Finsbury Growth & Income Trust (LON:) is managed by Nick Train and Madeline Wright at Lindsell Train. They are disappointed by the trust’s performance but have a high degree of confidence in FGT’s concentrated portfolio of high-quality UK-listed companies, which is biased towards ‘digital winners.’ These businesses sell software, services or data analytics to customers across the globe and trade at meaningful discounts to their international peers.

The two newest reported additions to FGT’s portfolio are Clarkson (shipbroking) and Intertek Group (LON:) (testing and assurance); they are both world-class businesses that happen to be listed in London. Clarkson and Intertek Group have outperformed the growth-focused US Index since 2000, but share price pullbacks over the last six to nine months provided attractive buying opportunities.

Why Consider FGT?

Train remains upbeat about the prospects for FGT’s portfolio companies and definitely has ‘skin in the game’; his recent purchase has taken his holding to c 5.6m shares, which is c 3.9% of the company and worth more than £50m. The manager cites legendary US investor Warren Buffett, who stated that a way to generate exceptional returns is from having a concentrated portfolio of exceptional businesses.

FGT’s highly concentrated portfolio has around 20 names, with the top 10 making up more than 90% of the fund. With a typically low turnover of around 5% per year, portfolio changes are rare; before the recent purchases of Clarkson and Intertek Group, the last additions to the fund were Rightmove (LON:) in September 2023 and Fevertree Drinks (LON:) and Experian (LON:) in early 2020.

FGT’s current 7.9% share price discount to cum-income NAV is wider than its historical averages (range of 2.1% to 7.8% over the last one, three, five and 10 years). This is likely due to an uncertain macroeconomic backdrop and the trust’s performance over the last few years.

However, it should be remembered that FGT has outperformed its benchmark by 3.4pp a year since Lindsell Train took over management of the trust in December 2000 until the end of 2024. Between 2001 and 2020 the trust outpaced the UK market in 16 out of 20 years. FGT has also performed well versus its peers over the long term, ranking second out of the 18 funds in the AIC UK Equity Income sector over the last decade. The trust is subject to a continuation vote at the January 2026 AGM.

FGT: Seeking A Return To Form From Its Concentrated UK Portfolio

The managers’ approach is to invest in high-quality, hard-to-replicate data assets or brands. These are companies with durable or market-leading franchises or data assets offering the potential for significant long-term returns.

Train says that US tariffs should not affect data providers Experian, RELX or the London Stock Exchange Group (LON:). These are subscription-based businesses, which along with Rightmove and Sage (LON:) and FGT’s holdings in two asset managers (Rathbones and Schroders (LON:)), which all provide services rather than products, make up around 70% of the portfolio.

Two consumer companies, Unilever (LON:) and Diageo (LON:), which are product-based, make up more than 20% of the portfolio. Unilever has only 10% of its revenues generated in the US, some of which is manufactured there, so should not be affected by tariffs. However, Diageo generates 50% of its profits in the US, including Mexican tequila and Canadian Whisky, which are world-class brands but may be subject to tariffs. FGT’s two newest holdings Clarkson and Intertek Group are both leading global players in services rather than manufacturing businesses.

H1 results

In the six months to the end of March 2025, FGT’s NAV and share price total returns of +2.1% and +4.2%, respectively, compared with the benchmark’s +4.1% total return. Performance dipped towards the end of the period on concerns about US tariff reforms, which were announced in early April 2025.

During H125, c 22.5m shares were repurchased (c 13.4% of the share base) at a cost of c £197.7m. An 8.8p per share interim dividend was declared, which was in line with H124.

Increased Focus On The Trust’s ‘Digital Winners’

While Train is very disappointed by FGT’s performance, evidenced by a current share price that is similar to the level in 2019, he rightly says that what happens going forward is the important thing. The manager likens the trust’s portfolio to a coiled spring, in which he surely has a high level of conviction given his substantial and increasing personal holding.

