discoverIE’s (LON:) FY25 results highlighted its ability to grow profits and earnings despite pressure on revenue. The adjusted operating margin increased 1.2pp to 14.3%, well ahead of the original 13.5% target for FY25, and adjusted EPS grew 5% y-o-y. This has prompted management to raise its adjusted operating margin target to 17% by FY30.

The customer destocking phase appears to be nearly complete; both divisions saw 15% y-o-y organic order growth in Q425, pointing to an inflection point for organic revenue in FY26. Strong cash generation reduced year-end gearing to 1.3x, providing headroom for further M&A.

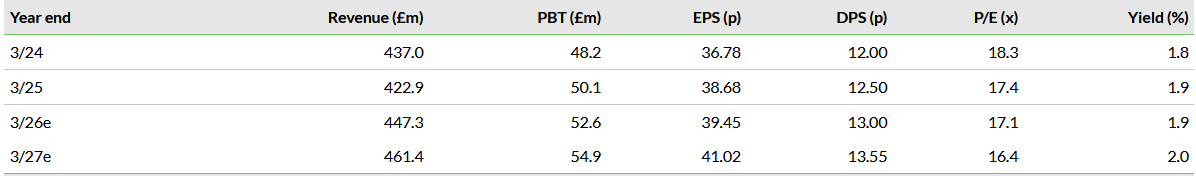

Note: PBT and diluted EPS as per discoverIE’s adjusted metric (excludes amortisation of acquired intangibles and exceptional items).

Profit Growth Despite Revenue Decline

For FY25, discoverIE reported a revenue decline of 3%, or 7% on an organic, constant exchange rate (CER) basis. Adjusted operating profit increased 6% with margin expansion to 14.3%. Strong cash generation reduced net debt by 9% y-o-y even after paying £28m for two acquisitions.

After a lengthy period of destocking, it appears that customers are starting to return to normal ordering patterns: organic order intake increased 2% for the year and 15% y-o-y in Q425.

Raising Margin Targets

Having easily exceeded the original 13.5% adjusted operating margin target for FY25 and now well on the way to the 15% target for FY28, the company has introduced a new 17% target for FY30. This is the tenth time the margin target has been raised in 15 years. It expects to achieve this through a combination of organic activity and M&A.

Management estimates that it has debt headroom of c £80m to fund higher-margin acquisitions. We raise our FY26 adjusted EPS forecast by 1% to reflect lower net interest expense and introduce a forecast for 4% EPS growth in FY27. While the tariff situation creates uncertainty on a market-wide basis, the company estimates that it should see limited direct impact and is able to offer flexibility to US customers in their choice of manufacturing locations.

Valuation: Confident Outlook Supports Upside

The stock has gained 24% since its mid-April trading update and now trades on P/E multiples of 17.1x in FY26e and 16.4x in FY27e. This continues to be at a discount to the wider UK industrial technology peer group and at a larger discount to peers with a similar decentralised operating model.

The upgraded margin target highlights management’s confidence in the business and the track record of profitable growth. With an active M&A pipeline and c £80m debt headroom, we expect further acquisitions to boost growth and earnings.

Review of FY25 Results

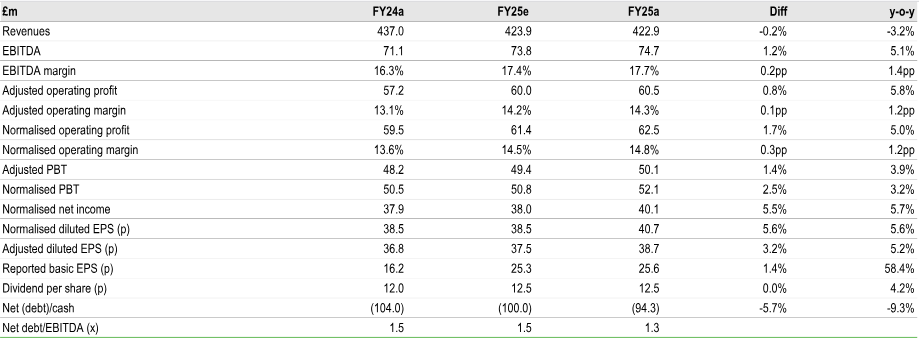

discoverIE reported revenue broadly in line with its April trading update. Revenue declined 3% y-o-y, 2% at CER and 7% on an organic, CER basis. Despite the revenue decline, adjusted operating profit increased 6% y-o-y, driving the adjusted operating margin up by 1.2pp to 14.3%, well ahead of the original 13.5% target for FY25.

