The announcement that the Competition and Markets Authority (CMA) has found Topps Tiles’ (LON:) acquisition of CTD Tiles generates no competition concerns in the majority of the areas reviewed should be welcomed.

Management is looking forward to taking full control of the assets in order to generate revenue synergies in areas where it currently has zero or low exposure, as well as introducing best practice to realise cost synergies and efficiencies where available.

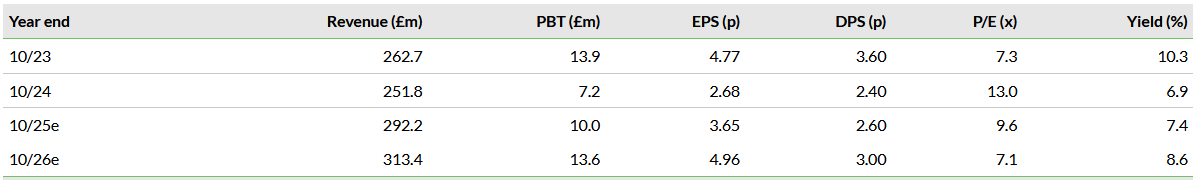

Note: PBT and EPS are normalized, excluding amortization of acquired intangibles, exceptional items and share-based payments.

The CMA has agreed with TPT that the acquisition of the commercial tiles operations of CTD Tiles (ie those that serve architectural and housebuilder customers) did not raise any competition concerns. This should not be a big surprise given TPT had no prior revenue in the volume housebuilder segment and its Parkside commercial activities reported revenue of £7.6m in FY24.

With respect to CTD Tiles’ retail activities, it has also been agreed there are no competition concerns in 26 of its 30 retail locations. In the four localities (Aberdeen, Dorking, Edinburgh and Inverness) where there are competition concerns, TPT has the opportunity to put forward remedies to address these concerns, in lieu of a more in-depth investigation. We believe, in all likelihood, this means the stores will be disposed of.

When TPT announced the acquisition of CTD Tiles in August 2024, management indicated the 30 stores being acquired had revenue of £20m in the year ended June 2024 and the commercial businesses (volume housebuilder and architect designer) had combined revenue of £24m.

At the time, we included £30m of revenue and £1.5m of profit, a margin of 5%, in our FY25 estimates for the acquisition.

At the H125 results in January 2025, we kept our prior revenue estimates but halved the expected profit from CTD Tiles to £0.75m as the CMA review had delayed management’s ability to take full control of the business and run it as management would have wished. If the four stores were sold, and none of the revenue was regained competitively by TPT, we estimate a pro-rata revenue reduction of less than £3m.

We make no changes to our estimates until there is further clarification from management on the conclusion of its discussions with the CMA, and given our initial estimate appears conservative versus the historical revenue of the assets being acquired.