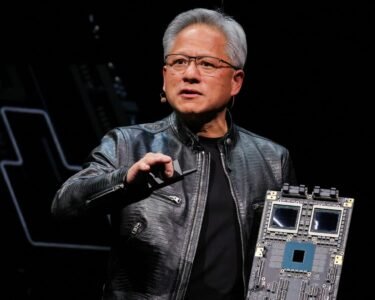

It could be time to take some profits with stocks near record highs. U.S. equities are off to a strong start in 2024. The S & P 500 climbed more than 6% this year, having broken through 5,100 for the first time ever just last week. Meanwhile, the Dow Jones Industrial Average also closed at a fresh record last Friday. But that same hot streak is making some stocks look expensive. We used the CNBC Pro Stock Screener to search for S & P 500 constituents that are looking overvalued when compared to the broader market. Here are some of the characteristics we searched for: Trailing 12-month price to earnings ratio above its five-year average. Forward P/E above that of the S & P 500 (16.6). Easily outperforming the market: up more than 15% year to date. These are the names that surfaced. Wall Street’s biggest artificial intelligence darling surfaced on the screen for most expensive stocks. Nvidia , which is higher by about 59% this year, hit fresh record highs after last week’s blowout earnings report. That added to investor confidence that the recent market rally may still have some runway. But the company’s trailing 12-month P/E ratio (P/E TTM) of 65.5 suggests the stock is overvalued, especially when compared to its historical earnings. The forward P/E of 35.2 also suggests the stock is expensive. Eli Lilly shares also came as an overvalued stock. This month, the pharmaceutical company posted a strong beat on the top and bottom lines in the fourth quarter, propelled by the strength of its new weight loss drug Zepbound. But Eli Lilly’s P/E ratio on a trailing 12-month basis of 130.5 shows the stock is expensive. Meanwhile, the forward P/E of 69.5 suggests investors may need to trim their exposure from here. Merck and Advanced Micro Devices also surfaced on the list.