Reported operating profit includes £16.2m amortisation of acquired intangibles, £3.1m for integration costs, £1.4m acquisition-related costs, a £0.5m credit from reducing the fair value of contingent consideration and a £2.1m gain on disposal of the Santon solar business. After net finance costs of £10.4m, adjusted PBT of £50.1m was 1% ahead of our forecast and 4% higher year-on-year.

The tax rate on reported PBT was 23.1%, benefiting from the use of tax losses. On an adjusted basis, the effective tax rate was 24.0%. This resulted in adjusted diluted EPS of 38.7p, up 5% y-o-y, up 8% CER and 3% ahead of our forecast.

The company announced a final dividend of 8.6p, in line with our forecast, resulting in a full year dividend of 12.5p, up 4% y-o-y. Net debt declined 9% y-o-y to £94.3m and was 6% lower than our forecast, with gearing of 1.3x at year-end.

During the year, the company paid a net £19.8m for acquisitions and disposals (paid £27.8m for the Hivolt and Burster acquisitions, received proceeds of £7.2m from the disposal of the Santon solar business, received £5.8m in deferred consideration from the disposal of Acal BFi, paid £3.2m in acquisition and integration expenses and paid £2.3m for earnouts).

Exhibit 1: FY25 Results Highlights

Source: discoverIE, Edison Investment Research

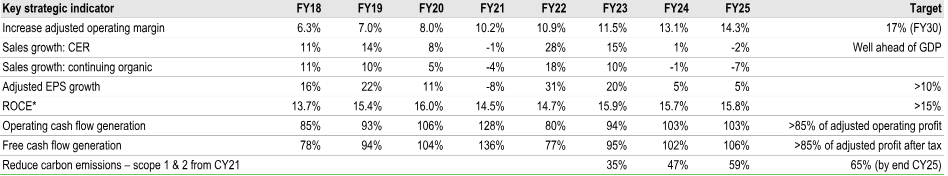

Key Strategic Indicators Show Positive Performance

The company provided an update on the seven key strategic indicators it tracks. The adjusted operating margin has grown consistently over the last 10 years and, since FY18, the company estimates that around half of the margin expansion came from organic activity with the remainder from M&A.

While organic sales have suffered from destocking over the last 18 months or so, this is line with the wider sector, and management expects that discoverIE will be able to grow ahead of GDP when customers return to normal ordering patterns.

Despite the lower revenue, the company achieved EPS growth of 5% in both FY24 and FY25. Return on capital employed (ROCE) remains above its 15% target and continues to be a balance of mature businesses operating at high ROCEs offset by newer acquisitions with lower ROCEs that should grow over time.

Operating and free cash flow generation are well above company targets, helped by lower working capital requirements during the period of weaker demand. As customer demand improves, we would expect working capital requirements to increase, although management expects to be able to maintain conversion above the target rates.

The reduction of Scope 1 and 2 emissions is on track to meet the company’s target of a 65% reduction by the end of CY25 (from a CY21 start point).

Exhibit 2: Key Strategic Indicators

Source: discoverIE. Note: *ROCE, return on capital employed.

Divisional Performance

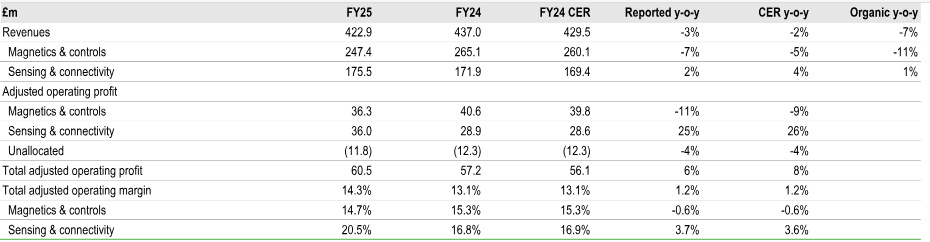

As we have previously written, the Magnetics & Controls (M&C) division has lagged the Sensing & Connectivity (S&C) division in terms of order intake and revenue (both on the up and downside).

