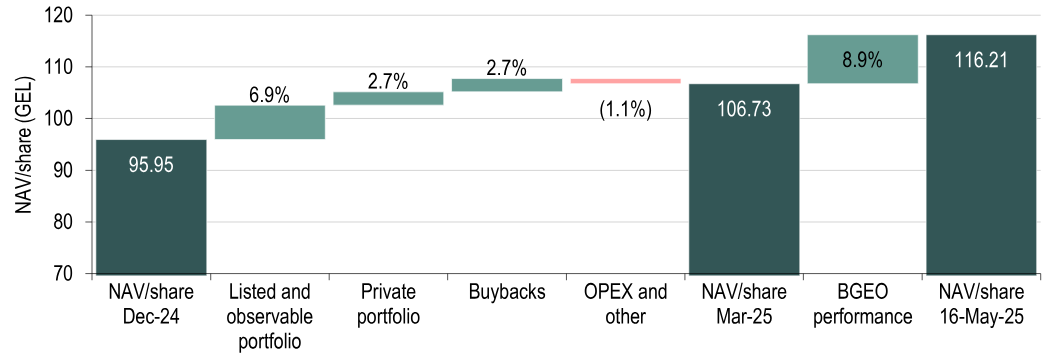

Georgia Capital (LON:) (GCAP) delivered a solid NAV total return of 11.2% in Q125 in local currency terms (9.8% in GBP), continuing its strong 15.1% growth per annum since end-2018. Q125 NAV growth was driven primarily by Lion Finance Group’s stock performance (BGEO, formerly Bank of Georgia), which contributed 6.9pp to NAV performance.

The strength of GCAP’s private portfolio continues to be reflected in robust earnings growth and sustained dividend flows. The group has reiterated its guidance to receive GEL180m in recurring dividends in 2025 (flat vs 2023 and 2024, which was sufficient to cover 169% of GCAP’s share buybacks over the last two years).

Given the persistent wide discount to NAV (currently 37% to end-March NAV), GCAP remains focused on accretive share repurchases, reinforcing its commitment to disciplined capital allocation.

Exhibit 1: GCAP’s NAV Per Share Development Since End-2024

Source: GCAP, Edison Investment Research

Georgia’s Economy Remains Strong

Georgia’s economy continues to exhibit strong momentum, with Q125 GDP growth reaching 9.3%, following 9.4% for the full year 2024. While the International Monetary Fund projects a moderation to 6.0% growth for 2025, this still reflects a healthy expansion. Unemployment has fallen to a record low of 15.2%, and the country benefits from resilient fx inflows, supported by robust tourism receipts and sustained remittances since Russia’s invasion of Ukraine in 2022.

The combination of solid macroeconomic fundamentals and a gradually stabilising political environment is enhancing investor confidence, as evidenced by GCAP’s recent and well-executed exit from its beer business (see our December 2024 note for details).

Why Consider GCAP Now?

GCAP offers investors diversified exposure to Georgia’s fast-growing economy through its portfolio of market-leading businesses across key sectors including healthcare, pharmacy, financial services, renewable energy and education. For investors seeking to capitalise on the country’s solid macroeconomic fundamentals and GCAP’s strategic positioning within core domestic industries, the shares may present an attractive entry point.

The current 37% discount to NAV suggests the private portfolio is effectively being valued at just 28% of its estimated fair value, highlighting a significant disconnect between intrinsic value and market perception.

NOT INTENDED FOR PERSONS IN THE EEA

Strong Q125 Of GCAP’s Portfolio Companies

The key contributor to Georgia Capital’s (GCAP) 11.2% NAV growth in Q125 was its strategic holding in Lion Finance Group (BGEO), listed on the London Stock Exchange (LON:). BGEO delivered a share price total return of 16% in GBP terms during the quarter, adding 6.9pp to GCAP’s NAV performance in GEL.

The positive momentum has continued beyond the quarter, with BGEO shares rising a further 17% (GBP TR) between end-March and 16 May 2025, implying 8.9% growth in GCAP’s pro forma NAV in GEL (see GCAP’s ‘live’ NAV estimate).

As a result of BGEO’s performance, its share in GCAP’s portfolio increased to 41% at end-March, up from 38% at end-December 2024. This performance was underpinned by BGEO’s strong FY24 results, including a 31.9% y-o-y rise in adjusted net profit to GEL1.8bn, a robust 30% adjusted return on average equity and 66% y-o-y loan book growth driven in part by its acquisition in Armenia, alongside a 19% increase in the Georgian portfolio.