Train explains that, in recent years, there has been a material shift in FGT’s portfolio. Since 2019, London-listed ‘digital winners’ have increased from 40% to 62%. There has been a conscious reduction in exposure to consumer brands from 49% to 29%, although the manager stresses that he is happy with the remaining consumer companies in the portfolio. Non-UK listed companies made up 18% of the portfolio in 2019 and have now been sold (note that there is an overlap between consumer and non-UK listed stocks, so the 2019 numbers add up to more than 100%).

The portfolio is now 100% committed to the UK stock market, due to Train’s frustration about the prolonged period of it being overlooked by global investors, which has led to disappointing returns from UK shares; he notes that investors can buy world-class UK companies in London for a fraction of the valuation of similar businesses listed overseas.

The manager says that for FGT to outperform, because of their high concentration in the fund, the ‘digital winners’ need to outperform, and to provide some context, these companies represent just c 8% of the benchmark. The manager explains that because of changing technology, for example, the growth in AI, having proprietary information makes these companies’ data even more valuable.

Looking at some of the trust’s ‘digital winners’, Experian is a leading data and analytics company, with financial information on c 200m individuals, predominantly in the United States. None of its competitors have such a rich source of data. Clarkson generates more data per day about the $2tn global maritime industry than any other entity. RELX’s acquired LexisNexis business is one of the first in the world to demonstrate profitability from a large language model of professional data.

Train quotes FGT’s deputy manager who suggests that investors may be underestimating the acceleration in revenue and earnings growth for London-listed data and software companies as they roll out new products and services to their customers. London Stock Exchange Group’s Q125 revenues exceeded expectations, in part due to new products from its joint venture with Microsoft (NASDAQ:), while Rightmove’s revenue is accelerating helped by 250m client contacts every single day.

Train highlights that using the US Nasdaq Composite Index as a guide, digital businesses that experience accelerating revenue growth tend to be afforded a higher valuation. The manager hopes this is true for FGT’s holding in Sage. The stock is trading on 5x revenues, which is a lower valuation than those of its peers. In recent meetings with the company, Sage’s management team have said that the business may get to the rule of 40, whereby operating margins plus revenue growth equal 40% or more.

If this does happen, Sage deserves a higher valuation, opines Train. The manager says that Sage started to ‘get its act together’ in 2019 and since then has moved up the rankings of the UK’s top 100 index. If its current business momentum continues and Sage becomes one of the largest 10 UK companies, Train comments that there is significant further upside in this stock.

RELX has been in the portfolio for more than 20 years; in 2000, it was the 68th largest UK company, and it is now the fifth. There has been an acceleration in growth in its legal publishing division helped by AI. RELX’s scientific publishing business generates three times the profits of the legal division and AI adoption is much slower; hence, the manager wonders if RELX could end up being the largest company in the UK.

