A version of this story first appeared on TKer.co.

Stocks made new record highs, with the S&P 500 reaching a closing high of 5,137.08 and an intraday high of 5,140.33 on Friday. For the week, the S&P gained 1%. The index is now up 7.7% year to date and up 43.6% from its October 12, 2022 closing low of 3,577.03.

In the markets and the economy, things rarely unfold exactly as expected. Often they’re better than expected. Sometimes they’re far worse.

In the same way that it’s helpful for investors to be mentally prepared for bad news and market volatility, it’s smart to balance that by also understanding what could go right.

Two hyped developments of late are the boom in artificial intelligence (AI) technologies and the emergence of GLP-1 drugs. Both are innovations that are expected to have far-reaching implications.

This past week came with bullish Wall Street research on each.

Here’s Morgan Stanley on AI (emphasis added):

… there is a notable amount of overlap among the industries discussing operational efficiency most prevalently and those that have the potential to realize more significant AI-driven efficiency gains based on the new framework we introduce in this report. … We see AI-driven productivity adding an additional 30 bps to 2025 net margin for the S&P 500 (13.0% net margin in the base case) though we believe risk is skewed to the upside/our bull case in this respect — 50 bps of added impact.

One of the biggest stories in the stock market in recent years has been the persistence of historically high profit margins. AI could prove to be a key tailwind that enables companies to turn a little bit of revenue growth into a lot of earnings growth.

Here’s Goldman Sachs on GLP-1 drugs (emphasis added):

… GLP-1 drugs could significantly reduce obesity, and obesity-related health complications subtract 3% from per capita output according to academic estimates. Under reasonable estimates for uptake and effectiveness, we estimate that GLP-1 drugs could raise GDP levels by 0.4%, with the effect rising to 1% if the number of users reaches the 60mn benchmark our equity analysts see as possible.

This is also encouraging, especially as some of the major economic tailwinds of late fade and GDP growth cools.

Zooming out

Sure, it’s possible that much of the upside with these stories is already priced into the markets. It’s also possible that the actual results are less exciting than anticipated.

But it’s also possible that we learn that analysts like those at Morgan Stanley and Goldman Sachs actually underestimated the promise of AI and GLP 1 drugs.

The bottom line is that people continue to come up with new ways to enhance productivity, and some of these innovations have gotten real traction.

All eyes are on these trends as we better understand just how big of an impact they will have on the markets and the economy.

Barclays raises its target for the S&P 500

On Tuesday, Barclays’ Venu Krishna raised his year-end target for the S&P 500 to 5,300 from 4,800. This is his first revision from his initial target.

“The U.S. economy continues to defy rates headwinds in 2024, much as mega-cap Tech continues to defy even the most bullish earnings target,” he wrote. “Economic strength in the U.S. has seemingly surprised even the most bullish market estimates. Robust domestic consumption and employment exiting 4Q23 suggests that any macro slowdown for the U.S. in 2024 is looking increasingly limited.“

Krishna is not alone in tweaking his forecasts. His peers at UBS, Goldman Sachs, RBC, and CFRA are among those who’ve already raised their targets.

Don’t be surprised to see more of these revisions as the S&P 500’s performance, so far, has exceeded many strategists’ expectations.

S&P 500 gets new stocks

From S&P Dow Jones Indices on Friday:

S&P MidCap 400 constituents Super Micro Computer Inc. (NASD: SMCI) and Deckers Outdoor Corp. (NYSE: DECK) will replace Whirlpool Corp. (NYSE: WHR) and Zion Bancorporation N.A. (NASD: ZION) in the S&P 500 respectively, and Whirlpool and Zion Bancorporation will replace Super Micro Computer and Deckers Outdoor in the S&P MidCap 400, respectively.

The change will be effective when the market opens on March 18.

Reviewing the macro crosscurrents

There were a few notable data points and macroeconomic developments from last week to consider:

