Refresh

Tesla shares make strong start to final session before earnings

Tesla shares have indeed gained ground today. The stock opened 1.5% up, and as of now are around 3.8% up on yesterday’s close.

Tesla no longer one of America’s top 10

Tesla’s share price decline yesterday has seen the carmaker drop out of the S&P 500’s top 10 largest companies. Tesla is now the 12th most valuable company in the index by market cap.

|

No. |

Company Name |

Market Cap ($ billion) |

|---|---|---|

|

1 |

Apple Inc. |

2,901.66 |

|

2 |

Microsoft Corporation |

2,669.69 |

|

3 |

NVIDIA Corporation |

2,364.60 |

|

4 |

Alphabet Inc. |

1,812.14 |

|

5 |

Alphabet Inc. |

1,800.10 |

|

6 |

Amazon.com, Inc. |

1,775.66 |

|

7 |

Meta Platforms, Inc. |

1,227.96 |

|

8 |

Berkshire Hathaway Inc. |

1,093.66 |

|

9 |

Broadcom Inc. |

781.51 |

|

10 |

Walmart Inc. |

740.84 |

|

11 |

Eli Lilly and Company |

734.57 |

|

12 |

Tesla, Inc. |

731.76 |

Source: Stockanalysis.com as of 21 April, market close. *Alphabet’s dual listing mean that two stocks here represents just one company.

As things stand though, Tesla could be set for a rebound today. Shares are up around 1.4% in premarket trading, just over half an hour before US markets open.

Tesla’s share price rise and fall

As of US market close last night, Tesla shares have fallen 43.7% so far in 2025. They are 52.6% below the stock’s peak on 17 December.

During that time, the company’s market cap has fallen from $1.53 trillion to $776.4 billion.

This rise and fall in Tesla’s share price can be put down, simply, to Trump’s election win and how investors’ attitudes towards the new administration have changed.

Tesla shares gained over 90% between 5 November, when it became clear that Trump had won the election, and 17 December.

At first, investors expected a boon to Tesla from Musk’s proximity to the new president. Perhaps a fast-track for its full self-driving approval, or other perks. Something along these lines could well still be coming, further down the road.

However, the prevailing assumption at the time was that Trump would be a fundamentally pro-business president, and that assumption is quickly being damaged. Opposition to his tariffs and DOGE’s slashing of US federal agencies has changed the mood considerably, especially among wealthy liberals in the US and abroad – Tesla’s target market.

The tariffs themselves threaten material damage to Tesla’s bottom line, particularly if the escalating US-China trade war raises the costs of exporting the cars from China, where around half of all Teslas are manufactured.

What time does Tesla announce earnings?

To recap, here’s the timeline of the key events that are happening today in the runup to Tesla’s earnings announcement. All times are BST unless specified.

|

When (22 April unless specified) |

What |

|---|---|

|

2.30pm |

US markets open |

|

9pm |

US markets close |

|

9pm-10.30pm |

Tesla posts Q1 2025 financial results |

|

10.30pm |

Tesla will host its post-earnings call |

|

1am, 23 April |

After-hours trading in the US closes |

Earnings calls tend to last around one hour. Tesla will post its earnings report online any time between the close of US markets and the start of its earnings call.

Each of the events in this table represents something of a milestone as far as trading Tesla shares is concerned. However, it’s important to bear in mind that there is often lots of volatility around earnings releases, and that’s likely to be especially true today given the amount of uncertainty in the markets.

MoneyWeek tends to advocate a long term approach wherein investors ignore the short-term volatility and avoid trying to time buying and selling shares, sticking instead to a consistent, sustainable investing strategy.

Analyst calls on Musk to step up

CEO Elon Musk, who for a long time looked like Tesla’s greatest asset, risks turning into a liability for the company.

His high-profile political exploits have alienated large swathes of Tesla’s potential consumer base, both in the US and globally. Outside of politics, his attention doesn’t seem to be on the carmaker.

