- Sterling is stuck between central bank drama and trade deal whispers.

- With Powell and Bailey taking the stage, GBP/USD could finally break free—or break down.

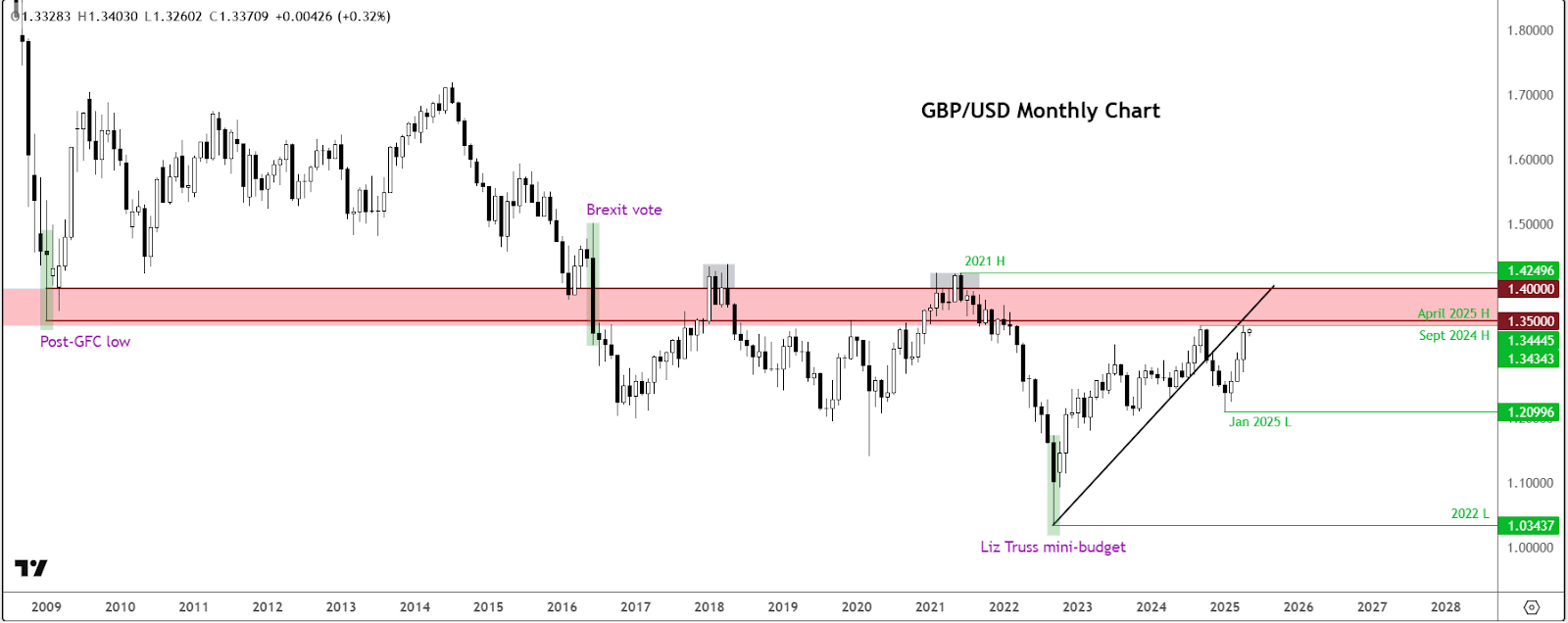

- All eyes are on 1.35: will cable crack resistance or retreat once again?

Sterling finds itself walking a financial tightrope this week. The is delicately poised between transatlantic central bank decisions and murky trade headlines. As the holds court across the pond and the gets ready to show its hand, traders are bracing for a possible divergence in tone—and in policy.

has taken a softer step into the week, retreating after two weeks of modest gains. But don’t be fooled: that weakness could easily reverse if the Trump administration’s trade negotiations result in new agreements. Officials suggest deals with partners beyond China might be inked by week’s end. Until then, the markets remain unimpressed. Friday’s US came and went with little fanfare, and Monday’s barely registered. So far, the macroeconomic data has taken a backseat to geopolitical posturing.

Trade Truce Could Revive the Dollar’s Fortunes

The dollar index has wobbled a little after a brief two-week recovery, helped by an unwind of previous “Sell America” trade. But the big question remains: will Washington and Beijing finally bury the hatchet? Equity markets are behaving as if they expect some form of resolution—however vague—but the greenback hasn’t followed suit. Fed independence is also under the microscope, with President Trump’s persistent rate-cut rhetoric raising eyebrows. The political fog isn’t helping matters. Yet, a trade breakthrough—particularly with China—could lend support to the dollar, shifting sentiment swiftly.

Sterling’s Fate Hinges on Central Bank Theatre

Two heavyweight monetary policy announcements are set to dominate fate for the pound to dollar exchange rate over the next 24 hours or so.

FOMC Rate Decision – Wednesday, 7 May, 19:00 BST

No surprises expected here. The Fed is widely tipped to hold rates steady at 4.25–4.50%. The real drama lies in the messaging. With political noise in the background, Powell may aim to exude calm and control. Markets will scour the statement for hints of June’s outlook.

Bank of England Rate Decision – Thursday, 8 May, 12:00 BST

Here’s where the action really lies for sterling. A 25bp cut is largely priced in, and a dovish 9-0 vote wouldn’t shock anyone. But traders will pay close attention to the inflation outlook—especially with energy prices softening. A slightly more optimistic growth revision could temper the dovishness. Any hint of hawkish resistance may offer the pound a temporary reprieve, perhaps even lifting GBP/USD to flirt with 1.3500.

Technical Outlook: Cable Bumps Up Against Familiar Ceiling

Technically speaking, GBP/USD is looking a bit overextended, though bears haven’t been vindicated just yet. Last week’s weekly chart printed an inverted hammer—a warning shot, perhaps, but without any firm follow-through so far.

The pair recently tested September’s high at 1.3434 before retreating. But more formidable resistance lurks between 1.35 and 1.40—a zone that’s proved impenetrable since the Brexit saga began. Unless bulls can muscle through this range, the path upward may remain blocked.

On the downside, keep an eye on 1.3200 for initial support, followed by the psychological barrier at 1.3000.

Final Word

It’s shaping up to be a pivotal week for cable. Trade chatter has failed to energise the dollar, while sterling stands on the edge, waiting for the ’s cue. With Powell and Bailey both stepping into the spotlight, and global trade deals waiting in the wings, this week could deliver the jolt that the GBP/USD has been waiting for. For now, a cautious stance on sterling feels justified—but everything’s in play, and sentiment may turn quickly.

***

Subscribe now and instantly unlock access to several market-beating features, including:

- ProPicks AI: AI-selected stock winners with a proven track record.

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.