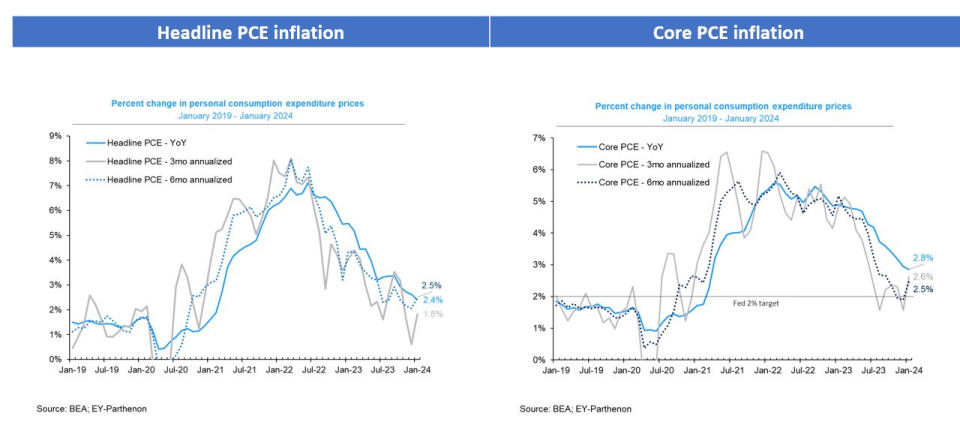

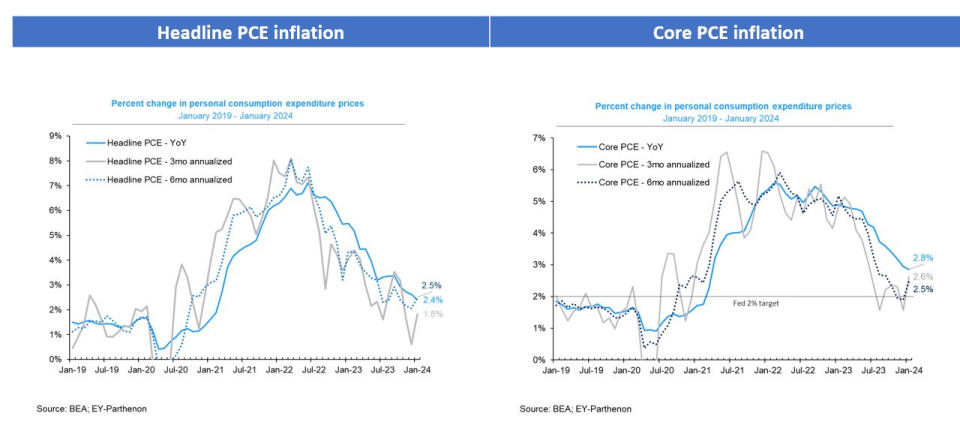

Inflation trends continue to cool. The personal consumption expenditures (PCE) price index in January was up 2.4% from a year ago, down from December’s 2.6% rate. The core PCE price index — the Federal Reserve’s preferred measure of inflation — was up 2.8% during the month, the lowest print since March 2021.

On a month over month basis, the core PCE price index was up 0.3%, up from the prior month’s print of 0.1%. If you annualized the rolling three-month and six-month figures, the core PCE price index was up 2.6% and 2.5%, respectively.

While inflation rates are hovering near the Federal Reserve’s target rate of 2%, the central bank has indicated that it wants prices to stay cool for a little while before it is confident that inflation is under control. So even though there may not be more rate hikes and rate cuts may be around the corner, rates are likely to be kept high for a while.

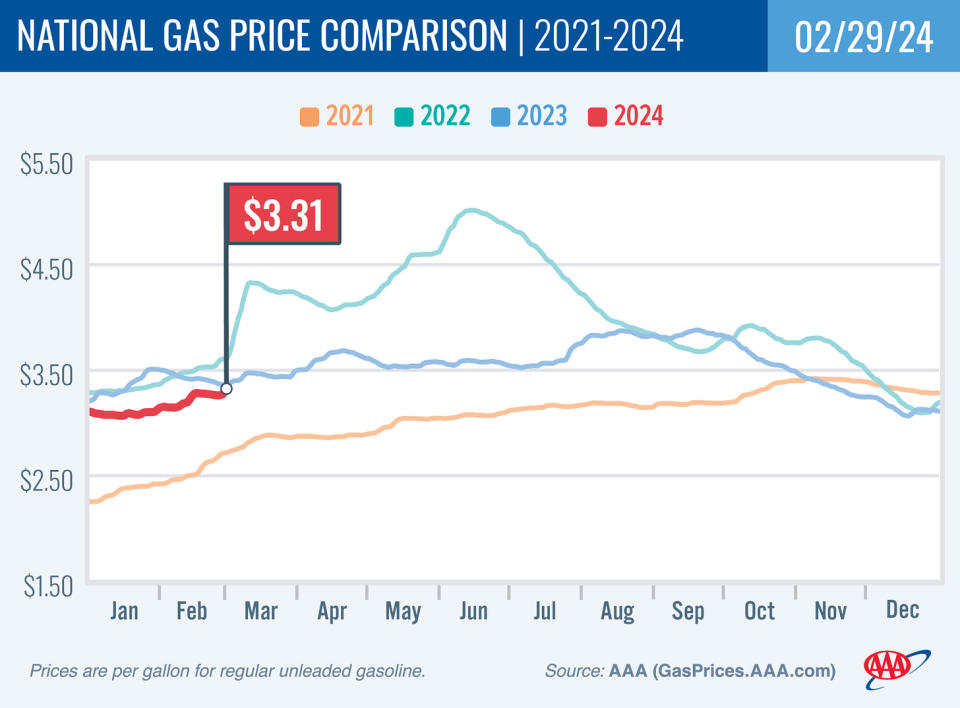

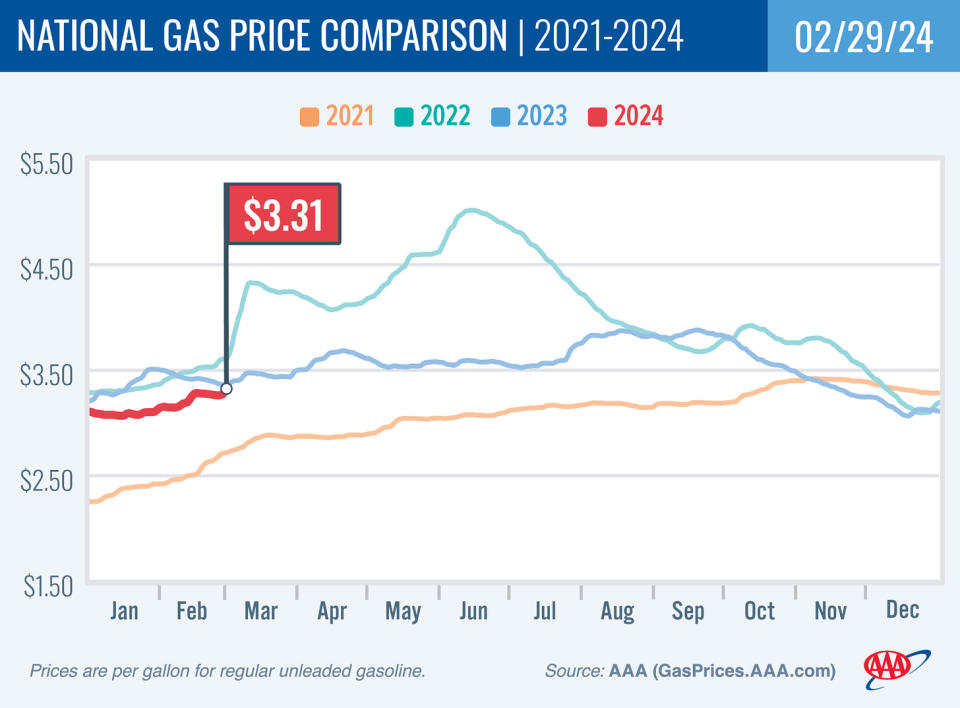

Gas prices rise. From AAA: “Drivers saw gas prices creep up the final week of February. The national average for a gallon of gas is $3.31 on this leap day, 4 cents higher than it was one week ago. The upward trend is likely to continue as travelers start heading out of town for Spring Break.”

