HSBC is among the major banks and building societies in the UK cutting mortgage rates in a boon for homeowners and prospective homebuyers.

The bank is making changes to around 140 mortgage products with rate cuts of up to 0.18 per cent.

Here is full list of the changes to mortgage rates being implemented by HSBC, as of today:

- New Business residential rates cut by 0.04 per cent to 0.18 per cent

- Buy-to-Let (BTL) new business rates cut by between 0.04 per cent and 0.14 per cent

- Residential Switchers, customers who already have a mortgage with HSBC UK and are getting a new fixed interest rate, are seeing cuts by up to 0.11 per cent.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

HSBC is among the high street lenders cutting mortgage rates

GETTY

Here is list of example mortgage rates with HSBC following this latest interest rate reduction from the lender:

Residential – Purchase

- Two year 60 per cent loan-to-value (LTV) with no fee: now 4.99 per cent reduced by 0.09 per cent

- Two year 90 per cent LTV with no fee: now 5.57 per cent reduced by 0.11 per cent

- Five year 60 per cent LTV with £999 fee: now 4.40 per cent reduced by 0.08 per cent

- Five year 85 per cent LTV with £999 fee: now 4.69 per cent reduced by 0.04 per cent.

Buy-to-Let (BTL) – Remortgage

- Two year 60 per cent LTV with £1999 fee: now 4.69 per cent reduced by 0.14 per cent.

This latest round of rate cuts to mortgage products comes amid a difficult period for Britons hoping to get on the property ladder.

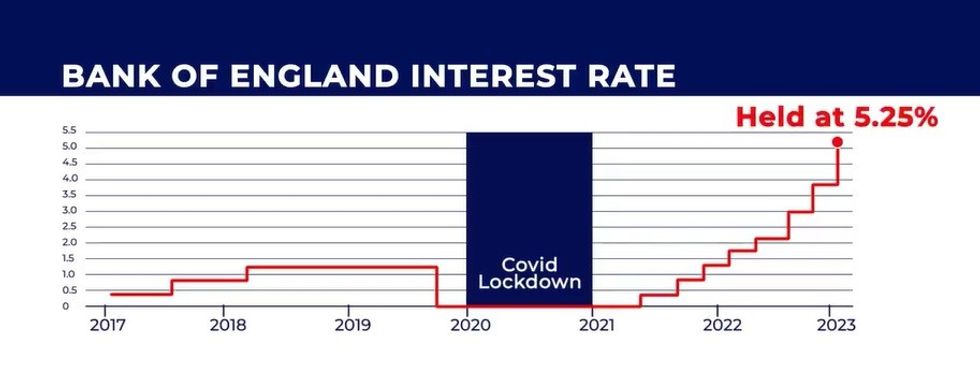

The Bank of England’s decision to raise and hold the base rate at 5.25 per cent in its fight against inflation has led to mortgage rates skyrocketing in recent years.

However, this latest move from HSBC signals that lenders are beginning to lower rates which will be beneficial for new and existing homeowners.

A HSBC UK spokesperson: “We are firmly focused on helping customers onto or up the property ladder.

“There are a number of factors that are taken into account when setting mortgage rates, and following a review, we are reducing over 140 mortgage rates by up to 0.18 per cent, we continue to keep our rates under review.”

Among the other high street financial institutions to slash mortgage rates this week include Barclays Bank and TSB.

LATEST DEVELOPMENTS:

The Bank of England has held the base rate at 5.25 per cent in recent months GB NEWS

The Bank of England has held the base rate at 5.25 per cent in recent months GB NEWS

Barclays Bank has confirmed it will cut the cost of five-year fixed-rate deals for new borrowers and those looking to remortgage by up to 0.45 percentage points as of today.

The bank’s five-year fixed-rate for mortgage holders with a 40 per cent deposit is falling from 4.47 per cent to 4.34 per cent.

As well as this, TSB has announced it is reducing two and five-year deals for property purchases by up to 0.1 per cent.

The Bank of England’s Monetary Policy Committee (MPC) will next meet to discuss the UK’s base rate on June 20.