Asian equities have outperformed the US and global markets this year and the manager of Henderson Far East Income (LON:) (HFEL), Sat Duhra, expects this outperformance to continue, underpinned by a number of structural growth trends, such as the drive to enhance shareholder returns via increased dividend payments.

Other supportive themes include financial inclusion and investment in technology and infrastructure. Since our last note, Duhra has continued its efforts to raise exposure to these structural growth opportunities, while still protecting income. These efforts, combined with an improvement in the performance of value stocks, have already improved performance in outright terms.

The trust also looks set to deliver an 18th successive year of dividend growth in FY25 (ending 31 August 2025) (Exhibit 1). Duhra believes the trust is well positioned to grasp further opportunities to invest in structural growth, at attractive valuations, as they arise, and to reap the performance benefit of such exposure, including rising dividend payouts, over the remainder of 2025 and well beyond.

Exhibit 1: Dividend History Since FY17

Source: Bloomberg, Edison Investment Research. Note: FY25’s estimated dividend is based on three interim dividend payments and the assumption that the fourth interim dividend payment will follow the pattern of previous years by matching the size of the third.

The Analyst’s View

We share the manager’s view that Asia’s structural growth prospects are compelling and likely to be a major driver of regional equity markets over the medium term. Investors are likely to appreciate the fact that HFEL’s portfolio now has greater exposure to these themes.

HFEL arguably has a unique exposure to structural growth, to the extent that only one of its top 10 holdings (TSMC) overlaps with those of its peers. HFEL’s offering is further differentiated by its focus on income and value, a style that appears to be coming back into its own across the region.

The trust’s prospective FY25 dividend yield of 10.8% (based on the current share price) is very competitive, creating demand for its shares, although the board limits HFEL’s share price premium via regular share issuance.

Investors seeking a high and growing income will be attracted by HFEL’s ongoing commitment to high and rising annual dividends and by the manager’s savvy use of options to support this commitment, while also providing exposure to exciting structural trends.

Ongoing Repositioning Towards Structural Growth

Market Developments Have Been Supportive Of Value Stocks

HFEL’s manager, Sat Duhra, reports that ‘interesting things’ have been happening recently in Asian equity markets. He says that ‘value has started working in Asia and this has been good for the trust, as it is more value-focused than its peers and the index.’ Duhra cites three developments in particular:

In South Korea, the government’s ‘value-up’ programme, which is designed to raise dividends and share buybacks, is having an increasingly favourable impact on investor returns. In addition, the recent appointment of a new president has calmed investor jitters after the former president’s declaration of martial law late last year and his subsequent arrest and impeachment. Together, these two developments have seen the market surge, with high-yield names doing especially well.

In Hong Kong, which is already a good market for income, key market interest rates have fallen very sharply in recent months, from 4.0% to 1.5%, due to excess liquidity and strong capital inflows. This sparked strong performances from Hong Kong’s high-yield stocks, including HFEL’s holdings of two telecommunications and two property names.

In China, economic and market conditions are clearly improving, thanks to a number of factors. Firstly, a series of government stimulus measures implemented during 2024 and H125 are having a positive effect on consumer and investor confidence and domestic consumption. Investor sentiment has been further buoyed by the launch of DeepSeek, a developer of unexpectedly advanced and cost-effective open-source AI tools, which rival those of Western competitors.

This is a very positive development for Chinese tech stocks, such as Alibaba (NYSE:), Tencent (HK:), Xiaomi (HK:) Corp, Meituan and JD.com, as it will accelerate their development of low-cost, AI-powered marketing strategies. This enhanced AI capability is also likely to boost productivity and generate cost savings across the broader economy over time. In addition, Chinese regulators are encouraging domestic investors, including large insurance companies and fund managers, to buy the domestic market, while also pressing companies to improve shareholder returns via higher dividend payments and share buybacks.

This has underpinned strong performances by China’s high-yielding state-owned enterprise (SOE) stocks.

China’s more stable macroeconomic environment, in concert with rapid technological developments, improving shareholder returns, and some recent de-escalation of Sino-US trade tensions, has supported more positive sentiment towards the whole Asia-Pacific region. This has resulted in the outperformance of Asian equities relative to US and global markets so far this year.

HFEL Is Adding Exposure To Structural Growth…

This has provided a very supportive investment environment for HFEL’s manager and, over the six months or so since our last note, he has continued to position the portfolio more towards structural growth opportunities in an effort to improve total returns by delivering better capital growth.