Consumers are spending. According to BEA data, personal consumption expenditures increased 0.2% month over month in January to a record annual rate of $19.05 trillion.

Adjusted for inflation, real personal consumption expenditures declined by a modest 0.1%.

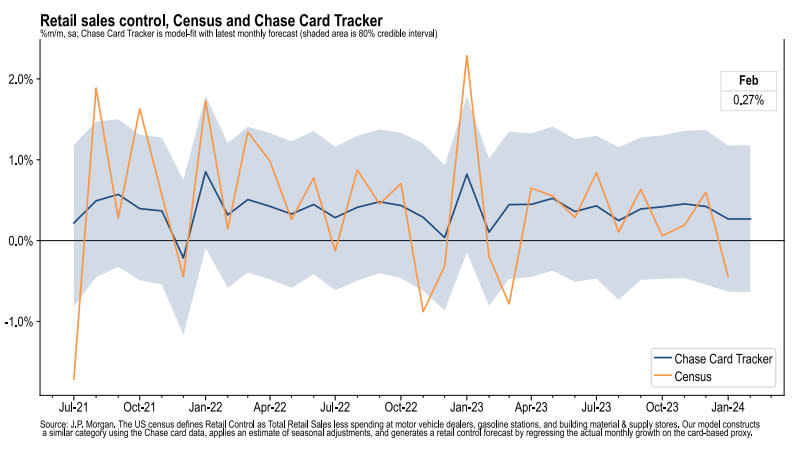

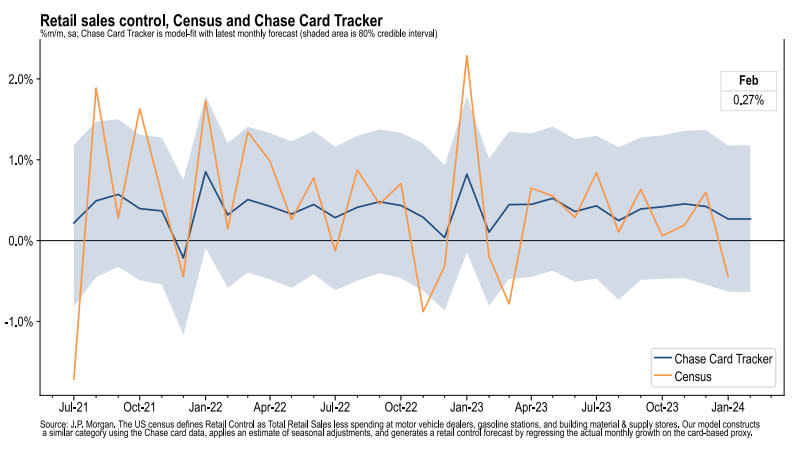

Card data suggests spending is holding up. From JPMorgan: “As of 21 Feb 2024, our Chase Consumer Card spending data (unadjusted) was 0.5% below the same day last year. Based on the Chase Consumer Card data through 21 Feb 2024, our estimate of the US Census February control measure of retail sales m/m is 0.27%.”

