New import taxes of 25% on cars and car parts entering the US have been announced by President Donald Trump.

The tariffs will come into effect from April 2, with charges on businesses importing vehicles starting the next day. Charges on parts are expected to start in May.

Jaguar Land Rover (JLR) was the UK’s top exporter of vehicles to the US last year, selling more vehicles there than it sells in the UK and China.

It is understood that the UK Government is in talks with the US administration and remains hopeful of a trade deal before tariffs come into force.

UK automotive trade body, the Society of Motor Manufacturers and Traders (SMMT), says that the news of tariffs from President Trump is not surprising but disappointing if, as seems likely, additional tariffs are to apply to UK made cars.

“The UK and US auto industries have a long-standing and productive relationship, with US consumers enjoying vehicles built in Britain by some iconic brands, while thousands of UK motorists buy cars made in America,” said Mike Hawes, chief executive at the SMMT.

“Rather than imposing additional tariffs, we should explore ways in which opportunities for both British and American manufacturers can be created as part of a mutually beneficial relationship, benefitting consumers and creating jobs and growth across the Atlantic.

“The industry urges both sides to come together immediately and strike a deal that works for all.”

Analysts have said the introduction of tariffs is likely to lead to the temporary shutdown of significant car production in the US and an increase in prices.

In a statement, Ineos Automotive said it was “outraged” that the tariff situation with the US has been “neglected” by the EU adding that, while President Trump has been asking for “fairness and reciprocity”, European leaders have not come to the table to negotiate a better solution.

“This is what happens when politicians sit on their hands,” said Lynn Calder, CEO of Ineos Automotive.

“As a growing EU-based automobile brand, we are vulnerable to tariffs, and we need our politicians to support our business, our jobs and our economies. We need urgent and direct political intervention on tariffs.

“We will give whatever support we can to our political leaders to keep the playing field even for small, competitive brands such as Grenadier. But we must see action from EU politicians: only they are in a position to address the issue.

“Fortunately, we have been planning for tariffs but there is only so much we can do to protect US customers from price rises.”

Some eight million cars were imported to the US last year, equating to $240 billion (£185bn) in trade and approximately half of overall sales.

Mexico is the largest supplier of cars to the US, followed by South Korea, Japan, Canada and Germany.

For the UK, the US is the second largest car export market after the EU.

A 2024 study by the US International Trade Commission, external predicted that a 25% tariff on imports would reduce imports by almost 75%, while increasing average prices in the US by about 5%.

UK car and commercial vehicle production declines

The threat of tariffs comes as UK automotive calls for measures to boost manufacturing and market competitiveness.

