Sensex Today Live : Jio Financial Services share price jumps 14% to a record high; market cap crosses ₹2 lakh crore

Sensex Today Live : Jio Financial Services share price jumped more than 14% to hit a record high on Friday, extending the rally for the fifth consecutive session. Jio Financial shares surged as much as 14.50% to hit a record high of ₹347 apiece on the BSE.

Jio Financial Services shares have rallied more than 48% in the past three months and over 40% on a year-to-date (YTD) basis, with its market capitalization crossing ₹2 lakh crore.

The demerged entity of Reliance Industries Ltd (RIL), Jio Financial Services was listed on the stock exchanges on August 21, 2023.

Sensex Today Live : Sector Indices Heat Map

Sensex Today Live : Across sectors, PSU Bank and Oil & Gas were the top losers, down nearly 1% and 0.37%, respectively.

Sensex Today Live : Broader market indices heat map

Sensex Today Live : The broader market outperformed the benchmark indices, with the Smallcap and Midcap indices remaining in the green through the day’s trading session.

Sensex Today Live : Gainers and Losers on Nifty

On Nifty, Bajaj Finserv, SBI Life, Dr. Reddy’s, Titan and HDFC Life, were the top gainers.

Sensex Today Live : Gainers and Losers on Sensex

HCL Tech, Asian Paints, Maruti, SBI and JSW were the top loser on Sensex.

Sensex Today Live : 3 pm market update

Sensex Today Live : In a day marked with choppy trading when the Indian benchmark indices opened higher, Sensex and Nifty 50 were trading muted on Friday in the closing hours of the trading session after coming down from the day’s highs.

At 3 pm, Sensex was up 45.94 points, or 0.06%, at 73,204.18, and Nifty was up 4.90 points, or 0.02%, at 22,222.35.

Sensex Today Live : Prabhudas Lilladher overweight on telecom due to rising data usage

Sensex Today Live : Prabhudas Lilladher turns overweight on Bharti Airtel in its model portfolio as a structural play on rising data usage in E-commerce, Infotainment, etc.

Expects sustained growth in the coming years. Institutional equities broking firm believes completion of 5G auctions will provide a trigger over the coming few months.

Sensex Today Live : Prabhudas Lilladher underweight on Oil & Gas, Overweight on Reliance

Sensex Today Live : Prabhudas Lilladher remains underweight but may turn overweight on RIL.

The firm believes that sustained growth in retail and expected forays in new energy segments will drive the next leg of growth in the company, even as earlier initiatives might see demerger on the lines of Jio finance unlocking value for shareholders.

Sensex Today Live : Prabhudas Lilladher underweight on Automobiles due to tepid volume recovery

Sensex Today Live : Prabhudas Lilladher remains positive on PV segment and have Maruti, M&M and TAMO in their model portfolio.

The firm believes that sustained traction and margin improvement in the Auto business of M&M will provide visibility despite near term headwinds in the tractor business.

Tata Motors will benefit from strong order book in JLR and growth momentum in the domestic PV business.

Sensex Today Live : Prabhudas Lilladher retains equal weight on IT as industry’s recovery gets delayed

IT services: Equal weight: Prabhudas Lilladher retains Equal weight on IT services as recovery in IT services is getting delayed. We believe segments like Engineering design services, ERP, Data Analytics, Digital, Artificial intelligence and supply chain etc. will drive growth in the next cycle.

Sensex Today Live : 2 pm market update

Sensex Today Live : Indian benchmark indices were muted on Friday after coming down from the day’s highs.

At 2 pm, Sensex was up 5.15 points, or 0.01%, at 73,163.39 and Nifty was up 13.20 points, or 0.06%, at 22,230.65.

Sensex Today Live : Prabhudas Lilladher overweight on Capital Goods driven by the strong growth visibility over the next three to five years

Sensex Today Live : Prabhudas Lilladher remains overweight on capital goods by 560 bps given strong the growth visibility over the next 3-5 years.

The firm increased the weight behind ABB given its strong order inflow and growth outlook and removed Bharat Electronics from its model portfolio post sharp rally.

The brokerage also positions ABB and Siemens as structural play and expects significant value unlocking in Siemens from the de-merger of Siemens energy in the coming 12-18 months.