X, formerly Twitter, and its acquisition by Musk’s AI company xAI, will have soaked up a lot of his attention over recent months. SpaceX is another massive venture demanding Musk’s attention. With so much going on, there is a danger that Tesla gets left by the wayside.

“Musk will need to step up if Tesla shares are to shift out of reverse in 2025,” says Josh Gilbert, market analyst at eToro. “Investors have started to lose patience with the EV giant due to poor vehicle deliveries, auto tariffs and [Musk] taking his eye off the ball.”

Analysts are calling for Tesla CEO Elon Musk to signal a greater focus on Tesla’s key priorities at tonight’s earnings call.

(Image credit: Shawn Thew/EPA/Bloomberg via Getty Images)

Gilbert calls for three areas of clarity on tonight’s earnings call: how tariffs on US auto imports are likely to impact Tesla; how long Musk plans to remain at DOGE; and the rollout of cheaper Tesla models going forward.

Musk has called cheaper EVs a ‘game-changer’ in the past, but timelines keep slipping. Over the weekend, Reuters reported that the cheaper Model Y, which had been slated for release in the first half of the year, is set to have its production date pushed back, citing three sources with knowledge of the matter.

If true, yet another delay could further stretch investors’ patience.

Tesla earnings expected to fall

Analysts polled by FactSet expect Tesla to post quarterly earnings per share (EPS) of $0.43 this evening, on revenue of around $21.45 billion.

If accurate, that would represent a year-over-year decline in EPS, from $0.45 during the equivalent period last year.

The FactSet estimate implies a slight increase in revenue – from $21.3 billion a year ago. However, not all analysts are convinced that Tesla will achieve even that small increase. Analysts polled by London Stock Exchange Group (LSEG) yield a consensus revenue estimate of $21.2 billion, which would mark a 0.47% decline in revenue year-over-year.

Tesla shares down ahead of earnings

Good morning, and welcome back to our live blog. Magnificent Seven earnings season officially kicks off today, with Tesla announcing results after markets close.

The carmaker has hit a speed bump in the run-up, though, with shares falling 5.7% during yesterday’s session.

Stay with us for rolling analysis ahead of the announcement, live coverage as Tesla announces its results this evening, and all the reaction tomorrow.

We’ll also start previewing the other Magnificent Seven companies. Alphabet is the next to announce its results, this Thursday evening.

Thanks for following the live blog today. We’re going to wrap up here for this evening, but join us tomorrow when we’ll have more build-up and analysis ahead of Tesla’s earnings release tomorrow evening.

When are other Magnificent Seven companies announcing their results?

As a reminder, we’ll be covering the first six Magnificent Seven companies to announce their earnings here on this blog. Given it reports later than the others, there will likely be a separate blog to cover Nvidia’s earnings release.

The full timeline for Magnificent Seven earnings is:

|

Company |

Earnings date |

Time |

|---|---|---|

|

TSLA |

22/04/2025 |

After markets close (AMC) |

|

GOOGL |

24/04/2025 |

AMC |

|

META |

30/04/2025 |

AMC |

|

MSFT |

30/04/2025 |

AMC |

|

AMZN |

01/05/2025 |

AMC |

|

AAPL |

01/05/2025 |

AMC |

|

NVDA |

28/05/2025 |

AMC |

Autonomy is key for Tesla

In Tesla’s case, analysts are going to be far more focused on how the company – and Musk in particular – is addressing the various challenges that it’s up against.

These can be broadly summarised as:

- Tesla’s status as a symbol of the Trump administration and DOGE, and the impact this has had on its share price;

- Brand damage done to Tesla as a result, and its impact on Q1 delivery numbers. Dan Ives, global head of technology research at Wedbush Securities, estimates this could imply 15-20% “permanent demand destruction for future Tesla buyers”;

- The impact of tariffs on the business, particularly on the rollout of Tesla’s long-awaited low-cost model.

And, as always with Tesla, demonstrable progress on autonomy is vital.

