JPMorgan European Discovery Trust (JEDT (LON:)) invests in European small-cap companies (excluding UK). Its objective is to identify and invest early in smaller companies demonstrating improving operational performance and strong growth prospects.

In the year since their appointment, JEDT’s new managers, Jon Ingram, Jack Featherby and Jules Bloch, have made some portfolio changes to reduce exposure to potentially unfavourable geopolitical and macroeconomic shocks. These changes have seen performance improve markedly. As at 30 June 2025, the trust outpaced the market over one, three and five years, and was the top performer among its peers over the year.

JEDT’s managers believe that Germany’s infrastructure investment plans, combined with a big boost to European defence spending, are likely to be ‘profoundly positive’ for European small caps over the long term. And with investors showing increasing appreciation of the value offered by European smaller caps, the managers are very optimistic about the outlook for the sector and their portfolio.

The analyst’s view

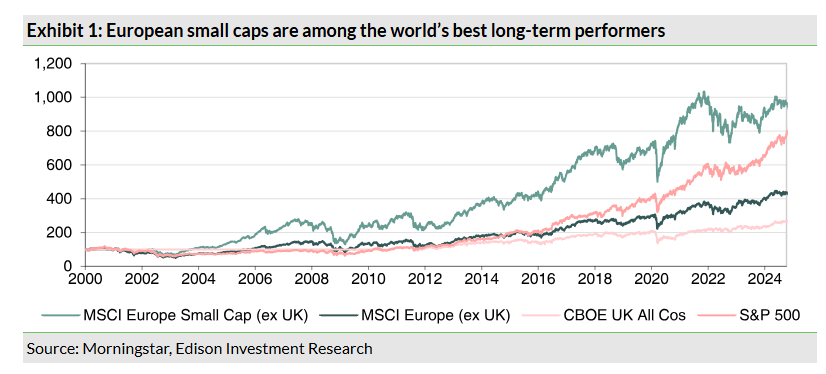

- European small caps have outperformed most other major markets over the long term, as illustrated by Exhibit 1. The sector experienced a period of underperformance over 2022–23, but history suggests small caps are due for a substantial re-rating, especially now that interest rates have begun to decline.

- JEDT offers investors diversified access to this world-beating market and potential investors may appreciate its recent, more balanced investment approach and consequent improved performance. They may also like the managers’ increasing focus on smaller, less liquid companies. These tend to be under-researched by most investors but are fast-growing, offering potentially significant multiple expansion over time, and JEDT’s holdings of these ‘hidden gems’ are now making a meaningful contribution to overall returns.

- Although the trust’s share price discount to NAV has narrowed, the discount has scope to narrow further if performance continues to improve and/or the recent resurgence in interest in European small caps continues.

Strategic enhancements intended to reduce risk and lift performance

JEDT’s strategy is to invest in companies with improving performance and strong growth prospects. This strategy works best, capturing market upside, when volatility is low and markets are trending higher, but it has tended to struggle during periods of high volatility. For example, the trust underperformed during 2022–23 as a result of significant sectoral bets, which left it underweight oil and metals when these sectors surged in response to Russia’s invasion of Ukraine.

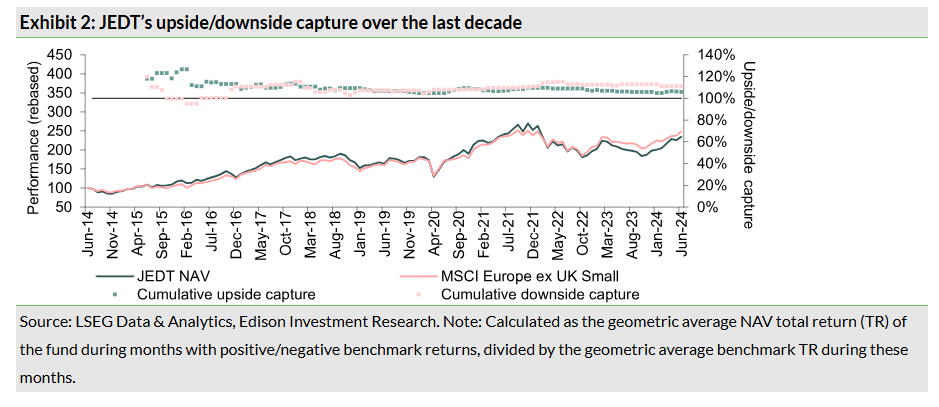

Exhibit 2 shows JEDT’s cumulative upside and downside capture over the last decade. The trust’s growth focus is highlighted by its more than 100% capture rates for both upside and downside risks, which are very similar, with both currently hovering above the 100% rate. (A 100% upside/downside indicates that the fund’s total return was in line with the benchmark’s during months with positive/negative returns).

These suggest that JEDT is likely to outperform by a few percentage points in rising markets and underperform by a similar magnitude in falling markets. The trust’s downside capture peaked at 115% during 2022, for the reasons mentioned above.

With geopolitical tensions and macroeconomic developments now generating fresh uncertainties, the managers have drawn lessons from the past and have decided to reduce exposure to potential shocks and related downside risks by cutting sector bets, as they believe they do not have expertise in these areas, and should focus instead on their core strengths as bottom-up stock selectors.

Specifically, they are now more focused than ever on finding companies driven by idiosyncratic, stock-specific factors, and businesses reliant on domestic economic activity, which gives them immunity against the risk of hefty US tariffs.

The managers stress that this shift in focus towards a greater emphasis on bottom-up stock selection is aimed at delivering the same alpha, more consistently, and thus sparing shareholders the discomfort of short-term volatility. The shift is not a change in the trust’s investment strategy, but rather an enhancement to the risk management process, to minimise downside risk during periods of volatility.