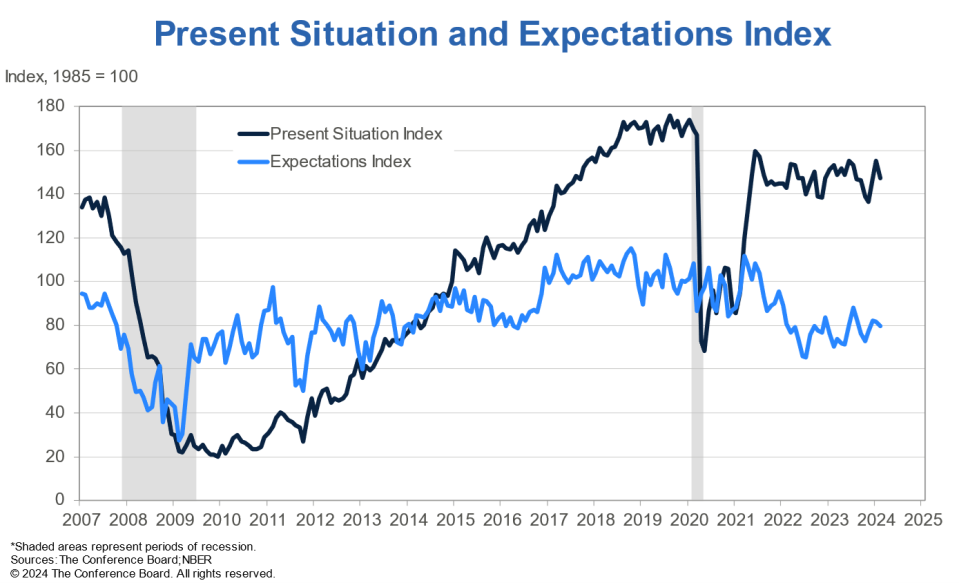

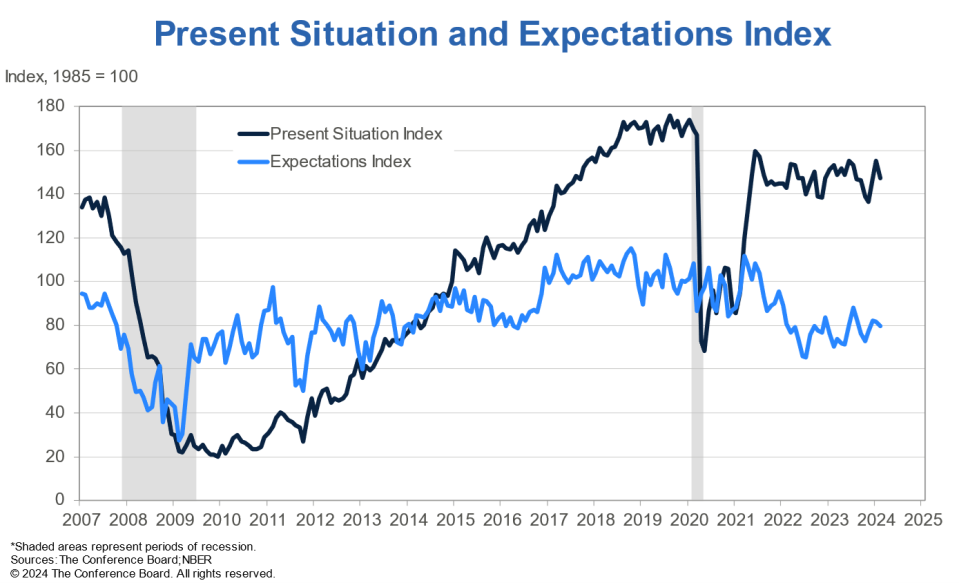

Consumer vibes recovery takes a pause. From The Conference Board’s February Consumer Confidence survey: “The decline in consumer confidence in February interrupted a three-month rise, reflecting persistent uncertainty about the US economy… February’s write-in responses revealed that while overall inflation remained the main preoccupation of consumers, they are now a bit less concerned about food and gas prices, which have eased in recent months. But they are more concerned about the labor market situation and the US political environment.”

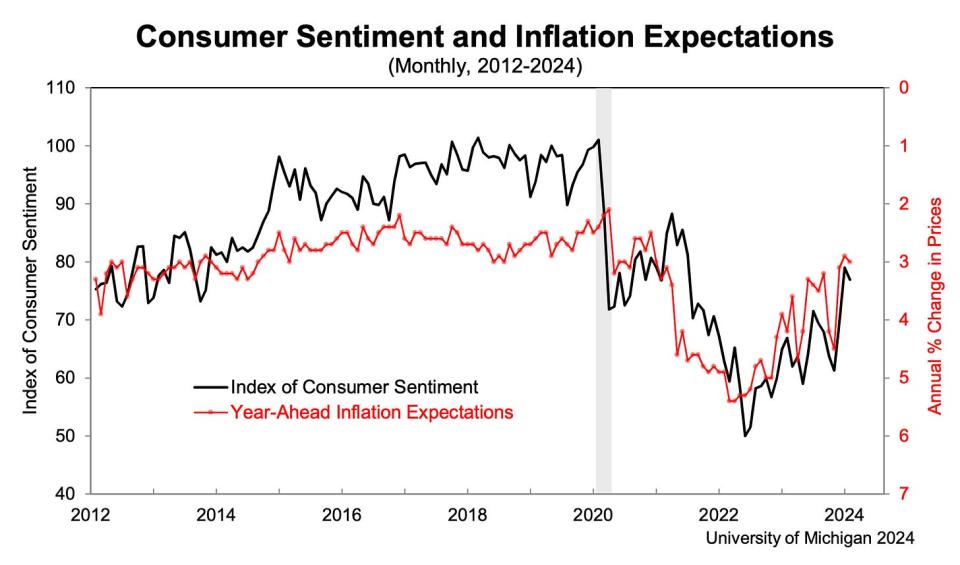

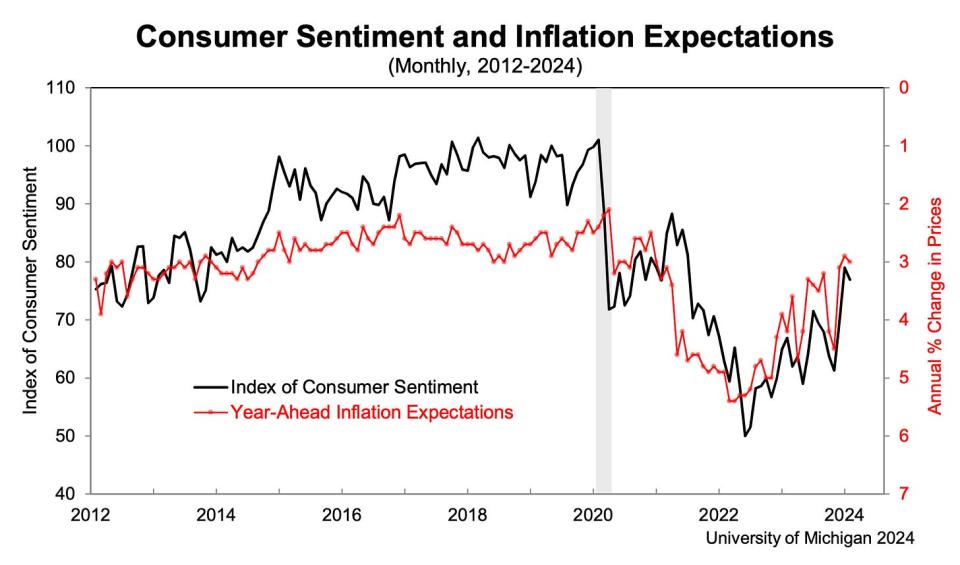

From the University of Michigan’s February Surveys of Consumers: “Consumer sentiment moved sideways this month, slipping just two index points below January and holding the gains in sentiment seen over the past three months. Expected business conditions remained substantially higher than last autumn, with short-run expectations now 63% above and long-run expectations 46% above November 2023 readings. For all but one index component, readings this month were higher than all values between mid-2021 and the end of 2023. Consumers perceived few changes in the state of the economy since the start of the new year, and they appear to be assured that inflation will continue on a favorable trajectory.”