Despite its share price declines, Tesla stock still trades at over 100 times trailing earnings and around 90 times projected earnings. That’s an enormous multiple even by Magnificent Seven standards, a group not known for its bargain valuations.

It is based on a long-held assumption among investors that Tesla is the company closest to cracking full self-driving (FSD) technology, opening up a potentially brand new robotaxi market in which Tesla would enjoy first-mover advantage.

However, Tesla has repeatedly delayed full reveal of its promised robotaxi. Musk promised that one would be unveiled in August this year, and investors will want reassurance that this, at least, is still on track, even if Tesla is facing multiple headwinds elsewhere.

“Musk needs to lay out for investors the timing/rollout of unsupervised FSD in Austin this summer,” says Ives. “It’s time to lay out the timeline/hard facts around autonomous and robotics/Optimus rollout over the next 6-12 months.”

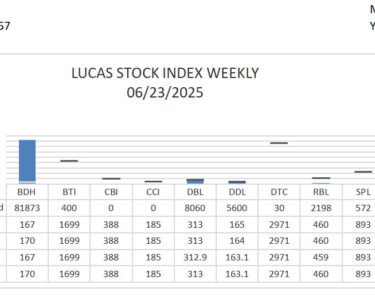

What do analysts expect from Magnificent Seven results season?

We’ve covered the context for Tesla’s results, but what do analysts actually expect the company and its Magnificent Seven colleagues to announce when they release earnings?

Here are the consensus expectations from analysts polled by FactSet for each of the Magnificent Seven:

|

Ticker |

Earnings per share ($) |

Sales ($ million) |

|---|---|---|

|

GOOGL |

2.01 |

89,248 |

|

AMZN |

1.37 |

155,097 |

|

AAPL |

1.61 |

93,932 |

|

META |

5.24 |

41,427 |

|

MSFT |

3.23 |

68,513 |

|

NVDA |

0.91 |

43,177 |

|

TSLA |

0.43 |

21,452 |

Source: FactSet consensus estimates, as of 16 April 2025.

Alphabet is reporting its earnings this Thursday. We’ll bring live analysis and reaction to those results on this blog too.

Remember that, given how much movement there has been in the markets so far this week, the numbers published on earnings days are likely to have little impact on each company’s share price movements compared to what you might normally expect during earnings season.

The biggest drivers in after-hours trading will likely be how each company’s management addresses the tariff situation, which has completely changed the outlook for big tech and for the global economy since the periods these results cover.

Tesla and tariffs

Musk’s DOGE involvement is no longer the biggest threat to Tesla shares coming out of the White House.

On the same day that Tesla announced its delivery miss, Trump unveiled his long-awaited tariff regime. This was both broader and deeper than many observers had expected, and had huge implications for global trade.

While most of the ‘reciprocal’ tariffs on individual countries have been paused for 90 days, a 10% baseline tariff remains on all imports to the US. This rises to 25% for auto imports, as well as for steel and aluminium.

More worrying yet is the trade war that ramped up rapidly once China responded by placing its own tariffs on US imports. That prompted a rapid-fire ratcheting up of each nation’s tariff barriers.

By 11 April, trade between the two superpowers had effectively been nullified; China is levying 125% on US imports, while US imports from China are subject to a 145% tariff.

That’s not good for anybody, but it’s particularly bad news for companies like Tesla. Not only is China the world’s largest market for electric vehicles (EVs) but it is also home to much of Tesla’s production and supply chain. Tesla’s gigafactory in Shanghai reportedly produces around half of all its cars.

The trade war between China and the US could hit Tesla particularly hard. Its gigafactory in Shanghai produces around half of all the world’s Teslas.

(Image credit: Xiaolu Chu/Getty Images)

Given the tariffs came into effect after the reporting period, they won’t have any impact on Tesla’s Q1 results. However, make no mistake: talk of tariffs will likely dominate the post-earnings call.

