[SINGAPORE] Wealth investment firm Chocolate Finance has temporarily implemented a S$250 per transaction spending limit on its debit card, it said in an e-mail update to customers on Tuesday evening (Mar 11). The company added that this is to help manage its liquidity “programme”.

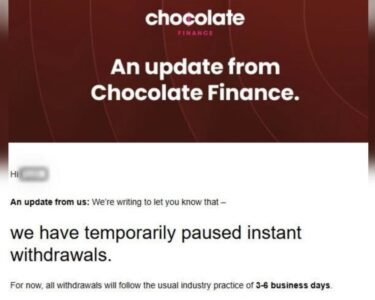

The firm, which was enjoying large inflows of funds due to its attractive rates on deposits, abruptly halted instant withdrawals on Monday, due to “high demand”, sparking alarm among investors. It also paused transactions on its debit card.

Three days on from the shock announcement, things could be looking up. Chocolate Finance says the waiting timeframe for customers who are looking to withdraw their funds will now be three to six days, instead of the three to 10 days timeframe earlier announced.

It explained that like asset managers, the underlying funds it invests in typically follow a three to six business-day withdrawal cycle.

In another sign of the improving situation, transactions on the debit card are now allowed, although a limit of S$250 has been imposed.

However, transactions made on AXS and e-wallet top-ups remain unsupported. This will “help us keep the HeyMax programme running strong”, Chocolate Finance said.

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

A partnership with rewards platform HeyMax offered a two-mile-per-dollar reward for all spending categories, including bill payments. It was a success for customer acquisition, but was unsustainable for Chocolate Finance, said founder and chief executive Walter de Oude. A surge in bill payments led the platform to withdraw from AXS.

However, Chocolate Finance is unable to “commit to” a set timeline for when instant withdrawals can resume, responding to queries from The Business Times.

Before the suspension on Monday, customers could request instant withdrawals of up to S$20,000 a day.

Chocolate Finance explained that liquidity issues were not the reason behind the pause in instant withdrawals. Instead, it is a “matter of managing increased transaction volumes”.

The company “fronts” the cash before receiving settlements, said de Oude in a LinkedIn post on Monday.

A spike in withdrawals would deplete its liquidity buffer, which is why a temporary pause is required, he said.

Chocolate Finance launched to fanfare last July and has since gained 60,000 customers and boasts close to S$1 billion in assets under management as at February – just seven months after its roll-out.

When it was first launched, Chocolate Finance promoted itself as aiming for better cash returns, offering a return of up to 4.2 per cent for the first S$20,000, just as rates on popular Treasury bills (T-bills) were dropping.

The platform’s latest rate is now 3.3 per cent for the first S$20,000, which is still higher than the T-bills’ rate. It targets a return of 3 per cent per annum on any amount thereafter.

Chocolate Finance remains committed to providing regular updates to its customers and will release a more comprehensive response soon, said a spokesperson.