In an unprecedented move that signals a transformative shift in Ireland’s mortgage market, MoCo, a fresh entrant backed by the Austrian giant Bawag, has unveiled plans to push the boundaries of mortgage repayment. By extending the age limit for repaying loans to 80 years, this initiative not only broadens the horizon for prospective homeowners but also ignites a conversation on the future of housing finance in a country grappling with evolving demographic and economic landscapes.

Breaking New Ground in Mortgage Terms

The announcement by MoCo marks a significant departure from traditional mortgage models, reflecting an adaptive response to the changing needs of the Irish population. With the extension of the mortgage repayment age, individuals who are looking to downsize or those whose personal circumstances have shifted now have a wider window to manage their financial commitments. This move is seen as a beacon of hope for many who feared the tightening grip of mortgage deadlines as they approach retirement.

However, the initiative is not without its challenges. Policy specialist Nat O’Connor has raised pertinent concerns regarding the need for stringent Central Bank regulations to safeguard borrowers against potential pitfalls such as heightened interest rates and onerous insurance costs that could disproportionately impact the elderly. The overarching goal, according to O’Connor, is to ensure that this extended mortgage term does not inadvertently lead to individuals losing their homes in their twilight years due to inflexible financial structures.

Reflecting Societal Shifts

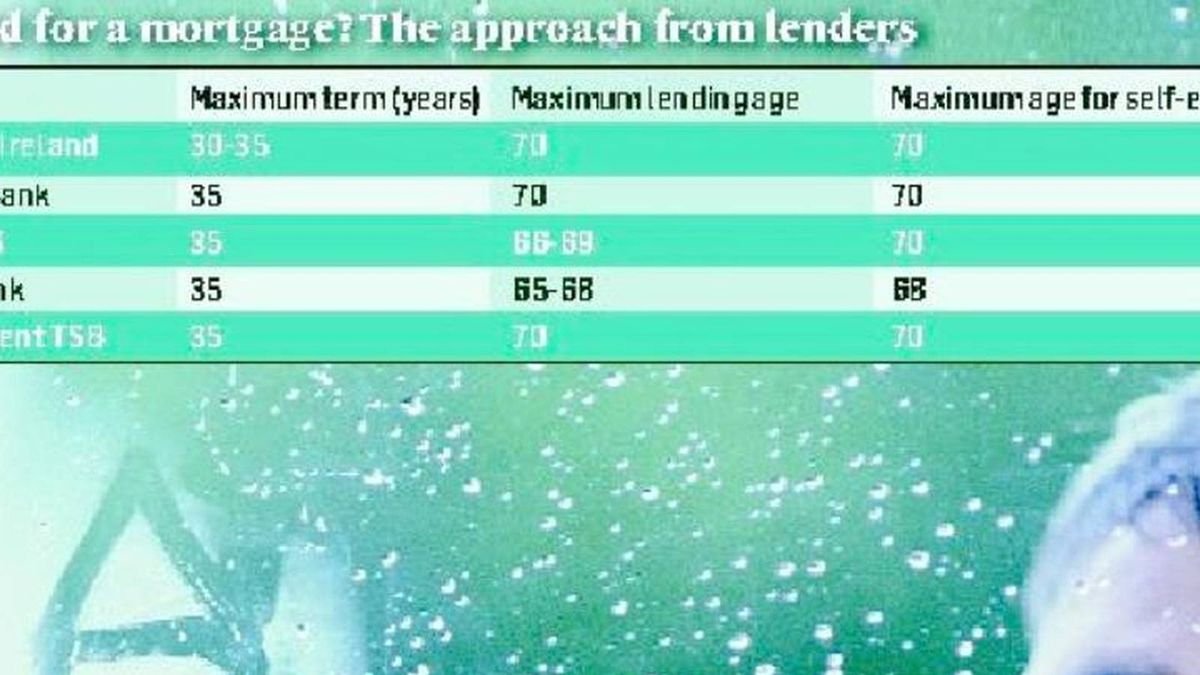

The evolving landscape of mortgage repayment terms in Ireland mirrors broader demographic shifts and legal evolutions, with the average age of homeownership on the rise. Experts, while skeptical about the immediate prospect of mortgages lasting until the age of 80 becoming commonplace, acknowledge a growing acceptance of extended repayment schedules. This shift is partly driven by the realization that longer mortgage terms can provide a lifeline to individuals who, due to various life events or financial challenges, find themselves in need of more time to fulfill their homeownership dreams.

As MoCo steps into the Irish market with its innovative offering, it sets the stage for a reimagined approach to mortgage financing. This move, emblematic of a broader trend towards flexibility and adaptability in financial services, underscores the industry’s recognition of the need to evolve in tandem with societal changes.

Charting the Course Forward

The introduction of extended mortgage repayment terms by MoCo and the subsequent dialogue it has sparked serve as a critical juncture for the Irish mortgage industry. It highlights the imperative for both lenders and regulators to tread carefully, balancing innovation with the protection of consumers’ interests. The conversation underscores the importance of robust regulatory frameworks that not only accommodate but actively support the changing dynamics of homeownership, ensuring that the dream of owning a home remains within reach, regardless of age.

In conclusion, MoCo’s groundbreaking policy to extend the mortgage repayment age limit to 80 encapsulates the ongoing transformation within Ireland’s housing finance sector. It reflects a cautious yet optimistic step towards redefining the parameters of mortgage lending, driven by a deep understanding of the shifting financial and demographic realities facing today’s and tomorrow’s homeowners. As Ireland navigates this changing terrain, the focus remains steadfast on creating a more inclusive, flexible, and sustainable mortgage market for all.