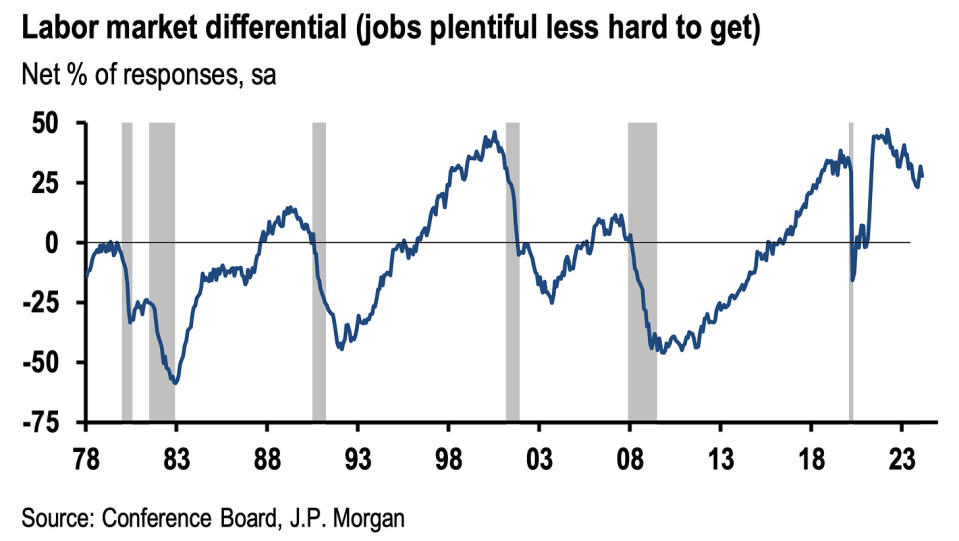

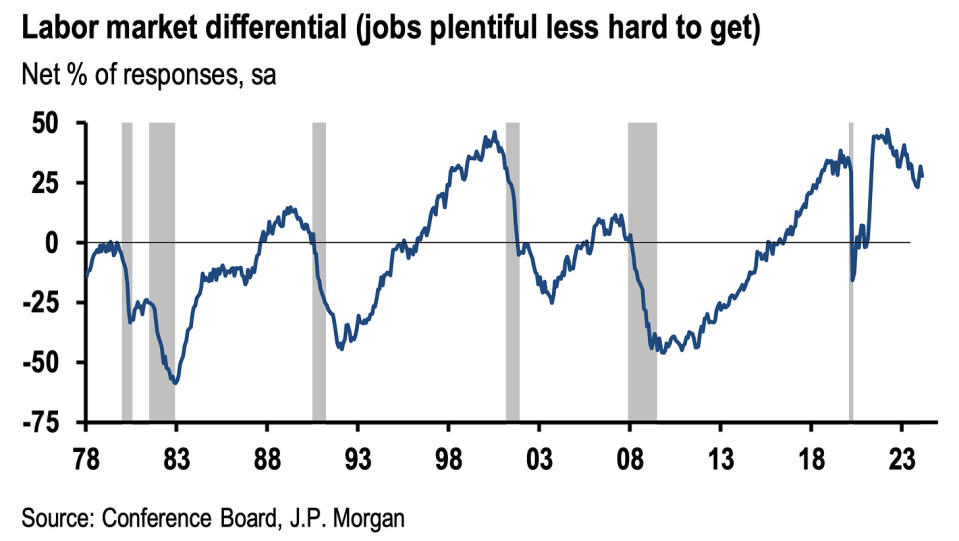

Labor market confidence is less good. From The Conference Board’s February Consumer Confidence survey: “Consumers’ appraisal of the labor market was also less positive in February. 41.3% of consumers said jobs were “plentiful,” down from 42.7% in January. 13.5% of consumers said jobs were “hard to get,” up from 11.0%.“

Many economists monitor the spread between these two percentages (a.k.a., the labor market differential), and it’s been reflecting a cooling labor market.

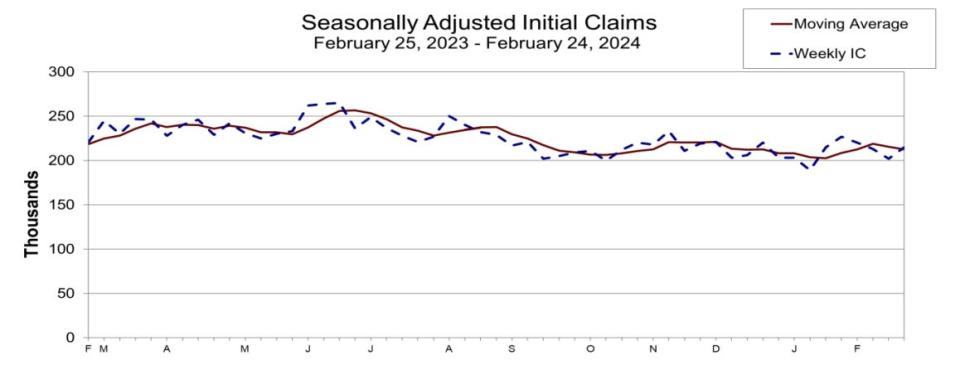

Unemployment claims rise. Initial claims for unemployment benefits increased to 215,000 during the week ending February 24, up from 202,000 the week prior. While this is above the September 2022 low of 182,000, it continues to trend at levels historically associated with economic growth.