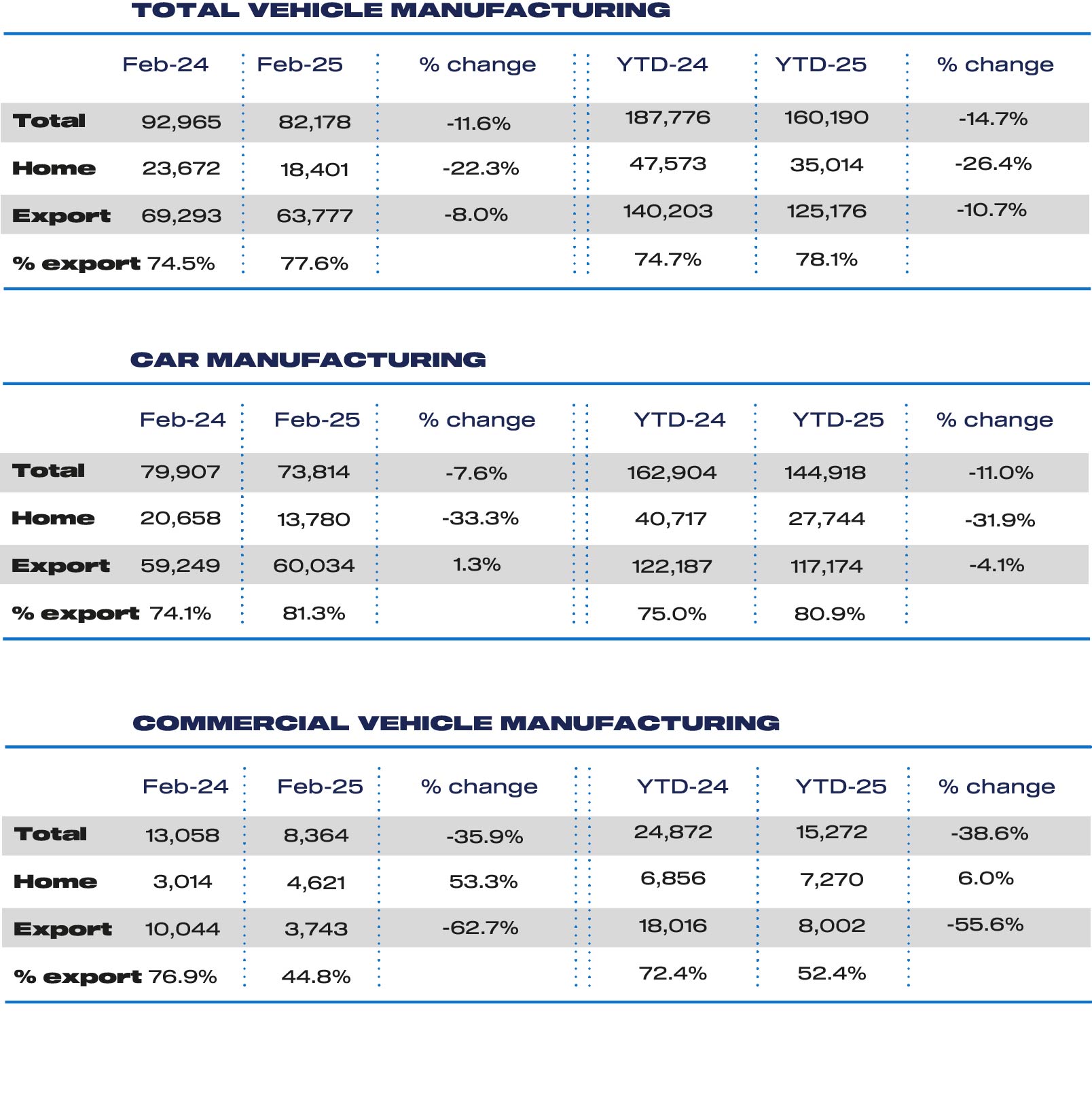

UK car and commercial vehicle production declined by 11.6% in February, to 82,178 units, according to new data published by the SMMT.

Manufacturers turned out 10,787 fewer cars, vans, trucks, taxis, buses and coaches than in February the year before, with multiple factors at play, notably soft markets at home and overseas, model changeovers and plant restructuring.

