Some 320,000 Britons have been pushed into poverty due to rising mortgage interest rates, according to new research.

The Institute of Fiscal Studies (IFS) is sounding the alarm due to the uptake in costs for those remortgaging or getting on the property ladder since 2022.

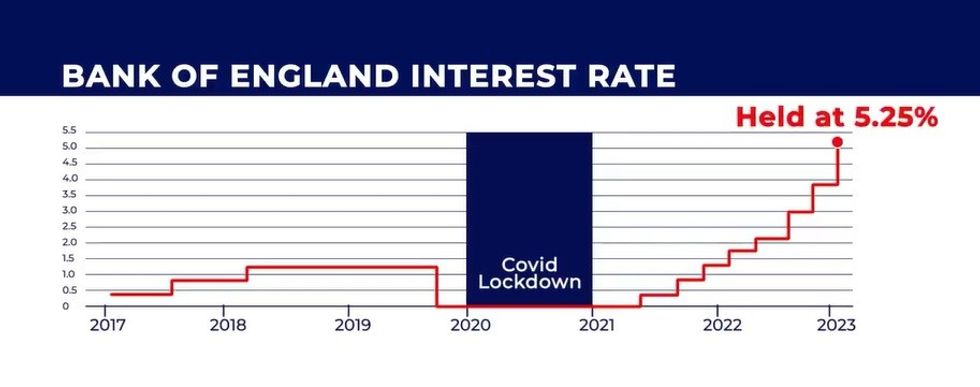

Interest rates have been raised by the Bank of England in its efforts against inflation which has resulted in a detrimental effect on homeowners.

Households have seen their disposable income plummet in recent years with the IFS estimated 320,000 people being plunged into poverty as a result.

According to the think tank, official Government data only captures two-thirds of the individuals who have been adversely affected.

During the 2022–23 tax year, the think tank found that the mismeasurement of mortgage interest payments had resulted in the number of people living in poverty being understated by 70,000.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Interest rate hikes have pushed up mortgage repayments for many GETTY

Interest rate hikes have pushed up mortgage repayments for many GETTY Based on the interest rates for December 2023, this number is set to jump to 150,000 as more fixed-rate mortgages come to an end.

There is further evidence that hikes to mortgage rates have been a factor in pulling British adults into greater financial hardship.

Adults remortgaging in 2022 were two percentage points more likely to fall into arrears on bills than those with mortgages who had not remortgaged.

Using this data, the number of adults struggling to get on top of their mortgage bills could hit 370,000 after all households have remortgaged.

Sam Ray-Chaudhuri, a research economist at IFS and an author of the organisation’s latest report, said: “Rising mortgage rates have played and are likely to continue to play an important role in many households’ living standards.

“But, perhaps surprisingly, they are not measured properly in the official income data. This has led to the headline statistics understating the number of people in poverty, something set to get worse in next year’s data.

“Poverty rises have also been understated due to the unequal impact of inflation.

“At a time when rates of deprivation and food insecurity have risen substantially, poverty statistics that hide the real scale of these increases risk policymakers missing what is truly happening to poverty.’

Peter Matejic, the think tank’s chief analyst, added: “This research shows the cost-of-living crisis wasn’t felt equally by everyone.

“Compared with before the Covid pandemic, many more people, especially those on a lower income, struggled to heat their homes or keep up with their bills.

LATEST DEVELOPMENTS:

The Bank of England base rate has held interest rates at a 16-year high since it was hiked to 5.25 per cent last August GB NEWS

The Bank of England base rate has held interest rates at a 16-year high since it was hiked to 5.25 per cent last August GB NEWS

“One reason lower-income households went without essentials is because they faced a rate of inflation even higher than the headline numbers.

“High interest rates also saw many households forced into financial hardship after they remortgaged.

“This report raises many questions about whether social security is adequate for the challenges looming over struggling households.

“The new Government can’t wait for growth, after years of cuts, caps and freezes to social security have left families without the financial resilience and security they needed to cope with higher prices and costs.”