Sensex Today Live : Prabhudas Lilladher underweight on Consumer due to tepid volume recovery

Sensex Today Live : The brokerage remains underweight on consumer staples given the industry’s tepid volume recovery, rising competition from regional players and rich valuations.

The broking firm cut the weight behind TITAN, Avenue and ITC, but introduced Astral Poly and Interglobe Aviation as a part of discretionary consumption.

Sensex Today Live : 1 pm market update

Sensex Today Live : 1 pm market updatndices were off the day’s high to trade range-bound on Friday.

At 1 pm, Sensex was up 142.28 points, or 0.19%, at 73,300.52 and Nifty was up 43 points, or 0.19%, at 22,260.45.

Sensex Today Live : Prabhudas Lilladher overweight on Healthcare as benign API prices spur generic pharma players

Sensex Today Live : Prabhudas Lilladher remains overweight on healthcare by 240bps as generic pharma players will benefit from benign API prices and stable US pricing while domestic growth is intact. We remain positive on Hospitals led by Max healthcare with huge overweight given expected increase of 33% in bed capacity in FY25 even as it is maintaining above teens growth with little capacity addition as of now.

Sensex Today Live : Prabhudas Lilladher overweight on Banks on sustained credit growth

Sensex Today Live : Prabhudas Lilladher has 220bps (190 earlier) overweight on Banks on sustained strong credit growth and asset quality while NIM seems to have peaked out.

Rising LDR concerns in a few banks led by HDFC have resulted in sharp correction in HDFC Bank and brakes on other private banks.

We believe HDFC Bank will take time to regain its mojo and reduce LDR to sub 100% levels. Although we remain overweight, we have cut our allocation from 13.5% to 11.5%.

The institutional equities broking firm is raising weight of SBI by 70bps as it is still trading at a 20-25% discount to its peak P/BV of 1.8x and has room to grow assets while maintaining asset quality.

Sensex Today Live : Sector Indices Heat Map

Sensex Today Live : Across sectors the PSU Bank index was the biggest loser, down 1%.

Sensex Today Live : Gainers and Losers on Nifty

Sensex Today Live : Cipla, Dr. Reddy’s, SBI Life, HDFC Life and Titan were the biggest gainers on the Nifty.

Sensex Today Live : Gainers and Losers on Sensex

Paints major Asian Paints was the top loser on Sensex at noon.

Sensex Today Live : 12 pm market update

Sensex Today Live : Indian benchmark indices were off the day’s high and trading muted at noon, after opening higher on Friday.

At 12 pm, Sensex was up 65.67 points, or 0.09%, at 73,223.91 and Nifty was up 15.25 points, or 0.07%, at 22,232.70.

Sensex Today Live : Prabhudas Lilladher anticipates a high-rise for Nifty, expects 25,363 by end of Dec’24

Sensex Today Live : Prabhudas Lilladher has provided an upward scenario in its Nifty target of 12 months, from 24544 to 25363 (base case scenario), by the end of December 2024m in its latest India Strategy report.

Amnish Aggarwal, Director – Research, Prabhudas Lilladher Pvt. Ltd says that this increase in Nifty target estimate is due to the upward revision in the 15-year average PE (18.9x) with Dec 25 EPS of ₹1,342 which was earlier based on 18.3x Dec 25 EPS of ₹1,343.

In the bull case, Prabhudas Lilladher values NIFTY at 6% premium to 15-year average PE 20x (5% discount to 10-year avg. at 19.3x earlier) and arrives at bull case target of 26885 (25907 earlier). In the Bear case scenario, Nifty can trade at 13% discount to LPA (25% earlier) with a target of 22066 (20453 earlier).

Sensex Today Live : Elara Securities India says competition escalating for IndiGo airlines; gives outlook

Sensex Today Live : INDIGO’s competitors turn aggressive on fleet addition.

Between September 2023 and January 2024, InterGlobe Aviation lost domestic market share from the peak of 63.4% to 60.2%, which mirrored the strong fleet addition by competitors at 26 narrow body aircraft (20 by Air India, three by Vistara and three by Akasa), versus 12 by INDIGO.

P&W engine issues to hit fleet near term

Expect domestic-demand-supply to be mostly balanced in H1FY25, post which domestic market may witness oversupply in H2.

