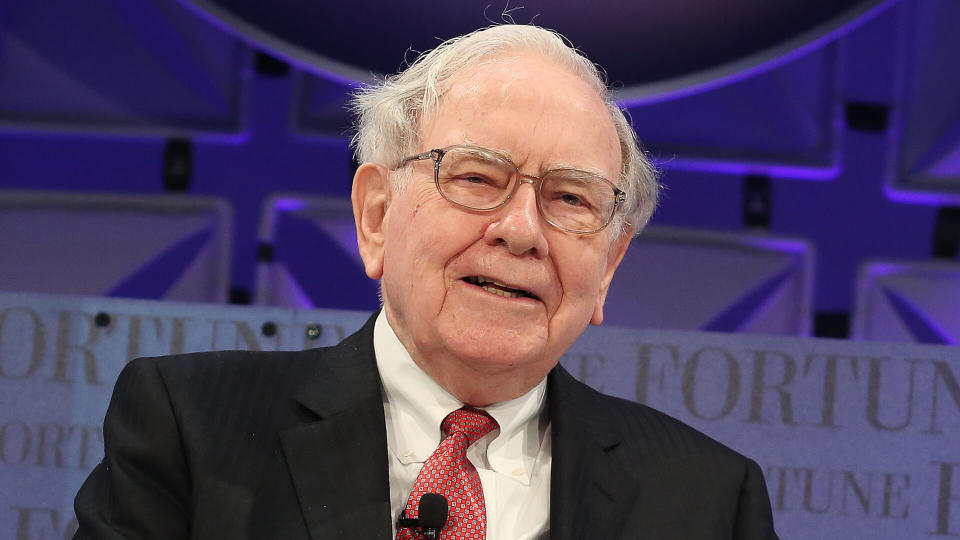

Warren Buffett, the Oracle of Omaha, famously began investing at the tender age of 11, purchasing his first stock shares well before most kids even understand the concept of the stock market. This early start helped lay the foundation for Buffett’s incredible wealth, which reached over $100 billion at its peak.

Find Out: In 5 Years, These 2 Stocks Will Be More Valuable Than Apple

Learn More: 4 Genius Things All Wealthy People Do With Their Money

While few achieve Buffett’s level of financial prowess, the experts below illustrate how starting your investing journey early can put you on the path to prosperity. Here’s what they did as kid investors.

Wealthy people know the best money secrets. Learn how to copy them.

Forced To Invest at a Young Age Paid Off

Jonathan Geserick of Texas Probate Pros was essentially required to be a kid investor by his forward-thinking parents.

“My parents forced me to open an IRA and deposit 20% of everything I earned from mowing lawns from the time I was 10 years old,” he said. “I can’t say that I got rich off that, but it gave me a firm foundation. And I learned how to read stock quotes in the newspaper – even though I was just investing in an S&P 500 fund. It also made me interested in learning more about personal finance.”

While being made to save and invest as a 10-year-old may seem extreme, Geserick’s mandatory foray into finances clearly benefited his money mindset.

Explore More: I’m a Self-Made Millionaire: 5 Stocks You Shouldn’t Sell

Building Financial Literacy Early

Geserick’s investing hobby as a child morphed into a lifelong appreciation for personal finance education. He continued: “As a child, I read every book about personal finance I could get my hands on. My favorite was ‘The Wealthy Barber.’ There were a few others like ‘The Millionaire Mind’ and ‘Rich Dad Poor Dad.’ I didn’t end up becoming any sort of investing guru, but it did start me down the path of understanding the power of investing and the importance of starting early.”

Getting an early jump on financial literacy is invaluable, helping build crucial money management skills from a young age.

Consistent Investing Leads To Financial Independence

For Geserick, those early investing habits compounded into a prosperous future.

He explained: “I carried on those habits and invested 20% or more from every job I’ve had since in 401(k)s. By doing that, I became financially independent by the time I was 45. At that point, I quit my day job and started my own business called Texas Probate Pros, a full service wills, estate planning, and probate law firm.”

Geserick’s story is all about investing consistently. When you do it year after year, even in modest amounts, you can ultimately fund your dreams of entrepreneurship or early retirement.

Comic Book Collecting: A Fun Way To Invest as a Family

For those looking to make investing collaborative and fun for the whole family, Vincent Zurzolo, co-owner at Metropolis Collectibles, recommended comic book collecting. He started this unique investing method as a kid himself.

“Parents can spend as much or as little time and money as they want – but, regardless, their kids will build some valuable real-world skills. And at the end of the day, they may have made some great investments that will increase in value over time and even augment their college funds,” he said.

Benefits of Comic Book Collecting for Families

Zurzolo elaborated on why comic investing can be an ideal family project.

“Unlike many family activities, comic collecting can be done completely from home,” he said. “While brick-and-mortar comic book stores still exist, the majority of collectible comics are sold and auctioned online. Because reputable dealers only sell comics that have been graded by a third-party service – most often Certified Guaranty Company (CGC) – parents can trust in the authenticity of their purchases.

He added that comic book collecting “can help kids build goal-setting, money-management and research skills, as parents and kids learn the market, collaborate on what to collect – and hunt together for the best finds.”

So whether going the traditional investment route like Buffett or getting creative with alternative assets, cultivating investing abilities from an early age can pay lifelong dividends. These experts’ stories prove that kid investors today could become the wealth-building success stories of tomorrow.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: I Started Investing as a Kid Like Warren Buffett — Here’s What I Did