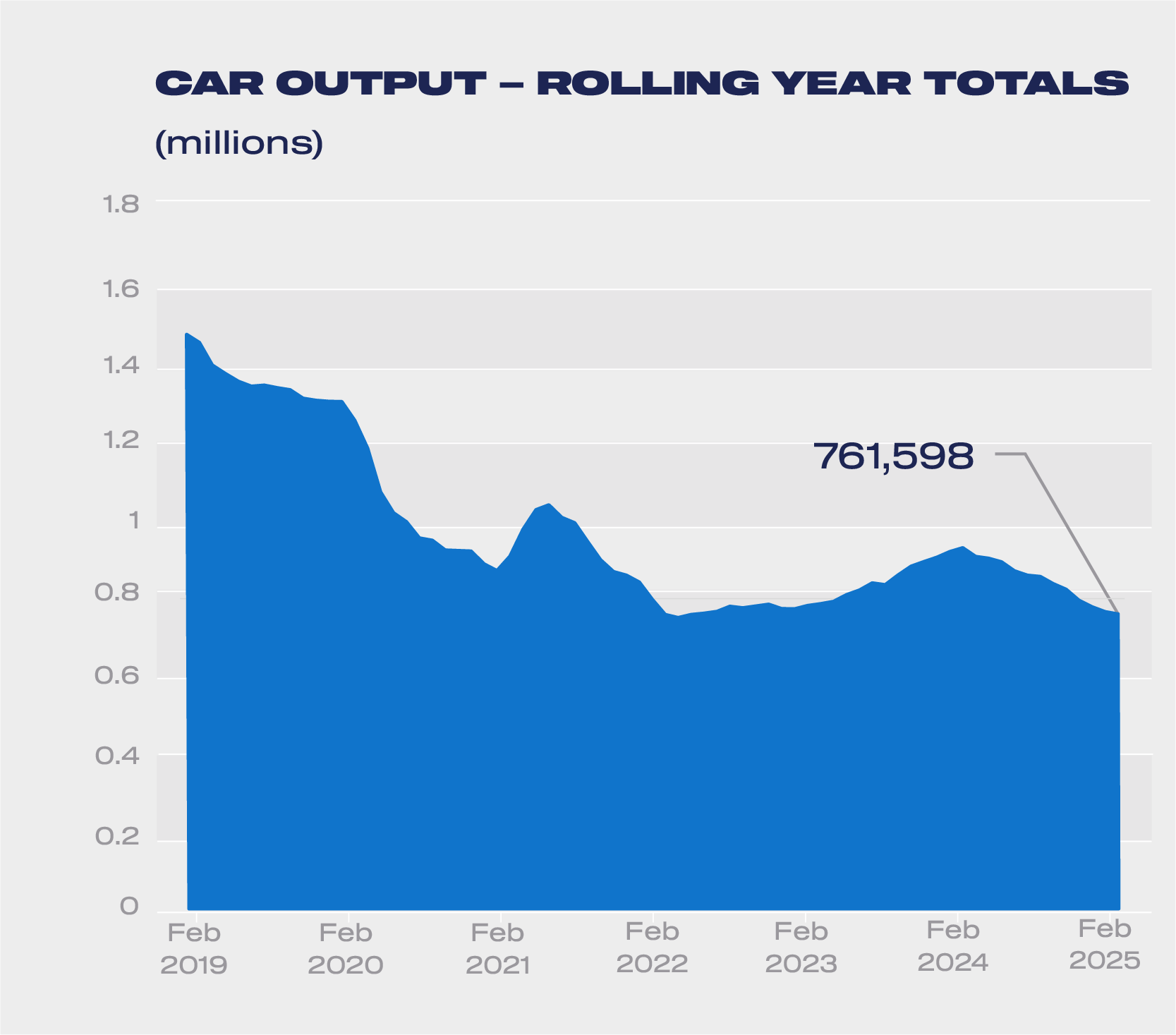

In the 12th consecutive month of decline for car manufacturing, the lion’s share of output was for export, with more than eight-in-10 units shipped abroad in the month and volumes up 1.3% to 60,034 units.

Car production for the UK market, meanwhile, fell by a third (33.3%) to 13,780 units.

The EU remained the largest market for UK car exports, taking 53.5%, followed by the US (19.7%) and China (6.3%).

In line with recent trends, while shipments to the EU and China fell 9.6% and 10.9% respectively, those to the US rose 34.6%.

Turkey and Japan rounded off the top five car export markets, taking a combined 6.3% share, with shipments up 75.5% and 119.2% respectively.

UK production of battery electric, plug-in hybrid and hybrid cars fell 5.6% to 27,398 units in the month, but still boosted their share marginally to 37.1%, from 36.3% last February.

In the year-to-date these electrified cars have taken a 39.6% share of production, up from 36.0% a year ago, with a more modest 2.1% fall in volumes compared with overall output down 11%.

