The administrators of Indigo Michael Limited have announced that all current SafetyNet Credit and Tappliy balances are being written off. And that any affordability complaints have to be made within the next few weeks.

The administrators of Indigo Michael Limited have announced that all current SafetyNet Credit and Tappliy balances are being written off. And that any affordability complaints have to be made within the next few weeks.

My previous article SafetyNet Credit goes into administration gives details about why the lender failed. And also why, unusually, it was allowed to carry on lending to existing customers for a few months in administration.

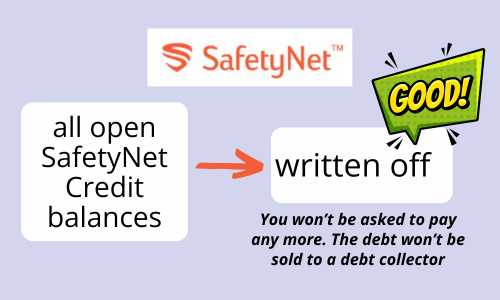

Loan write-offs

Their website now says:

Collections for outstanding SafetyNet and Tappily loans will cease after 9 April 2024. For any customers who still have an outstanding balance at this point, this will be marked as partially settled on their credit file to reflect that the loan was not fully repaid.

Customers who still owe a balance are getting an email that also says:

- no scheduled payments will be attempted to be taken;

- any Standing Orders will bounce and customers should cancel them.

How many loans are affected?

It isn’t clear at the moment how many SafetyNet Credit and Tappily debts have been written off.

At the start of the administration in January 2023, there were 142,000 customers with open loans. 41,000 of these accounts were not in arrears and had borrowed in the previous 30 days.

As SafetyNet Credit was a form of “rolling credit”, many customers who were not actively trying to clear a balance would borrow each month. So a lot of the remaining 100,000 loans may have been in default. But some of these loans will now have been repaid.

Loans that had been sold to a debt collector before the administration in January 2023 are not affected.

Good news if your loan has been written off

The administrations have been using CRS to collect debt repayments. It is likely that all of the remaining loans that have been written off will have been defaulted or will have missed payments on their credit record.

In this situation, getting the remaining balance cleared and the debt marked as partially settled is normally very good news.

You should stop paying CRS if you have been. This debt is not going to be sold to a debt collector.

What about your credit record?

How long the debt stays on your credit record will depend on whether it has defaulted:

- if there is a default recorded on the debt on your credit record, then the record will drop off 6 years after the date of the default;

- if there is no default recorded, just missed payments / arrears, then the debt will drop off 6 years from the settlement date, which will be this month.

If you think there is an error on your credit report – perhaps some of the dates or amounts are wrong, perhaps a default should have been added but wasn’t, or was added when it should not have been – you have two options.

At the moment, you can email help@imladmin.co.uk and ask them to correct your credit record. People in other administrations have found getting administrators to listen and take a problem seriously is a difficult and frustrating procedure, but it may work.

Or you can wait 6-12 months, by which time the administrators will no longer be replying to any queries. At that point you can ask the Credit Reference Agencies to “suppress” the incorrect record so it isn’t visible to other lenders. See Correct credit records by “suppressing” them if the lender has disappeared for details on what to do. But at the moment – March 2024 – it is too early to do this.

Any affordability complaints must be made now

If you win an affordability complaint, you may be owed a refund. Customers who are owed refunds for unaffordable lending are treated as “unsecured creditors” by the administrators.

The latest administrators report (Feb 24) says that unsecured creditors may be paid 3-4p in the £, or possibly a bit more. So if you should have had a refund of £1,000, you may receive £30-40.

The administrators website says:

We will no longer be able to accept new complaints from 15 April 2024. Complaints submitted prior to this date will be assessed and customers advised of the outcome as usual.

So if you want to make a complaint, you should do this quickly. Email help@imladmin.co.uk with the subject AFFORDABILITY COMPLAINT. You don’t have to go into detail., just say how long you were borrowing and how it was hard to repay this.

Any questions?

Ask them in the comments below.