Stay informed with free updates

Simply sign up to the UK property myFT Digest — delivered directly to your inbox.

Nearly three quarters of buy-to-let properties purchased this year have been bought by limited companies, showing landlords’ preference for the tax advantages of corporate ownership as borrowing costs soar.

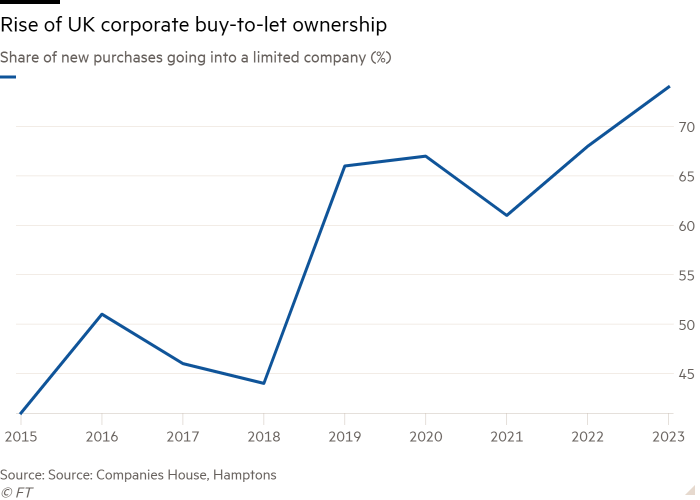

Landlords can choose to own a buy-to-let property in their own name or via a company structure. Some 74 per cent of buy-to-let purchases in England and Wales have gone down the corporate route so far in 2023, up from 68 per cent last year and 41 per cent in 2015, according to research by estate agency Hamptons.

The shift has been under way since full tax relief on mortgage interest for buy-to-let owners who own in their names was phased out between 2017 to 2020, and has accelerated with Bank of England interest rate increases.

Before 2017, landlords could deduct mortgage interest costs from their rental income when calculating profits and claim relief at their personal rate of income tax. Since the changes, claims are limited to the 20 per cent basic rate, leaving landlords who pay the higher or additional rate facing higher costs. Mortgage interest deductibility is still available to limited company owners, however.

The trend picked up after rates on landlord mortgages jumped this year in response to higher inflation. In December 2021, average rates on two-year buy-to-let mortgages were 2.9 per cent. Today, they are 6.6 per cent, according to data provider Moneyfacts.

“The rush to incorporate started six years ago and the rise in interest rates has just exacerbated this. It’s become an even more pressing issue,” said Sean Randall, a partner at tax adviser Blick Rothenberg.

Though rates remain high, some competition is returning to the mortgage market. Many lenders are trimming their rates, as the outlook for UK inflation — and banks’ costs of funding — has improved. The Mortgage Works, the buy-to-let arm of Nationwide, this week announced it was cutting rates by up to 0.5 percentage points. TSB and NatWest also dropped rates on their buy-to-let ranges.

Being able to access more attractive rental cover ratios is another factor in the growth of limited company landlords.

When judging the viability of a loan, lenders look to ensure the rental income covers mortgage payments with room to spare. Chris Sykes, consultant at broker Private Finance, said the standard coverage was 145 per cent of the mortgage cost, “whereas it’s 125 per cent for properties held within a limited company, offering the potential to borrow more”.

However, he added that the rates charged on limited company borrowers were typically higher than those offered to individual owners.

BM Solutions, the buy-to-let arm of Lloyds Banking Group, this week said it would allow “top slicing” if borrowers were falling short of qualifying for a mortgage. This means they could include not just rental income, but a share of their earned income, to meet rental coverage requirements.

Hamptons found that only 22 per cent of outstanding buy-to-let mortgages — the portion of the overall stock — were company-held. Three years ago, though, that figure was just 15 per cent.

Switching ownership to a company structure typically incurs transaction costs: a landlord will pay stamp duty land tax in England and Northern Ireland (or a similar transaction tax in Scotland and Wales) and may face a capital gains tax bill when selling to the corporate vehicle.

Aneisha Beveridge, research director at Hamptons, said the share of new buy-to-let purchases going into a company was likely to be close to its ceiling. “There will always be some investors for whom owning homes in their own name will make the most sense,” she said. “The minority without a mortgage or lower-rate taxpayers will continue to prop up the number of homes held in personal names.”

The analysis also looked at regional variations, finding that rental properties in the north of England were most likely to be owned by a limited company. This reflected higher rental yields in the region, Beveridge said, a factor that appealed particularly to larger-scale portfolio landlords.

“Interestingly, a quarter of all limited company buy-to-lets located in the north-east are owned by London-based limited companies,” she said.