Musk has made a rare break with the White House party line on tariffs, clashing publicly with Trump’s senior trade advisor Peter Navarro – who Musk has referred to as a “moron” and “dumber than a sack of bricks”.

Tesla shares down at start of earnings week

It has been a torrid few months for Tesla’s share price, and the selloff continues this morning as the stock opens 4.6% below its close last week.

Tesla’s market cap is currently around $776 billion, having been over $1 trillion just two months ago.

Read more: Should you invest in Tesla?

The DOGE days are over?

Despite its delivery miss, Tesla’s shares eventually gained on 2 April, thanks to a Politico report suggesting that Musk would be stepping back from his work with DOGE in the coming months.

The report wasn’t confirmed – and has been contradicted by official White House statements. As such, Musk’s relationship with DOGE is likely to come under the microscope following Tesla’s earnings release tomorrow.

“We would expect Musk to address his role in the Trump Administration, and he will be asked about if he plans to stay in an advisory role for the White House,” says Dan Ives, global head of technology research at Wedbush Securities.

“We view this as a fork in the road time: if Musk leaves the White House there will be permanent brand damage, but Tesla will have its most important asset and strategic thinker back as full time CEO,” Ives continues.

Musk’s involvement with Trump and DOGE has already damaged the Tesla brand, according to Wedbush’s Dan Ives. Here, an activist in Washington DC holds a sign symbolising Tesla’s share price decline during a protest in March.

(Image credit: Alex Wong/Getty Images)

“If Musk chooses to stay with the Trump White House it could change the future of Tesla/brand damage will grow,” says Ives. “A huge week ahead for Musk, Tesla, and investors.”

Deliveries and DOGE

Tesla’s earnings are unusual among the Magnificent Seven, in that investors usually have a fairly good idea of how the preceding quarter has gone from a sales perspective. This is because Tesla announces its delivery numbers for the quarter several weeks before it releases its full results.

On that basis, analysts have been slashing expectations ahead of Tuesday’s release. Tesla’s delivery miss during Q1, announced on 2 April, saw quarterly vehicle sales fall to their lowest level for nearly three years.

Analysts had forecast 498,000 deliveries; Tesla fell short, with 495,570.

It’s thought that CEO Elon Musk’s close association with the Trump administration, as well as his activity with the Department of Government Efficiency (DOGE) contributed to the miss by prompting a widespread backlash against Tesla cars.

Tesla CEO Elon Musk’s political activities have caused a backlash among consumers, even Tesla fans. This bumper sticker was photographed in Lafayette, California on 28 March, 2025.

(Image credit: Smith Collection/Gado/Getty Images)

Markets will have already priced in a poor set of financial results for Tesla for Q1. However, of all the Magnificent Seven stocks, Tesla’s valuation is often based far less in what it has done before, and what markets expect it to do in the future. We’ll be delving into the details of what markets will be watching out for, particularly during the all-important post-earnings call.

When does Tesla announce earnings?

Tesla announces its earnings after US markets close on Tuesday 22 April – that is, soon after 4pm UK ET, 9pm in the UK.

The post-earnings call, which is likely to have the biggest influence on the market reaction, is scheduled for 5.30pm ET (10.30pm in the UK).

Tesla earnings release kicks off Magnificent Seven results

Good afternoon, and welcome to our live blog covering Magnificent Seven earnings season, starting with Tesla’s results on Tuesday 22 April.

Like last week’s UK inflation data, the upcoming round of big tech earnings promises to be something of a snapshot into a bygone era, with the sweeping tariffs that president Donald Trump announced at the beginning of Q2 2025 having completely upended the stock market and thrown all future forecasts out of the window.

The Magnificent Seven – Tesla especially – have, however, been judged far more on their future outlook than their past performance over recent years, though. More than ever, this earnings season promises to be one of volatility and unpredictability, as nervous global investors watch for any clues as to the future of US tech dominance.

We’ll bring you live updates and rolling analysis, to help you keep track of every major development as it happens.