We look at the silver price consolidation, compare it with other long consolidations in other markets, and conclude that patience will be rewarded. Why worry?

RELATED – Our 2024 silver forecast 2024.

Many investors are challenging the bullish silver thesis.

That’s odd, and at the same time it isn’t.

We firmly believe that the emotional and mental system of investors is the root cause. It can’t be anything differently. That’s because all data points underpin the bullish thesis for silver.

A market, any market, will only start trending when the time is right. As investors, we do not decide when the time is right, unfortunately.

Let’s review the data points of the silver market, compare with consolidations in other markets, come to a rational conclusion.

Will the silver price consolidation ever end?

Let’s do this – ask the opposite question.

As investors, we are very often stuck in our own way of thinking. Our own little world, with emotions and thoughts, fear and excitement, is how we look at the world. We tend to ask questions based on this inner world.

What if we turn the question around: why would the silver price consolidation not end?

It’s a no-brainer answer that comes up.

The silver price consolidation will come to an end, sooner or later.

Not an market in history trended flat for decades, silver won’t be any exception to that rule.

The more relevant question is ‘when exactly’ the silver price consolidation will end. We asked this question, and answered it in our blog post when will silver stage its long overdue rally:

As investors eagerly await silver’s rally to $50, a nuanced understanding of market dynamics and technical patterns is crucial. While precise timing remains uncertain, monitoring the silver COT report, analyzing price patterns, considering historical context, and acknowledging the potential for a two-stage rally can offer a well-rounded perspective.

Yes, all pieces of the puzzle need to be set right before a trend unfolds. This does not only apply to silver, it applies to every market.

Silver consolidation from the perspective of silver’s supply deficit

It might not have been sufficiently clear, but the physical silver market is challenged by a supply shortage.

Here is one data point that investors should re-read a few times:

Global Silver Demand to Reach 1.2 Billion Ounces in 2024: The forecasted global silver demand for 2024 is an impressive 1.2 billion ounces, potentially the second-highest level ever recorded. This growth is primarily driven by strong industrial demand.

The silver demand is reaching the “second-highest level ever recorded”.

So, then why is the silver price not following?

From our silver supply shortage article:

Within these silver market dynamics, the looming silver shortage stands out as a ticking time bomb. Despite COMEX silver price setting, the law of supply and demand will eventually prevail. As we approach a true silver supply shortage, the silver market’s true potential awaits, ready to reshape the price setting dynamics and elevate silver to new heights.

Stated differently, there are forces at work that prevent the silver price from reflecting the supply shortage.

We would add to this that intermarket dynamics (capital flows between and within asset classes) are not supportive of the big silver rally to start. We acknowledge that this does not make sense when looking at this topic from the perspective of a silver supply shortage. A shortage has to result in a higher price, market dynamics 101.

Sooner or later, the law of supply and demand has to reign, is what we conclude. Why not take advantage of what should we considered ‘low silver prices’?

The situation in the silver market is a ticking time bomb. It is vulnerable. Any ‘event’ similar to the one shown below can be the catalyst. The market is waiting for a catalyst.

Turks are gobbling up #silver. Why?

Annual #inflation running at 65%. pic.twitter.com/Qa1j8Re9PN— Peter Krauth (@peter_krauth) February 7, 2024

Current silver price consolidation length

One relevant question to ask is to compare the length of this ongoing silver price consolidation with similar consolidations in the past.

While we don’t read a lot into the following data point, we certainly find value in it in terms of benchmarking.

If there would be a baseline, for silver price consolidations, it would be 1076 days. That’s how long the current consolidation is ongoing. Though this qualifies as an anecdotal data point, it certainly is supportive to the thesis “this silver price consolidation will not continue forever.”

CHART: #silver ETF $SILJ. Blue arrow dictates the # of days each bear market lasted. Since 2013 there have been 3; each lasting:

1106 days

1016 days

1106 days (current)Avg length = 1076 days. We’re over that now. pic.twitter.com/QoHwYsVYfl

— Aaron (@Silver_Gold_U) February 14, 2024

Which silver price consolidation?

Let’s turn our attention to the charts now.

