The Reserve Bank of India’s (RBI) impending framework for gold loans has come amidst a significant surge in gold loan outstanding and non-performing assets (NPAs) in the segment. The sustained rally in gold prices has driven the growth in gold loans, as consumers tap into the rising value of their gold assets. Simultaneously, banks and financial institutions have witnessed a substantial increase in gold loan disbursals, leading to a corresponding rise in NPAs. RBI data reveals that NPAs in gold loans have jumped 28.58 per cent in a year and loan outstanding grew by 27.26 per cent.

The RBI’s new framework on gold loans aims to regulate the gold loan segment and mitigate potential risks.

Surge in bad loans, loan growth:

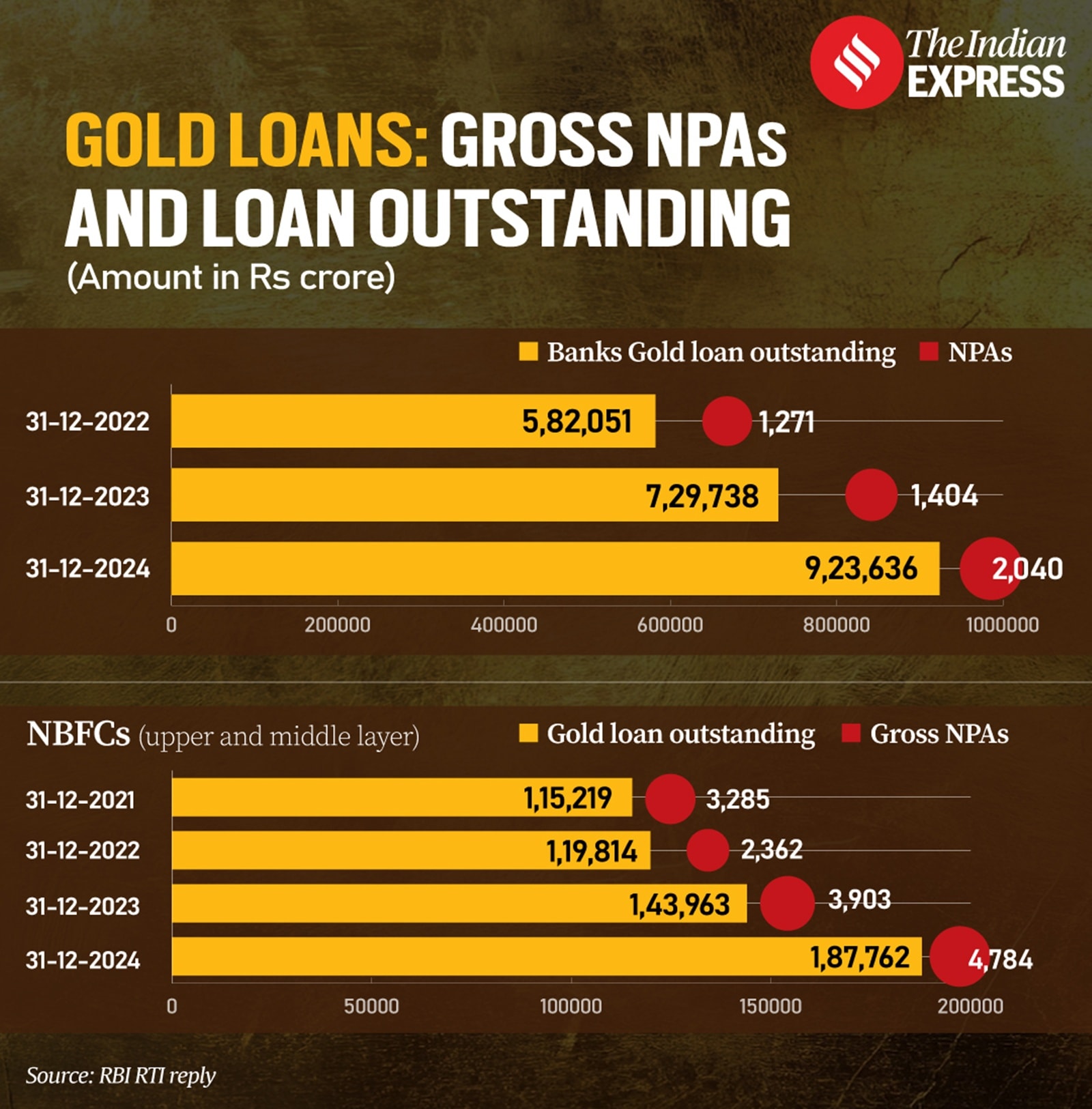

Ahead of the Reserve Bank’s decision to come out with a new framework for gold loans last week, gold loan outstanding of banks and non-banking finance companies and bad loans, or non-performing assets (NPAs) in the segment, witnessed a substantial growth. NPAs spurted by over Rs 1,500 crore to Rs 6,824 crore as of December 2024 as against Rs 5,307 crore a year ago, according to latest data from the Reserve Bank of India.