Easing capacity constraints in key metros in FY26 to be the key to drive future demand

Despite near-term hiccups, long-term aviation story intact

Expect FY23-28E domestic passenger traffic CAGR at ~12-15%, driven by: government focus on improving air connectivity beyond tier 1 /2 cities, large order book of domestic carriers (1,606 outstanding order book as on December 2023) – ~350 net deliveries are expected in the next five years (~600 new deliveries less ~175 old fleet retirals) and higher capacity at existing key metro airports.

Retain Reduce on INDIGO

We retain Reduce, given the anticipated pause in market share growth and potential margin decline in H2FY25 with TP at INR 3,005 based on 8.0x FY26E EV/EBITDA. We expect a 19% passenger volume CAGR in FY23-26E.

Sensex Today Live : Buy or sell: Rajesh Palviya of Axis Securities recommends BEL, Jio Financial Services, SML Isuzu stock for today

Sensex Today Live : Stock Recommendations for today By Rajesh Palviya, SVP – Technical and Derivatives Research, Axis Securities

Bharat Electronics Ltd (BEL) (CMP ₹196.30)

With almost 4% gains, the stock has decisively broken out its “multiple resistance” zone breakout at 192 levels on a closing basis, indicating positive bias. This breakout is accompanied by a huge volume, which signifies increased participation at the breakout. The stock is well placed and sustained above its 20, 50, and 100-day SMA, which reconfirms a strong uptrend. The stock has also registered an all-time high, which shows positive sentiments. This momentum is expected to extend towards 210–230 levels. The short-term support zone is around 188–185 levels, said Rajesh.

BEL has seen a long build in Thursday’s session with a price gain of 4% and an OI gain of 2.5%, indicating a long build. On the options front, 200 Call has the highest OI concentration, indicating a probable resistance zone, while significant writing at 195 Put Strike indicates strong support for the stock, explained Palviya.

Jio Financial Services Ltd (CMP ₹305.80)

In the weekly time frame, the stock has experienced a “multiple resistance” breakout in the range of 268–270 levels. Huge volumes at this rally signify increased participation. The weekly Bollinger band buy signal shows increased momentum. The stock is well placed above its 20, 50, and 100-day SMA, and these averages are inching up along with the price rise. Investors should buy, hold, and accumulate this stock with an expected upside of 330–365 with a downside support zone of 1290–280 levels, advised Rajesh.

SML Isuzu Ltd (CMP ₹1,818)

On the monthly time frame, the stock is surpassing its “multi-month” resistance zone of 1550–1600 levels, indicating bullish sentiments. This rally is accompanied by huge volumes, indicating a strong comeback of bulls. The stock is in a strong uptrend, forming a series of higher tops and bottoms across all the time frames, indicating bullish sentiments. Investors should buy, hold, and accumulate this stock with an expected upside of 1885–1950 and a downside support zone of 1640–1550 levels, said Palviya.

Sensex Today Live : Atmastco share price lists with 18% premium at ₹91 apiece on the NSE SME

Sensex Today Live : Atmastco share price made a decent stock market debut on Friday with the stock listing at a premium of 18.18% on NSE SME platform.

Atmastco shares were listed at ₹91 apiece on the NSE Emerge, a premium of over 18% to the issue price of ₹77 per share.

Ahead of the listing, Atmastco IPO GMP today was ₹6 per share, which meant that Atmastco shares were trading at a premium of 7.79% to the issue price at ₹83 in the grey market today.

EPC contractor Atmastco Ltd launched its initial public offering (IPO) on February 15 to raise ₹56.25 crore from the primary market. The bidding for the Atmastco IPO ended on February 20 and the issue received strong investors’ participation as it was booked 17.61 times against its offer size. Atmastco IPO listing date was fixed on February 23 and the SME IPO allotment was done on February 22.

Atmastco raised ₹56.25 crore from the fixed price issue comprising a combination of fresh issue of 54.8 lakh equity shares aggregating to ₹42.20 crore and an offer for sale (OFS) of 18.26 lakh shares aggregating to ₹14.06 crore. Atmastco IPO price band was set at ₹77 per share and the IPO lot size was 1,600 shares.

Sensex Today Live : 11 am market update

Sensex Today Live : Indian benchmark indices erased their early lead to trade flat on Friday.

