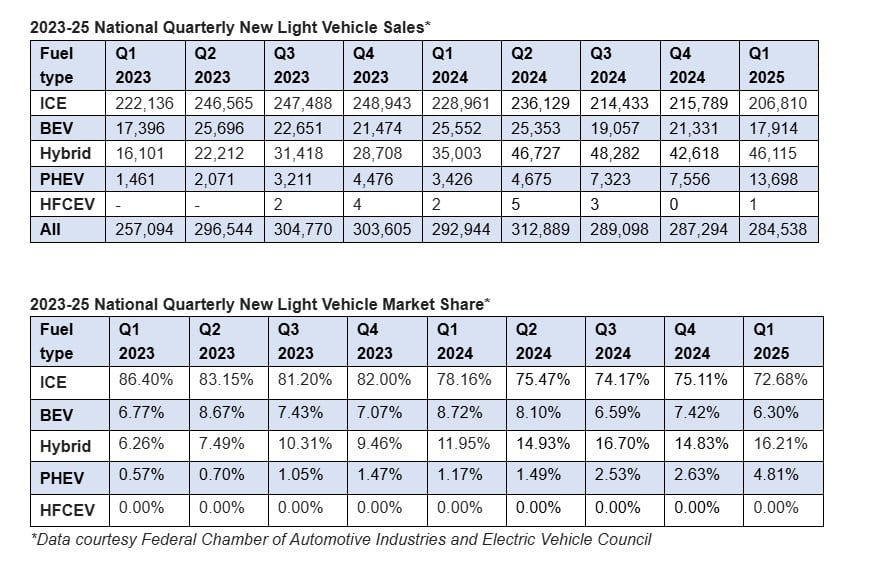

Australia’s electric vehicle (EV) market experienced a notable shift in the March 2025 quarter, as battery electric vehicle (BEV) sales fell to their lowest levels in two years, while hybrids and plug-in hybrid electric vehicles (PHEVs) recorded strong gains.

The latest data from the Australian Automobile Association’s (AAA) EV Index revealed that BEVs accounted for just 6.3 per cent of new car sales, down from 7.42 per cent in the December 2024 quarter.

Only 17,914 BEVs were sold between January and March 2025, compared with 21,331 in the previous quarter. This decline coincided with a broader 0.96 per cent dip in total vehicle sales nationally. Internal combustion engine (ICE) vehicles remained dominant with 206,810 sales, although this too was down from 215,789 the quarter before.

In contrast, PHEV sales surged by 81 per cent, jumping from 7,556 units in Q4 2024 to 13,698 in Q1 2025, capturing 4.81 per cent of the market. Hybrid vehicles also rebounded after a temporary dip in the December quarter. Analysts suggest the end of fringe benefits tax exemptions for PHEVs in April 2025 and the launch of BYD’s Shark 6 plug-in hybrid 4WD ute – with 4,836 units sold – may have fuelled this surge.

The Shark 6’s success also reshaped the PHEV segment, historically dominated by medium SUVs. In the March quarter, medium SUVs made up 46.9 per cent of PHEV sales – down from 76.7% in Q4 – while 4WD utes, led by the Shark 6, accounted for 35.3 per cent of PHEV sales and 9.28 per cent of all 4WD utes sold.

Vehicle type preferences remain clear: medium SUVs continue to dominate BEV, PHEV, and hybrid sales. In this segment, 50.26 per cent of sales were ICE, 29.88 per cent hybrid, 10.94 per cent BEV, and 8.92 per cent PHEV. Meanwhile, ICE vehicles still rule the 4WD ute and van markets, though the former saw its ICE share fall to 89.98 per cent, reflecting increased PHEV uptake.

Despite fluctuations, hybrid sales have shown consistent growth over the past two years. BEV sales, on the other hand, have yet to regain their Q2 2024 peak, and hybrids have now outsold BEVs in seven consecutive quarters. The cessation of BEV purchase incentives across all states – most recently in Western Australia – may also be influencing buyer decisions.

It should be noted VFACTS data released by the Federal Chamber of Automotive Industries (FCAI) for the month of April 2025 showed a downturn in sales in the PHEV segment following the end of the fringe benefits tax (FBT) exemption on March 31.

PHEV sales for April totalled 2,601 units, accounting for just 2.9 per cent of the market. This is a notable slide from the 4.8 per cent share recorded in the first quarter of 2025.

The AAA’s EV Index, which compiles national sales data from several key industry bodies, serves as a vital tool for tracking Australia’s evolving automotive landscape.