ITV News Political Correspondent Shehab Khan gives an update on how all of this might affect you

Words by Senior Business and Economics Producer Jack Abbey

We’ve had days of economic turmoil and for the first time in a week, financial markets have finally seen some gains – all because Donald Trump paused some of his tariffs.

Both the American S&P 500 and British FTSE 100, good measures of how their respective markets are performing, are up by about 3% since yesterday’s suspension.

But gains do not mean a full recovery. The American stock market had a tough day on Thursday and is down, and markets are still 8% behind where we were when tariffs were first introduced.

Markets matter.

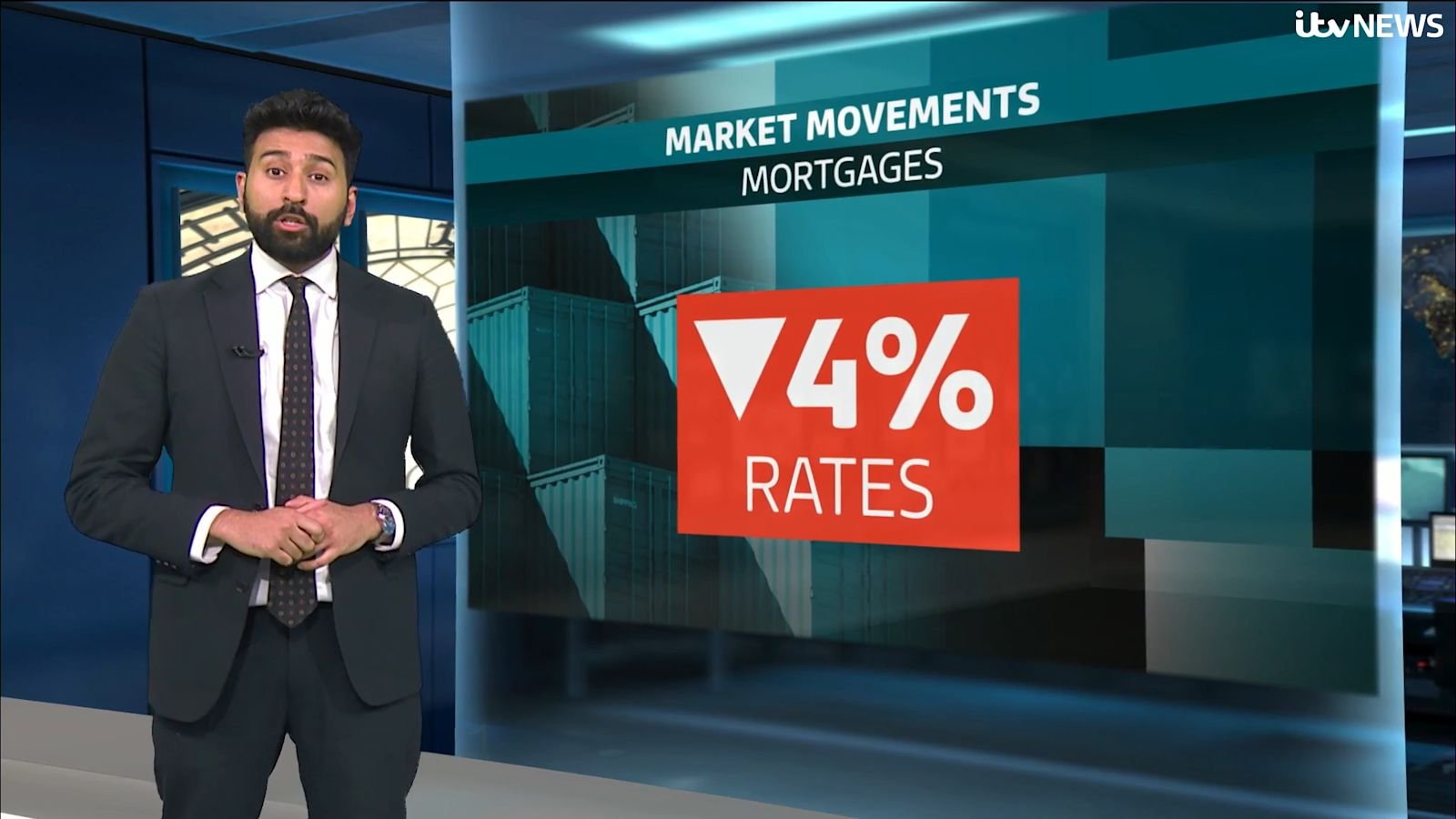

For one, it impacts interest rates. Markets now expect them to be cut faster to give the economy a boost and that means mortgages coming down too.

We’re even starting to see some being offered at below 4% – Barclays today became the first major lender to do so.

On top of that, a lot of people have their savings and pensions, at least in part, invested in stock markets and across the board pensions are down.

AJ Bell has crunched the numbers for ITV News and has calculated that in broad terms, higher-risk pensions are down 5.9%, medium risk 3.8% and low 1.9%.

Experts say don’t panic though.

Most people will have their pensions moved to safer assets in the years before retirement, and younger people have time to ride out the volatility. Those losses were also down on Monday when by comparison a higher-risk pension was down around 8%.

But it wasn’t stock market pain that caused Trump to change his mind. Instead – something else is likely to have scared him.

Remember Liz Truss. Her political career was cut short when her economic policies spooked the markets and resulted in the cost of government borrowing going up.

Something similar started happening in the US in recent days. Spooked investors started selling government bonds, which in turn acted to push up interest rates that the US government would have to pay to borrow.

There were serious concerns that this spike in the cost of borrowing would get out of control. That’s why Trump felt he had to act.

But regardless we are not out of the woods yet. Britain still faces tariffs of 25% on steel and aluminium and on cars, plus there’s a base of 10% on all goods sold to the US.

So while the big tariffs faced by the rest of the world are on pause, the trade war with China isn’t and that has the ability to set off market volatility again.

Subscribe free to our weekly newsletter for exclusive and original coverage from ITV News. Direct to your inbox every Friday morning.

From Westminster to Washington DC – our political experts are across all the latest key talking points. Listen to the latest episode below…