At 11 am, Sensex was up 62.26 points, or 0.09%, at 73,220.50 and Nifty was up 15.85 points, or 0.07%, at 22,233.30.

Sensex Today Live : Esconet Technologies share price lists with 245 % premium at ₹290 a piece on the NSE SME board

Sensex Today Live : Esconet Technologies share price saw a stellar debut, listing at ₹290 on the NSE SME, a 245% premium over the issue price.

Esconet Technologies IPO that opened for subscription on February 16 and closed on February 20 , had received a strong response from the investors. The Esconet Technologies IPO was subscribed 507.24 times. The public issue was subscribed 553.02 times in the retail category, 156.02 times in QIB, and 868.05 times in the NII category by February 20, 2024.

Esconet Technologies IPO GMP or grey market premium stood at ₹100 per share, as per investorgain.com . This indicates that Esconet Technologies shares was trading at a robust premium of 119.05% in the grey market as compared to its IPO price of ₹84 per share. The grey market premium also indicated the the street was expecting strong listing of share at ₹184 a piece.

Esconet Technologies is raising ₹28.22 crore from the IPO that is entirely a fresh issue of 33.6 lakh equity shares. The company proposes to utilise the fresh issue proceeds towards working capital requirements, investment in Wholly Owned Subsidiary, viz. Zeacloud Services Private Limited, to fund its capital expenditure expenses, and general corporate expenses.

Sensex Today Live : Thaai Casting lists at ₹186, 141% premium to IPO price

Sensex Today Live : Thaai Casting share price made a strong debut on the bourses today, February 23, 2024, as the stock open at ₹185.90 apiece on NSE SME, a premium of 141.55% to the issue price of ₹77. The stock surged further to hit an intraday high of ₹195.15 apiece.

The ₹47.20 crore SME IPO was open for subscription between February 15 and February 20, with a price band in the range of 73–77 per share. The IPO comprises a fresh issue of equity shares worth 61.3 lakh shares.

The issue was overall subscribed to 345.85 times. The issue received a stellar response from retail investors whose portion set was subscribed to 467.94 times and a solid response from non-institutional buyers whose portion set was subscribed to 960 times. The qualified institutional buyers (QIBs) portion was subscribed to 76 times, according to data on Trendlyne.

The company plans to use the net proceeds from the issue for capital expenditure and general corporate purposes.

Sensex Today Live : Prataap Snacks shares down nearly 3% after denying its in talks with ITC for a 47% stake sale

Sensex Today Live : Prataap Snacks on Thursday rejected media reports that ITC is planning to buy a 47% stake in the company. The Yellow Diamond parent firm issued a clarification in which it said that it is not in any negotiations with the FMCG giant for the stake sale.

“The company is not in negotiations as reported in the above-referred news article,” said the company in its BSE filing, while mentioning an article reporting a stock surge after reports of ITC stake sale talks.

Sensex Today Live : 10 am market update

Indian benchmark indices rallied at open on Friday, taking cues from a rally in global stocks led by tech-focussed stocks. But the initial enthusiasm was curbed a bit as the trading session progressed.

At 10 am, Sensex was up 120.34 points, or 0.16%, at 73,278.58 and Nifty was up 41.20 points, or 0.19%, at 22,258.65.

Sensex Today Live : Vodafone Idea shares up nearly 8% on fundraise move

Sensex Today Live : Vodafone Idea shares witnessed strong buying interest among the Indian stock market bulls. After the announcement of the board meeting on 27th February 2024 to discuss fundraising, Vodafone Idea shares attracted the attention of Dalal Street bulls in early morning deals and opened with an upside gap. The telecom stock went on to touch an intraday high of ₹17.65 apiece on NSE, logging an intraday gain of 8 percent against its previous close of ₹16.30 per share.

While climbing to its intraday high of ₹17.60 apiece on NSE during the early morning session, Vodafone Idea share price today came close to its existing 52-week high of ₹18.40 apiece that it had climbed in January this year.

According to stock market experts, Vodafone Idea share price today is on an uptrend due to the fundraising news. Avinash Gorakshkar, Head of Research at Profitmart Securities said about the rally in its stock price, “Vodafone Idea share price is rising today as the market has responded positively at the telecom company’s decision to go for the fundraising. The company has a fixed board meeting on 27th February and hence bulls’ are reacting to this positive development in the company.”