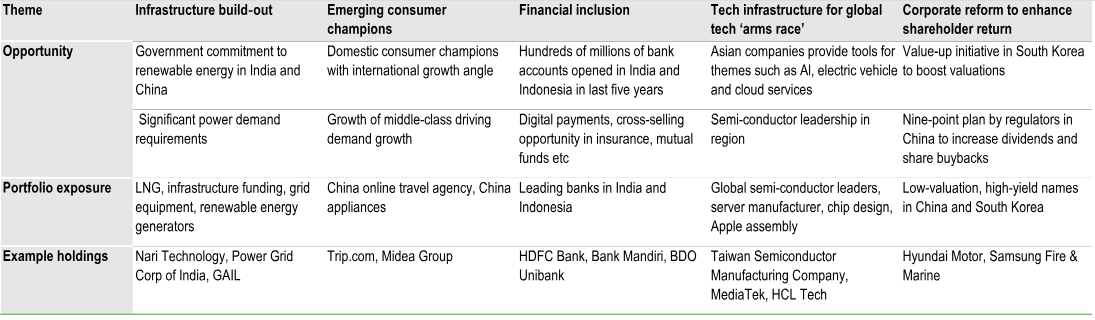

Exhibit 2 shows five key themes Duhra sees as drivers of regional structural growth over the medium term. It also shows the investment opportunities these themes are generating across a broad range of sectors and the portfolio holdings that provide exposure to these opportunities.

In the manager’s view, these themes are increasingly compelling, thanks to the arrival of DeepSeek and ongoing government efforts to raise infrastructure investment and improve shareholder returns, and he has been adding exposure to them all, in China, Hong Kong, India, Indonesia and other markets (see the portfolio positioning section below). Approximately 80% of the portfolio is now invested in these five themes.

Exhibit 2: Positioned for Structural Growth Opportunities

Source: Janus Henderson Investors. Note: As at 31 December 2024.

…but Still Maintaining Its Income Focus and Value Style

Duhra stresses that this reallocation in favour of structural growth themes is not adversely affecting HFEL’s commitment to annual dividend growth or its value style. Exhibit 3 illustrates that HFEL comprises names that are more attractively priced than the market, and that nonetheless deliver earnings and dividend growth exceeding the market.

The manager achieves this by seeking out well-priced, value names offering performance, strong cash flows, and yield, or the prospect of future dividend growth. By focusing on future dividend growth, as well as current yield, the manager is effectively capturing future earnings growth earlier in a company’s growth cycle and buying into this performance at better valuations than if he waited for rising dividend payouts to materialise.

The manager has bought some stocks that are attractive because of their growth outlook and valuations, but do not offer much yield, but he is redressing this lack of income by using call option writing as a means of boosting total portfolio revenues and ensuring the trust continues to meet its income objective (see the dividend section below for further discussion).

Exhibit 3: Maintaining Value Style With Dividends and Earnings Growth

Source: Janus Henderson Investors.

Note: As at 30 April 2025. *Uses net book value. **Uses forecast earnings for next year, with earnings defined as net income after tax. ***Year-on-year growth in HFEL dividend. ****Based on net income divided by available shares.

Performance is improving in outright terms

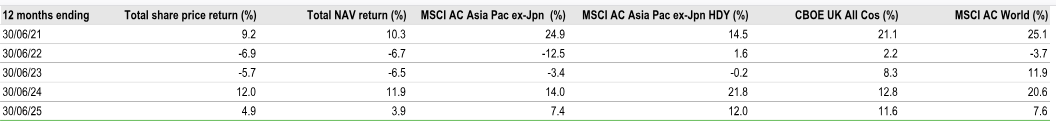

Exhibit 4: Five-Year Discrete Performance Data

Source: LSEG Data & Analytics. Note: All % on a total return basis in pounds sterling.

The manager’s increasing focus on structural growth opportunities is leading to better performance and higher dividends. In the 12 months ended June 2025, the trust made outright gains in both NAV and share price terms. Returns were also positive in the previous 12 months. This compares with the two previous years when returns were negative on both bases (Exhibit 4).

HFEL’s recent returns have been supported by the good performance of high-yielding banks across the region, which have benefited from persistently high interest rates, and from their efforts to increase dividends and share buybacks. Notable financial names that contributed to the trust’s performance include HSBC (LON:), China CITIC Bank International, China Construction Bank, Oversea-Chinese Banking Corporation (OCBC) and United Overseas Bank Singapore.

The portfolio’s e-commerce businesses Meituan, a Chinese food delivery company, and Sea, a Singaporean player with operations across South Asia, also did well following the arrival of DeepSeek. Meituan has subsequently been sold (see discussion below).

Conversely, its exposure to Indian infrastructure names, such as utility companies Power Grid Corporation of India, GAIL, NTPC (NSE:) and Bharat Petroleum (NSE:) Corporation, was a key detractor as these stocks came under pressure from tighter credit conditions and doubts about the Indian government’s commitment to infrastructure development.

The manager has since sold both NTPC and Bharat Petroleum Corporation.

HFEL’s performance over the past year has lagged the market, as measured by the ex Japan Index, which we use as a market proxy for comparative purposes. This is due mainly to its underweight to Chinese tech shares, which the manager has avoided as they do not tend to pay attractive dividends. These names outperformed following news of DeepSeek’s AI offerings.

Click on this link to read the full report