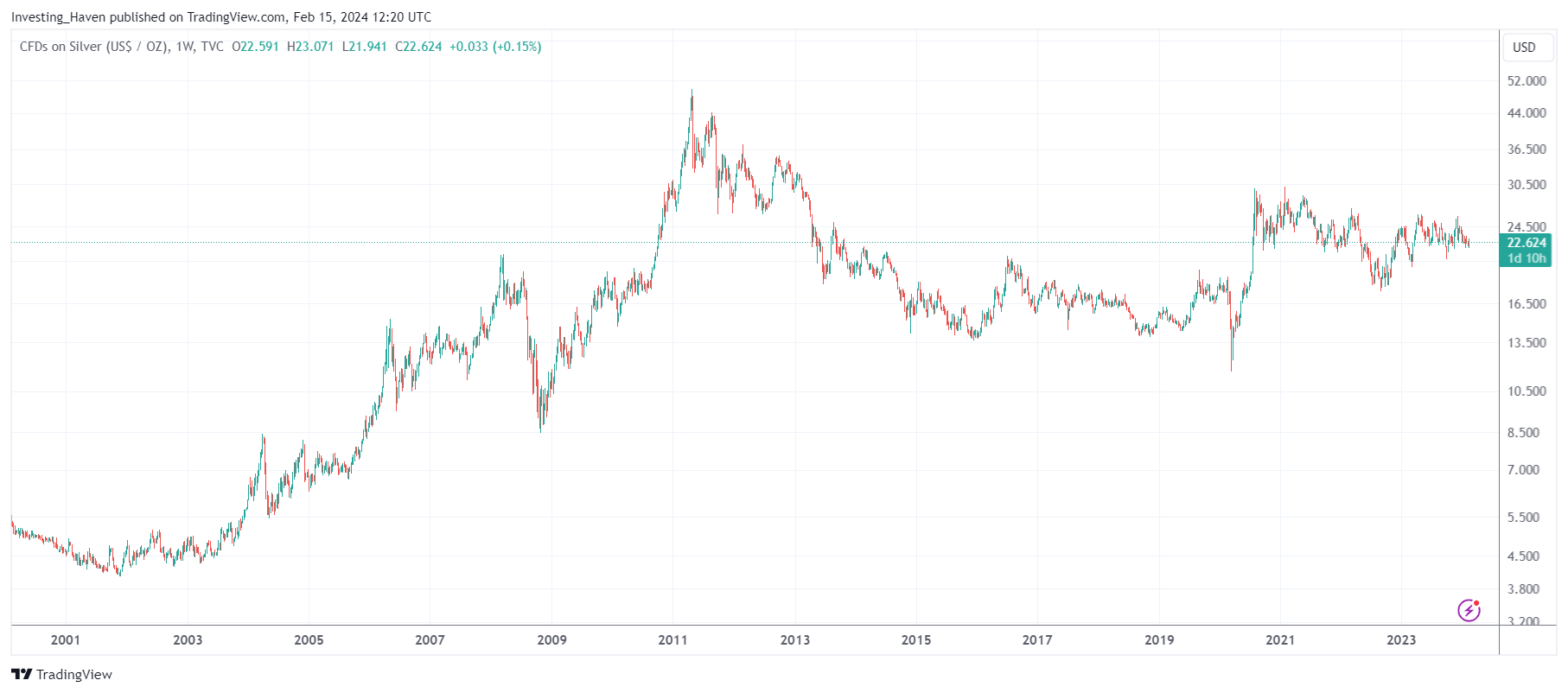

We start with the weekly chart.

As investors, our timeframe should be long. We are no traders, we invest in assets or asset classes of which we believe their value will rise.

When looking at the long term timeframe of the silver price, we would be inclined to ask “which silver price consolidation?” No joke, this consolidation is meaningless in the bigger scheme of things.