Construction spending ticks lower. Construction spending declined 0.2% to an annual rate of $2.1 trillion in January.

Notably, manufacturing construction spending (HT Joseph Politano) grew to a new record high during the period.

New home sales rise. Sales of newly built homes grew 1.5% in January to an annualized rate of 661,000 units.

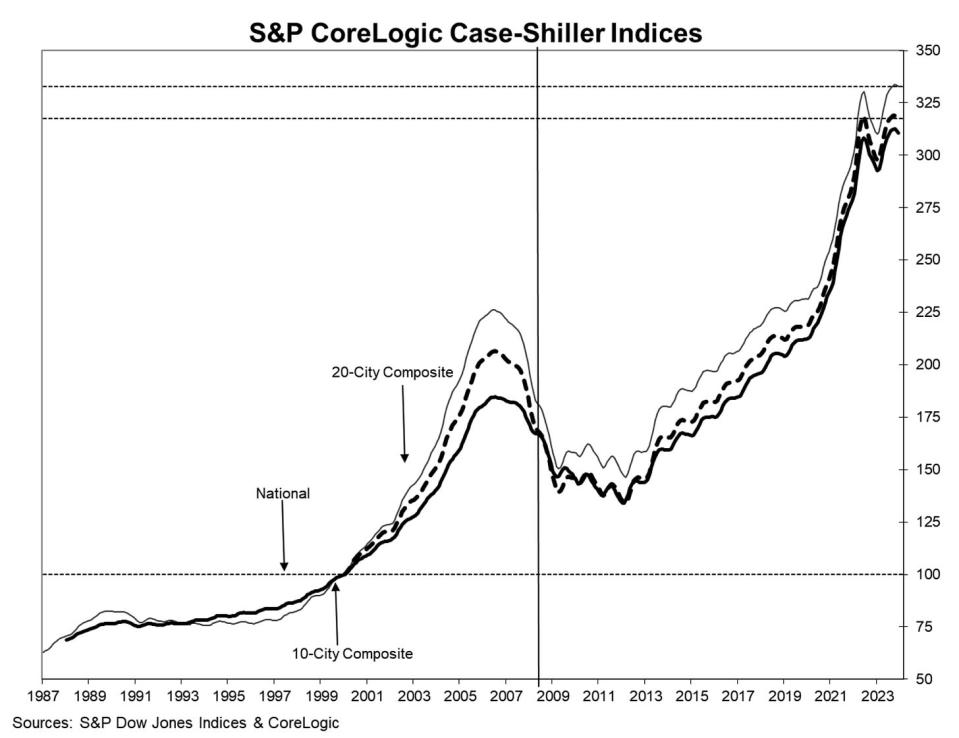

Home prices rise. According to the S&P CoreLogic Case-Shiller index, home prices rose 0.2% month-over-month in December. From S&P Dow Jones Indices’ Brian Luke: “Looking back at the year, 2023 appears to have exceeded average annual home price gains over the past 35 years. With trend growth at the national level of 4.7%, a 5.5% return demonstrates solid, steady growth. While we are not experiencing the double-digit gains seen in the previous two years, above-trend growth should be well received considering the rising costs of financing home mortgages.

We previously suggested that the surge in home prices during the COVID pandemic could have accelerated home ownership temporarily. The past two years reflect consistent growth slightly above trend, suggesting a more secular shift in home ownership post pandemic. In the short term, meanwhile, we should be able to measure the impact of higher mortgage rates on home prices. Increased financing costs appeared to precipitate home price declines in the fourth quarter, as 15 markets saw lower values compared to September.”

