Smiths News’ (LON:) PBT increased by 11% in H125, a combination of higher profits and lower financing costs as both debt and debt margins declined. However, in addition to this and perhaps more exciting is confirmation that Smiths has appointed a managing director for its recycling operations from within the industry, a clear endorsement of the potential in this area.

Furthermore, its new activities are already gathering momentum, which is mitigating the structural decline of the news and magazine activity and, we believe, has the potential to result in long-term profit growth. This in turn underpins cash generation and dividends, and could see further distributions. We have maintained our operating profit forecasts and valuation of 93p/share, but reduced our FY25 net debt estimate.

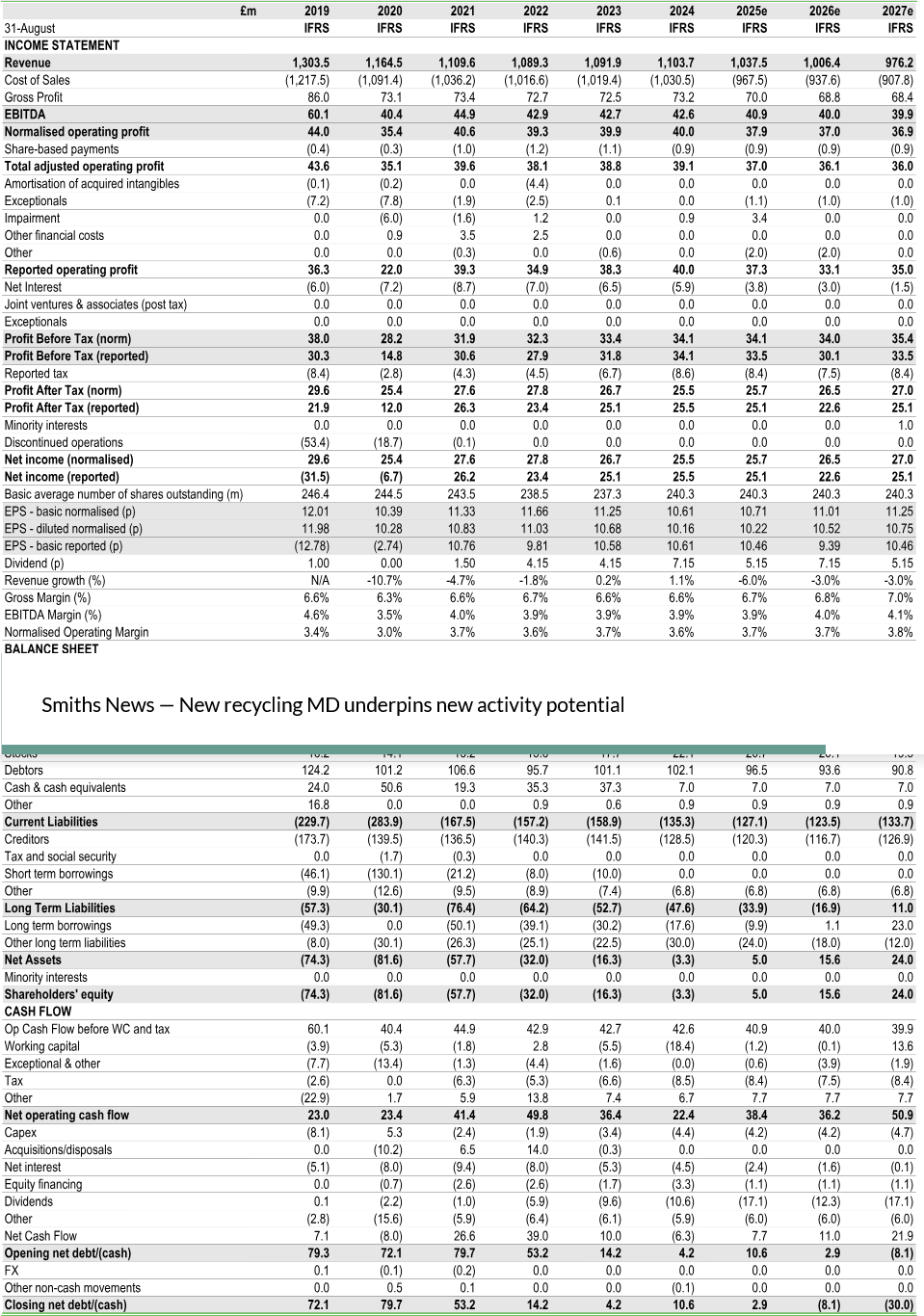

Note: PBT and EPS are on a company adjusted basis.

Early Morning Supply Chain Potential ‘Underestimated’

Smiths News Recycle is gaining momentum and, to this end, and as a solid endorsement of the potential of the new business stream, Smiths has recruited a new managing director (MD) for recycling to drive the business forward.

This is a significant move, as we understand that the as-yet unnamed MD joins from a leading waste recycling company and is therefore convinced by the Smiths News story and its potential to take share from existing traditional waste handling companies. Other non-core verticals are being trialled which may offer exciting opportunities to further diversify away from the core news and magazine markets.