Silver price structure

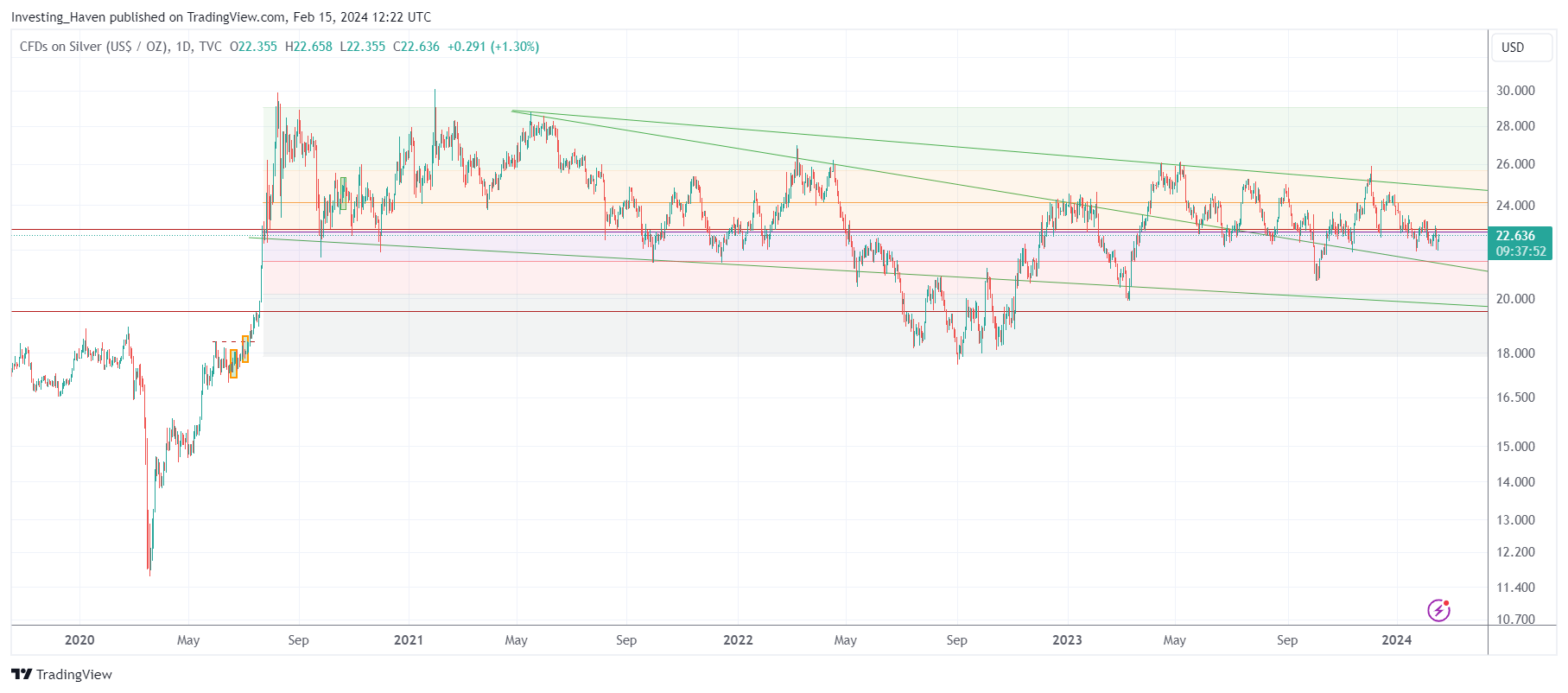

Let’s zoom in, to also address the astute reader that has a shorter timeframe.

This is the daily silver price chart.

What do you see? Nothing? Choppiness? Lack of excitement?

Let’s turn on our annotations now, to bring in structure.

What you can see is that silver is consolidating right at its 50% retracement level. Also, the price of silver is moving above the falling trendline. This setup has a lot of bullish potential. A lot and bullish are the words that stand out.

