(Bloomberg) — European stocks futures were steady, while Asian equities gained ahead of the Federal Reserve’s key inflation metric that will help identify the path forward for interest rates. Bitcoin’s rally extended past $63,000.

Most Read from Bloomberg

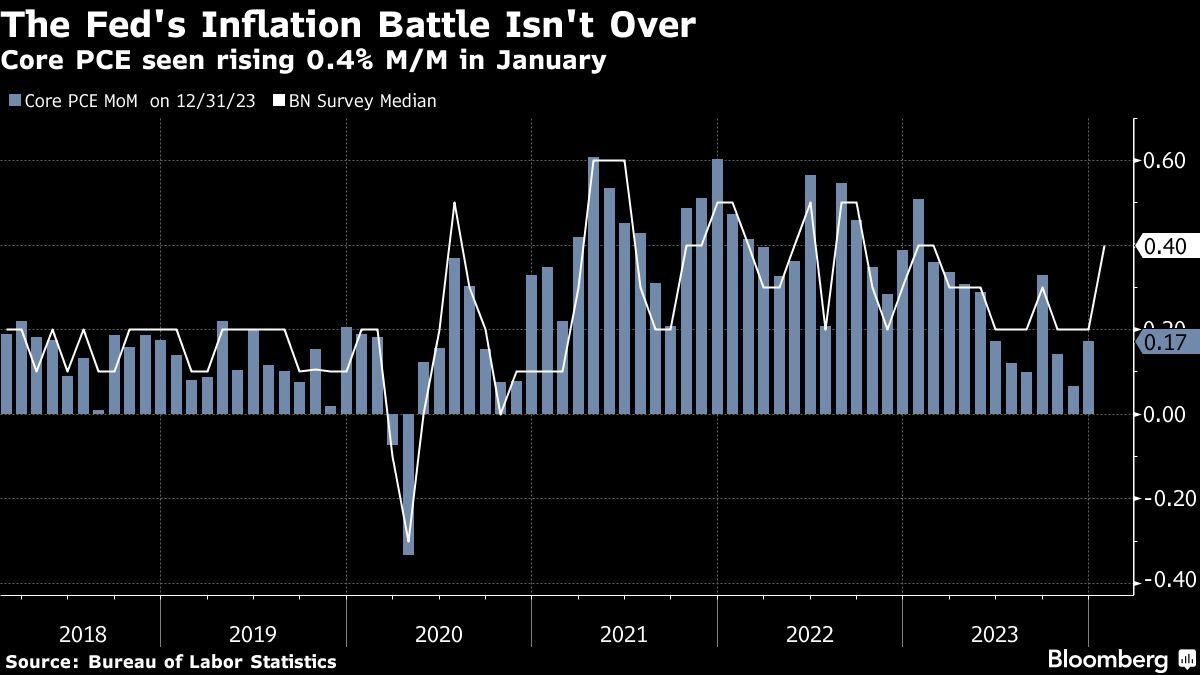

The Euro Stoxx 50 contract was little changed along with the US equity futures. Traders await the core personal consumption expenditure gauge that will likely highlight the bumpy path the central bank faces in achieving its 2% target. The PCE data due later Thursday is seen validating recent commentary from officials showing no rush to ease monetary policy.

A gauge of regional equities reversed early losses, driven by a rebound in Chinese shares. The yen climbed the most in more than a week against the dollar after Bank of Japan Board Member Hajime Takata signaled that the case for ending the negative interest rate policy is gaining momentum.

Chinese equities have rebounded sharply this month and are set for their biggest outperformance versus global stocks since July after authorities took a slew of measures to bolster sentiment. Investors are looking ahead to next week’s meeting of the National People’s Congress to deliver more support measures.

“The momentum may be sustained toward the commencement of the NPC” on March 5, with most focus on ministerial comments on capital market reform and industrial policies, said Redmond Wong, strategist at Saxo Capital Markets. But “elevated prices can set the stage for disappointment,” he said.

Declines for US stocks overnight came as data showed strong consumer spending despite a small revision to US gross domestic product growth in the fourth quarter of 2023. The report comes ahead of the Fed’s favored inflation gauge and was broadly supportive of the caution voiced by Fed officials in recent weeks.

Treasuries were steady in Asia after a rally on Wednesday saw the 10-year yield falling four basis points and the policy-sensitive two-year slipping six basis points.

New York Fed President John Williams said Wednesday the central bank has “a ways to go,” in its battle against inflation and Atlanta Fed chief Raphael Bostic urged patience in regard to policy tweaks.

Traders are currently pricing around 80 basis points of easing by year-end — almost in line with what officials in December indicated as the likeliest outcome. That would equate to three cuts in 2024 — as the Fed moves have historically been increments of 25 basis points. To put things in perspective, swaps were projecting almost 150 basis points of cuts this year at the start of February.

A gauge of dollar was slightly weak against major currencies after rising on Wednesday. The yen strengthened as high as 149.70 versus the dollar as investors positioned a likely narrowing in the interest rate gap between Japan and the US.

“We expect the BOJ to take advantage of this reflationary environment to exit negative rates, but the policy stance will remain very accommodative through 2025,” Jessica Hinds, director at Fitch Ratings said in a note.

Bitcoin extended gains after surging above $60,000 for the first time in more than two years Wednesday, reflecting new demand from exchange traded funds. The currency almost touched $64,000. The 2021 record high is just below $69,000.

Alibaba shares dropped in Hong Kong after the company rolled out its second major cost cuts for cloud services in years. Air France-KLM reported a quarterly loss versus expectations of a profit as the Franco-Dutch airline suffered from high costs and geopolitical tensions.

In Asia, economic reports due Thursday include fourth-quarter GDP data for India, the current account balance in Thailand, and inflation data for Sri Lanka and Vietnam.

Elsewhere, SQM, the world’s second-largest lithium producer, reported a 82% drop in quarterly profits amid global glut for battery material that the company expects will keep prices subdued this year.

Key Events This Week:

-

Germany CPI, unemployment, Thursday

-

US consumer income, PCE deflator, initial jobless claims, Thursday

-

Fed’s Austan Goolsbee, Raphael Bostic and Loretta Mester speak, Thursday

-

China official PMI, Caixin manufacturing PMI, Friday

-

Eurozone S&P Global Manufacturing PMI, CPI, unemployment, Friday

-

BOE chief economist Huw Pill speaks, Friday

-

US construction spending, ISM Manufacturing, University of Michigan consumer sentiment, Friday

-

Fed’s Raphael Bostic and Mary Daly speak, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures were little changed as of 3:27 p.m. Tokyo time

-

Nasdaq 100 futures were little changed

-

S&P/ASX 200 futures fell 0.1%

-

Hong Kong’s Hang Seng rose 0.2%

-

The Shanghai Composite rose 1.3%

-

Euro Stoxx 50 futures were little changed

Currencies

-

The Bloomberg Dollar Spot Index fell 0.1%

-

The euro was little changed at $1.0835

-

The Japanese yen rose 0.6% to 149.86 per dollar

-

The offshore yuan was little changed at 7.2088 per dollar

Cryptocurrencies

-

Bitcoin rose 4.3% to $63,143.81

-

Ether rose 4.6% to $3,477.08

Bonds

Commodities

This story was produced with the assistance of Bloomberg Automation.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.