Current Portfolio Positioning

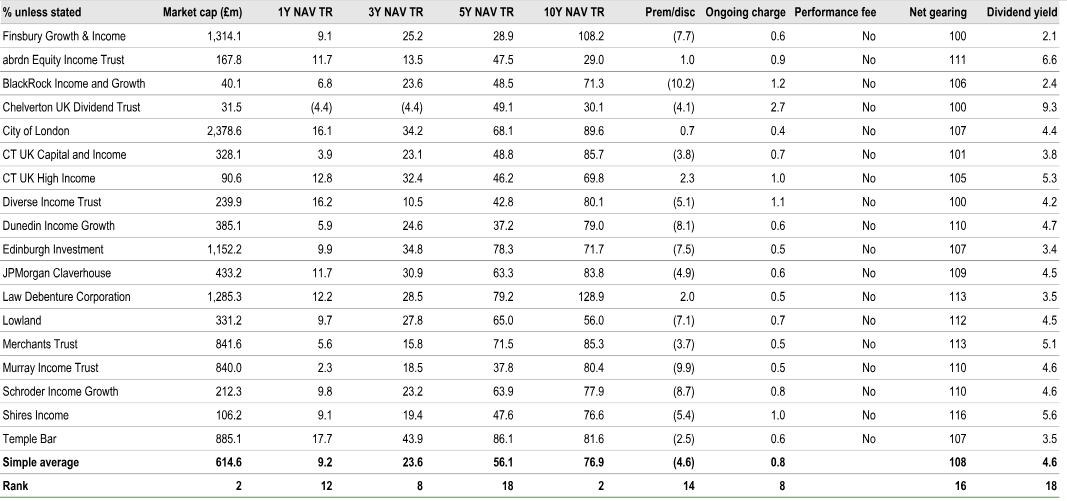

Top 10 Holdings

At the end of April 2025, FGT’s top 10 holdings made up 91.5% of the portfolio, which was a higher concentration compared with 85.1% 12 months earlier; eight positions were common to both periods. The two companies that featured in the trust’s top 10 list at the end of April 2024 were Mondelēz, which is a US-listed stock that exited the portfolio along with FGT’s other non-UK holdings, and Hargreaves Lansdown (LON:), which was sold to a private equity buyer in April 2025.

Exhibit 1: FGT’s Top 10 Holdings

Source: FGT, Edison Investment Research. Note: N/A not in April 2024 top 10.

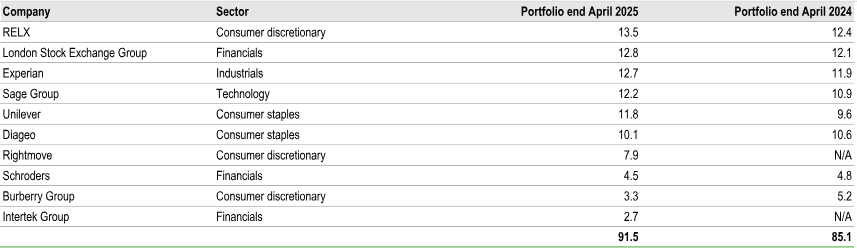

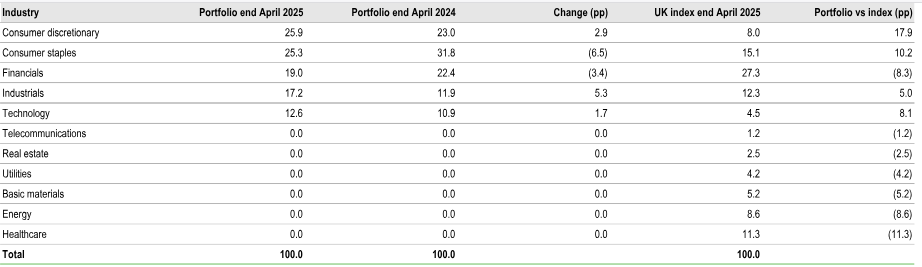

Sector Breakdown

FGT retains exposure to just five of the 11 market sectors, so has zero exposure to the other six, which at the end of April 2025 made up a third of the benchmark. Over the 12 months to the end of April, the largest changes were an increase in industrials (+5.3pp) as the managers are building up the Clarkson and Intertek Group positions, and a decrease in consumer staples (-6.5pp), which included the sale of the non-UK listed companies. Versus the benchmark, the trust’s largest active weights were in the consumer sectors, discretionary (+17.9pp) and staples (+10.2pp), and the lack of healthcare stocks (-11.3pp). FGT’s active share at the end of April 2025 was 83.7%; this is a measure of how a fund compares to an index, with 0% representing full index replication and 100% zero commonality.

Exhibit 2: Portfolio Sector Breakdown Versus Benchmark (% Unless Stated)

Source: FGT, Edison Investment Research. Note: Excludes cash.