Sensex Today Live : Sector Indices Heat Map

Sensex Today Live : Across sectors, PSU Banks and Realty stocks were up nearly 1% each.

Sensex Today Live : Broader market indices heat map

The broader market was trending up in the early hours of Friday’s trading session.

Sensex Today Live : Gainers and Losers on Sensex

Hero MotoCorp, Titan, Grasim Industries, LTIMindtree, and HDFC Bank, were the top losers on Nifty.

Sensex Today Live : Gainers and Losers on Sensex

Sensex Today Live : Asian Paints, Axis Bank, Airtel, ICICI Bank, and NTPC were the top losers on Sensex.

Sensex Today Live : Opening Bell

Indian benchmark indices rallied at open on Friday, following a rally in global stocks led by tech-focussed stocks.

At opening bell, Sensex was up 236.20 points, or 0.32%, at 73,394.44 and Nifty was up 33.85 points, or 0.15%, at 22,251.30.

Sensex Today Live: Sensex, Nifty advance at pre-open driven

Indian benchmark indices were in the green at pre-open on Friday, driven by strong cues from global peers.

Sensex was up 247.08 points, or 0.34%, at 73,405.32 and Nifty was up 72.55 points, or 0.33%, at 22,290 during pre-open.

Sensex Today Live : Reliance Securities gives technical outlook on Bank Nifty

Bank Nifty has closed in a doji candle and bounced from the support of 46,400 levels to close flat to negative for the day.

On the higher side 47,600 will act as resistance and on the downside support is placed at 46,800 followed by 46,300 levels being the hourly averages crossover.

RSI is trending above the average line and we expect the momentum to continue to test the higher band over the next few days.

Bank Nifty highest call OI is at 47,000 levels while on the downside put OI is at 46,500 levels for the monthly expiry.

Sensex Today Live : Reliance Securities gives technical outlook on Nifty-50

Nifty-50 bounced from the support of 20 day average, scaled a new all time high and closed near the higher end of the range.

The volatility was high in the range of 21,800-22,300 levels being the weekly expiry and sharp short covering in call options.

The retest of averages and reversal confirms the continuation of the up move to 22,400 levels over the next few days.

Highest call OI is at with 22,500 strike while on the downside the highest put OI is at 22,000 for the monthly expiry.

Sensex Today Live : HSBC mutual fund fully exits Paytm; Quant, Aditya Birla reduce shareholdings by 72%: Fisdom

Sensex Today Live : After the Reserve Bank of India (RBI) placed operational restrictions on Paytm Payments Bank (PPBL) due to the ongoing non-compliance issues and significant supervisory concerns, HSBC mutual fund (MF) completely exited from the stock (One 97 Communications) in January ’24, from its actively managed funds.

Quant MF on the other hand reduced the exposure by 72.4 percent during the same period and Aditya Birla Sunlife MF has reduced the exposure by 10 per cent, according to brokerage house Fisdom Research. After the RBI action, shares of One 97 Communications shares declined 55 per cent on NSE and BSE. Moreover, following the announcement, major players such as Jefferies and Macquarie also downgraded the stock rating.

Fisdom Research also highlighted that before the recent decline since January 31, the MF industry’s shareholding in Paytm had increased by 41 per cent in January 2024 from December 2023. As per the brokerage, in terms of share count, Nippon MF, Mirae Mutual Fund, and Motilal Oswal Mutual Fund rank as the top three, holding the largest number of Paytm shares in their portfolios as of January 2024.

Sensex Today Live : Buy or sell – Vaishali Parekh recommends three stocks to buy today — February 23

Sensex Today Live : Vaishali Parekh, Vice President — Technical Research at Prabhudas Lilladher believes that the Indian stock market mood has turned positive after the strong rebound on Thursday’s session. The Prabhudas Lilladher expert said that the Nifty 50 index is now heading for its immediate targets placed at 22,400 and 22,800 levels. (Read her stock picks here.)

