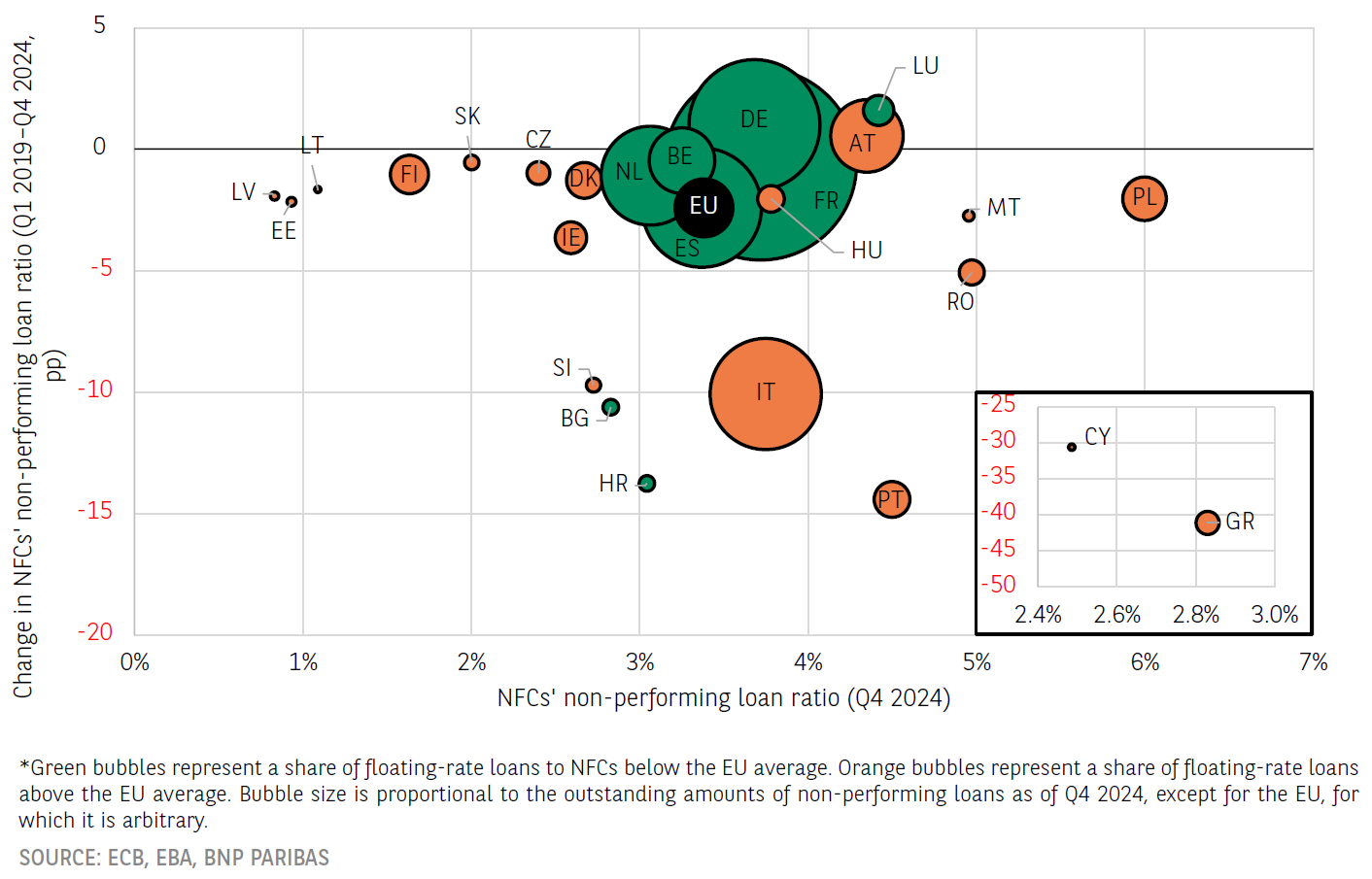

Non-performing loan (NPL) ratios of non-financial corporations declined in most EU/EEA banking systems between 2019 and 2024. On average, the ratio fell significantly to 3.38% in Q4 2024 (-2.4 percentage points since Q1 2019). Only the German, Austrian and Luxembourg banking systems recorded an increase, but they started from a level significantly below the EU/EEA average NPL ratio.

RATIOS AND CHANGES IN NON-PERFORMING LOANS IN EU BANKING SYSTEMS

Regional homogeneity is emerging

A dichotomy can be observed between banking systems located in the north east of Europe and those located in the south. The NPL ratios of the former were initially quite low and declined only slightly between 2019 and 2024, while the ratios of the latter were both historically higher and fell more sharply over the period. Finally, banking systems in core Europe not only had ratios close to the Eurozone average but also showed more moderate variations (increase or decrease) between 2019 and 2024; these geographically central countries are also notable for their significantly higher proportion of fixed-rate loans. This illustrates the protective nature of fixed rates for borrowers and, consequently, the lower impact of interest rate rises on non-performing loan ratios.