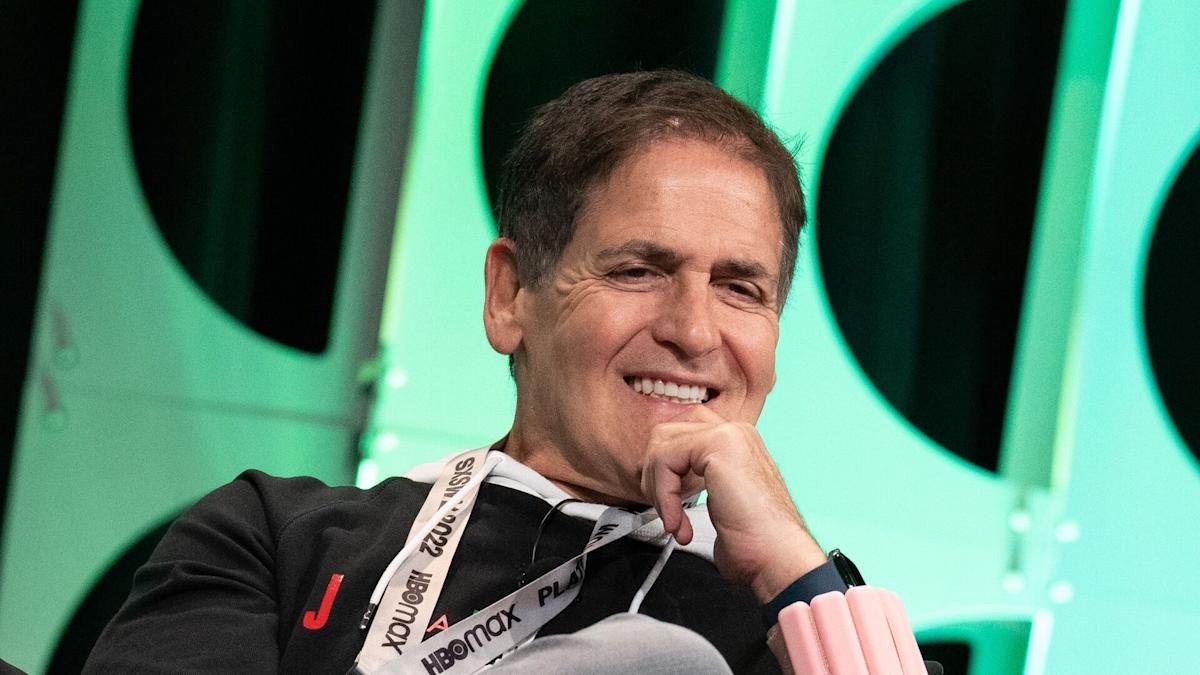

In the famous words of Mark Cuban, the billionaire you probably know from “Shark Tank,” “If you’re using a credit card, you don’t want to be rich.” With a net worth of $5.7 billion of June, according to Forbes, he certainly knows a thing or two about building wealth. But are credit cards really the culprit holding you back?

Read More: 7 Frugal Habits of the ‘Shark Tank’ Stars

Trending Now: How Far $750K Plus Social Security Goes in Retirement in Every US Region

To get to the bottom of it, we spoke with Ashley Morgan, attorney and owner of Ashley F. Morgan Law. Read on for her expert take on Cuban’s claim, and what you really need to know about building wealth, with or without credit cards.

Morgan agreed with Cuban to a degree. She acknowledged credit cards can be dangerous if used irresponsibly, and it’s perfectly fine if they’re not your thing.

“For many people, using credit cards is risky,” Morgan said. “It is too easy not to track your spending or carry a balance. Using credit cards properly takes discipline, and not everyone is a credit card person.”

But that doesn’t mean they’re always a bad idea.

How To Build Wealth in 2025: 10 Smart Steps That Work

Let’s say you buy a latte with a credit card. Even though the card is in your name, the bank is the one fronting the money, not you. Unlike a debit card that pulls funds directly from your personal account, a credit card borrows from the bank’s funds. So, if you don’t pay that money back in full, the remaining balance becomes debt.

“You need to avoid carrying a balance at all costs,” Morgan said. “Also, you want to be aware of your spending. If you are not budgeting and monitoring your purchases because you are just paying for them later, it means your cards are encouraging your spending.”

And if you’re not paying off your balance each month, the interest and debt can quickly cancel out any potential rewards.

Used wisely, credit cards can be a helpful tool to build wealth. But it takes strategy and self-discipline.

“To properly use credit cards, you need to track your spending and pay off the balance in full each month,” Morgan said. “You almost have to think of your credit card as a debit card. The moment you start carrying balances, the benefits to those credit cards start to diminish rapidly.”

While Cuban warns that credit cards can stall your financial progress, Morgan says that, if used properly, they’re often key to financial growth.