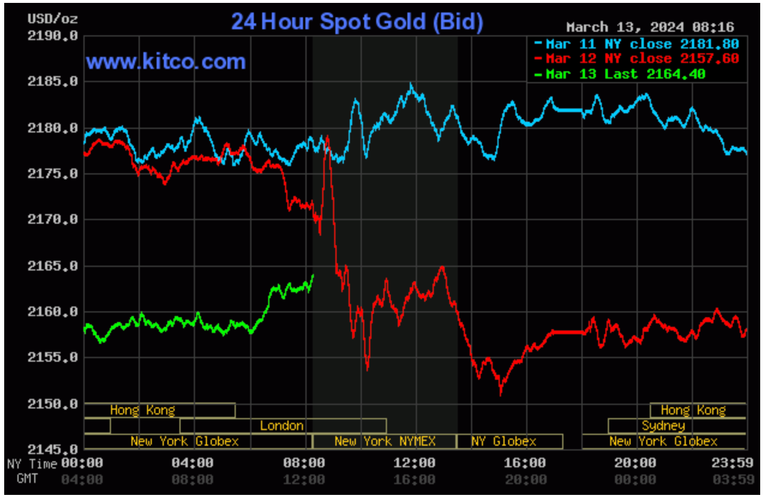

(Kitco News) – Gold and silver prices are just a bit firmer in early U.S. trading Wednesday. Bullish near-term technical postures and friendly outside markets (weaker USDX and firmer crude oil) are supporting mild buying interest in both precious metals today. April gold was last up $2.60 at $2,168.70. May silver was last up $0.146 at $24.535.

The marketplace has mostly digested Tuesday’s U.S. consumer price index for February that came in a bit warmer than expected, at up 3.2%, year-on-year, versus market expectations for a rise of 3.1%, and compares to a rise of 3.1% seen in the January report. The core CPI number for February was up 3.8% compared to expectations of up 3.7% and up 3.9% seen in the January report. The slightly warmer CPI readings followed the slightly warmer-than-expected CPI report for January. Thursday’s February producer price index report is now in focus. PPI in February is seen coming in up 0.3%, month-on-month, following a 0.3% rise in the January report. More warm U.S. inflation readings in the coming weeks may prevent the Federal Reserve from cutting interest rates as soon as it had just recently anticipated.

Asian and European stock markets were mixed in overnight trading. U.S. stock index futures are set to open mixed when the New York day session begins.

The key outside markets today see the U.S. dollar index near steady. Nymex crude oil prices are higher and trading around $78.75 a barrel. The yield on the benchmark 10-year U.S. Treasury note is presently fetching 4.162%.

U.S. economic data due for release Wednesday includes the weekly MBA mortgage applications survey and the weekly DOE liquid energy stocks report.

Technically, the gold futures bulls have the solid overall near-term technical advantage. A steep four-week-old uptrend is in place on the daily bar chart. Bulls’ next upside price objective is to produce a close in April futures above solid resistance at $2,250.00. Bears’ next near-term downside price objective is pushing futures prices below solid technical support at $2,100.00. First resistance is seen at $2,180.00 and then Tuesday’s high of $2,190.80. First support is seen at this week’s low of $2,156.20 and then at $2,150.00. Wyckoff’s Market Rating: 8.0.

The silver bulls have the overall near-term technical advantage. Prices hit a 2.5-month high Tuesday. Silver bulls’ next upside price objective is closing May futures prices above solid technical resistance at $26.00. The next downside price objective for the bears is closing prices below solid support at $23.50. First resistance is seen at this week’s high of $24.90

and then at $25.00. Next support is seen at this week’s low of $24.22 and then at $24.00. Wyckoff’s Market Rating: 6.5.

(Hey! My “Markets Front Burner” weekly email report is my best writing and analysis, I think, because I get to look ahead at the marketplace and do some market price forecasting. Plus, I’ll throw in an educational feature to move you up the ladder of trading/investing success. And it’s free! Email me at jim@jimwyckoff.com and I’ll add your email address to my Front Burner list.)

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Kitco Metals Inc. The author has made every effort to ensure accuracy of information provided; however, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in commodities, securities or other financial instruments. Kitco Metals Inc. and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.