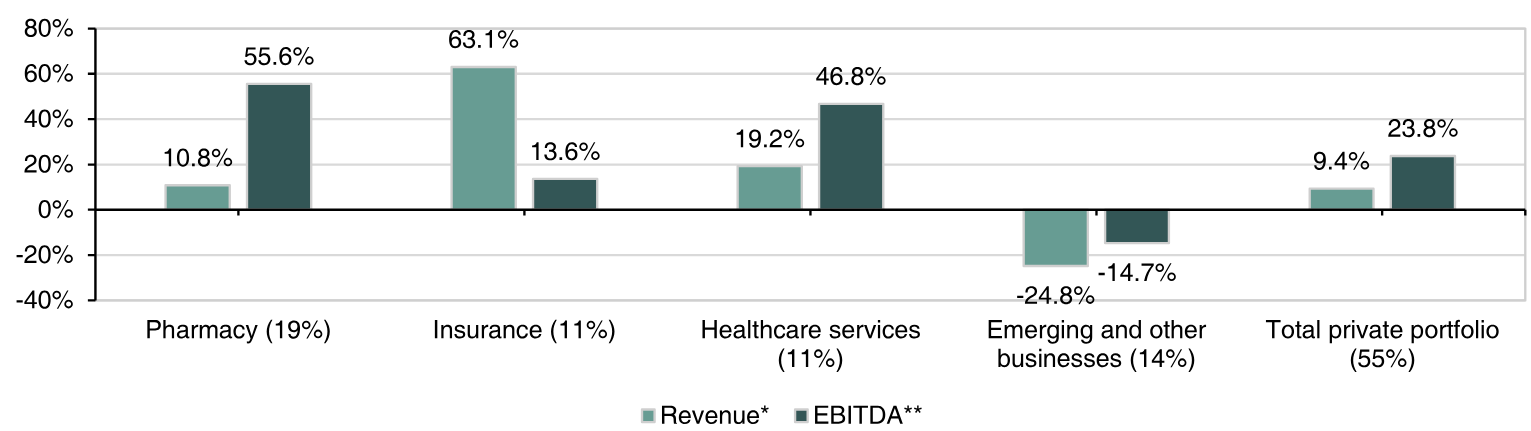

GCAP’s private portfolio continued to deliver robust operational performance, with trailing 12-month (LTM) revenue and EBITDA growth of 9% and 30% y-o-y, respectively.

This was driven by strong contributions from large portfolio companies (namely pharmacy, insurance and healthcare services), which recorded 16% revenue growth and a 34% increase in EBITDA over the same period. In Q125, aggregate revenue and EBITDA rose by 9% and 24% y-o-y, respectively, with the large portfolio companies again outperforming, delivering 21% revenue and 46% EBITDA growth.

Exhibit 2: GCAP’s Private Portfolio Companies’ Operational Results (Q125 Y-O-Y % Change)

Source: GCAP, Edison Investment Research.

Large portfolio companies were also the main source of value creation in Q125, generating GEL129m of value uplift, partially offset by a GEL28m decline from emerging and other businesses (renewable energy, education, auto service, wine, housing, and hospitality). Notably, over half of this uplift (GEL66m) stemmed from the pharmacy business, which remains a key growth engine.

In Q125, the pharmacy segment achieved 11% y-o-y revenue growth, supported by strong wholesale sales linked to state healthcare programmes and a 2.8% increase in same-store sales across its 435-store network spanning Georgia, Armenia, and Azerbaijan. EBITDA surged by 56% y-o-y, reflecting favourable renegotiation of trading terms with suppliers and a rising share of higher-margin beauty products in the sales mix, which remains a key strategic target of the business.

GCAP Continues Its Share Buyback

GCAP continues to prioritise share buybacks over new investments, as the current 37% discount to NAV presents a more compelling internal rate of return than any currently available new deployment opportunities. In May 2024, GCAP committed to allocating at least GEL300m to buybacks and dividends by the end of 2026.

To date, GEL221m ($80m) has been deployed, leaving GEL79m ($29m) available for further capital returns. GCAP finances its share buybacks mostly from dividend income from portfolio companies. The cash inflow can also be supported by the realisation of the put option in its remaining stake in the water utility business, currently valued at GEL188m.

While the current discount is narrower than the five-year average of 54%, we still consider it wide, especially if, for analytical purposes, we exclude GCAP’s listed and observable holdings (BGEO stock and water utility option) from both NAV and market capitalisation. The implied discount on the remaining private portfolio rises to approximately 72%.

These underlying valuations are independently provided by Kroll on a semi-annual basis (covering 93% of the private portfolio), with quarterly adjustments made solely to reflect portfolio company performance, without changes to valuation assumptions. It is worth noting that the recent disposal of beer and distribution business was completed at a c 30% uplift to carrying value, reinforcing our confidence in GCAP’s valuation of its private portfolio.