Fund selectors reveal which strategies they would pick to build an allocation to global equities.

Global funds can sometimes be US funds in disguise – offering regional diversification in name but not in reality – so it is important to look underneath the bonnet. This is especially the case for index trackers, as the US accounts for more than 70% of the MSCI World and more than 60% of the FTSE All World index.

Moreover, the hegemony of a few technology stocks over the past decade means that they now dominate global indices. As a result, investors need to make sure that their allocations to global equities do not unintentionally overexpose them to a narrow subset of companies.

Below, experts explain how to navigate those risks when building an allocation to global equities.

BlackRock Global Unconstrained Equity, Stewart Investors Worldwide Sustainability and Schroder Global Sustainable Value Equity

For Rob Morgan, chief analyst at Charles Stanley, chose three funds with different investment styles that provide diversification from one another.

BlackRock Global Unconstrained Equity invests in what manager Alistair Hibbert and FE fundinfo Alpha Manager Michael Constantis see as the ‘growth compounders’ of the coming decade.

Morgan said: “This is a pure stock picking fund with a very defined approach and style in the hands of an accomplished manager. It is likely to be more volatile, however, given the very high conviction approach.”

The fund is highly concentrated, with the top 10 holdings accounting for 60% of the portfolio.

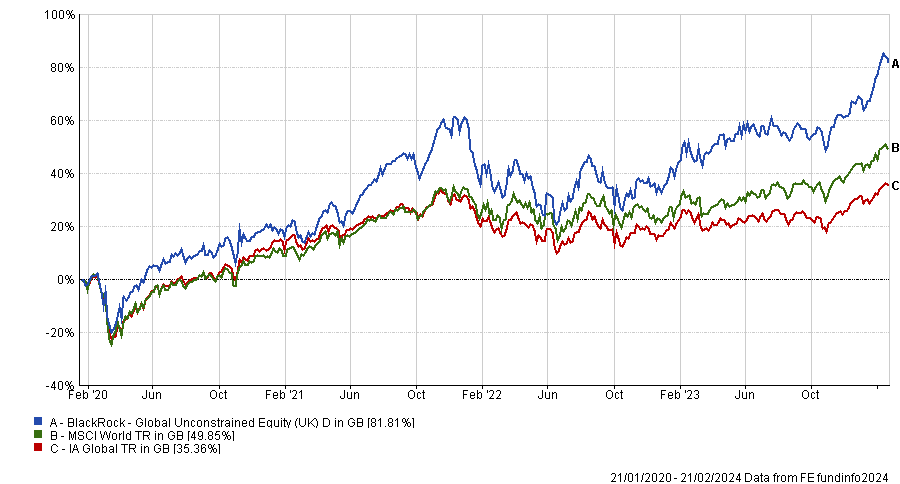

Performance of fund since launch vs sector and benchmark

Source: FE Analytics

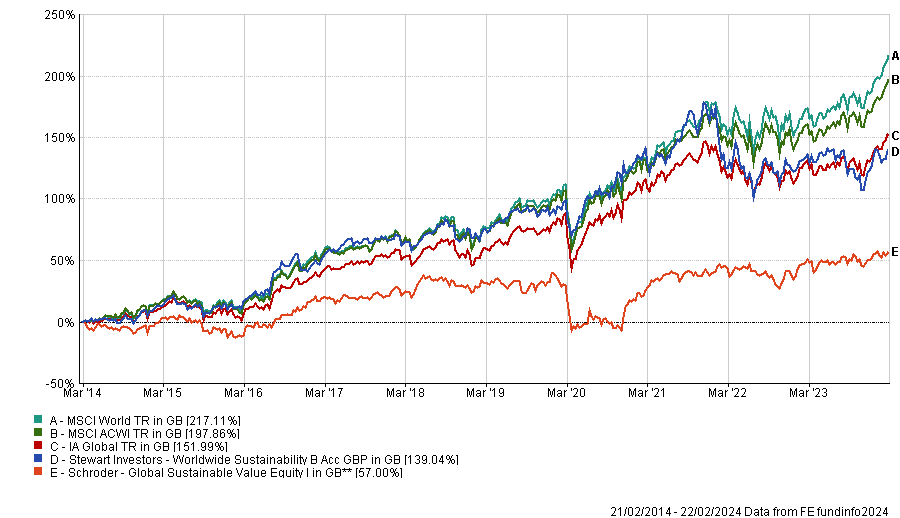

Stewart Investors Worldwide Sustainability seeks to identify sustainable business models and predictable growth.