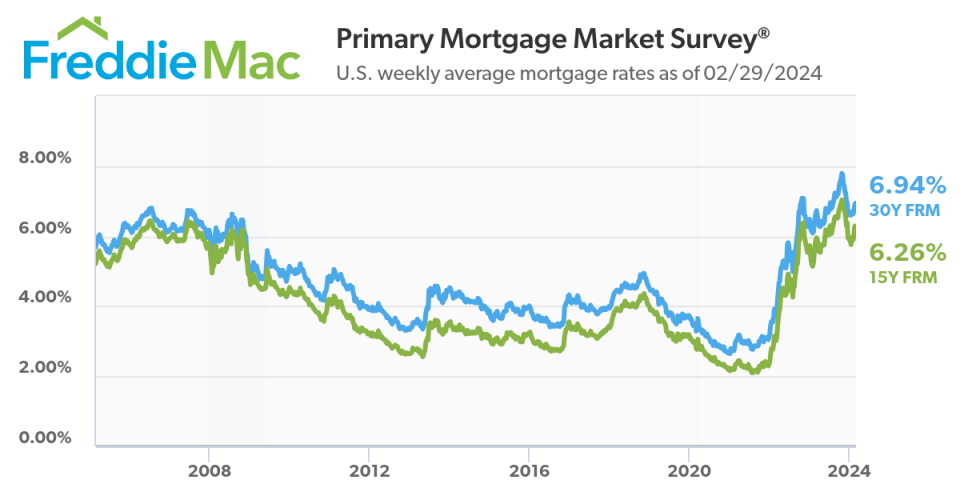

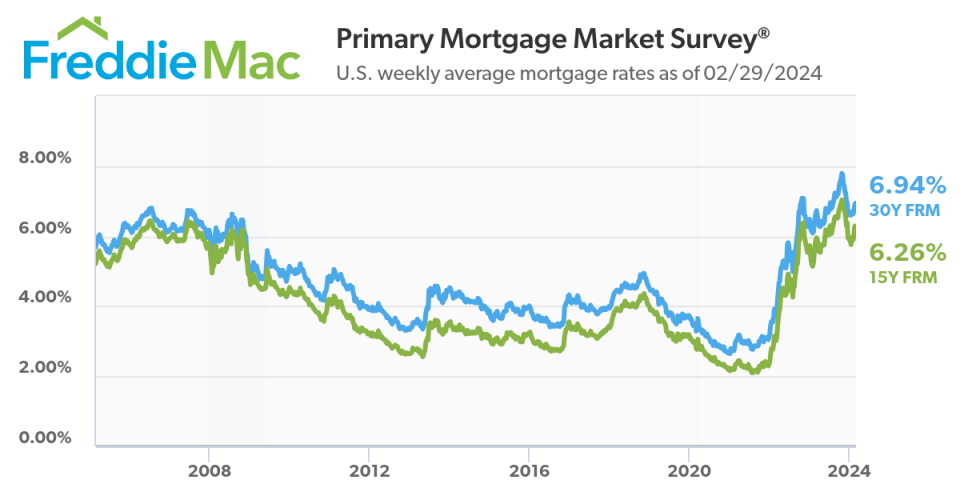

Mortgage rates tick up. According to Freddie Mac, the average 30-year fixed-rate mortgage rose to 6.94% from 6.90% the week prior. From Freddie Mac: “Mortgage rates continued their ascent this week, reaching a two-month high and flirting with seven percent yet again. The recent boomerang in rates has dampened already tentative homebuyer momentum approaching the spring, a historically busy season for homebuying. While sales of newly built homes are trending in a positive direction, higher rates and elevated prices continue to pose affordability challenges that may leave potential homebuyers on the sidelines.”

Manufacturing survey cools. The ISM manufacturing PMI fell in February, signaling contraction in the sector for the 16th consecutive month.

It’s worth remembering that soft data like the PMI surveys don’t necessarily reflect what’s actually going on in the economy.

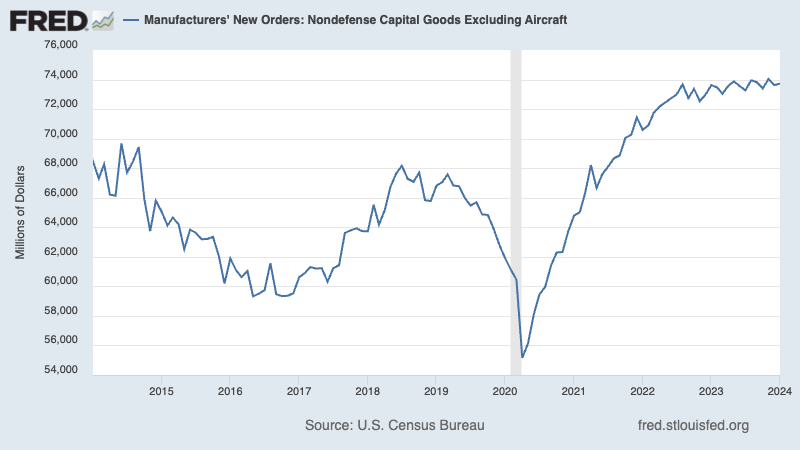

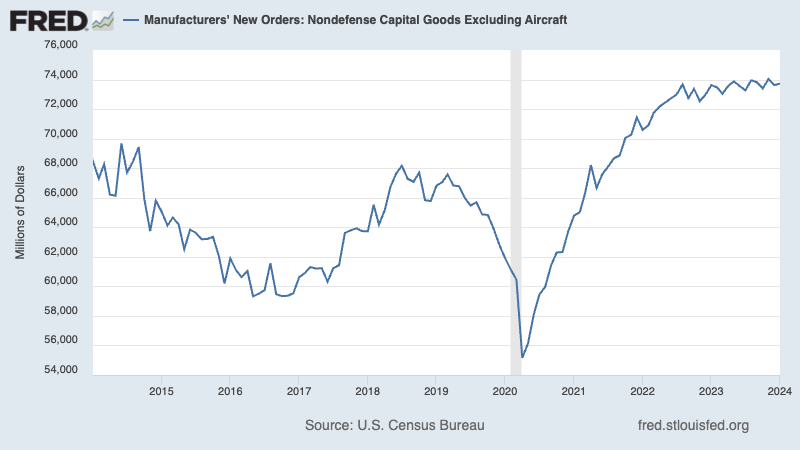

Business investment activity is up. Orders for nondefense capital goods excluding aircraft — a.k.a. core capex or business investment — grew 0.1% to $73.7 billion in January.

Core capex orders are a leading indicator, meaning they foretell economic activity down the road. While the growth rate has leveled off a bit, they continue to signal economic strength in the months to come.