What about this bullish consolidation

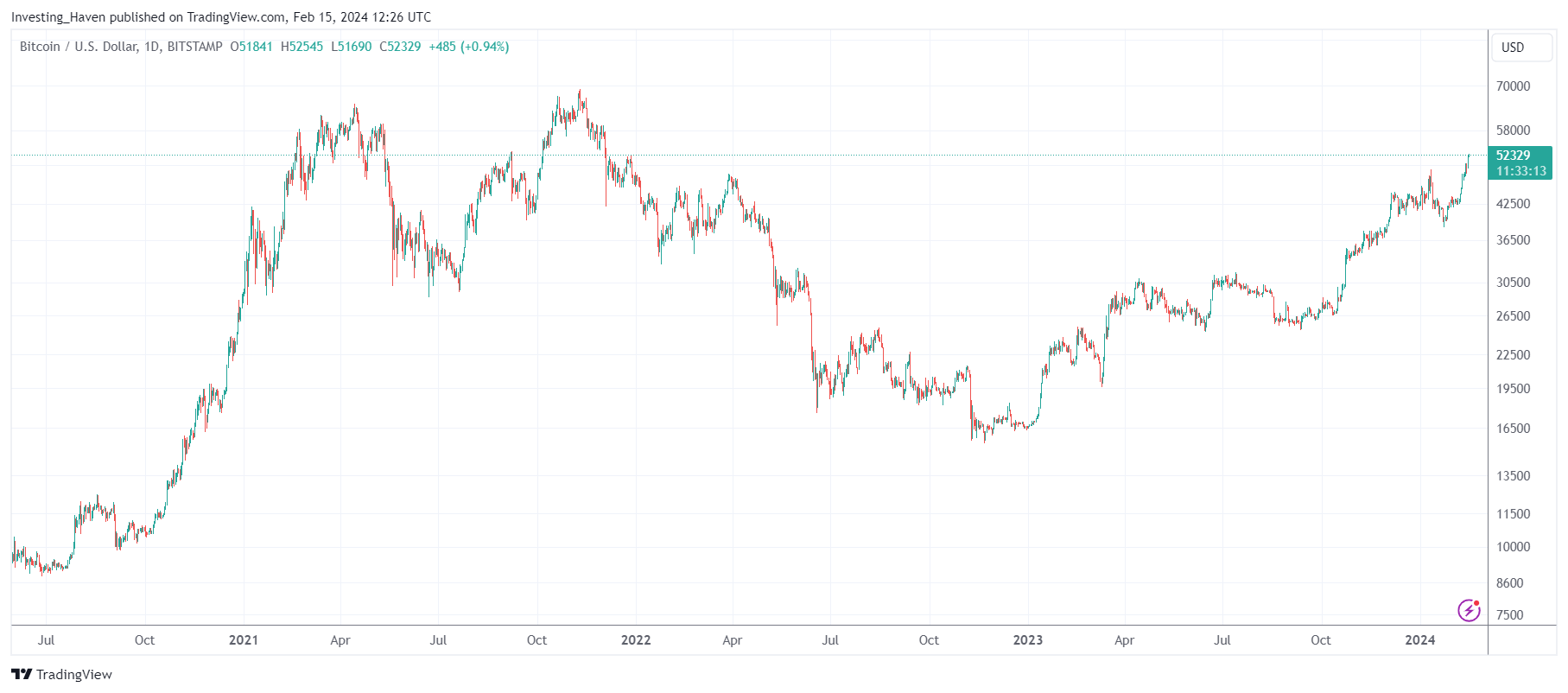

Now, let’s look at the concept of a consolidation, but now in other markets.

Back in 2023, there was hardly any crypto bull out there.

We were screaming it from the rooftops: buy crypto, it will be one the best investments of the decade. Most were laughing. Why? Because of the long consolidation (in crypto terms, the consolidation shown below is very long).

We saw the bullish of the consolidation.

Look how the consolidation resolved.

A very long consolidation

Similarly, how do you think investors in Tesla were ‘feeling’ when they were looking, day in day out, to the Tesla price chart in 2017, 2018, 2019?

The consolidation was very long. Very long. Consequently, you were considered a ‘fool’ to keep on holding Tesla shares.

This is how long consolidations in quality assets tend to resolve.

A long and slow consolidation

Consider now Core Lithium, our top pick in 2021, when it was going through a long and slow consolidation. How bad was this for investors in this lithium project?

This is how long and slow consolidations tend to resolve.