Exhibit 3: FGT and Benchmark Sector Breakdowns at the End April 2025

Source: FGT, Edison Investment Research

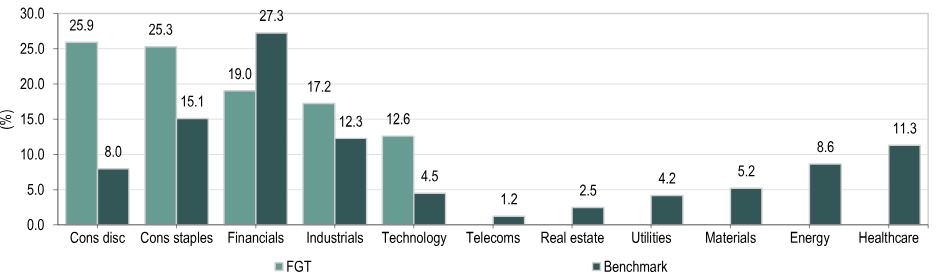

Performance: Favourable Long-term Record

FGT is one of the biggest funds within the relatively large AIC UK Equity Income sector. The trust retains its very strong long-term performance record, with its NAV total return ranking second out of 18 funds over the last decade, which is 31.3pp above the sector average. FGT has had broadly in line/above-average total returns over the last one and three years respectively, but underperformance versus the UK market since 2021 has negatively affected its five-year record, with the trust currently at the bottom of the sector rankings.

In terms of valuation, FGT’s discount is wider than the sector average, where four funds are trading at a small premium. The trust has a competitive ongoing charges ratio and no gearing. Unsurprisingly, given its growth focus, FGT has the lowest dividend yield in the sector.

Exhibit 4: AIC UK Equity Income Sector at 5 June 2025

Source: Morningstar, Edison Investment Research. Note: TR, total return. Performance at 5 June 2025.

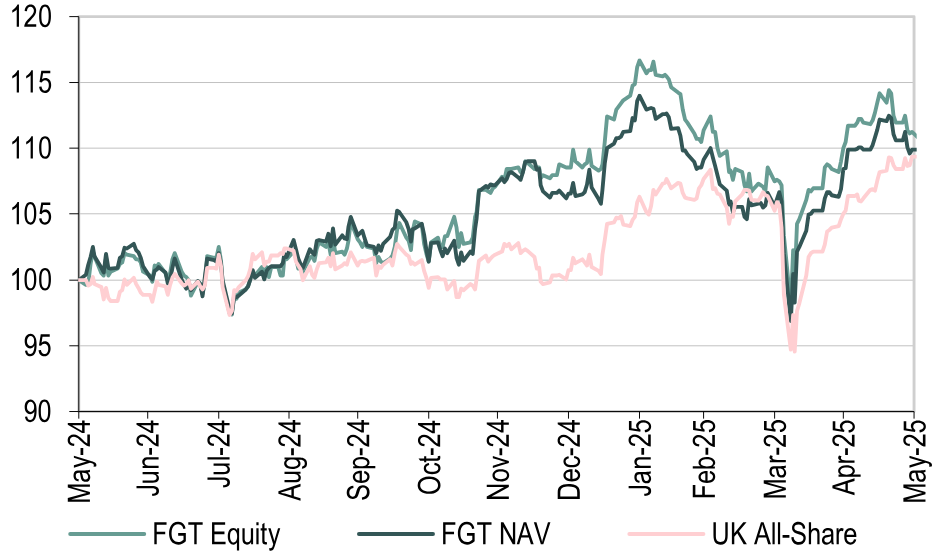

Exhibit 5: Performance to End May 2025 (One-year Rebased)

Source: LSEG Data & Analytics, Edison Investment Research

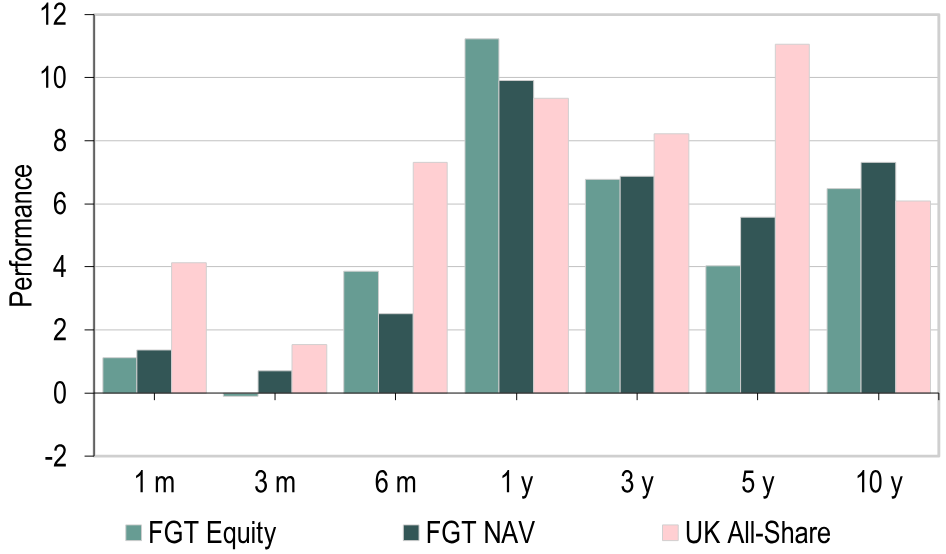

Exhibit 6: Price, NAV and Index Performance (%)