H125 Growth and Strong Dividend-Paying Potential

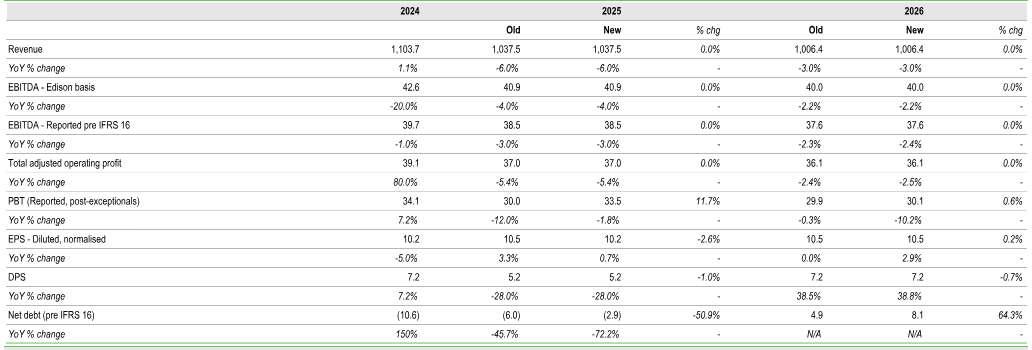

A modest decline in news and magazine revenue was offset by growth from contract wins, collectables and non-core growth initiatives. This resulted in a modest decline in group revenue which, when cost savings were included, resulted in c 3% operating profit growth. Lower finance costs led to 11% growth in H1 PBT. Smiths remains very cash generative. We therefore forecast that, in the absence of additional investment or M&A activity, it may pay another 2p ‘special’ in FY26 which, given the rapid decline in net debt, seems likely.

Valuation: P/E C 5x and 9% Yield

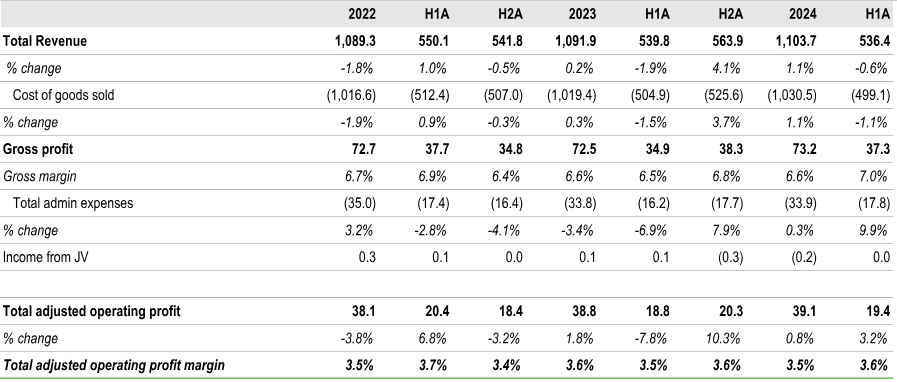

Our underlying revenue and operating profit estimates are unchanged, but we anticipate a better cash performance, hence we have reduced FY25 net debt expectations from £6.0m to £2.9m. Our discounted cash flow (DCF) valuation remains 93p/share, representing c 60% upside. Smiths trades on a P/E of 5.2x in FY25e, which we believe is attractive for a company with such cash-generative characteristics. Its twice-covered ordinary dividend yields 9.0%, with ‘special’ dividend potential on top.

New Business Streams Offer Upside Potential

Smiths’ new business streams appear to be going well and, in support of this progress, the company has appointed an industry expert as its new MD of Smiths News Recycle, which we believe is a solid endorsement of the business’s substantial potential.

Several trials of other new verticals are underway, which, if successful, could more than offset the anticipated declines in contribution from the news and magazine business, implying growth. In addition, the balance sheet is now almost completely ungeared, offering investors substantial dividend potential.

Expansion of New Business Streams With Multiple Trials

Smiths News Recycle is gaining momentum and, to this end, and as a solid endorsement of the potential of the new business stream, Smiths has recruited a new MD of the division to drive the business forward. This is a significant move because we understand that the as-yet unnamed MD joins from a leading waste recycling company and believes in the Smiths News story, as well as its potential to take share from existing traditional waste handling companies.

In H1, Smiths grew the uptake of recycling from its existing news and magazine network of clients by 5%, and the new MD will be tasked with the continued roll-out of recycling to existing daily clients along its 900 routes, as well as the expansion to non-clients for which a small scale trial has been initiated in Liverpool and Stoke. These non-news and non-magazine clients are likely to be those shops and organisations that are located adjacent to existing clients.

These clients could include bakeries, betting shops and fast-food outlets that produce material amounts of dry mix recyclate (DMR). At many news and magazine delivery locations, there could be multiple opportunities to offer DMR services at a lower cost than via existing service providers.