Gross NPAs and loan outstanding.

Gross NPAs and loan outstanding.

Of this, gold loan NPAs of Rs 2,040 crore were reported by commercial banks as of December 2024 from Rs 1,404 crore a year ago. Finance companies involved in gold loans accumulated Rs 4,784 crore NPAs as against Rs 3,904 crore last year, the RBI said in its reply to an RTI application filed by The Indian Express.

Total gold loan outstanding of banks and NBFCs was Rs 11,11,398 crore as of December 2024 as against Rs 873,701 crore in December 2023. Banks accounted for a lion’s share of Rs 923,636 crore in the total gold loan outstanding, the RBI said.

Irregular practices in gold loans:

The RBI, which conducted a review of gold loan practices last year, found several irregular practices in the gold loan activity. The major deficiencies include shortcomings in the use of third parties for sourcing and appraisal of loans, valuation of gold without the presence of the customer, inadequate due diligence and lack of end use monitoring of gold loans, lack of transparency during auction of gold ornaments and jewellery on default by the customer, weaknesses in monitoring of LTV (loan to value) ratio and incorrect application of risk weights.

The RBI then asked banks and NBFCs to comprehensively review their policies, processes and practices on gold loans to identify gaps and initiate appropriate remedial measures in a time-bound manner. Further, the gold loan portfolio should be closely monitored, especially in the light of significant growth in the portfolio. It should also be ensured that adequate controls are in place over outsourced activities and third-party service providers, the RBI said.

Story continues below this ad

Earlier, borrowers could repledge the jewellery on the same day by paying only the interest. This had led to evergreening of gold loans as borrowers extended loans indefinitely without making repayment of principal.

After the RBI asked lenders to tighten the gold loan processes in September last year, borrowers are now required to repay the full principal and interest on the loan if they want to repledge the gold and ask for an extension of the loan. The change has made it costlier for borrowers, as they will have to borrow again to repledge the loan and extend the loan tenure for another year.

RBI’s new norms

On April 9, the RBI released draft comprehensive guidelines on gold loans. Under the proposed norms, the RBI has barred lenders from granting any advance against primary gold/ silver or financial assets backed by primary gold/ silver like units of Exchange-traded funds (ETFs) or units of mutual funds. The maximum loan-to-value (LTV) ratio in respect of consumption gold loans should not exceed 75 per cent of the value of gold.

The guidelines said that the eligible gold collateral should not be used concurrently for extending loans for income generating purposes as well as consumption loans. Lenders should not extend loans where ownership of the collateral is doubtful, and they should keep a record of the verification of the ownership of the collateral. Tenor of consumption loans in the nature of bullet repayment loans where both principal and interest become due at maturity should be capped at 12 months, the RBI said.

Story continues below this ad

The attractiveness of gold loans

What has made gold loans an attractive option for individuals seeking immediate financial assistance is the ease of obtaining these loans, coupled with minimal documentation and swift processing. Major financial institutions, including PSU banks, offer instant gold loans with flexible repayment options, further increasing their attraction. On top of this, the sharp rise in gold prices has ensured that borrowers will get a higher loan amount from their gold holdings.

Gold prices (24 karat; Rs 10 per grams)

Gold prices (24 karat; Rs 10 per grams)

Gold holds a significant place in Indian culture, often being accumulated over generations. During times of financial needs like hospital expenses and college fees, individuals are more willing to pledge their gold holdings like jewellery to secure loans.

“The slowdown in the economy in the last a few months would have prompted consumers to pledge gold to meet the financial requirements. During periods of economic uncertainty like trade wars or inflation, gold is perceived as a stable asset, prompting individuals to opt for gold loans to meet immediate financial needs,” said an analyst. The growth of digital platforms, apps and fintech solutions has also made gold loans more accessible and attractive, even in remote areas, contributing to their rising popularity.

As gold prices continue to glitter, loans in this segment are likely to remain a popular financing option for individuals across the country.