2025 has not been a good year for Amazon.com’s (NASDAQ:) stock so far. The share price is down over 15% since January. Although the stock recovered slightly in recent weeks, that rebound has lost steam ahead of the company’s and the holiday season.

Investors are uncertain about several things—mainly how US sanctions, especially those targeting China, could affect Amazon’s business. With Donald Trump ramping up tariffs, trade tensions may create more challenges. It will likely take a few more quarters to get a clear sense of how Amazon is handling these changes, which could continue to shift quickly. Investors are also watching closely how much Amazon earns from its growing AI and advertising businesses.

Clash Between Donald Trump and Jeff Bezos

There was controversy at the White House after reports surfaced that Amazon planned to show how much of a product’s price was due to new tariffs. Donald Trump personally called Jeff Bezos, and the idea was eventually dropped. Still, the episode showed how sensitive the US administration is to criticism of its tariff policy.

As for Amazon’s upcoming results, investors will pay close attention to its cloud business, Amazon Web Services. It is expected to grow by around 18%, though that would be a slight slowdown from the previous quarter. Like other major tech companies, Amazon is investing heavily in data centers to support AI development. Spending on this could cross $100 billion this year.

Advertising is another key area. Amazon may feel pressure here soon, as smaller businesses facing higher costs and a weaker economy might cut back on ad spending.

Amazon’s Solid Financial Fundamentals

For today’s earnings report, analysts expect both earnings per share and revenue to show growth compared to the same quarter last year. The current market estimates are as follows:

Source: InvestingPro

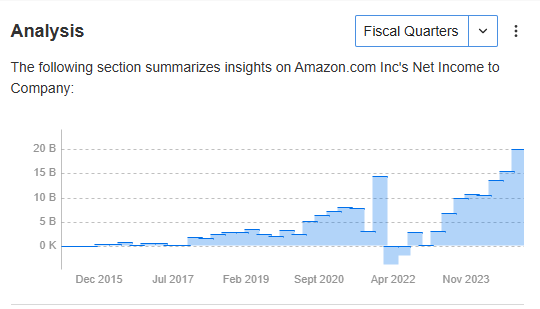

Investors will be closely watching to see if Amazon can continue its strong streak of rising net profits—a trend that has held steady since the post-Covid rebound at the end of 2022.

Source: InvestingPro

Overall, Amazon’s financial position remains strong. It holds a 4 out of 5 rating on the financial health index, and its cash flow compared to interest payments has been steadily improving.

On the stock chart, there is a positive signal as the price recently broke above a downward trend line and is now retesting it. For the stock to move higher, it will need to break through the $190 resistance level, which could set the stage for a move toward $205.

Source: InvestingPro

A drop below the $162 per share level would signal a return to the downtrend for Amazon’s stock.

Amazon’s results today will present both opportunities and risks. Whether you’re a novice investor or a seasoned trader, leveraging InvestingPro can help you navigate these dynamics and make more informed investment decisions.

Subscribe now and instantly unlock access to several market-beating features, including:

- ProPicks AI: AI-selected stock winners with proven track record.

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belongs to the investor. We also do not provide any investment advisory services.