Morgan said: “The approach focuses on companies whose operations reduce negative environmental and social impacts, and steers away from companies facing sustainability headwinds, so it could be of particular interest to investors looking to take a responsible approach with a focus on quality growth companies.”

Performance of funds over 10yrs vs sectors and benchmarks

Source: FE Analytics

Finally, Schroder Global Sustainable Value Equity provides diversification from growth funds and passive options.

Morgan added: “Given its distinct style, concentrated portfolio and differentiation from the global benchmark and many of its peers, performance may be erratic on a relative basis in the shorter term but could bring something completely different to portfolios dominated by growth stocks.”

Scottish Mortgage, AVI Global and Heriot Global

Sheridan Admans, head of fund selection at TILLIT, picked a purist high-growth approach with Scottish Mortgage, a value focus with AVI Global and a dividend growth strategy via Heriot Global.

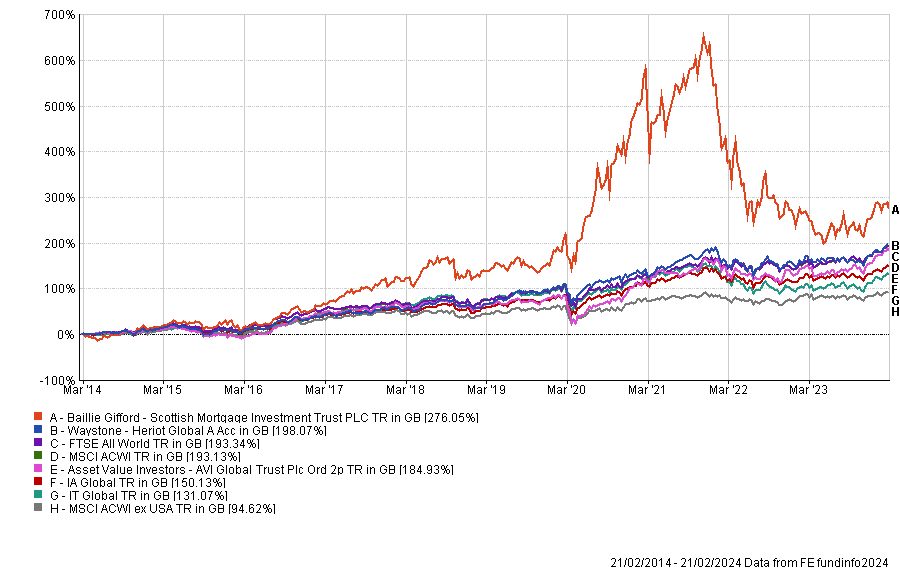

Performance of funds over 10yrs vs sectors and benchmarks

Source: FE Analytics

Scottish Mortgage invests in companies with structural growth potential across public and private markets. The trust has a bias towards tech and takes large bets in its key holdings.

Admans warned that it should be a long-term investment with at least a 10-year view.

Unlike Scottish Mortgage, AVI Global has less exposure to the US and technology. Therefore, it tends to struggle when the US is performing particularly well.

Admans added: “This is a global value-style investment trust focused on three key areas: family-controlled companies, investing in other closed-ended funds and trusts, and high-quality companies trading at a discount to NAV.”

Heriot Global invests in companies with solid cashflows that have the ability to pay dividends, even if they don’t pay one currently.

Admans stressed, however, that the focus on more defensive companies means that the fund is likely to underperform in a risk-on environment, but should hold up better in falling markets.

Polar Capital Global Insurance, AXA Framlington Global Technology and CT Global Extended Alpha

Darius McDermott, managing director of FundCalibre, chose two sector specialists and a quality growth strategy.