Sensex Today Live : Day trading guide for stock market today: Seven stocks to buy or sell on Friday — 23rd February

Sensex Today Live : After the sharp selling in small and mid-cap stocks, the Indian stock market opened lower on Thursday. However, bulls came back strongly in the last session and most of the Indian sectors witnessed sharp buying, which helped Dalal Street recuperate its losses and end higher. Except for the Bank Nifty index, all sectors ended in the green zone with IT and auto being the outperformers.

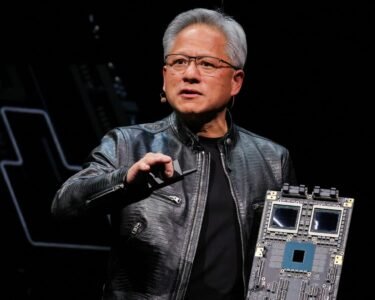

Global stocks rallied, with Japan’s benchmark hitting a record high and Europe’s on track to do the same after Nvidia’s blowout sales forecast reinforced investor conviction in the boom in generative AI use. (Read the full story here.)

Sensex Today Live : Dividend stocks – Bosch, Bharat Forge, National Aluminium, Sun TV among 21 stocks to trade ex-dividend today

Shares of Bosch, National Aluminium Co., Sun TV Network, Bharat Forge, Kirloskar Oil Engines, Cantabil Retail India, Aegis Logistics, BLS International Services, India Nippon Electricals, Career Point, Dynamatic Technologies, Gretex Corporate Services, Garden Reach Shipbuilders & Engineers, Modison, Nicco Parks & Resorts, Nirlon, Sandesh, Saurashtra Cement, Taparia Tools, United Drilling Tools, Xchanging Solutions, Zydus Lifesciences, Kaveri Seed Company, and Remedium Lifecare, will be in focus when the stock market opens on February 23 (Friday) as the Board of Directors of these companies have declared interim dividend, shares buyback, and stock split for their eligible shareholders. (Check details here.)

Sensex Today Live : SAIL, Biocon, ZEEL among 15 stocks under F&O ban list today

Aditya Birla Fashion and Retail, Ashok Leyland, Balrampur Chini Mills, Bandhan Bank, Biocon, GMR Infra, GNFC, Hindustan Copper, Indus Towers, National Aluminium Company, Piramal Enterprises, PVR INOX, RBL Bank, SAIL, and ZEEL are the 15 stocks that are part of the F&O ban list by the stock market exchange for February 23.

Sensex Today Live : What to expect from Indian stock market in trade on February 23

Sensex Today Live : The Indian stock market indices, Nifty 50 and Sensex, today are expected to open higher following positive global market cues.

The trends on Gift Nifty also indicate a higher start for the Indian benchmark index. The Gift Nifty was trading around 22,310 level as compared to the Nifty futures’ previous close of 22,270.

On Wednesday, the frontline indices witnessed an excellent upside recovery from the intraday lows and closed the day with handsome gains with the Nifty 50 registering a new all-time high at 22,252 levels. (Read the full story here.)

Sensex Today Live: Seven key things that changed for market overnight – Gift Nifty, RBI minutes to Nvidia stock price jump

Sensex Today Live: The domestic equity indices are likely to open higher on Friday, extending previous session’s rally, led by positive global market cues.

Asian markets traded higher, while the US stock market rallied overnight with the S&P 500 ending at a record high and the Dow Jones Industrials Average closing above 39,000 for the first time.

The bullish global market sentiment was led by a buoyant outlook from Nvidia Corp., the most valuable chipmaker, whose shares surged 16% amid artificial-intelligence mania, boosting its market value by $277 billion in a single day. (Read the full story here.)

Sensex Today Live: Buoyant global peers drive Gift Nifty up; Indicate strong start in India Markets

Sensex Today Live: Driven by buoyant global peers, Gift Nifty futures, at 22,304.50 at 7:50 am on Friday morning, climbed higher than Thursday’s Nifty close of 22,217.45, indicating a strong opening for Indian benchmark indices.

Hong Kong stocks opened lower on Friday, a day after Japanese, US and European markets saw surging tech gains driven by demand for AI-powering chips.

The Hang Seng Index opened down 0.5 percent, or 88.27 points, to 16,654.68.

The Shanghai Composite Index was up 0.2 percent, or 4.55 points, at 2,992.91, and the Shenzhen Composite Index on China’s second exchange added 0.4 percent, or 5.85 points, to 1,655.95.