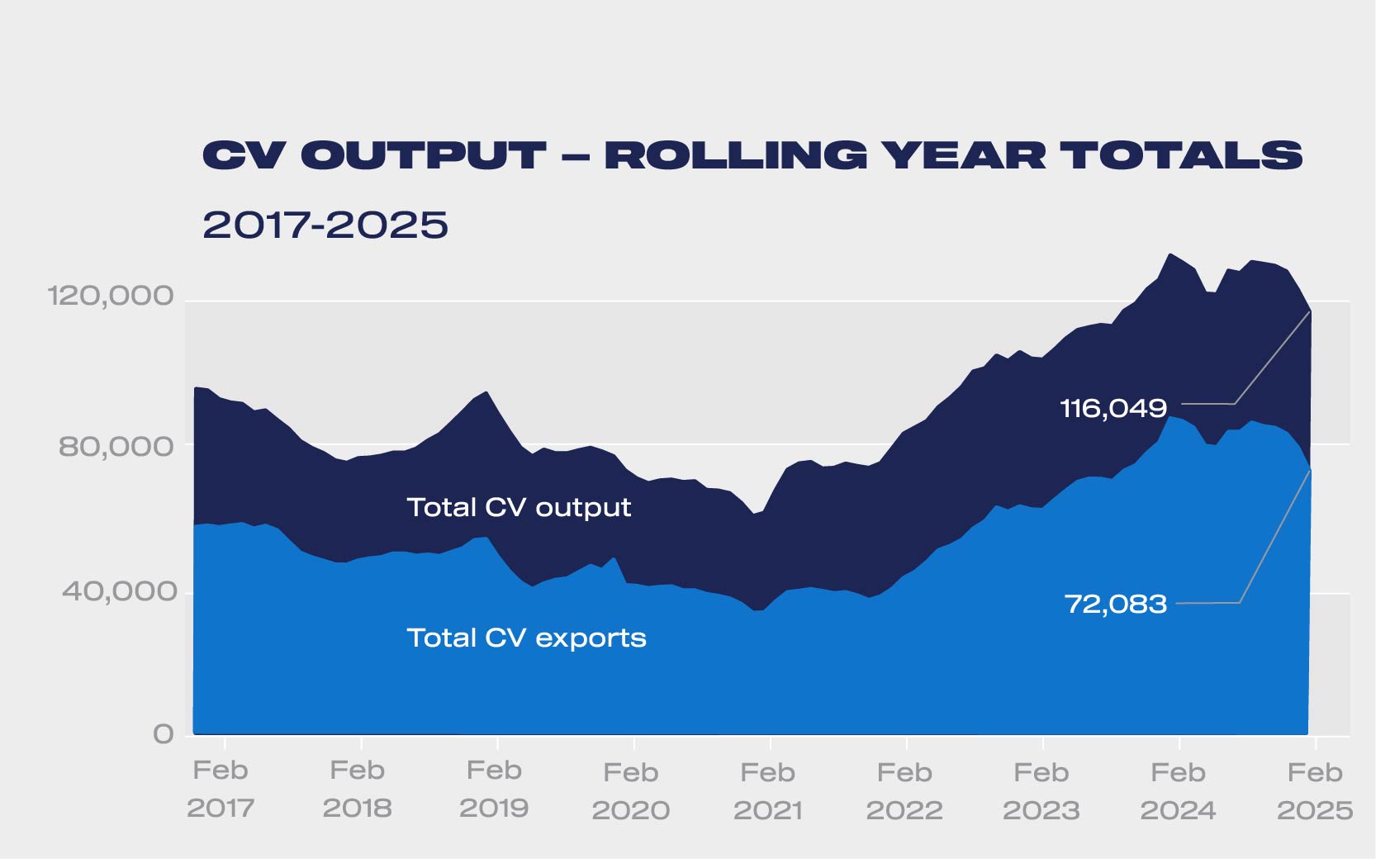

CV output, meanwhile, fell 35.9% to 8,364 units, driven primarily by less van production and following last year’s February performance, which was the best since 2008 when output almost doubled.

Volumes were driven by domestic demand, accounting for 55.2% of output with volumes up by more than half to 4,621 units.

CV exports, however, fell 62.7% to 3,743 units, and with 93.8% heading to the EU, reflecting a drop of 5,956 units shipped to the bloc.

The overall performance reflects the challenges the sector faces globally. Measures, says the SMMT, are needed urgently to bolster the UK’s competitiveness and drive consumer demand.

It criticised the Spring Statement for offering no support for the industry or consumers, labelling it a missed opportunity.

Hawes said: “These are worrying times for UK vehicle makers with car production falling for 12 months in a row, rising trade tensions and weak demand.

“The market transition is not keeping pace with ambition and, while the industry can deliver growth – and green growth at that – it needs policies to deliver that reality.

“It was disappointing, therefore, to hear a Spring Statement that did nothing to alleviate the pressure on manufacturers and, moreover, confirms the introduction next month of additional fiscal measures which will actually dissuade consumers from investing.

“Without substantive regulatory easements our manufacturing viability remains at risk and the UK’s transition to zero emission mobility under threat.”