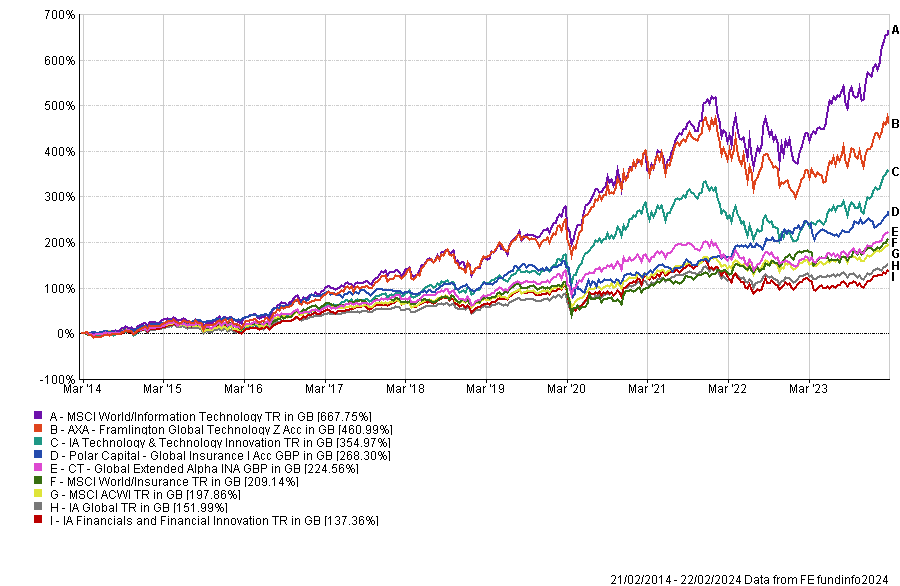

Performance of funds over 10yrs vs sectors and benchmarks

Source: FE Analytics

Source: FE Analytics

Polar Capital Global Insurance is designed to provide exposure to non-life insurance companies, a sector that McDermott noted for often being undervalued.

He said: “Everything around us is insured, regardless of economic boom or bust, which provides this fund with very good defensive characteristics.”

The second sector specialist is AXA Framlington Global Technology, managed by Jeremy Gleeson.

McDermott said: “Its lack of benchmark constraints means it is free to invest in ‘new technology’ rather than ‘old commodity’ companies.

“Gleeson’s level-headed commitment to finding new opportunities with strong commercial potential, and ignoring yesterday’s winners, coupled with his and his team’s vast experience, makes make AXA Framlington Global Technology an appealing option.”

CT Global Extended Alpha gives investors exposure to businesses benefiting from high returns on capital. Its 130/30 structure allows the manager Neil Robson to short stocks he expects to do badly.

McDermott said: “When implemented correctly, the 130/30 fund structure can help to magnify a good team’s performance and give investors more bang for their buck. The fund has benefited from its quality growth style being in favour in recent years, but even so the long-term performance has still been very strong.”

Vanguard Global Equity and Royal London Global Equity Income

Dan Coatsworth, investment analyst at AJ Bell, suggested combining a balanced global equity fund with an income fund.

He pointed to Vanguard Global Equity for investors looking to hedge their bets in terms of investment style, as the fund blends growth and value.

Performance of fund since launch vs sector and benchmark

Source: FE Analytics

Coatsworth said: “Having a balance of both styles could help to reduce volatility in a portfolio. It means the investor doesn’t have to worry about timing the market and flip-flopping between whichever style is working.”

The growth portion of the portfolio is managed by Baillie Gifford, while Wellington oversees the value side.

Coatsworth also chose Royal London Global Equity Income, which offers exposure to companies with a dividend yield at least 20% higher than the market.

As the fund was launched in February 2020, the track record is limited, but the fund has delivered a 73.8% return since inception, which is more than twice that of the IA Global Equity Income sector.

Performance of fund since launch vs sector and benchmark

Source: FE Analytics

Coatsworth said: “Royal London’s fund is slightly different in that it has a mix of stocks offering lower starting yields but faster dividend growth, together with more mature businesses with higher starting yields. It believes this blended approach helps to insulate the portfolio from the worst effects of market rotations.”