Source: LSEG Data & Analytics, Edison Investment Research. Note: Three-, five- and 10-year annualised.

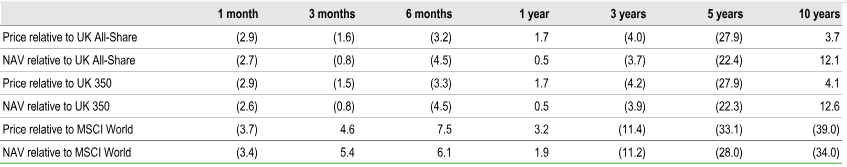

Exhibit 7: Share Price and NAV Total Return Performance, Relative to Indices (%)

Source: LSEG Data & Analytics, Edison Investment Research. Note: Data to end May 2025. Geometric calculation.

As shown in Exhibit 7, FGT’s relative performance remains volatile. Its NAV is ahead of the benchmark over the last decade and modestly so over the last year. However, the last six months have been difficult. Looking at the performance of the trust’s top 10 holdings in the year to date, shares that have performed well include Rightmove, which has rejected multiple takeover offers from Australian REA Group, and whose business remains strong helped by a robust housing market and a history of innovative new product introductions. Schroders has delivered good results including growth in its wealth management business. RELX’s revenue growth has been supported by its AI-supported products.

The standout detractor to FGT’s performance this year is Diageo; its stock has been in a downtrend since the end of 2021. The company is facing a range of headwinds including consumers trading down to cheaper brands and younger generations drinking less alcohol. There are economic pressures in some of the company’s important end markets and, as discussed earlier in the report, Diageo’s business is likely to be negatively affected by US tariffs.

Nevertheless, Train highlights the company’s portfolio of high-quality global brands and marketing acumen, such as its recent high-profile Guinness campaign, which led to a significant increase in demand for this beverage. The manager also notes that, despite Diageo’s share price weakness in recent years, it has still managed to outperform the Nasdaq Composite Index since 2000.

Exhibit 8: NAV Relative Performance Versus Benchmark (10 Years)

Source: LSEG Data & Analytics, Edison Investment Research

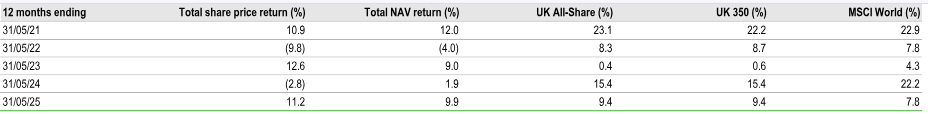

Exhibit 9: Five-year Discrete Performance Data

Source: LSEG Data & Analytics. Note: All % on a total return basis in pounds sterling.

Upside/Downside Analysis

FGT’s cumulative upside/downside capture rates over the last decade are shown below. The trust’s upside capture of 84% suggests that it will underperform by around 15% during periods when the UK market is rising. FGT’s defensive nature is illustrated by its downside capture rate of 71%, which indicates that FGT is likely to outperform by around 30% during periods of UK share price weakness.

Exhibit 10: FGT’s Upside/Downside Capture

Source: LSEG Data & Analytics, Edison Investment Research

Note: Cumulative upside/downside capture calculated as the geometric average NAV total return (TR) of the fund during months with positive/negative reference index TRs, divided by the geometric average reference index TR during these months. A 100% upside/downside indicates that the fund’s TR was in line with the reference index’s during months with positive/negative returns. Data points for the initial 12 months have been omitted in the chart due to the limited number of observations used to calculate the cumulative upside/downside capture ratios.