As an illustration of this revised approach, the managers cite the case of the oil services sector. They are ‘not big fans’ of the sector as a whole, due to its exposure to oil prices, which are highly unpredictable. Yet in their view, the sector nonetheless includes some good companies, with the potential for outperformance.

For example, Saipem (BIT:) is an Italian engineering and construction company specialising in the oil and gas industry, providing services such as offshore and onshore drilling, pipeline installation and energy transition projects. The stock is outperforming due to strong order intake, improved financial delivery and strategic repositioning towards higher-margin offshore projects and energy transition initiatives. are another example.

In the past, JEDT did not hold any banks, but with interest rates unlikely to return to the extremely low levels seen over the past 20 years, the portfolio now owns several smaller-cap regional banks, including Italian bank BAWAG (VIE:), one of the trust’s top holdings (Exhibit 11). These banks are performing strongly and paying very attractive dividends, and holding these names has significantly reduced the portfolio’s underweight to financials (Exhibit 9).

Smaller companies can offer great potential returns

The managers’ greater focus on stock selection has also intensified their interest in smaller, less liquid companies. Their analysis of past performance has shown that long-term returns are driven by just a few stocks that do extremely well, rising tenfold or more over a decade. For example, Fortnox, a Swedish financial and business software provider, has risen 300x since its IPO in 2007.

The common theme among these mega performers is that they all started as very small businesses, with market caps below €1bn. These stocks tend to grow very fast for a couple of years, eventually attracting the attention of investors, which lifts valuations dramatically. The multiples paid for these stocks are usually well below those of larger stocks offering the same growth, and early investors can make handsome gains from this multiple expansion.

Yet smaller, less liquid stocks are an under-researched area of the market, as sell-side research is scant, and these businesses tend not to do roadshows or have consensus forecasts for performance, so they are missed by screening based on forward-looking financials. However, JEDT’s managers have set up a simple screen based on historical financials to identify these ‘hidden gems’.

Some investors may avoid such smaller-cap stocks as they tend to be less liquid, but this is not a concern for JEDT, due to its investment trust structure, which eliminates the need for forced sales to fund divestments. The trust currently has about 10 smaller-cap holdings (up from six in October last year), where the managers see very good long-term potential for share prices to increase by several multiples.

Position sizes are small, around 0.50–1.0% of portfolio value, and holdings include two Swedish names: AQ Group, an electrical equipment producer, and Raysearch, a medical technology company. JEDT’s recent performance has been underpinned by some of these stocks, although their contribution to returns is less obvious because of the relatively small size of the positions.

The managers expect this good performance to ‘snowball over time’ and they are keen to find more of the same kind of small, fast-growing, quality businesses.

Recent Changes and a Supportive Backdrop Lift Performance

Portfolio changes made in the past eight months are already having a positive impact on returns. The investment environment was also helpful, as inflation and interest rates declined, and wages and consumer sentiment rose. The market has been further supported as investors have begun to appreciate the efficiency gains offered by the rapid spread of artificial intelligence (AI), and the significant capex that will be needed to harness AI’s potential.

On the political front, the anti-NATO rhetoric of the new US administration was seen by many as a turning point in post-war trans-Atlantic relations, making it clear that Europe needs to step up its defence spending, while the new German government, elected in February 2025, has promised a very significant increase in government investment. This package includes greater defence spending and infrastructure spending worth €500bn (more than 11% of GDP), which is five times the amount Germany spent during the pandemic.

These funds will be used for projects across several sectors, including transport, healthcare, energy, research, and digitalisation. In addition, borrowing constraints on Germany’s state governments have been eased.

These initiatives represent a profound shift in Germany’s fiscal policy, and while this money will take time to flow into the real economy, markets have already begun to factor in its impact on activity, especially for domestically focused smaller caps; this sector of the market has outperformed European large caps since Germany announced its fiscal policy initiatives.

In the year to end June 2025, the portfolio has returned 25.8% on an NAV basis and 23.7% in share price terms, well ahead of the trust’s benchmark, the ex-UK , which rose by 14.0% over the period (see Performance section for details).

This outperformance has boosted JEDT’s already solid longer-term track record. The company has made absolute gains and outperformed the market over three- and five-year periods to end-June 2025, and it has chalked up annualised returns of 10.6% on an NAV basis over 10 years, in line with the benchmark (see Exhibit 6).

Furthermore, JEDT’s downside capture characteristics have improved, meaning returns are less responsive to market declines. In recent months, its downside exposure has declined to 109%, from its 2022 peak of 115%. Its upside capture has also improved slightly, to 107% from 106% over the same period. This is further evidence that the managers’ recent portfolio adjustments are having their intended effect to reduce downside risk and smooth returns.

Managers are very bullish about the outlook for European smaller caps

JEDT’s managers believe Germany’s massive fiscal boost, combined with higher regional defence spending, will be ‘profoundly positive’ for European small caps over the longer term. Their domestic focus provides investors with a better way to play the German stimulus story than via larger German companies with exposure to the US and Asia, where the benefit of the stimulus will be diluted.

Domestically focused companies have the additional benefit of being much more insulated from threatened US tariff increases than their larger counterparts, as mentioned above. Smaller caps will also be helped by falling interest rates, as many small businesses are financed by floating-rate debt.

For the managers, the appeal of European small caps is further enhanced by the fact that valuations are still cheap in absolute terms and versus European large caps and US equities. And history suggests the sector is overdue for a rebound, as we discussed in our last note. Indeed, this rebound may already be underway.

The trust’s managers have noted a decisive shift in the mood of investors, who they believe are finally coming to appreciate the value offered by European small caps. Recent portfolio adjustments mean that JEDT is strategically positioned to capitalise on these favourable developments, while being more protected from the unwelcome consequences of unpredictable macroeconomic and political events.