CIL Management Consultants believes the market could be worth c £230m, growing at 3–5% pa and offering a 10–15% EBITDA margin. Smiths generated an operating profit of c £2.0m in FY24 from non-news and magazine services so if it took, say, a 10% share of this non-news and magazine market, the profit stream could potentially be more than doubled, ie £230m x a 10% market share (£23m), with a 10% margin implies a profit of c £2.3m.

A second area of potential growth outside recycling is in the delivery of additional categories, such as books and home entertainment, to other retail customers, including supermarkets and other grocers. Smiths has started a second trial with Hallmark, the global greetings card expert, which included cards in pre-prepared stands and spinners. Management says that early indications from the trial suggest it has started well, and that success and progress will be reviewed in H225.

A third trial has also been conducted around the delivery of engineering and manufacturing specialist parts to customers along routes. An example is the delivery of spare parts for white goods to drop-off points for collection by engineers en route to domestic customers. Smiths would not deliver to domestic locations as this is outside its remit, potentially affecting core service quality.

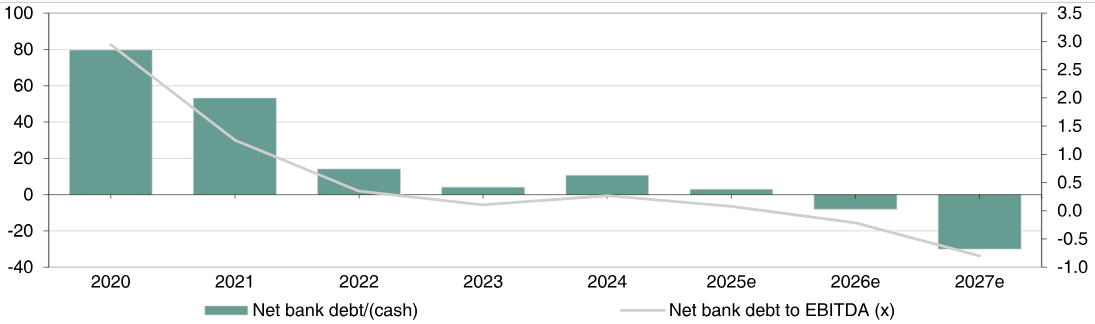

H125 PBT Rose by 11%

H125 results were robust, with revenue declining marginally to £536.4m (down 0.6% vs H124) and underlying news and magazine revenue slipping by just 3.1%, offset by the annualisation of previous contract wins (+1.6%), growth in collectables of 4.3% and 25% growth in the non-core early morning supply chain initiatives.

Smiths News continues to focus on operational efficiencies and was able to generate savings in the period of £3.0m (H124: £3.1m) which, along with the growth mentioned above, led to an increase in adjusted operating profit of 3.2% to £19.4m. This implies that the adjusted operating margin edged up to 3.6%.

Further down the income statement, finance charges fell from £2.9m to £1.7m as both average net debt and debt margins were more favourable, which contributed to an 11% increase in PBT and a 10% increase in EPS to 5.4p. The dividend was unchanged at 1.75p.

Free cash flow amounted to £13.3m (H124: £4.2m) and was particularly strong due to higher operating profit (£1.2m), a smaller working capital outflow (£4.8m lower), lower interest costs (£0.8m) and income of £2.3m from adjusting items, offset by some small outflows. Average daily net debt in the period fell from £12.5m to £1.1m.

As mentioned above, Smiths made good progress on the non-core growth initiatives, especially in Smiths News Recycle, where customer numbers increased by 5% from the year-end (August). It is also making progress with trials on some other non-core growth initiatives. Importantly, it has appointed a new MD for its recycling activities from one of the largest players in waste recycling, endorsing the opportunity’s potential.

Management’s outlook is encouraging and revenue, adjusted operating profit and cash generation are all in line with expectations. The growth initiatives are advancing and the company hopes to provide a more comprehensive update with the FY25 results in November.

Exhibit 1: H125 Interims Results and History (£m)

Source: Smiths News, Edison Investment Research

Revenue and Profit Forecasts Unchanged, Cash Generation Better

Our revenue and adjusted operating profit forecasts are unchanged from our previous publication. However, H1 net debt fell by more than we expected due to the one-off benefit of a £1.5m tax pension refund and the receipt of a £1.6m interim dividend from the administrators of McColl’s Retail Group. A second interim dividend of £1.7m was received since the half year and a final, probably modest, ‘true-up’ payment is expected before the financial year-end. Total payments to date amount to c 61% of the total debt balance, hence our net debt in FY25 is somewhat lower and net cash in FY26 is higher than previously anticipated.

Exhibit 2: Revised Forecasts

Source: Smiths News, Edison Investment Research

The better cash position supports our FY26 assumption that the company may consider another special dividend of 2p/share, a similar assumption to the special paid in FY24, which implied a total dividend in that year of 7.2p. For a more detailed discussion of the dividend paying potential, see our update note published on 18 November 2024.

Exhibit 3: Net Bank Debt Reduction and Debt Ratio

Source: Smiths News, Edison Investment Research

Exhibit 4: Financial Summary

Source: Company accounts, Edison Investment Research