final vote is inching closer.

The amendment, part of the Dodd-Frank Wall Street Reform and Consumer Protection Act, would reduce the cost charged to merchants that accept credit cards. It says that businesses pay more than $100 million in swipe fees annually. But opponents to the change say reduced interchange revenues could wipe out the miles, points and perks that consumers enjoy from their credit cards.

Credit card payment is now the preferred method of payment by many consumers.

getty

This week, airlines, travel unions and aircraft manufacturers have stepped up their campaigning against these proposed changes, according to a Business Insider article. They say that weakening loyalty programs (and their associated perks) could have a detrimental effect on the aviation and travel industry as a whole. It could affect travel demand, which would hurt employment in the industry and eventually aircraft orders.

The trade group Airlines for America is spearheading the efforts and has partnered with various travel companies and unions in a recent letter to senators, which includes support from the Allied Pilots Association, Airbus, American Airlines, Boeing, Southwest Airlines and United Airlines among others.

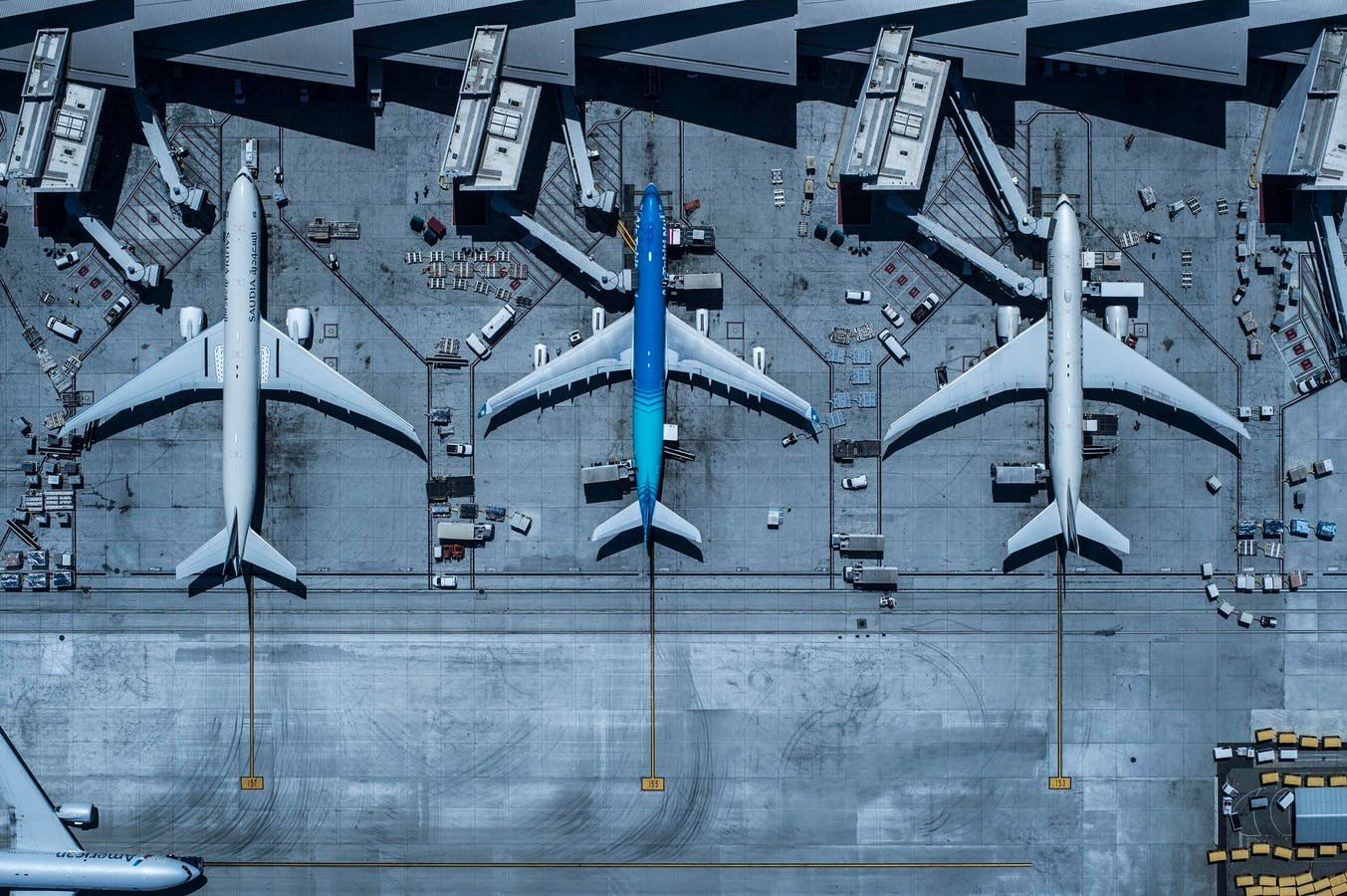

America Airlines planes waiting for passengers at Miami International Airport.

getty

According to the group, credit cards had a nearly $25 billion effect on the economy in 2023, representing over 31 million American consumers. Limiting credit card benefits could put a dent in the loyalty miles and points game for consumers and a proverbial crater in the bottom line for airlines and hotels that rely on credit card revenue to offset slim margins elsewhere.

In the December quarter alone, Delta brought in nearly $2 billion in credit card remuneration, which represented a 14% year-over-year increase from the same period last year.

Airlines for America points to research that says that more than half of the loyalty miles and points redeemed in 2023 came from credit cards rather than via flights or hotel stays.

A Delta Air Lines Airbus A330-300

getty

The Electronic Payments Coalition, which represents credit card companies, adds that this legislation would only benefit mega-stores and does not have the same effect for consumers. The group maintains that interchange fees have not increased in recent years and that credit card fees are hardly the highest expense that most businesses have to pay. In fact, it believes that small businesses stand to suffer the most if this legislation were to pass.

According to a public document from EPC, “credit card routing mandates would not lower the cost of goods for consumers, and in some cases, may raise costs for consumers.”

United Airlines Boeing 777 Aircraft (777-200), Los Angeles International Airport (LAX).

getty

It counters that the argument that low-income individuals are footing the bill for these rewards programs is not accurate. Studies show that “low-income individuals use rewards credit cards at a rate similar to high-income individuals” and “there is substantial evidence that caps placed on credit cards transactions reduces rewards offered to consumers while increasing the cost of holding a card, ensuring consumers across income levels are left worse off.”

Current, bipartisan negotiations are taking place on the Senate floor with a vote potentially taking place next week.