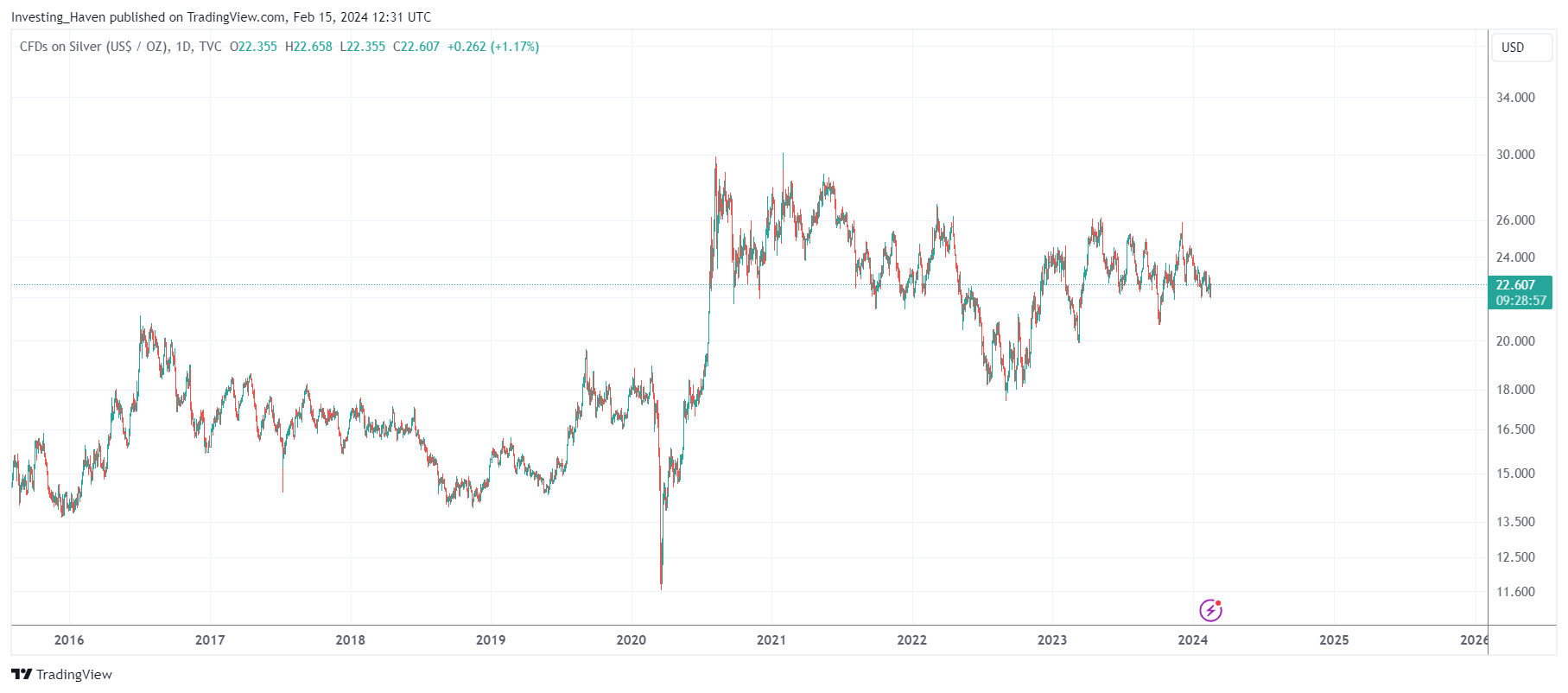

What about the outcome of the silver price consolidation?

Now, considering all points outlined above, it is helpful to go back to the daily silver price chart. We now take again the second daily silver chart, embedded in this article, without annotations.

We look at it through the lens of what we outlined.

How does this silver price consolidation look now?

What to expect from its outcome, say in 2025 and 2026?

What if the consolidation continues for a little longer?

Moreover, the Fed is not so far removed from the point of cutting rates. Considering what rate cuts have done for the price of silver in the past:

#Silver gained on average 413% over last three Fed rate cutting cycles.

— Peter Krauth (@peter_krauth) February 14, 2024

Should we really be so concerned?

And if the point is ‘opportunity cost’, i.e. holding silver while its flat and other assets are doing well, why not simply look for some exposure in our favorite 6 AI stocks or top cryptocurrencies, which are on the rise? A healthy mix of a portfolio, in which some positions experience momentum and others consolidate, is a good thing, not a bad thing.