Destocking by S&C customers was substantially complete by the end of H125, with orders for FY25 up 16% (18% CER) and up 12% on an organic CER basis, and orders in Q425 were up 15% y-o-y. The book-to-bill ratio increased to 1.01x for FY25. Revenue increased 2% (4% CER) or 1% on an organic CER basis.

On a half-yearly basis, organic CER revenue declined 5% in H125 and grew 6% in H225. Profitability improved significantly, with adjusted operating profit up 25% y-o-y and the margin up 3.7pp to 20.5%. Orders benefited from strong demand from industrial, security and medical applications, whereas sales reflected strong demand from industrial, connectivity and data security applications.

M&C saw a 1% CER increase in orders and a 4% decline on an organic basis (H1 -11% y-o-y, H2 +4% y-o-y). In Q425, orders returned to growth, up 15% y-o-y. The industrial and security sectors led the recovery in H2, while destocking continued in other sectors.

For the year, M&C revenue was down 7% on a reported basis, down 5% CER and down 11% on an organic CER basis. Book-to-bill for the year was 0.95x (H1: 0.91x, H2: 0.99x). Adjusted operating profit declined 11% y-o-y with the margin down 0.6pp to 14.7%.

Exhibit 3: Divisional Revenue and Adjusted Operating Profit

Source: discoverIE

Tariffs: Creating Uncertainty, but Limited Direct Impact

We have previously written about discoverIE’s exposure to US import tariffs. It expects to pass on incremental tariff costs but is also seeking to mitigate them by using local manufacturing where appropriate. As many countries are still negotiating trade deals with the US, it is too soon to have a definitive picture of individual country tariffs (and counter-tariffs), and this means that most customers are waiting to see the final outcome before making decisions on where to source their product.

Outlook and Changes to Forecasts

Raising Medium-Term Operating Margin

Management sees potential to deliver further manufacturing efficiencies and commercial synergies across the group and has upgraded its medium-term adjusted operating margin to 17% by FY30 (from 15% by FY28). It currently estimates that around a third of the margin increase will come from organic operations, with the remaining two-thirds from higher-margin acquisitions. At the current level of gearing, management estimates that it has debt headroom of c £80m for acquisitions, which could add c 15% to EBIT (based on an average EV/EBIT multiple of c 8x).

Order Book Has Normalised From Post-COVID Heights

At a group level, orders increased 6% y-o-y, 8% CER and 2% on an organic CER basis, resulting in a book-to-bill of 0.97x for the year. The order book was £161m at the end of FY25, down 8% y-o-y and equating to roughly 4.5 months of sales, down from seven months at the peak of inventory constraints. Management indicated that this was three to four weeks higher than pre-COVID, but could represent the new normal level for several reasons:

- Customers are carrying slightly higher levels of inventory, as just-in-time inventory management leaves no room for flexibility if there are supply chain issues.

- Some customers are placing 12-month frame orders, and

- Some customers are calling off their orders over a longer period of time.

During FY25, the company’s products were designed into projects with an estimated lifetime value of £355m, up 5% y-o-y and 30% compared to FY23. This provides the foundation for future growth; as the destocking phase comes to an end, we expect customers to start to place orders for the new design wins.

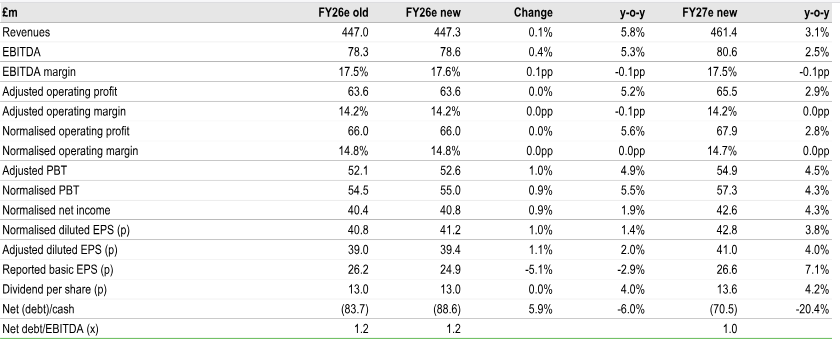

Changes to Forecasts

We have revised our estimates to reflect a slightly lower interest charge in FY26. We introduce estimates for FY27, which conservatively forecast revenue growth of 3% and adjusted diluted EPS growth of 4%.