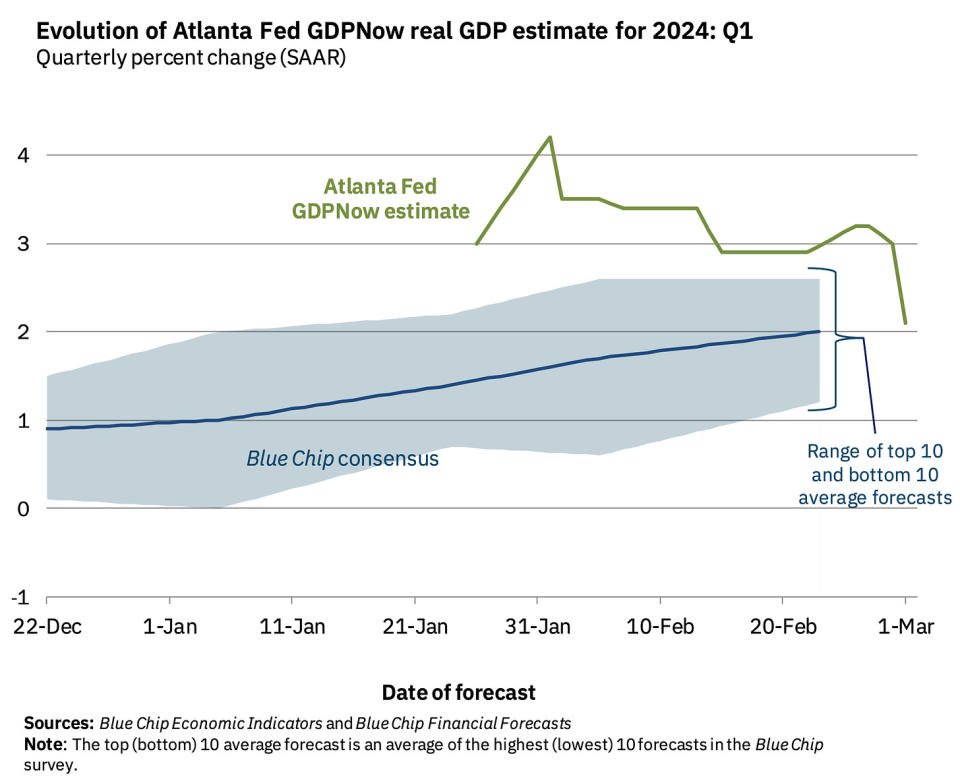

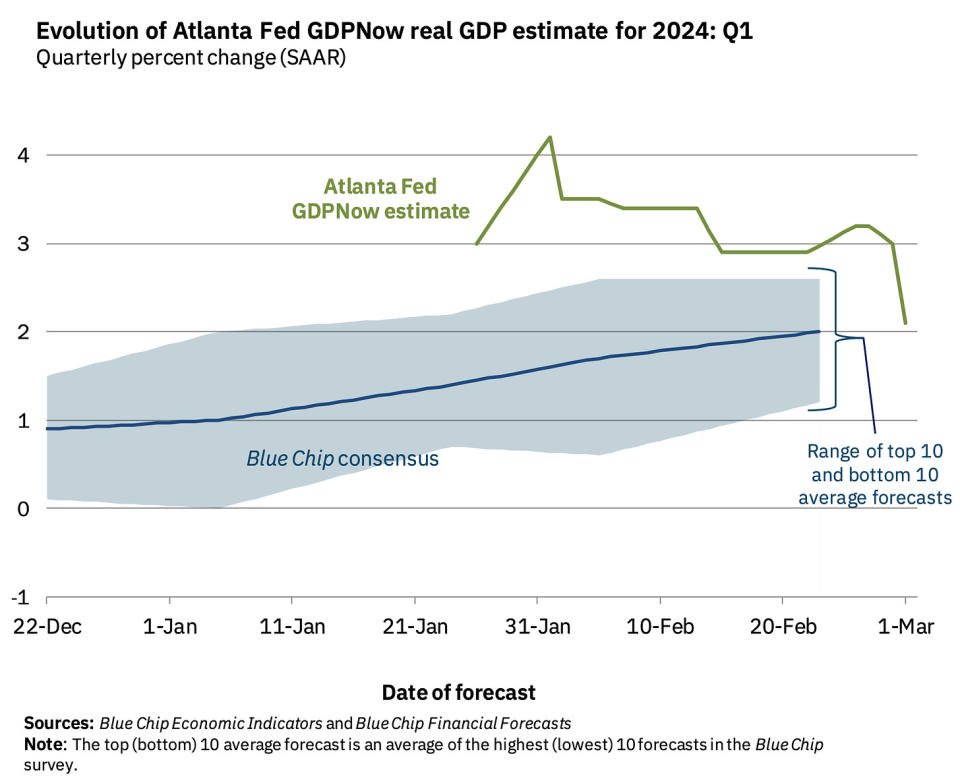

Near-term GDP growth estimates look good. The Atlanta Fed’s GDPNow model sees real GDP growth climbing at a 2.1% rate in Q1.

Putting it all together

We continue to get evidence that we are experiencing a bullish “Goldilocks” soft landing scenario where inflation cools to manageable levels without the economy having to sink into recession.

This comes as the Federal Reserve continues to employ very tight monetary policy in its ongoing effort to get inflation under control. While it’s true that the Fed has taken a less hawkish tone in 2023 and 2024 than in 2022, and that most economists agree that the final interest rate hike of the cycle has either already happened, inflation still has to stay cool for a little while before the central bank is comfortable with price stability.

So we should expect the central bank to keep monetary policy tight, which means we should be prepared for relatively tight financial conditions (e.g., higher interest rates, tighter lending standards, and lower stock valuations) to linger. All this means monetary policy will be unfriendly to markets for the time being, and the risk the economy slips into a recession will be relatively elevated.

At the same time, we also know that stocks are discounting mechanisms — meaning that prices will have bottomed before the Fed signals a major dovish turn in monetary policy.

Also, it’s important to remember that while recession risks may be elevated, consumers are coming from a very strong financial position. Unemployed people are getting jobs, and those with jobs are getting raises.

Similarly, business finances are healthy as many corporations locked in low interest rates on their debt in recent years. Even as the threat of higher debt servicing costs looms, elevated profit margins give corporations room to absorb higher costs.

At this point, any downturn is unlikely to turn into economic calamity given that the financial health of consumers and businesses remains very strong.

And as always, long-term investors should remember that recessions and bear markets are just part of the deal when you enter the stock market with the aim of generating long-term returns. While markets have had a pretty rough couple of years, the long-run outlook for stocks remains positive.