Exhibit 4: Changes to Forecasts

Source: Edison Investment Research

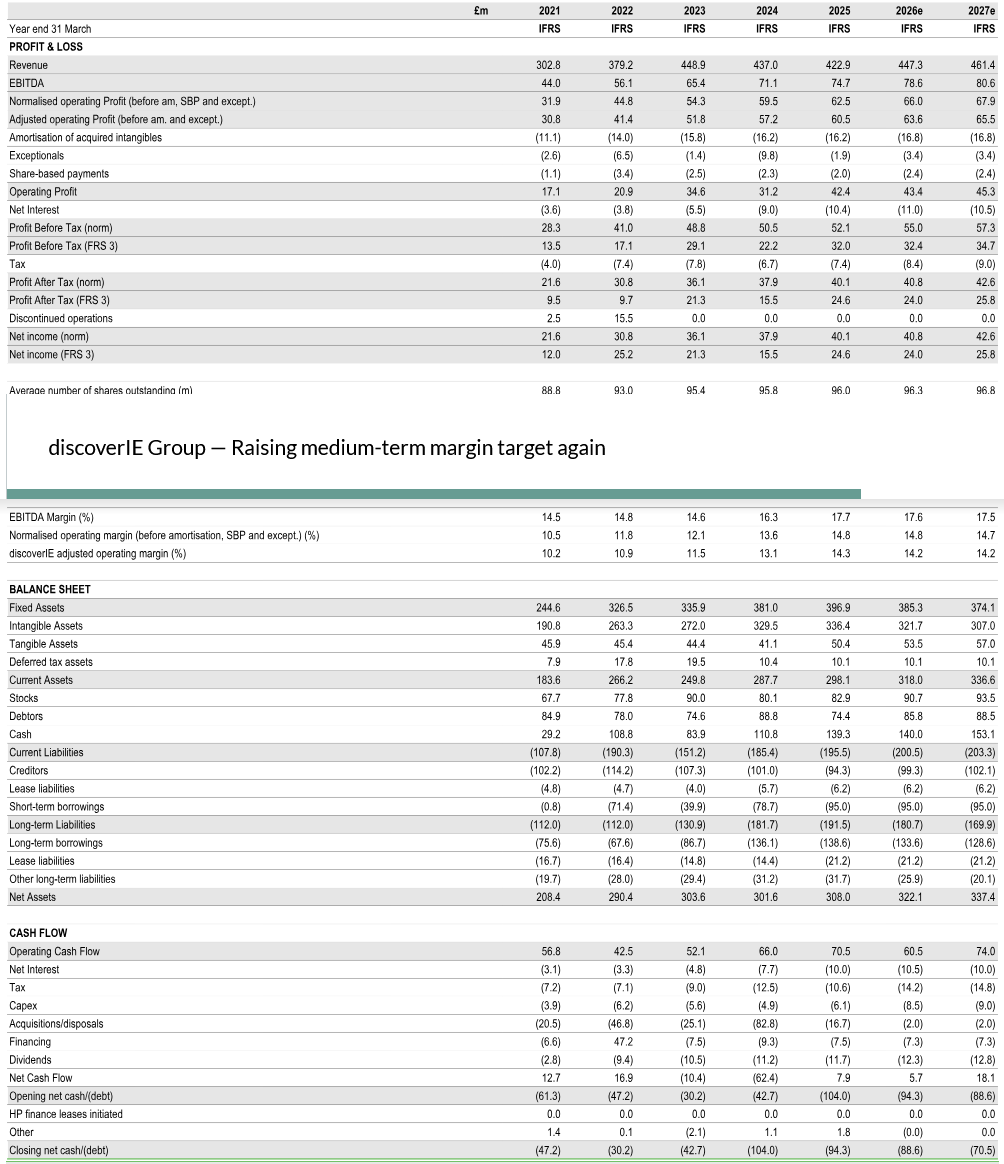

Exhibit 5: Financial Summary

Source: discoverIE, Edison Investment Research